first level title

Original source: Nansen

Original Compilation: Rhythm BlockBeats

Annual overview

2021 is an important year for encryption, with many strong projects and hot spots and trends dominating the year.

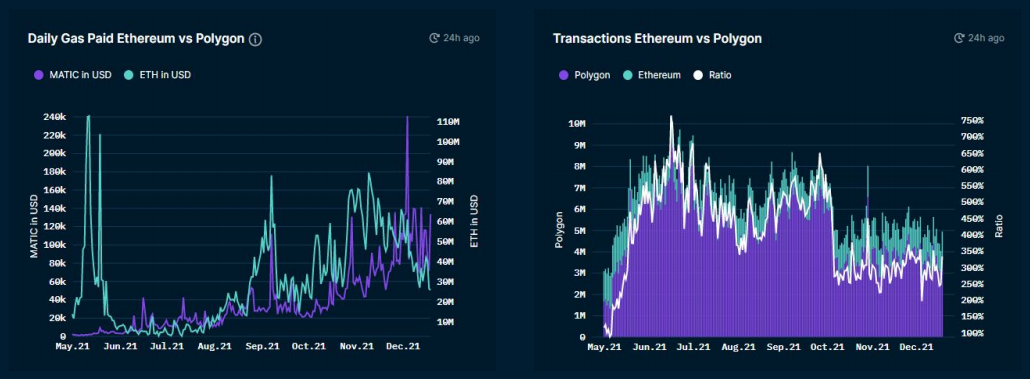

Ethereum is no longer the only smart contract platform with a large number of users, because "multi-chain" is the general trend in 2021.

DeFi continues to inject funds into the encryption field, and NFT has brought fresh blood to encryption. Austrian economics failed to be the theory behind convincing people to buy Bitcoin, and some cartoon JPEGs were found to be a better investment strategy.

first level title

Layer 1 & Layer 2 public chain

Speed, security and decentralization are the three key elements of a public chain. Around the scalability of the blockchain, these three elements are called the blockchain's trilemma, and it is considered impossible to achieve all of them while making trade-offs among the three.

In recent years, with the continuous improvement of user and product demand for blockchain, the inherent public chain is urgently looking for various scalability solutions.

Many Layer 1 and Layer 2 solutions have come up with innovative ways to solve the various problems that arise when blockchains run on traditional consensus algorithms, competing with each other for market dominance. The rise of these solutions can be observed through the deployment of contracts on various chains, the increase in users and transaction volume, while the Ethereum mainnet is currently lagging behind, with about 20,000 contracts deployed every day, and even in 2021 Below that level between August and December 2021.

secondary title

image description

secondary title

Ethereum

Ethereum, with its first-mover advantage, remains the blockchain network with the largest Total Locked Volume (TVL) and market capitalization.

However, since the summer of DeFi in 2020, due to the congestion of the base layer, it has become commonplace for the Gas price on Ethereum to fluctuate greatly. The urgent need for capacity expansion provides opportunities for the vigorous development of Layer 1 and Layer 2 expansion solutions. Due to the rise of other high-performance, low-fee alternative public chains, the amount of contract deployment on Ethereum has also remained at a fairly low level recently, and some projects are easy to migrate due to compatibility with EVM.

image description

(Data source: Nansen; interception date: December 31, 2021)

image description

(Data source: Nansen; interception date: December 31, 2021)

