2021 is a year of rapid development and historic breakthroughs in the encryption ecosystem: Affected by the macroeconomic environment, Bitcoin hit a record high of 69,000 US dollars. Driven by institutional funds and market sentiment, the total market value of the encryption market also exceeded 3 The trillion-dollar mark; diversified on-chain activities led by GameFi are showing prosperity, TVL and other on-chain data are rising steadily; Ethereum is starting from the London upgrade and is moving towards the grandeur of ETH2.0 (also known as the consensus layer) The goal is moving forward, the Layer2 sector has emerged, and many emerging public chains have risen rapidly.

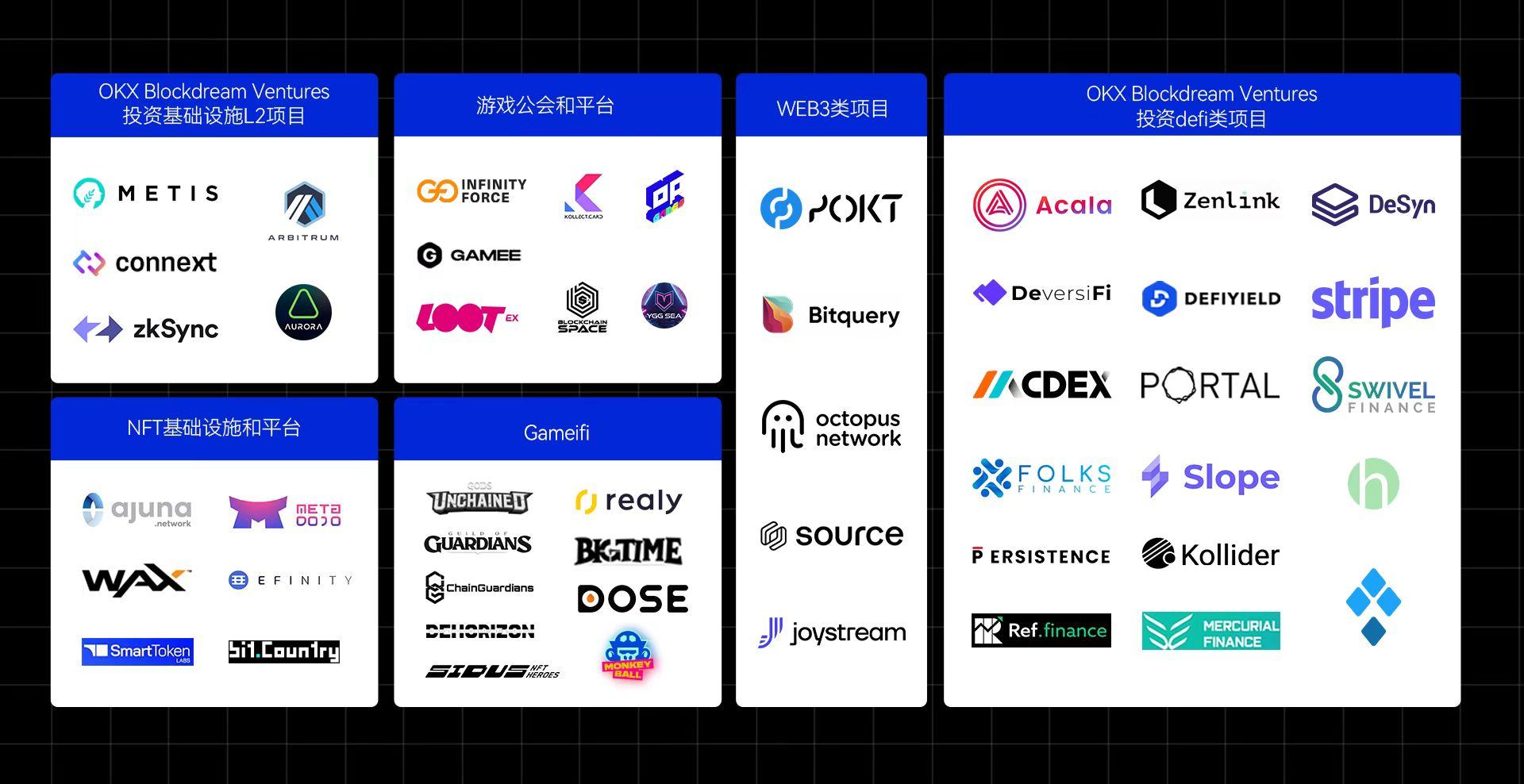

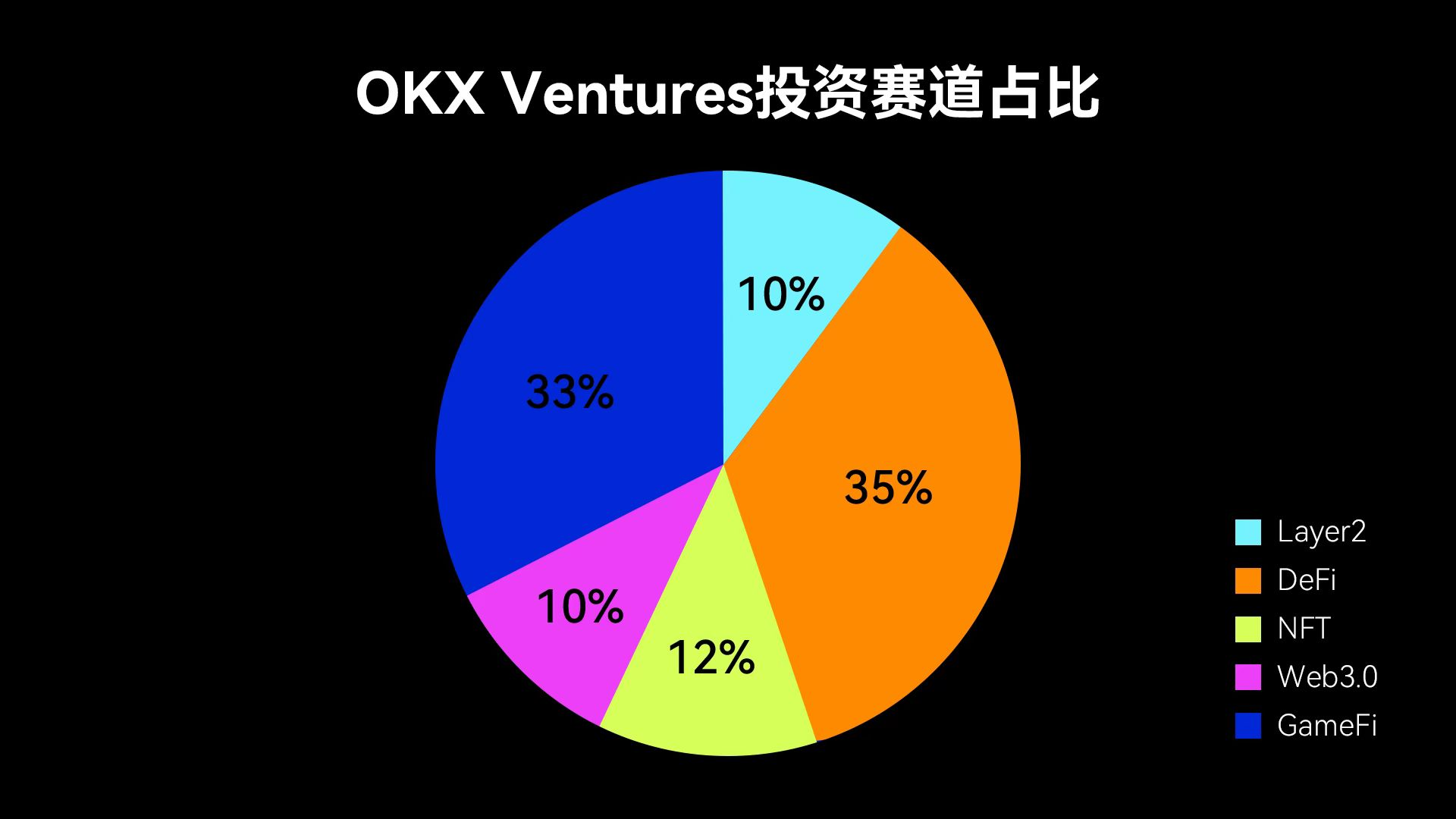

OKX Ventures has long been committed to promoting the prosperity of the Crypto Ecosystem. With the purpose of helping the development of high-quality projects, it has invested in more than hundreds of projects, covering core tracks such as NFT, GameFi, DeFi, Layer2, and Web3.0, and participated in more than 90% of the projects. In the ecological construction of the department project. At the same time, OKX Ventures, together with popular public chains such as Solana, Near, Polygon, and Avax, established an ecological fund to support their ecological projects.

