Original compilation: Flying fish

The purpose of Web3 is to realize value exchange, and DEX is in the best position to provide this utility and capture value. How they capture and distribute value, this article will answer for you.

Transaction fees are one of the most straightforward ways to generate cash flow for DeFi protocols. Today, some DEXs are generating hundreds of millions of dollars in daily trading volume and in some cases generating over $1 million in daily revenue. Here are the three exchanges that generate the most revenue:

Revenue comes primarily from transaction fees. Accrued fees are proportional to the trading volume of each DEX. These fees tend to range from 0.30% to 0.01%, depending on each protocol and pool setup.

In addition to comparing these numbers, it is also interesting to explore how these revenues flow differently on each protocol, as these fees can be distributed for the stakeholders of the protocol: liquidity providers, DAO/team supporting the protocol or Holders of protocol tokens. Properly incentivizing all parties involved is critical to a successful decentralized exchange. This process can turn a DEX into a steady income machine.

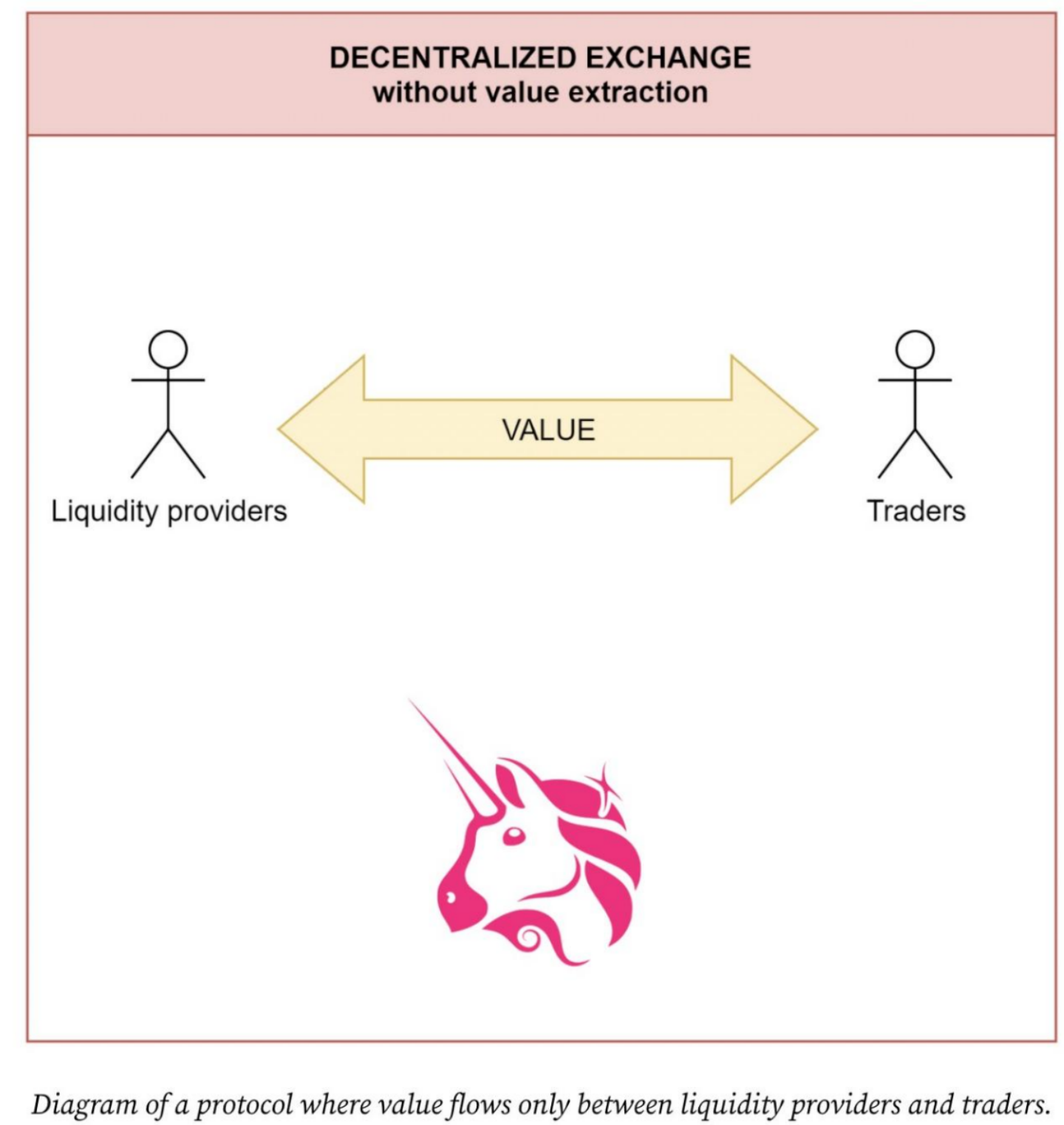

There is a DEX where the act of trading tokens is simply an exchange between liquidity providers and traders, who pay these providers small incentive fees. In this case, neither the holders of the protocol tokens nor the team behind the protocol receive financial rewards.

The best example is Uniswap: there are no protocol fees, and all transaction fees go to liquidity providers. The tokens of the agreement will not generate part of the income, and governance is the main utility of its tokens, which is not necessarily"worthless", because governance token holders have the power to authorize how the protocol works. For example, they might approve the introduction of a service fee that will generate revenue.

At present, Uniswap has not set up an incentive pool for UNI, which instead reduces the potential buying pressure that these incentives may bring. For this reason, the protocol does not actively incentivize it to use its primary token to provide liquidity to its pool:

Most decentralized exchanges fall into the second category, taking a different approach from UNISWAP. Not all transaction fees go to liquidity providers, some go to stakers of protocol tokens.

So that creates buying pressure because that's what attracts users to buy and hold (and often stake) these protocol tokens. Due to the impact of this decision on the profitability of liquidity providers, many liquidity pools are incentivized by the liquidity mining rewards of the main protocol token.

