Happy New Year! To celebrate the start of 2022, we are launching a public beta of Strips! Excited to show you the stunning new UI for Strips and introduce some of the features and updates that have already been deployed on the page.

Strips Finance is a next-generation fixed income platform for global investors. From interest rate trading to bond trading, we're building the infrastructure for DeFi 2.0. Strips Finance will be the world's first decentralized interest rate derivatives exchange.

Strips are currently only available on the Arbitrum testnet:

Network Name: Arbitrum Testnet

New RPC URL: https://data-seed-prebsc-1-s1.binance.org:8545

ChainID: 421611

Symbol: ETH

Block Explorer URL: https://explorer.binance.org/smart-testnet

Features and updates:

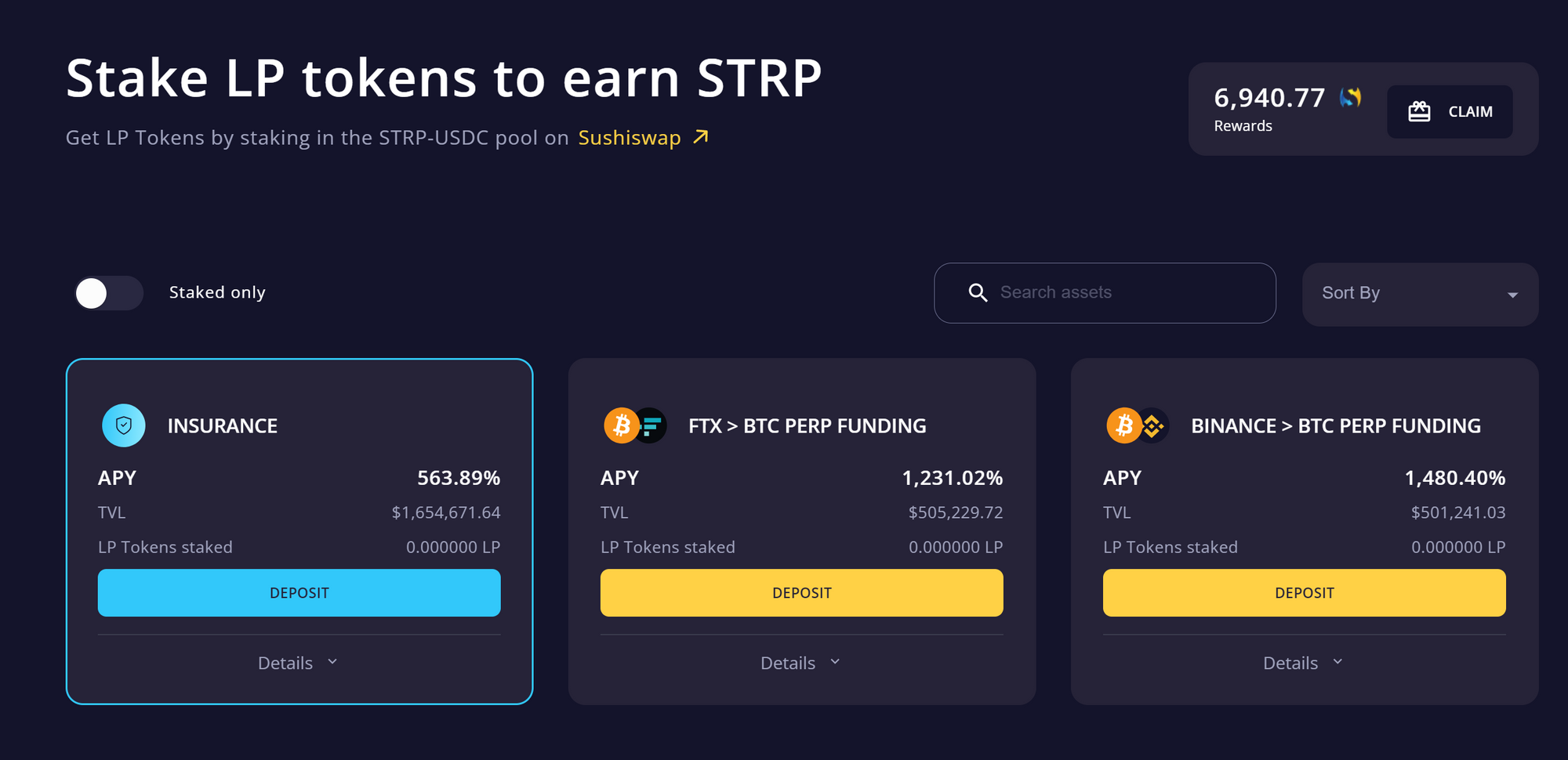

Users can stake the LP of STRP-USDC into the liquidity pool as collateral quality

Trade and stake STRP to earn rewards

Get rewards in real time

Add or withdraw collateral in real time

Staking can get higher transaction rewards (up to 200%)

Historical APY Chart

Improved liquidation engine

The average entry price of the transaction can be dynamically calculated

Optimize gas fees to reduce transaction costs

a. go tohttps://faucet.rinkeby.io/And follow the instructions to receive ETH from the Rinkeby testnet

b. Enter the amount of ETH you want to cross-chain to the Arbitrum testnet, and click Deposit.