secondary title

secondary title

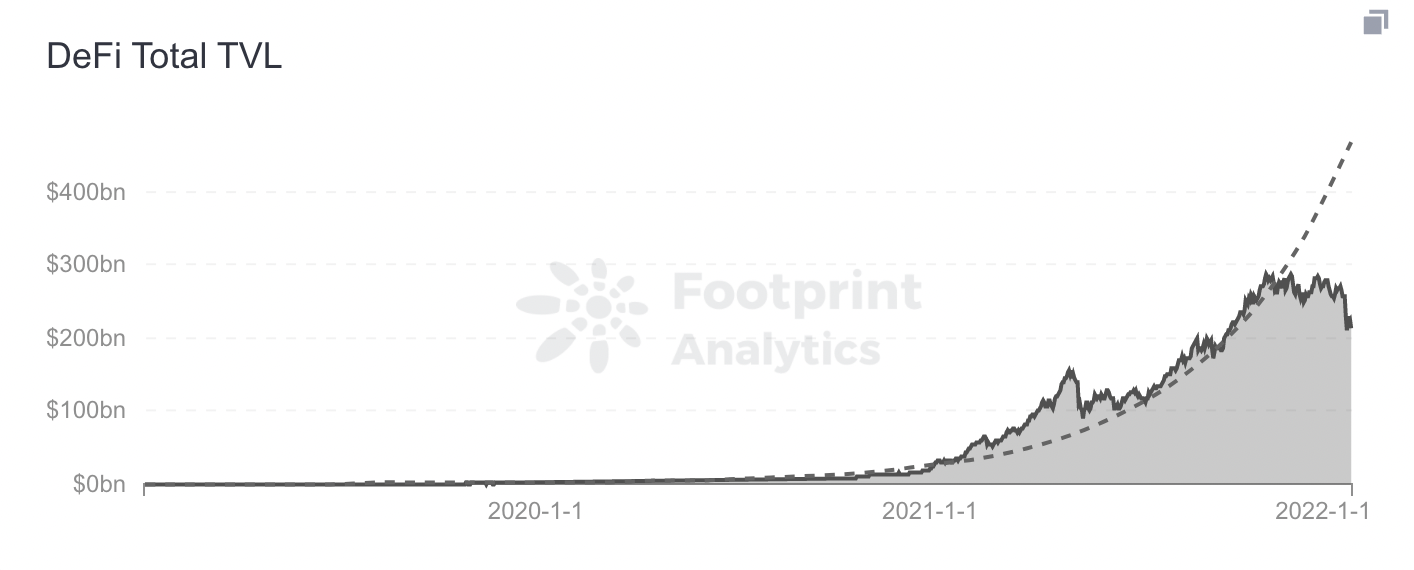

The popularity of DeFi continues unabated

In 2021, the DeFi ecosystem will continue the rapid momentum of the previous year's "DeFi Summer". According to data from The Block, the total value locked (TVL) in the protocol has soared from $16.1 billion to $101.4 billion, and user data has reached a new high. At the same time, a large number of high-quality native on-chain projects have also been born in the market, and the total locked-up volume (TVL) of DeFi agreements reached 247.12 billion US dollars.

secondary title

The respective prosperity of Layer2 & public chain

As the leader of the Dapp ecosystem, Ethereum has maintained its leading position in capital accumulation and financial innovation in the past year, and both its market value and the number of Dapps have also broken new highs. With the continuous transformation of ETH2.0, the prospect is promising.

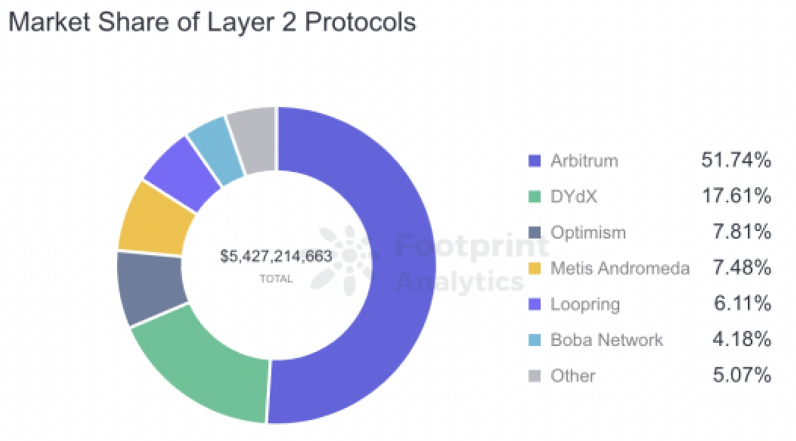

This year, the ecosystem on the chain exploded rapidly, and the number of users increased exponentially. But at the same time, the congestion of the main chain of the Ethereum network and the high Gas Fee have not been resolved, and performance problems have always been objective problems that hinder user participation and limit ecological development. Restless market funds are seeking greater profit margins, developers are pursuing a more open and inclusive development environment, and users are also looking forward to a better trading experience. Therefore, the Layer 2 expansion plan and the new public chain have become new hot spots in 2021.

Layer 2 is a general term for a series of off-chain scalability solutions. This kind of expansion does not affect the public chain itself, and the scalability improvement is achieved through other methods, that is, off-chain improvement. Such solutions include state channels, sidechains, and Plasma, Rollup, etc. In addition, Layer 2 expansion is not an intermediate compromise, but a long-term solution. After the successful launch of Ethereum 2.0, the Layer 2 expansion mechanism can still coexist with the fragmentation expansion of Ethereum 2.0.

Therefore, OKX Ventures has focused on expansion projects and invested in Arbitrum, zkSync 2.0, Connext, Aurora, Metis and other projects dedicated to expansion solutions.