image description

secondary title

Polygon

image description

secondary title

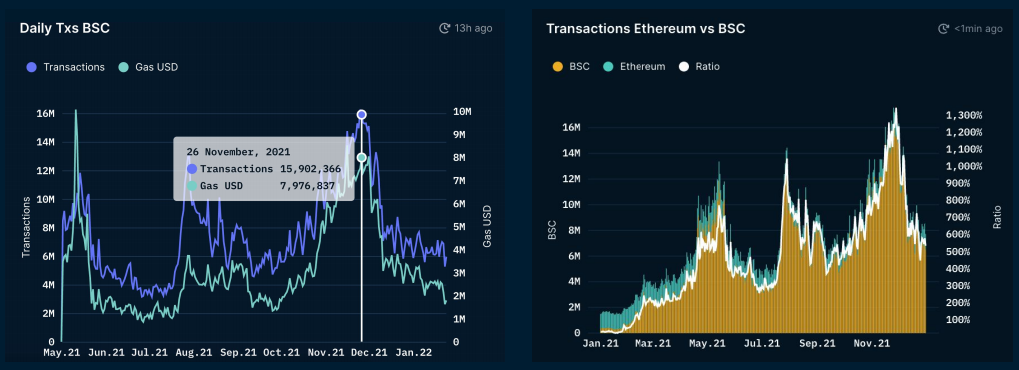

Binance Smart Chain

image description

secondary title

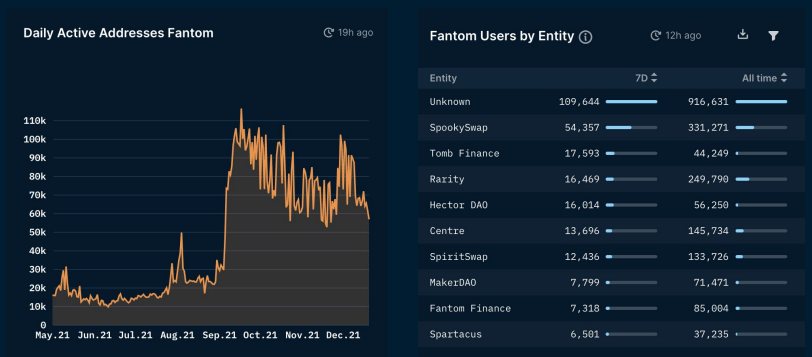

Fantom

image description

secondary title

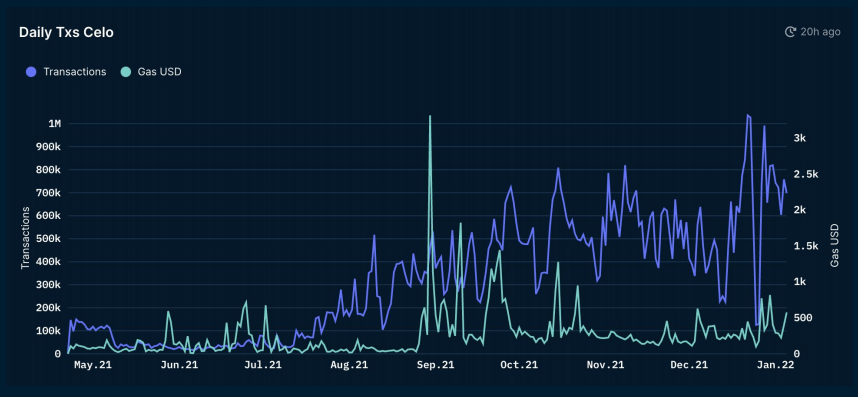

Celo

image description

secondary title

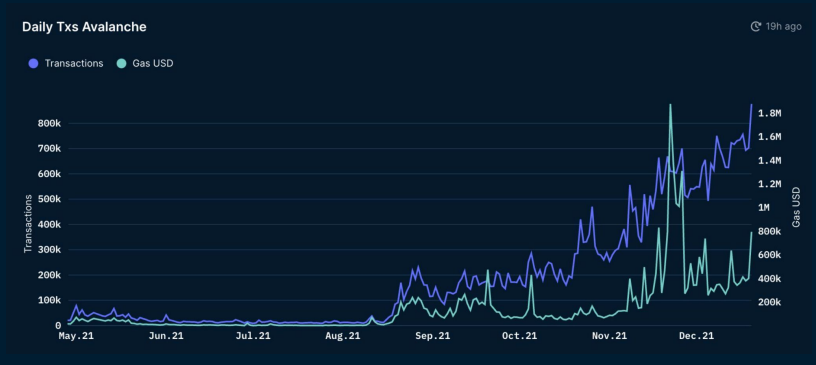

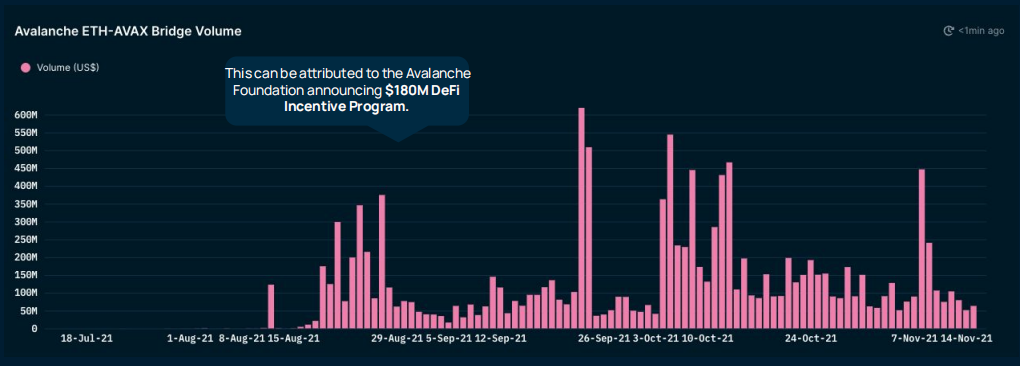

Avalanche

image description