Enterhttps://app.strips.financeConnect your Metamask wallet

Switch to the arbitrum testnet network as prompted by Metamask

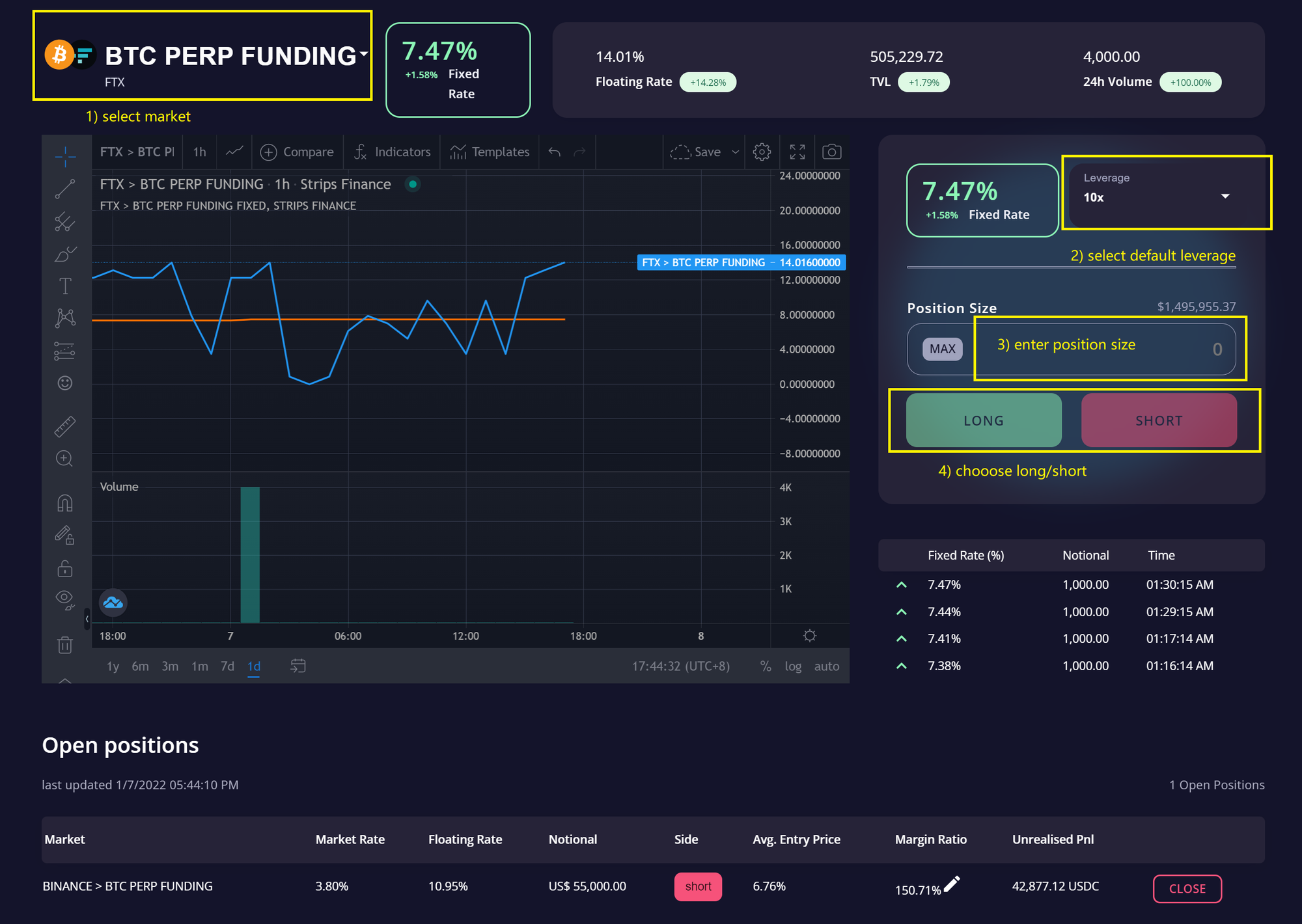

select market

Choose the default leverage (up to 10 times leverage)

Enter position size

1. Long: You think the fixed rate will go up 2. Short: You think the fixed rate will go down

Confirm your transaction in the pop-up page Note: If your slippage is too high, you may need to increase your maximum slippage

Confirm both transactions in your Metamask wallet

Blue line: The blue line represents the floating rate

Orange line: The orange line represents a market fixed rate

start operation

Cross-chain ETH to Arbitrum testnet

Get free ETH:

Cross-chain the ETH of the Rinkeby test network to the Layer 2 Arbitrum test network

a.go tohttps://bridge.arbitrum.io/

Note: switch to Rinkeby Ethereum testnet

Link to Strips

Get testnet SUSD and SLP from mint page

herehereRead more.

how to trade

Choose long or short

sheet:

Market rate: current fixed rate price

Floating rate: the current floating rate (for the party providing the funding)

Notional: position to open a position

Side: open long or open short

Avg. Entry Price: average position entry price

Margin ratio: The margin ratio of the current position (less than 3.5% will automatically trigger liquidation)

Staking Tutorial

Click on DEPOSIT to select a market

Enter the amount of Sushi LP (SLP) tokens you want to stake

Confirm the deposit in Metamask (if it is the first deposit, you may need to confirm twice)

open position

After the order is successfully placed, your open position will be displayed at the bottom.

Note: If you do not see your positions, please refresh the page.

Staking Tutorial

What will we do next?

We will be hosting a trading competition soon.

The event will award $100,000 in prizes.

Every participant has the opportunity to share in the rewards, and if you want to get ahead of the competition, you can experience and practice on the public testnet before the event!