Take Arbitrum, the largest Layer 2 project on the ETH network, as an example: its total locked value is as high as 280 million US dollars, accounting for 51.74% of the L2 market share, and it is far ahead in terms of TVL. Arbitrum builds sustainable infrastructure by reducing costs and increasing efficiency, efficiently and securely powering higher throughput DApps.

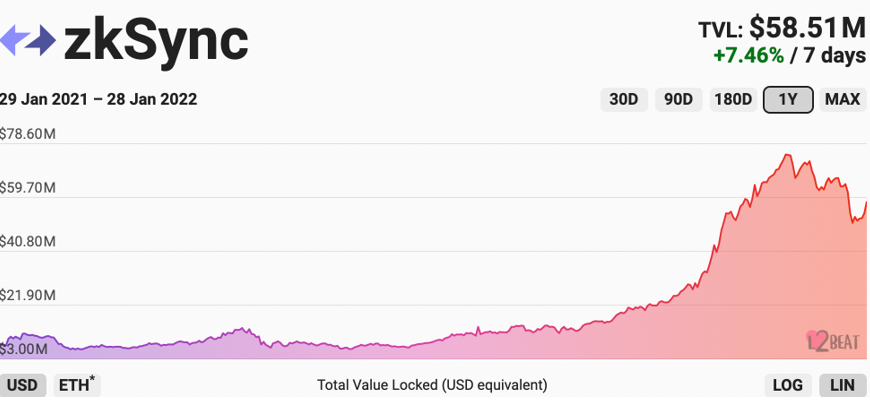

And zkSync built by Matter Labs also performed well:

Data Sources:

Data Sources:https://l2beat.com/projects/zksync/

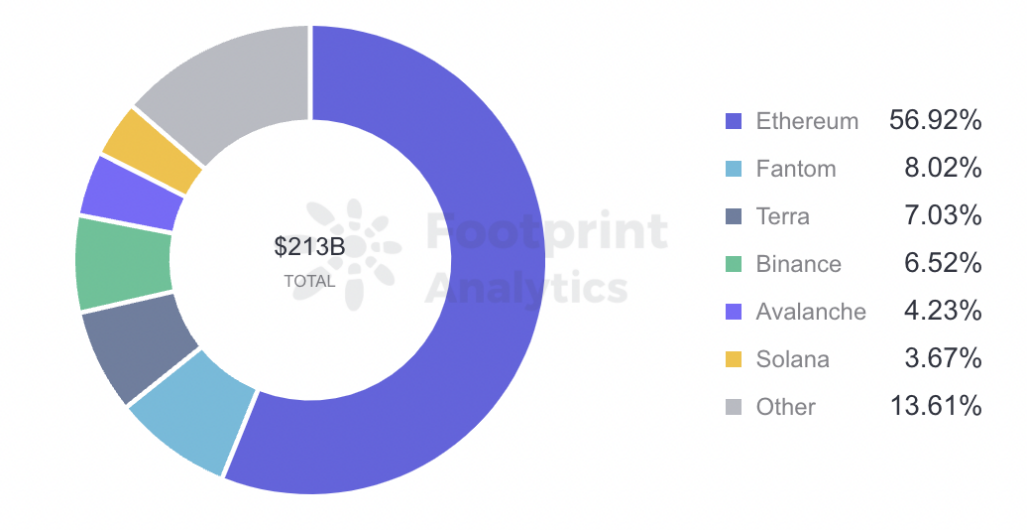

In addition to the sudden emergence of Layer 2, the spillover of Ethereum’s ecological resources has also given a number of emerging public chains the opportunity to rise rapidly by creating a Dapp ecosystem. This year, the emerging public chain has attracted a large number of developers and users by improving performance, reducing transaction costs and thresholds, and the era of multi-chain coexistence and common prosperity has officially opened.

According to the ratio of TVL, the top six public chains in the past year are Ethereum, Fantom, Terra, Binance, Avalanche, and Solana.

secondary title

secondary title

Metaverse duo: NFT and GameFi complement each other

2021 is called the first year of the metaverse. On the one hand, it is inseparable from the substantial progress in technologies such as VR and 5G, the increasing demand for people's digital activities under the epidemic environment, and the "All In" layout of technology giants such as Facebook. On the other hand, it is due to the rapid development of the two basic modules of Metaverse, NFT and GameFi. NFT solves the problem of confirming rights in the Metaverse world, and GameFi provides more references for the construction of the economic model of the Metaverse.

GameFi refers to the presentation of decentralized financial products in the form of games, the gamification of DeFi rules, and the NFT of game prop derivatives. One of the most notable features is that the user's assets become equipment or tools in the DeFi game, and users can obtain benefits or rewards during the process of participating in the game.