(Data source: Nansen; interception date: December 21, 2021)

image description

(Data source: Nansen; interception date: December 21, 2021)

image description

secondary title

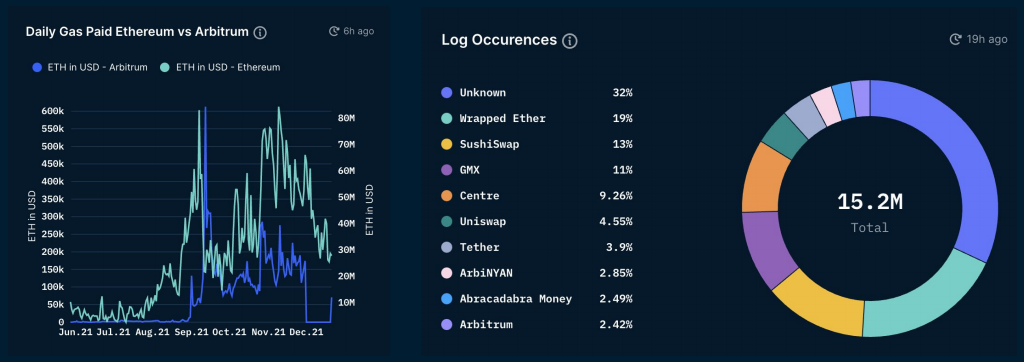

Arbitrum

image description

first level title

DeFi

secondary title

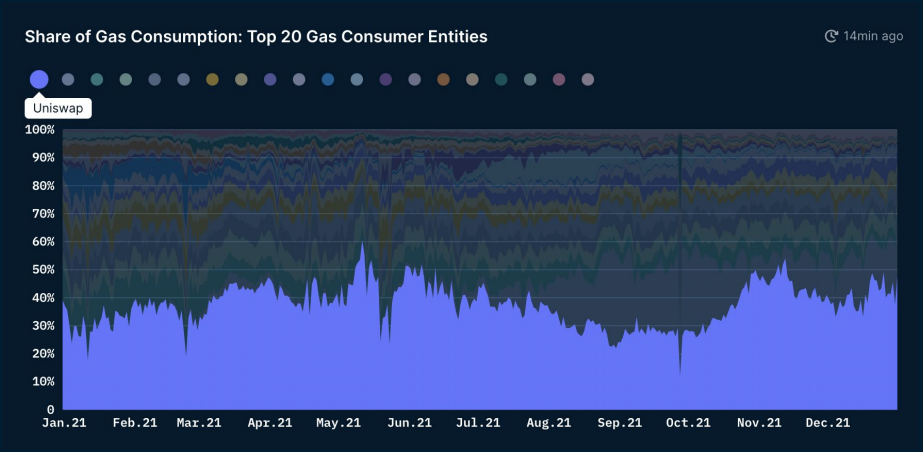

Uniswap

Uniswap’s interaction volume initially doubled with the release of V3, but saw a noticeable dip as more forks and variants were released.

