0. Summary

In just half a year, Arbitrum's ecology has grown rapidly, and it has matured and out-of-the-box featured projects on various tracks. The potential of Arbitrum has been initially realized. In the future, Arbitrum will continue to develop at a high speed and occupy the forefront of L2.

Thanks to the characteristics of Arbitrum, Arbitrum's infrastructure is extremely complete, and its wallet and exchange support are also very prominent among Layer2 solutions, laying a solid foundation for the development of the ecology.

Arbitrum's DEX and DeFi protocols are very diverse, and accessing Arbitrum has almost become the default choice for such applications. Arbitrum's TVL ranks among the best in all Layer 2 ecology, and at the same time, characteristic decentralized exchanges such as GMX have emerged in the ecology.

first level title

1. Introduction to Arbitrum

Arbitrum is an Ethereum Layer2 expansion solution created by the Offchain Labs team based on Optimistic Rollup technology. Arbitrum uses the communication capabilities between L1 and L2 to transfer any form of Ethereum assets between the first and second layers without trust. Although Arbitrum The transaction is still settled on Ethereum, but Arbitrum only submits the original transaction data to Ethereum, and the execution and contract storage take place off-chain, so compared to the Ethereum mainnet, the gas fee required on Arbitrum is very small, And the contract is fully compatible, no gas limit.

Half a year after the Ethereum expansion star project Arbitrum went live on the mainnet, Arbitrum's ecology has gradually matured under the construction of developers. Compared with Vitalik's recent praise of StarkWare and zkSync's zk-Rollup, it has a strong background of Optimism, and is surrounded by rural areas. The Polygon that grows wildly from the city, the ecology of Arbitrum has been developing more quietly and quietly.

secondary title

text

first level title

text

text

secondary title

Apart from

Apart fromOfficial cross-chain bridgesecondary title

text

secondary title

c. tools

development tools

For developers, commonly used Ethereum development tools and suites (Web3.js, Truffle, Hardhat, Infura, Moralis) all support the Arbitrum network. Developers can use these tools normally, and the development process is basically the same as that of Ethereum There is no difference in the development of the workshop.

In order to enrich and complete the functions of decentralized applications, The Graph and Chainlink are also an indispensable part of the development, both of which support the Arbitrum network.

With these basic tools, developers, as the first users of Arbitrum, can switch to Arbitrum's ecological construction almost seamlessly, and can obtain the same development experience as the Ethereum network, and can develop fully functional decentralized application.

It is worth noting that although these tools all support the Arbitrum network, they are still slightly different from the Layer1 main network due to high latency issues. For example, they may encounter pitfalls in obtaining block height and block time. Therefore, in some Applications that require low latency still need to do some optimization for Arbitrum or wait for the official to solve the problem.

user tools

In addition to the wallet, other user tools are also an important part of the ecology. Arbitrum's user tools include the Arbiscan blockchain browser, Nansen, Token Multisender (which can perform NFT transfers in batches), Gnosis Safe (multi-signature wallets, which can be used to The team’s shared wallet or personal multi-device wallet management tools). These tools not only ensure the needs of basic users to view transaction information, but also provide data analysis and special interaction functions for some users, so that the use of Arbitrum can be expanded go out.

base token

secondary title

3. Arbitrum DeFi

text

text

text

Dfyn

text

Dfyn is the first DEX to launch gasless transactions. As the name suggests, users do not need to pay gas when Swap. Gasless is mainly achieved through Biconomy's repeaters. When trading, users only need to sign the transaction, and then Biconomy's The repeater will pay gas, forward the transaction back to the Dfyn contract, and finally the contract will update the state on the chain. In actual use, operations such as Approve still require gas, and currently only the Polygon chain has a gasless mode. But this gasless The model is still very novel and eye-catching.

white paperwhite paperIt does not disclose too many details, but such a cross-chain Swap is indeed a very simple and easy-to-understand solution. In addition to Dfyn's Router Protocol, there are also THORchain and Chainflip on the track of cross-chain Swap. The solution provided may be more decentralized than Router Protocol.

text

GMX

GMX is a decentralized spot and perpetual contract exchange, featuring low Swap fees and zero slippage transactions, currently deployed on the Arbitrum and Avalanche networks.