With the popularity of Axie Infinity, a new Play-To-Earn economic model has been born. At present, most of the GameFi game methods mainly include role-playing, virtual space, training and fighting, and multiplayer building. Compared with the previous liquidity mining model, the GameFi project is more interactive, experiential and immersive with users, and it is also more interesting. For example, many games will use NFT pets to breed , Use NFT equipment to improve skills, pledge NFT to obtain income, or introduce PK battle mode, participate in battles, and complete tasks, allowing users to make money while playing games. The rise of GameFi not only allows people to see the progress of on-chain finance and the possibility of innovation in social production relations, but also sees the prototype of metaverse economy.

OKX Ventures is more optimistic about the long-term development of the GameFi track, and will start to focus on this field in early 2021. Dora, founder of OKX Ventures, believes that Gamefi can be simply understood as NFT+DeFi, but it focuses more on DeFi. On the one hand, Gamefi integrates DeFi into the game, that is, DeFi gamification, which makes the game more interesting and promotes the development of the Game ecology; on the other hand, Gamefi allows players to have more More ways to enter the market and get more benefits. GameFi is the concept of "gamified finance" under the fusion of DeFi and NFT. It presents financial products in the form of games and makes the rules of DeFi gamified. Gamefi is the inevitable result of the development of DeFi and NFT. Its value lies in enabling participants to obtain real benefits while enjoying the fun of games. Compared with the "Deposit to Play" of traditional games, Gamefi is "Play to Earn". The former is to spend money to recharge and then play games, and the latter is to make money while playing games. The difference brought about by this can be described as revolutionary.

Therefore, OKX Ventures has focused on the upstream and downstream industries of GameFi, investing in high-quality GameFi projects including Big Time Studios, Relay, Dehorize, Godsunchained, and Chain guardian.

