Original Author: Decentral Park Capital

secondary title

Fragile Data Infrastructure

Decentral Park, along with Rocktree Capital and Arrington Capital, recently participated in Pocket Network's latest strategic investment round worth $10 million, and our first investment in Pocket Network was in April 2020.

Applications in Web3 need to access data on public blockchains in the form of API requests.

Given the huge number of Web3 applications that require public blockchains and public data and the diversity of blockchains that provide public data, the size of the Web3 data infrastructure market will reach hundreds of billions.

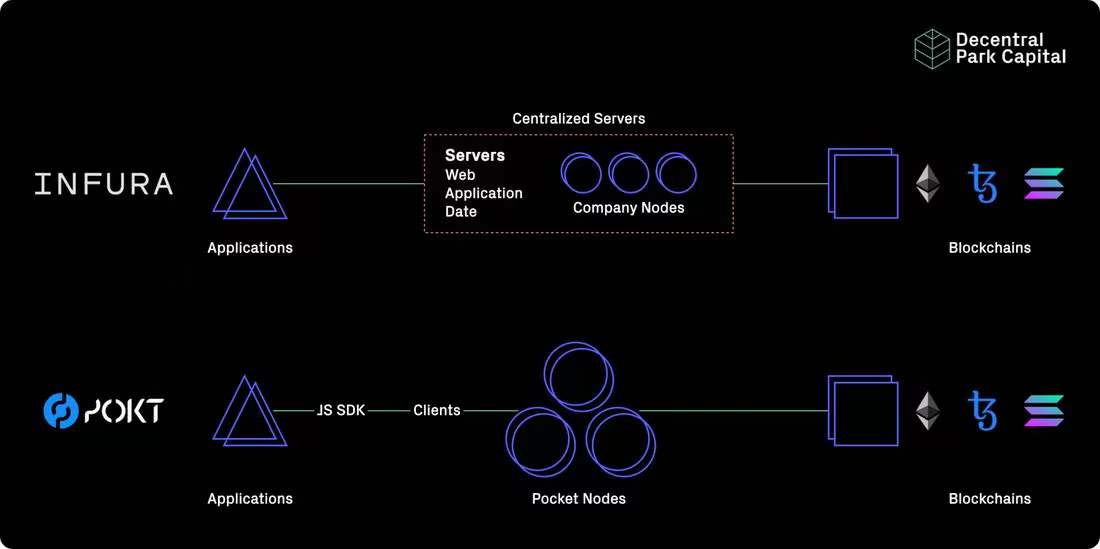

So far, we've seen centralized blockchain infrastructure like Infura make it easy to implement, maintain, and develop data networks that drive API calls to billions of blockchain data.

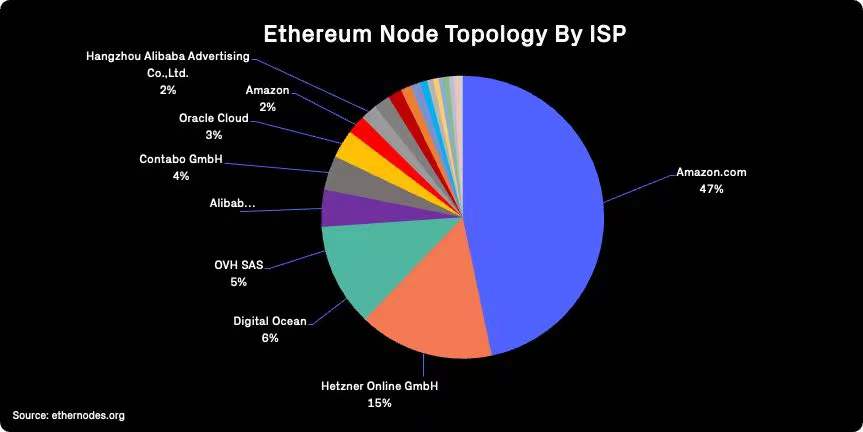

However, the costs of these centralized providers are enormous. In November 2020, Infura experienced a severe outage on the Ethereum network, directly affecting all applications using the service. As recently as September 2021, Metamask's Avalanche node suppliers dwindled to such an extent that Coinbase even looked for available public node information on Twitter.

