Zhao Wei, senior analyst at Ouyi Research Institute

The first week of February 2022 was not peaceful.

On February 4, European Central Bank President Christine Lagarde no longer ruled out the possibility of raising interest rates this year, moving closer to the policy tightening stance of global central banks. Officials privately expect an adjustment to policy guidance as early as next month.

Just minutes before the ECB's policy decision, the Bank of England raised its benchmark interest rate by 25 basis points to 0.5%, less than two months after the last 15 basis point increase.

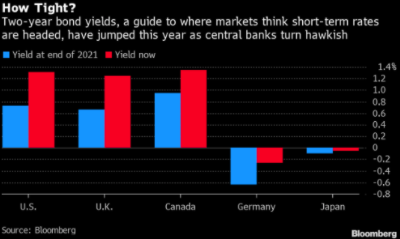

image description

Two-year bond yields have risen sharply this year as central banks take a hawkish stance, according to Bloomberg

As early as December 15, 2021, the Federal Reserve announced that it would reduce its purchases of U.S. Treasury bonds and mortgage-backed securities (MBS) by $30 billion per month (the original plan was to reduce $15 billion per month), which was the same as before. According to this, the asset purchase plan is expected to end at the beginning of next year, not in the middle of the year. And it expects to raise interest rates three times in 2022 to control the pace of inflation.

All tried to hit the brakes, with less than satisfactory results.

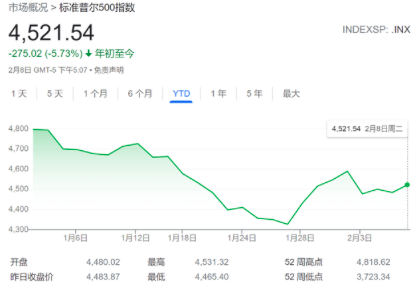

image description

S&P 500 plummets 11% in 14 days

The Bank of Canada, which is trying to rein in inflation-induced high house prices, unexpectedly announced that it would not raise its benchmark interest rate for now. The reason is still high-sounding "because the new wave of epidemics has brought uncertainty to the economy", but the Federal Bank of Canada regulator had previously warned that raising interest rates may cause house prices to plummet by more than 20%.

BlackRock, the world's largest asset management company, even directly asserted that global interest rate hikes are more thunderous and less rainy: "We believe that despite the tough rhetoric of central banks, central banks will eventually admit that fighting inflation through substantial interest rate hikes will bring economic growth. Too high a price. That's why we think the ultimate policy response will be modest."

Facts have proved that the resistance of the global central bank's policy shift is far more than investors expected.

image description

The price of Bitcoin is close to the $45,000 mark again after falling below $33,000, data from Ouyi

The phenomenon of the "independence" of the cryptoasset market from the monetary and financial markets has not gone unnoticed. On February 8, the US SEC sought feedback from the public on whether the Bitcoin ETF and Bitcoin itself are vulnerable to manipulation and fraud.

In fact, although the interest rate hike policies of the world's major central banks have had an impact on the encrypted asset market, there is still considerable resistance to a firm and substantial shift in policy.

At present, according to the market, the value potential of Bitcoin is far from reaching the critical point, and the bullish trend is beyond doubt.

After the weather changes, track selection will become the key.

According to public data from the media, more than $800 million in venture capital has poured into the cryptocurrency field in the past week.

image description

The number of Bitcoin non-zero wallets broke a new high, data source: Glassnode

The era of monetary easing led by the dollar will come to an end sooner or later. At that time, the flow of funds may bring about a reshuffle, and there will be a period of re-selection of the track.

Careful selection and decisive decision-making are always the most important weapons for investors.