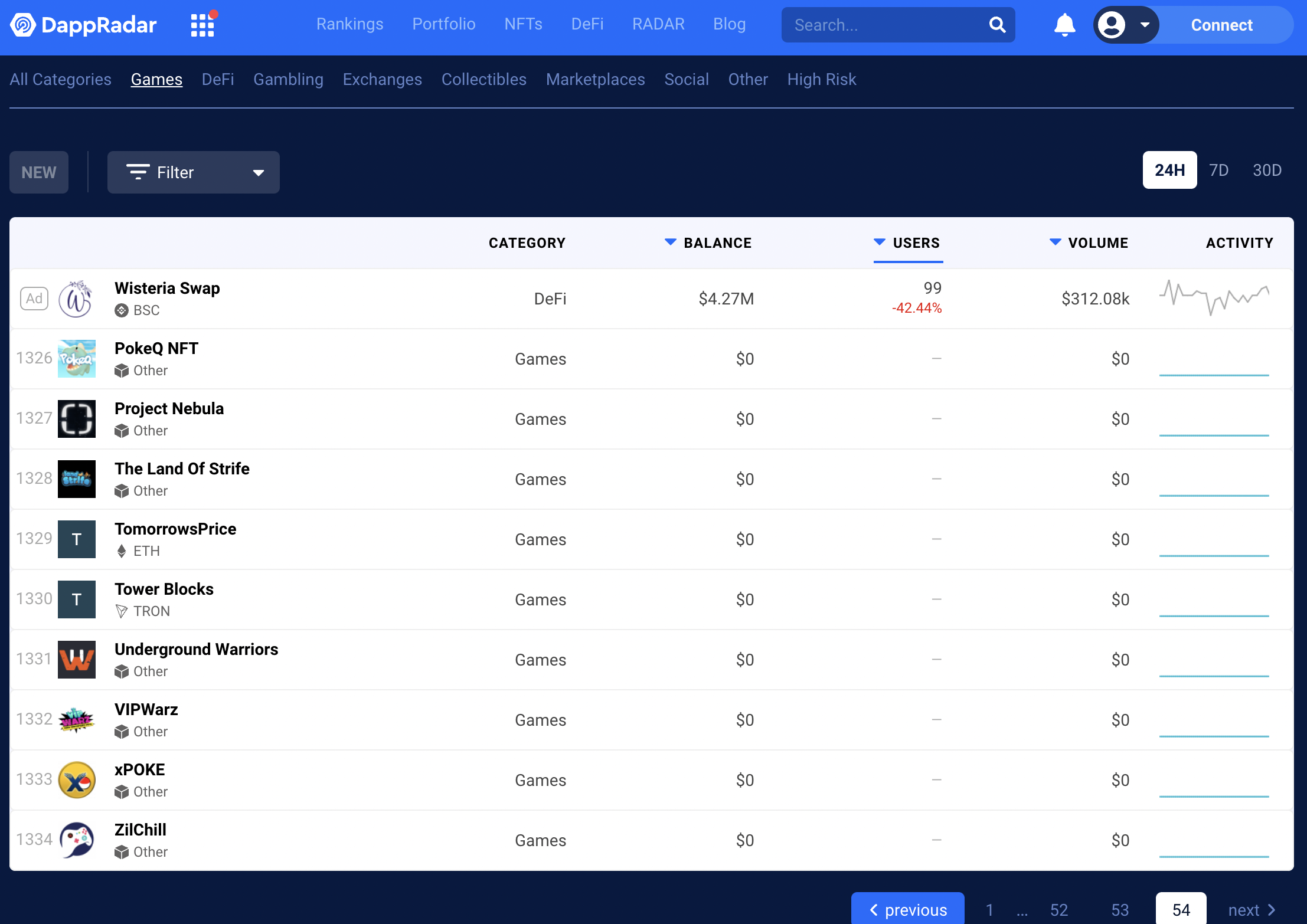

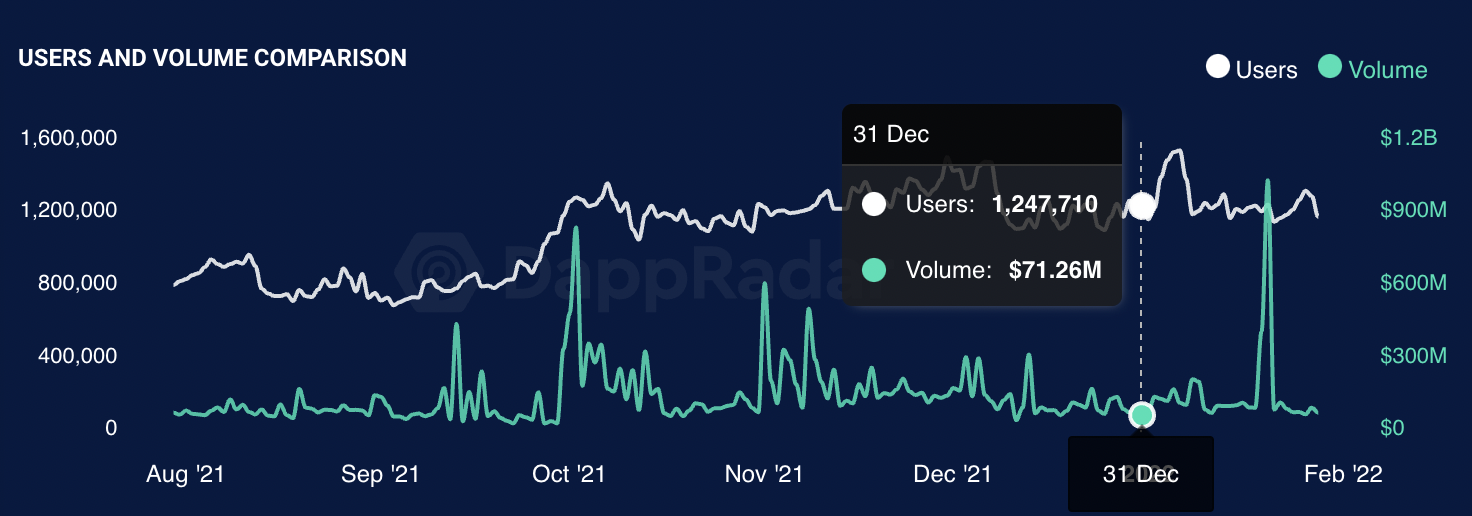

In 2021, the total number of global game players will approach the 3 billion mark, a year-on-year increase of 5.3% compared with 2020, indicating that the strong growth momentum of the game industry is not only leading the continued growth of the number of players, but still has a greater rise space. Although there is still a huge gap between the combination of games and blockchain and the number of users in the traditional game field, the speed of data growth can also be called rapid. According to DappRadar data, a total of 1,334 game Dapps have been launched and deployed on the entire network. Since July 2021, the data of chain games has grown rapidly. The number of players has increased from 80,000 in early April to 1.248 million in December, and the daily transaction volume has increased from about US$500,000 in early April to an average of about US$200 million. level, with the highest daily trading volume exceeding $850 million.

With the double rapid growth of blockchain game projects and the number of players, two subdivided tracks have emerged:

First of all, the characteristics of blockchain games are destined to have very frequent interactions on the chain. High gas fees and congestion on the chain are unbearable pain points for both players and developers, and people are beginning to pursue infrastructure platforms with better performance. The public chain with a more friendly interactive experience and development environment has begun to gain favor, and some new game platforms have also emerged as the times require. For example, WAX has become one of the most popular chain game blockchains.

Secondly, the total financing scale of the GameFi sector in 2021 is close to 4 billion US dollars. In addition to traditional institutions and companies launching special funds to support the development of the GameFi ecosystem, many game guilds that are essentially DAOs have also begun to become brand-new financing channels and participate in the construction of the GameFi ecosystem. Today, game guilds such as Yield Guild Games have become an integral part of the GameFi ecosystem.