Such incidents clearly highlight the risk of a single point of failure from a fault tolerance and security perspective. At the same time, application developers do not have the resources, expertise, or time to run their own full nodes. Collectively, this has resulted in an over-reliance on a small number of centralized providers.

A key part of the problem, we believe, is the protocol's lack of incentives for relay nodes. The good news is that this is changing.

secondary title

Let's learn about Pocket Network

Pocket is a standalone blockchain built for applications. It is effectively a two-sided marketplace for applications and infrastructure providers (e.g. Ethereum, Solana) running full nodes. Through token incentives, cryptographic proofs, and verifiable random functions, Pocket can provide developers and their applications with more robust and lower-cost API services.

secondary title

POKT pass

In Pocket, developers of Web3 applications can call the number of RPC relays from the public blockchain, which is related to the number of POKT pledged. Therefore, the POKT token represents the right to access Pocket network resources.

Likewise, on the supply side, infrastructure providers run full nodes and service these relays and earn POKT proportionally to the work performed. For node operators, POKT represents the right to provide work to the market, and each node needs to invest about 15k POKT.

Each relay generates 0.01 POKT, 89% of which is allocated to the service nodes that complete the relay work, 10% goes to the Pocket DAO Foundation, and 1% goes to the verification nodes that generate blocks. Therefore, Pocket dynamically adjusts rewards based on potential market demand for API relay services.

There are no centralized servers, no single point of failure, and no restrictions on node incentives.

Pocket is unique in that it provides a more resilient and less expensive alternative to centralized solutions for Web3:

elasticity

Full node operators are more diverse in number and geography

Node operators can provide RPC relay on multiple blockchains at the same time

cost

cost

Demanders only pay for the relays they want to use

The supply side can increase/decrease its number of nodes according to the overall market demand (e.g. incentives are dynamically and timely adjusted)

No payment intermediary between developers and node operators

secondary title

Emerging Infrastructure Ecosystem

As an implicit middleware protocol, Pocket can provide developers with API services no matter which blockchain the application is built on.

The uniqueness of Pocket lies in its horizontality, the success of Pocket itself does not depend on any one blockchain. Pocket will become the default node infrastructure platform for multi-chain applications in the entire Web3 ecosystem.

As Pocket expands across chains, we will see an abundance of development around its tools. In the past 6 months, we have seen a large number of community-led projects such as mining pool staking and the launch of POKT explorers.

We expect community participation in existing and new Pocket-related infrastructure projects to accelerate starting in 2022 as the network matures.Finally, by focusing on the node (access) layer first, Pocket may eventually add an indexing layer that can sit on top of Pocket to plan and manage the data it provides to the application.

Moving downstream in the tech stack into the data indexing market is just a potentially natural evolution of the long-term evolution of the Pocket ecosystem.

We believe that Jack Laing's leadership in governance is excellent and will inspire other protocols and their communities.

secondary title

traction

Since its inception, the Pocket team has always been committed to building a safe and stable product, which has left a deep impression on us.