image description

secondary title

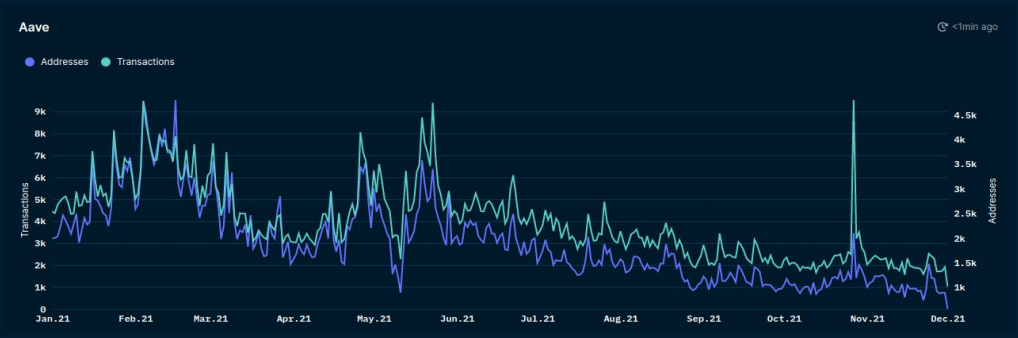

Aave

Aave's daily transaction peak exceeds 9K, and the number of active addresses reached 4,500 in March.

image description

secondary title

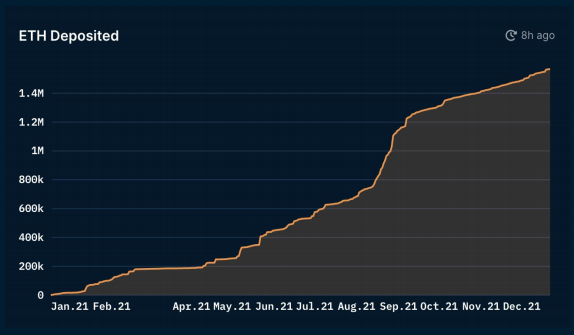

Lido

image description

Changes in the amount of ETH pledged over time (data source: Nansen; interception date: December 22, 2021)

Smart Money

Overall, Smart Money will trade the WETH-Stable trading pair most frequently on DEX in 2021, followed by the WBTC-WETH trading pair.

image description

(Data source: Nansen; interception date: December 24, 2021)

secondary title

Shiba Inu (SHIB)

Given the recent rise in Shiba Inu (SHIB) over the course of several months, some addresses have seen incredible gains.

image description

secondary title

SHIB Significant Earner

image description

(Data source: Nansen; interception date: December 24, 2021)

Stablecoin

image description

(Data source: Nansen; interception date: December 2021)

Ethereum's total share in the DeFi market continues to remain high (about 70%), and USDT will also maintain its dominant position in the Stablecoin field in 2021.

As regulation and scrutiny of USDT intensifies in 2021, USDT's dominance is weakened. USDC appears to have found its niche this year as the stablecoin of choice for decentralized exchanges, trailing only USDT in stablecoin market cap in 2021, before overtaking USDT’s market cap in the first few days of 2022 .

image description

(Data source: Nansen; interception date: November 2021)