In terms of game guilds and platforms, OKX Ventures has invested in high-quality projects such as YGG SEA, Blockchainspace, Infinity Force, Lootex, Gamee, and kollect;

GameFi has endowed NFT with more practical value through gamification settings. The NFT props inside are no longer just items to be sold on the NFT trading platform, but can also be traded directly on the market in the game, and the entire transaction The process is simpler than traditional games. These factors directly led to the explosion of the entire game NFT track in 2021.

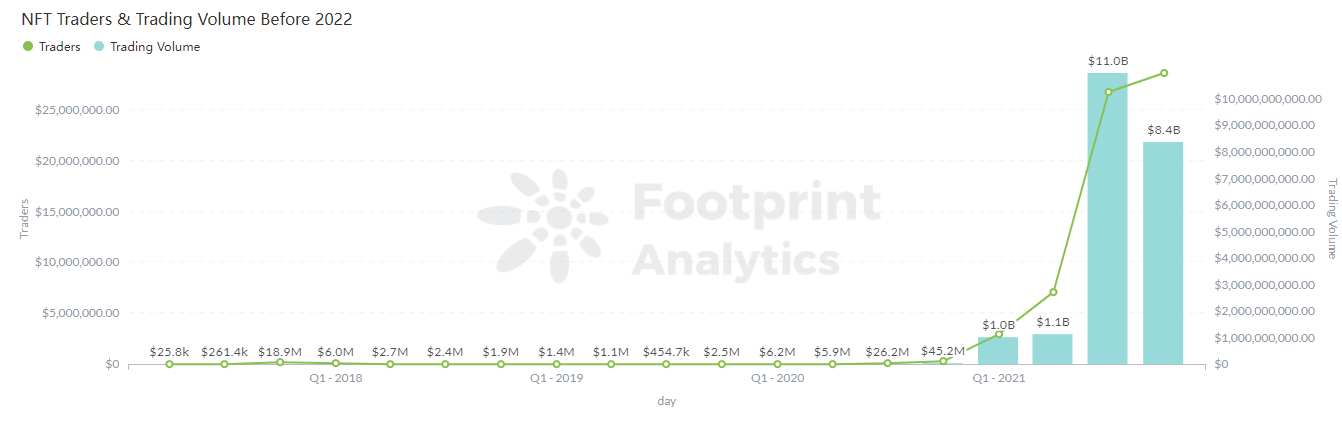

As one of the two basic modules of the metaverse, NFT, in addition to being used as a tool or equipment in blockchain games, has also achieved impressive results in artwork, collectibles, avatars, film and television music, etc. In 2021, CryptoPunks, BAYC, Loot and other phenomenal products with huge influence and significant wealth-creating effects will appear in the NFT market. The auction prices of NFT artworks will hit new highs repeatedly, and they will continue to go out of the circle at a terrifying speed. Disney, Porsche, Coca-Cola, Burberry and other leading companies in various fields have deployed; Curry, O'Neill, Shawn Yue, JJ Lin, Jay Chou, Wilber Pan and many other celebrities have also set foot in the NFT field and made public voices for them. According to the data of Footprint Analytics, as of 2021, the cumulative transaction volume of NFT is $21.5 billion, and before 2021, the cumulative transaction volume is only $120 million, and the cumulative transaction volume has soared 200 times in one year. In the context of the increasingly popular metaverse, NFT is also known as the key to the metaverse world.

secondary title

Web3.0, the critical period of Internet transformation

It can be simply considered: Web1.0 is a read-only network, Web2.0 is a read-write network, and Web3.0 promises to provide an intermediary-free read-write network, that is, a decentralized Internet. Web 3.0 is more ambitious than Web 2.0 because Web 2 is about companies trying to extract value from people, while Web 3 is about communities creating value for people.

Over the past decade or so, Internet-based Web2.0 tends to be centralized. For example, Google provides the fastest and most convenient search service, obtaining 74% of search traffic control. Facebook built the largest social network, gaining control over the online identities of 2.2 billion people. As more and more Internet companies in a monopoly position have problems such as information privacy leakage, Web2.0 has fallen into huge doubts. Internet companies that once brought convenience have accumulated excessive power. Under the storage system, it seems that users are just a tool to contribute traffic and data.

In a Web3 world, people can control their data through a personalized account, switching from social media to email to shopping, creating a public record of all these activities on the blockchain. Therefore, Web3.0 is more open, trust-free, and license-free. Blockchain-based social networks, transactions, and businesses will grow and prosper in the coming years, democratizing the internet, creating a more level playing field, and changing the lives of many.

secondary title

Judgment on the future trend of the market

In 2021, many milestone events occurred in the encryption industry: Bitcoin and Ethereum both broke new highs in price and market value; Coinbase landed on Nasdaq; Announced support for Bitcoin and Dogecoin payments; the United States passed the first Bitcoin futures ETF; El Salvador announced that Bitcoin will be used as legal tender; the single-day revenue of the blockchain game Axie surpassed King of Glory...