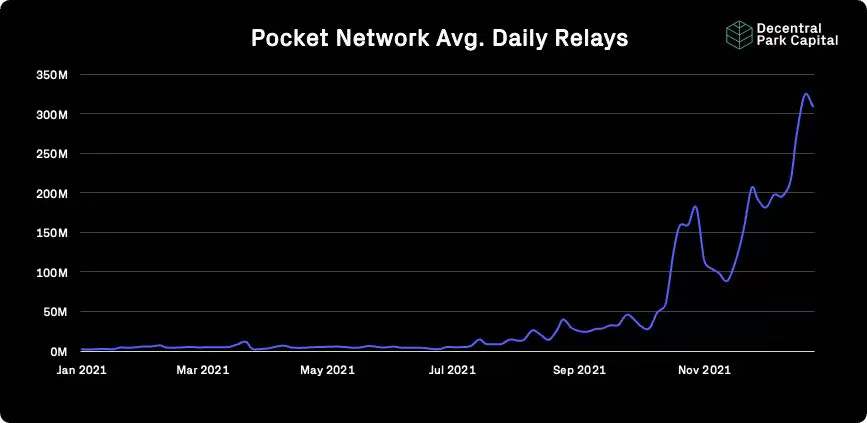

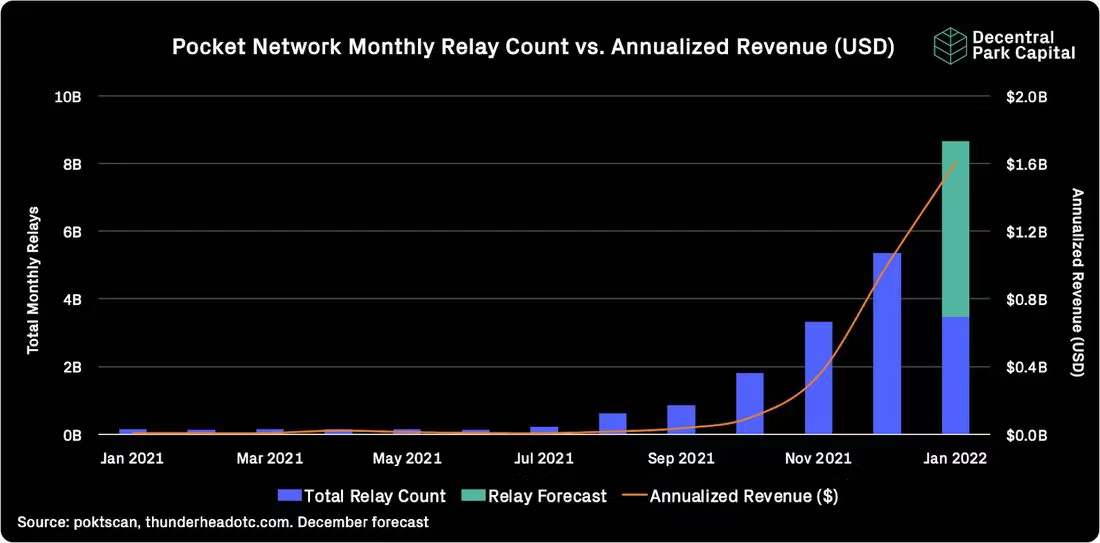

In the early stages, we have seen the power of focusing on data infrastructure incentives. Pocket now serves more than 300 million relays per day, a 12-fold increase from six months ago. While that's still far below Infura's billions of API requests per day, the gap is rapidly closing.

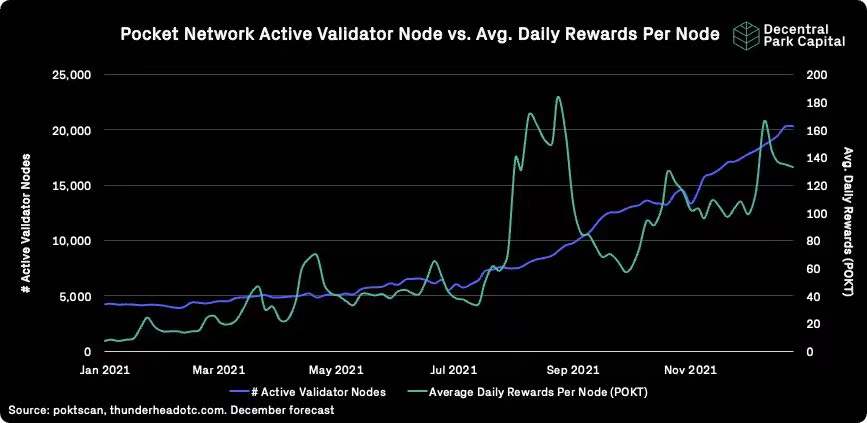

The accelerated growth in the number of relays has led to a higher average daily POKT reward per node, which has increased by nearly 4 times since last summer. As people are hungry for yield, individuals and entities are starting to spot and take advantage of Pocket's bonus opportunities.

This allows for a healthy increase in the number of nodes providing relay services for applications. Today, more than 20,000 operational nodes in 24 countries are supporting the network. Over the past few years, we have concluded that the more nodes, the better the relay service feedback, the more resilient the network is, and the more attractive it is for the applications that need the service. This is exactly the case today - the more node operators there are, the more applications use the relay service, and vice versa.

We expect that the introduction of pool staking such as poktpool will allow those with less POKT to also participate in supporting the network.