This trade-off attracts liquidity, which increases the success rate of the exchange, which increases liquidity and also accumulates more transaction fees, but puts some selling pressure on the protocol tokens on the system. This approach is one of the most successful mechanisms for attracting liquidity to the protocol, as shown in the next example, which features historical liquidity from Curve Finance:

The model offers the possibility to include an acceptance rate where some of the fees are directly generated by the team/DAO behind the protocol. This is a coherent aspect considering that these protocols require active and ongoing management to improve the product or adjust certain parameters. Activities such as customer support or social media presence require constant attention and play a huge role in the success of a product. Therefore, they should be rewarded somehow.

How to divide the percentage that each group should receive, there is no fixed way of distribution. In fact, each protocol actually sets a different amount than its competitors. In some cases, they won't even charge some groups at all. The report shows the agreements that generated the most revenue. Despite their different plans, they both achieve impressive amounts of income.

A token economy can be used to incentivize the team behind the protocol. If the DAO/team gets a significant percentage of the initial token allocation, then giving a fixed amount of fees back to the team can double their incentives while gaining some incentives from liquidity providers or token holders.

Of course, there is room for practice to better align incentives among all parties involved in the protocol, and there are new approaches not considered in the table above. For example, the Osmosis exchange penalizes liquidity providers who remove liquidity with a small fee called an exit fee. Since removing liquidity is a detriment to the protocol and traders, extracting some value to incentivize liquidity providers to exist in the long run and partially mitigate the so-called"mercenaries"Liquidity, they think is fair. This is a concept that describes how liquidity can change rapidly from one pool to another by trying to chase those pools with optimal incentives.

Coordinating the parties involved in an agreement is no easy task.

Through a longer period of market testing, we will know what methods are most effective and what will fail. Ideally, liquidity providers are fairly rewarded for maintaining liquidity, transaction fees are reasonably priced, token holders are accruing substantial income, and teams maintaining the protocol are rewarded accordingly.

Will the protocols we use today be around in 5, 10 or 50 years? Legally and competitively balancing the interests of the parties mentioned in this article may be the key to the success and sustainability of a decentralized exchange.