Unlike traditional order books or AMM exchanges, GMX does not use a pool in the form of trading pairs, but uses a multi-asset GLP (GMX Liquidity Provider) for executing Swap and leveraged transactions. Liquidity providers will putETH,Tokens such as BTCIt is charged into the GLP pool. The price of the traded ETH and other currencies is obtained by combining the Chainlink oracle and the average price of several other mainstream DEXs. It is the above design that allows GMX to achieve 0 slippage and low-fee transactions.

The price of GLP tokens is derived from the total value of assets in the GLP pool/GLP supply. When liquidity providers inject assets into GLP, they mint a certain amount of GLP tokens and burn them when they withdraw liquidity Corresponding GLP tokens. In this process, if the number of ETH tokens in the GLP pool is small, the corresponding handling fee for adding ETH will be reduced, so as to motivate the provider to provide the most beneficial assets for the pool.

At the same time, GLP holders will receive these two incentives: one is that they will receive esGMX that can be fully converted to GMX after one year, and the other is that 70% of the platform revenue will be shared with the holders (in block Tokens that are native to the blockchain network are issued).

The GMX token is the utility and governance token of the platform, which can be used for pledge. The reward after pledge is: esGMX mentioned above, 30% of the platform’s revenue share, and the points generated by 100% APR per second (Multiplier Points , can obtain the same native token fee income as GMX).

text

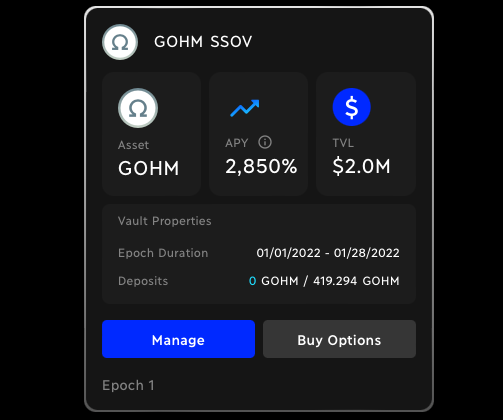

Dopex

Dopex is also a relatively popular decentralized options trading platform recently, which was launched on Arbitrum and BSC. The basic design of Dopex is very similar to that of Opyn. The characteristics of Dopex are: option pool concept, pricing model (BS equation), dual token model ( Option sellers can get rDPX rebates in case of losses, and rDPX can also be used as collateral to mint other derivatives). In the recent popular Curve War series of articles, Dopex was also widely discussed because of gOHM's option pool.

secondary title

b. DeFi Protocol

Mainstream DeFi protocols have also chosen to stand in line with Arbitrum to expand their territory and potential user groups. Recently, Aave also passed the proposal to deploy on Arbitrum with a support rate of 99.99%.

The active support of the DeFi protocol for Arbitrum is mainly due to the sense of competition with other DeFi protocols. The protocol hopes to gain the support of more network users through as much support as possible and improve its own competitiveness.

Of course, iron still needs to be hard. Arbitrum’s excellent infrastructure and existing ecology make it difficult not to support these protocols. Recently, Curve locked up only 77 US dollars within 4 hours after Optimism went live. This may be due to the imperfect ecology. It shows that there are few users. In this respect, Arbitrum is very mature.

Arbitrum's DeFi ecosystem includes Badger, Beefy Finance, Curve, Olympus DAO and other projects.

Dev Protocol

Dev Protocol is an interesting project in Arbitrum's DeFi ecosystem.Stakes.socialIt is a decentralized open source project funding platform similar to GitCoin based on Dev Protocol. Dev Protocol currently has two tokens, DEV and Creator.

DEV tokens can be pledged to open source projects to obtain income. At the same time, they are utility tokens in the platform and can be used to pay for authentication and other interactions. Creator tokens are project tokens that open source projects can create by themselves.Stakes.socialToken distribution management and proof of ownership are carried out on the platform, and these different Creator tokens can obtain part of the income of Dev tokens pledged by supporters to the project. Regarding Creator tokens,Stakes.socialA unique oracle machine Khaos is also built in, which can export ownership certificates to platforms such as GitHub by listening to user signatures (or other chain events).