The current economic theory of Pocket shows that the more relay services provided by nodes, the more POKT will be generated. Pocket's incentives may attract most of the newly generated POKT to be re-staked back to the system to participate in further growth of relay services and avoid dilution effects. This makes the network more resilient and scalable over time. Just this month, we saw for the first time the total supply of staked POKT surpass the supply of unstaked POKT.

When Pocket enters the growth phase from the startup phase, the DAO may vote to destroy the POKT pledged by the application in proportion to the number of requests submitted by the application. Alternatively, once Pocket reaches a certain level in the total supply or number of relays, the rewards for each relay service could drop. Discussions on these key points are where the Pocket community shines.

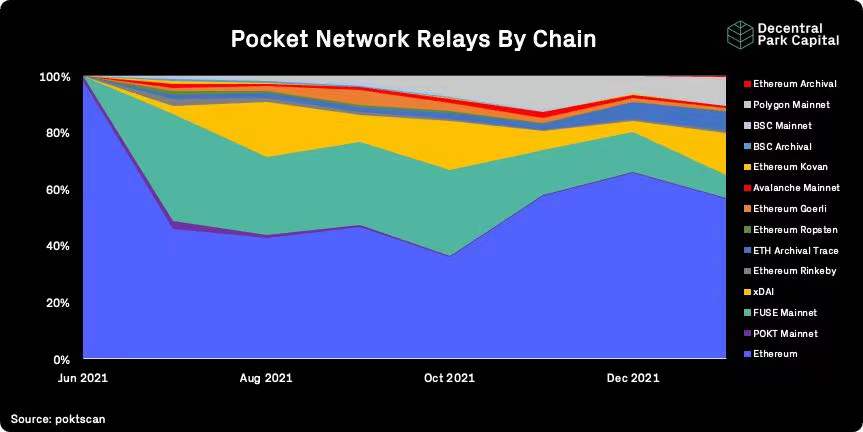

How successful Pocket is depends on the breadth of blockchains it supports. Pocket now supports 37 public chains and more than 2,000 applications, which is impressive. Blockchain network integration is the main focus of the team in 2022, and we look forward to seeing Pocket accelerate support for more and more public chains in the coming quarters.

We believe a key factor driving this multi-chain growth is Pocket’s ability to dominate at the client layer. Building a simpler multi-chain full-node mechanism so that work can be easily transferred to any blockchain has great potential.

An example is the default use of Pocket's SDK for archive nodes, full nodes, and light nodes. This suits blockchain customers that are offloading most of their storage and networking layers to specialized middleware protocols.

secondary title

billions in revenue

Pocket's relay growth has led to an average month-over-month increase in protocol revenue of 92% over the past six months. Although the network is still nascent, annualized revenue exceeded $1 billion in December (a 243-fold increase since July 2021), with service nodes generating the majority of the protocol's revenue.

This makes Pocket Network one of the highest paid protocols in Web3 today.At a fully diluted valuation of $1.7 billion, January's forecast annualized revenue implies a P/S ratio of just 1.05, one of the lowest in the entire market.

To further optimize the network, we are also impressed by the deep community participation in the Pocket economy. For example, it has been proposed to implement an on-chain revenue sharing mechanism aimed at accelerating the onboarding of high-quality full node providers and improving the overall efficiency of the network.

wPOKT

secondary title

One issue that the community is currently considering is that POKT can only send and receive transactions on its own blockchain at present. In order to connect POKT liquidity with the ecosystem of other blockchains and facilitate the launch of applications, the network will introduce a cross-chain version of POKT (wPOKT).

Pocket will be launching a truly unique "Data Mining Program" that will allow users to stake the app on their behalf to subsidize their infrastructure costs and earn revenue through relay. Profit-seeking miners expand their usage through applications, increasing node revenue and revenue.

Finally, miners can stake and subsidize their relay costs on the most valuable Dapps, and these applications will be more inclined to adopt Pocket instead of centralized solutions. Therefore, wPOKT will be an effective mechanism to expand the market and fully satisfy the needs of those applications that use Pocket the most.

wPOKT transforms "speculative capital into productive tools within the Pocket ecosystem".

The Pocket team currently has more than 30 people. Decentral Park is honored to be their long-term supporter, and is happy to help the Pocket team and the community achieve their goal of becoming the default data infrastructure platform for Web3.