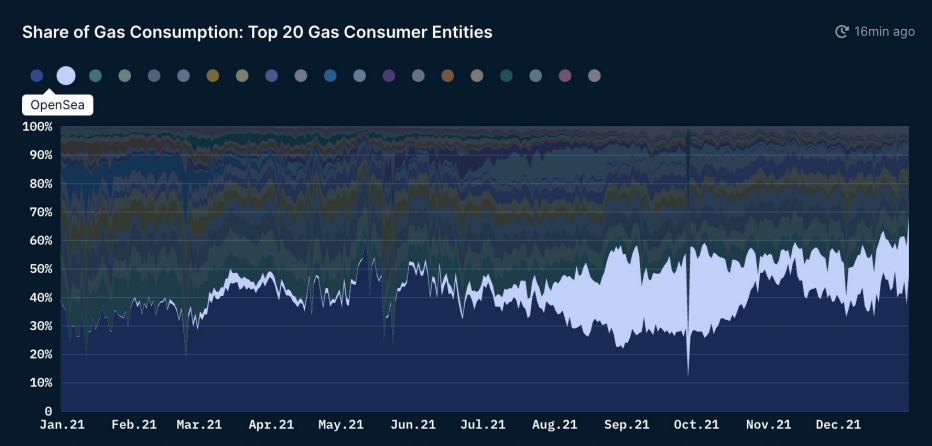

NFT

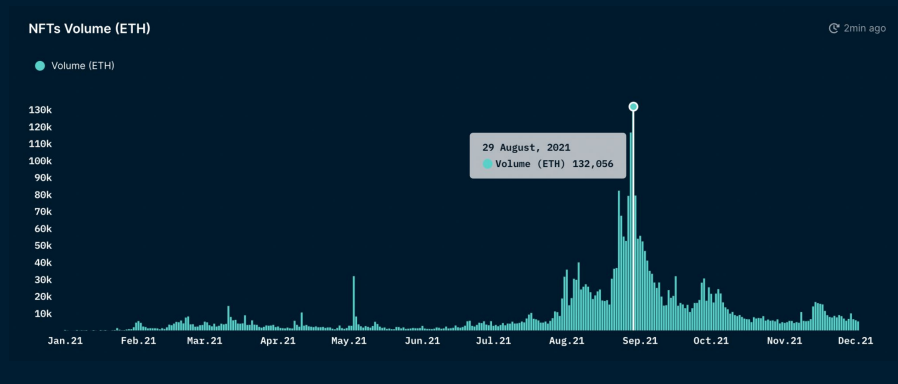

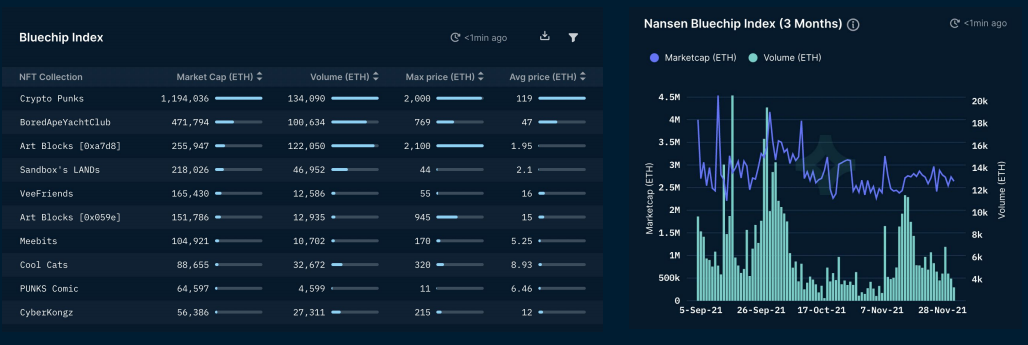

The market experienced two transaction peaks in late May and late August, mainly due to users' attention to certain hot items. It's Meebits (May) for CryptoPunks and Mutant Ape Yacht Club (August) for Bored Ape Yacht Club.

NFT trading peaked on August 29, with daily sales reaching an unprecedented 130,000 ETH (approximately $422,080,100).

On August 29, multiple projects saw daily transaction volumes exceeding 1,000 ETH ($2.7 million). By the end of the year, total NFT sales exceeded 4.6 million ETH ($17 billion).

On August 29, NFT trading volume hit a new all-time high, a day documented in Nansen’s 24-hour data overview.

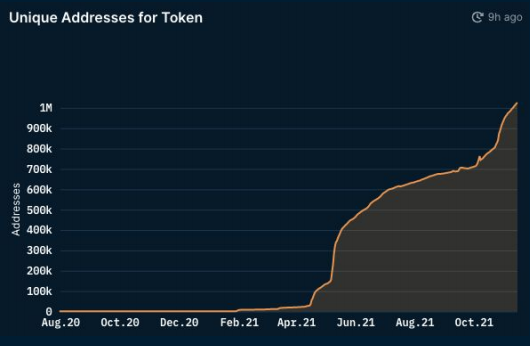

In total, more than 1.2 million wallets minted NFTs across 18,000 projects on Ethereum this year, with a total transaction fee of 187,000 ETH ($7.2 million).

The Mint Master dashboard shows the recent minting activity of NFT projects on Ethereum.

This year’s top 10 NFT traders made a total of 46,221 ETH ($185 million) in net profit, with many influential figures like “Pranksy” choosing to reinvest that profit into new projects.