In 2022, the development trend of the encryption industry is particularly important for investors and institutions.

Trend 1. The accelerated expansion of the Metaverse

The term Metaverse has almost become something that cannot be ignored. Metaverse is a large-scale network of 3D virtual worlds focusing on social links, which includes the physical world and virtual world as well as the integration with the virtual economy. Not only can we use the material information in the universe, but we can also get rid of various complex laws of nature, and maximize human subjective initiative. The metaverse in an ideal state allows users to conduct any experience or activity, so there are many application scenarios, such as virtual office platforms, virtual shopping malls and video games in the commercial field, field trips without place and time constraints in the educational field, real estate field Virtual home tours and more. What is lacking in the real world can be supplemented by computer means in the virtual world. With the development of computer technology, the application scenarios of the Metaverse are still expanding.

If the original metaverse is just an imagination that is too far away from reality, then with the successive explosion of basic components, NFT and GameFi, the accelerated landing of the metaverse is infinitely approaching the possibility. Facebook's rebranding to "Meta" appears to be just the beginning of the Metaverse becoming a marketing theme.

Trend 2. Web3.0 undertakes development

Web3.0 is the identity layer of the Internet. Users can have their own identity on the Internet and have absolute control over the degree of information disclosure, instead of giving up the ownership of personal information due to the monopoly of social media networks. At the same time, Web3.0 based on blockchain technology can also allow users to enjoy the dividends brought about by the ecological expansion of the platform without worrying about privacy and security issues. In other words, the value generated by the user during the interaction will be attributed to the user rather than the developer. The essence of Web3.0 is the process of returning operational power to users. At that time, various decentralized Internet applications will be managed by users instead of developers.

Currently, Web 3.0 is controversial, and even Musk, who is extremely tolerant of the encryption industry, has doubts about its application scenarios and value. But it is undeniable that the traditional Internet has entered an obvious bottleneck, and Web3.0 is the key word for the transformation of the pattern, and it is also a good medicine to solve the current pain points of Web2.0. Although the application of the concept of Web3.0 is relatively limited, it mainly focuses on areas such as storage, decentralized social networking, payment, and domain names. But I believe that as more and more teams and companies join in the development of Web 3.0, and more composable applications are integrated into Web 3.0, this concept, which seems to be relatively vague at present, will surely gain more mainstream attention. accept.

Trend 3. New type of cooperative organization - DAO

Centralized autonomous organization DAO is a digital world organization form based on blockchain technology. It has the characteristics of information transparency, community autonomy, freedom and openness. It can be said that the flat organizational structure of DAO can integrate scattered individual forces through smart contracts, so that group intelligence can be maximized, thereby avoiding bias and mistakes in central decision-making. At the same time, the structure and characteristics of DAO also give it more advantages in flexibility.

2021 is a year of rapid development for DAO. The ecology has begun to take shape (the cumulative number of organization members and token holders exceeds 1.3 million), and it has shown unlimited potential as a new form of cooperation. According to statistics, as of January 2022, there are a total of 4,157 DAO organizations in the industry, covering three major directions: investment, application, and governance, and covering multiple fields such as development tools, services, social networking, creation, and collection.

At present, DAO still has problems such as vulnerabilities in smart contracts that lead to governance attacks. However, it is believed that with the further development of the DAO modular operating system and the improvement of various services, the DAO ecosystem will make further progress in interoperability and composability, and thus continue to broaden its boundaries. Major organizations and institutions will also successively participate in the experiment of paradigm shift of cooperative organizations.

Trend 4. Explosion of DEX derivatives track

Derivatives are one of the key elements of any mature financial system. From the perspective of the development of the traditional financial market, since the 1970s, derivatives have been one of the main forces driving the entire financial industry forward. The volume of derivatives in the traditional financial field is 40 to 60 times that of the spot market, while in the encryption market Among them, the transaction market value of derivatives accounts for less than half of the entire digital asset market. In contrast, the development of derivatives still has huge room for imagination. In addition to the comparison of volume, mature players and institutions in the market have also begun to try to use derivatives to avoid risks and obtain more value capture. According to estimates, the current daily trading volume of DeFi derivatives is only equivalent to 1/6 of the spot trading volume of DeFi, which is equivalent to 1/100 of the trading volume of CEX derivatives.

epilogue

epilogue

The Federal Reserve’s rate hike warning, as well as macroeconomic uncertainty, make the crypto market’s start to the year look rather bleak. But we should be aware that in 2021, when the market value continues to hit new highs, it is also full of callbacks, risks and the impact of the general environment. In the past year, GameFi, NFT, DAO, Layer2 and other sectors have exploded one after another, laying a good foundation for 2022.

We realize that the speed of development of the industry has surpassed most people's imagination. In the face of this change, all industry practitioners should be more fully prepared.