Stakes.socialCurrently deployed on the Ethereum mainnet, Arbitrum and Polygon, there are different open source projects in different networks. Among them are Vyper and other Web3 projects, and there are also many Web2 projects, including Mandane (the Lisp Hypervisor of Apple's M-series chips), Sindre Sorhus's A series of open source projects (GitHub 46k followers), Redux-toolkit (GitHub 7k stars) etc.

secondary title

c. GameFi

text

4. Arbitrum DApp

a. NFT

text

Treasure DAO

Treasure DAO is a decentralized NFT ecosystem on Arbitrum, built for the metaverse. The project is a metaverse base layer platform, used to support other metaverse projects to build ecosystems, and also build an NFT market for projects within the ecology.

The metaverse center of Treasure DAO is Bridge World. Bridge World is a community-centric metaverse game that encourages community collaboration through guilds and sub-DAOs to achieve resource accumulation, resource efficiency optimization, and player-oriented development Strategy. Bridge World includes Magic (metaverse’s common currency, governance token), Treasure (metaverse’s game resources and background narrative cornerstone, Treasure’s native NFT), Legions (metaverse’s Legion).

The community attributes of Treasure DAO are very strong. It not only highlights community functions through token voting governance, but also has a large number of secondary creations and feedback to the community. For example, some Treasure derivedIndependent DAO,Users can create background stories for Treasure through proposals, and the concept of subDAO has also penetrated into the community...

The Smol Brains on Treasure DAO's market has also slowly evolved from a free Mint NFT to "CryptoPunks" on Arbitrum. Treasure DAO is constantly updating the white paper, and will release the Bridge World game in the next few weeks, similar to OpenSea The NFT market of Treasure DAO, as well as many other new projects, can be said to be developing rapidly with the help of the community, which is worthy of attention. Treasure DAO's comprehensive world view, diverse gameplay and the prosperity of the community allow us to see the real development of chain games direction.

secondary title

b. to pay

On the payment track, Arbitrum's low fees and EVM compatibility also bring a very good solution for payment-related smart contract applications. Arbitrum mainly includes Zippie (a payment solution for the African market) and Superfluid (coming soon to Arbitrum) .

Superfluid

Superfluid is a payment protocol and new token standard that enables true cash "flow" payments that can be applied to salaries, subscriptions, or rewards that are usually paid out monthly. Superfluid is implemented through blockchain timestamps Real-time settlement increases capital efficiency. The user's balance will change in real time, which means that the user can use part of the salary that is usually paid on a monthly basis at any time, which is very flexible. For example, if there is a sharp drop on January 20, 2022, Then we can use the streaming funds received this month to buy bottoms at any time. The security of the streaming funds is guaranteed by the blockchain. Superfluid is currently on the Polygon and xDAI networks, and will soon be on the Arbitrum network.

The MakerDAO team, Delphi Digital, and even members of Visa have used Superfluid for streaming salary payments. Superfluid has also sponsored a lot of hackathons. In 2021, more than 250 projects will be developed based on Superfluid. Among them are Diagonla (Streaming Web3 Subscription service), Streamroll (enabling DAO to borrow and lend through streaming payment), TokenVesting (as the name suggests, using streaming payment to do token vesting)...

Users have deployed more than 100 Superfluid tokens on its basis. Superfluid has attracted a TVL of 120 Million, which is already high for Superfluid's mechanism, because for example, Ricochet Exchange only needs a TVL of 200 dollars to operate each The total monthly funding is 2.3 Million. The TVL of Superfluid is mainly driven by the use cases of Treasury, Vesting, and native Superfluid tokens.

Under the innovation of streaming payment, Superfluid perfectly utilizes the characteristics of blockchain and smart contracts, and continuously promotes the construction of the developer community, which has revolutionized the payment method very well and opened up infinite possibilities for multiple use cases.

In the field of streaming payments, there areZebecsecondary title

c. DAO

5. Summary

5. Summary

Arbitrum's ecology continues to grow with a complete infrastructure. With the advantages of EVM compatibility and low transaction fees, not only are various already popular DeFi protocols deployed on the network on Arbitrum, but there are also innovative applications bursting on the Arbitrum network. In the future of the blockchain, more applications will choose to deploy on the second-tier network of Ethereum. Now our most focused public chain battle may become a second-tier battle. Arbitrum will always be a very important part of this competition. A strong player.