first level title

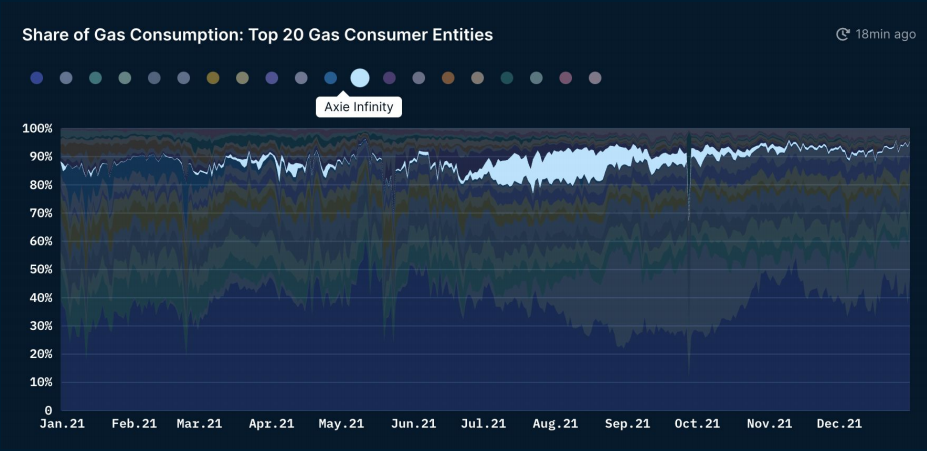

Play-to-Earn

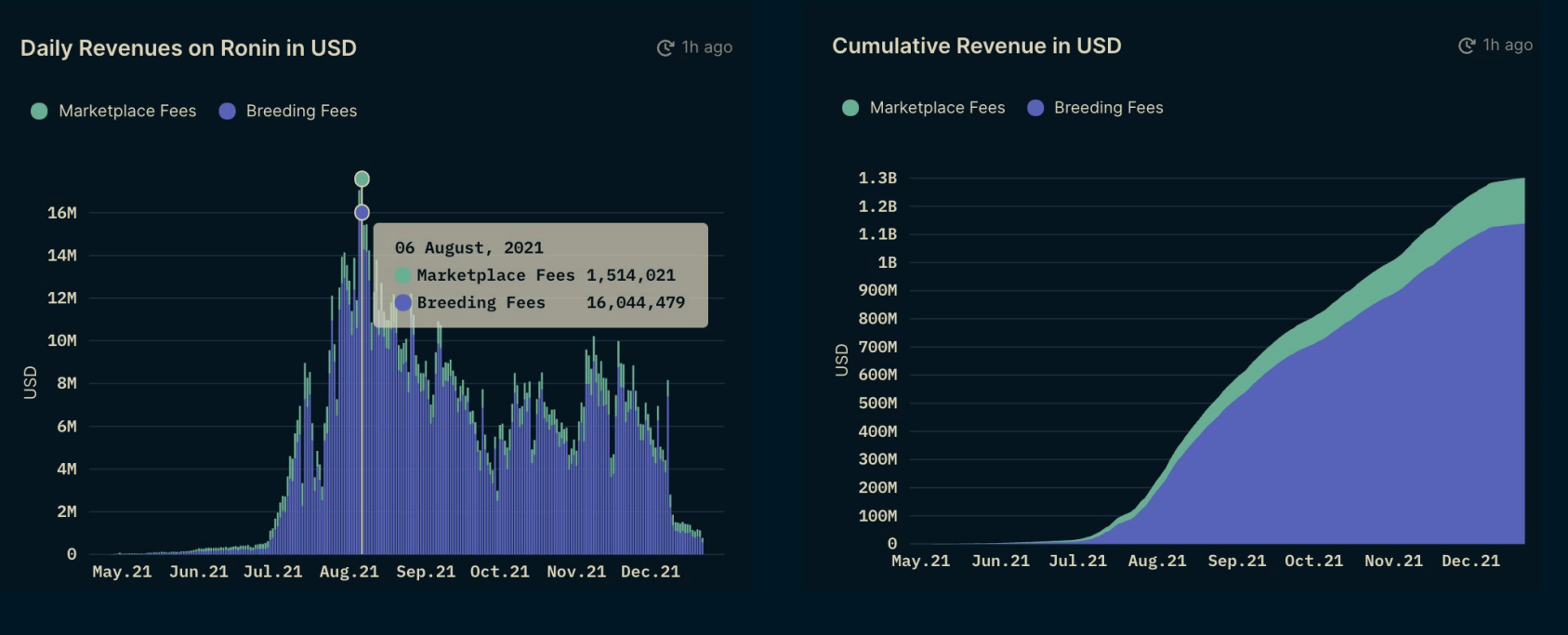

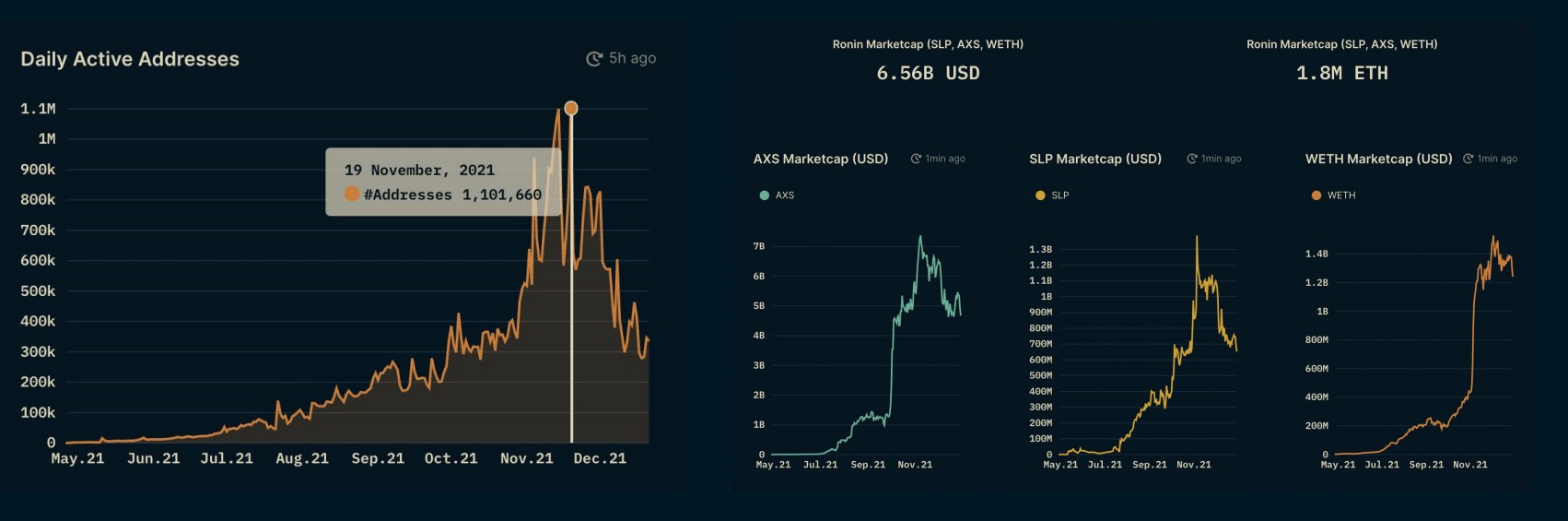

The most popular Play-to-Earn game, Axie Infifinity, has annual revenue of $1.3 billion. Its highest daily earnings record was $17.5 million on August 6.

image description

(Data source: Nansen; interception date: December 30, 2021)

first level title

DAO

DAO means Decentralized Autonomous Organization, which covers from a purely social platform on a Token-based Discord server (such as: Friends With Benefits) to a purely investment-driven platform like MetaCartel.

PleasrDAO is another interesting example, a social and art collection agglomeration.

ConstitutionDAO was formed in November 2021 to bid for an original facsimile of the U.S. Constitution, attracting more than 17,000 participants and raising a total of $47 million in ETH.

secondary title

Value drivers for DAOs:

Effective incentive mechanism operation;

High voting participation;

first level title

Outlook to 2022

As encryption becomes more widely used in 2022, Layer 1 and many Layer 2 will continue to perform well because of their scalability. Winners will be based on the quality and quantity of DApps, and the ease of bridging with virtually no withdrawal delays and fees, in line with a multi-chain future.

In 2021, experimentation with Stablecoins increases, and at the same time, the acceptance of Stablecoins other than USDT on those relatively small chains is also increasing. This indicates that USDT's market share will further decrease in the coming year. A promising stablecoin to stand out in 2021 is TerraUSD (UST), whose market cap has surpassed $10 billion.

Customer demand for crypto assets is likely to outpace regulatory developments. The biggest risk is in wealth management, where clients can easily buy crypto assets. In 2022, inflation concerns and Fed actions will weigh on the real economy, making crypto relatively more attractive.

As more institutions explore the crypto market, crypto lending and options are expected to be adopted by institutions. While few companies hold BTC directly on their balance sheets like Tesla or MicroStrategy, the opportunity to pay with cryptocurrencies may finally make it mainstream. Additionally, we expect institutional investor cryptocurrency holdings to boom in 2022, possibly surpassing retail investors.

Original link