On January 4th, Beijing time, the encryption trading platformFTX Announced that the latest IEO project is the DeFi option agreement PsyOptions (see the end of the article for specific rules).

PsyOptionsIt is a decentralized options protocol based on the Solana blockchain, and its unique feature is that it focuses on physical delivery and American options.In the official introduction, PsyOptions aims to "bring the feel of TradFi to DeFi" by building a decentralized, permissionless, community-owned financial services platform.

The founding team of PsyOptions has been focusing on the construction of the Solana ecosystem, and has participated in the DeFi "hackathon" held by Solana&Serum twice. In the first "Hackathon" event, the team was inspired by Chainlink to create an oracle project, but failed to get the ranking, regrettably lost; in the "Hackathon" event in February this year, the team aimed at the DeFi derivatives competition Dao, created the Solana ecological DeFi options agreement, and finally won the championship, and PsyOptions came into being.

After half a year of preparation (technical development, legal compliance), PsyOptions officially launched the Solana mainnet and launched the v1 version in August last year.PsyOptions V1 is a clearing and settlement layer for options on Solana. With no external dependencies (i.e., oracles), anyone can create options for any SPL standard token, including tokens, NFTs, and tokenized stocks, in a completely trustless manner for any period of time.

“The core protocol is completely trustless, making no assumptions about how options should be traded or priced, allowing users to price them as they wish, and Serum’s market makers will price options as they see fit,” says PsyOptions.

The so-called option is to give the buyer the right to buy or sell the underlying asset at the agreed price and date, but there is no obligation. There are five concepts involved in PsyOptions options, namely:Underlying asset, quote asset, contract size, strike price, expiration date.Below, we specifically introduce the use cases of PsyOptions options.

Assuming that the current SOL price is 170 USDT, user Xiao Qin believes that the SOL price will fall or remain volatile in the future, but user Xiao Zhang thinks that the SOL price will soar. At this time, the two can choose to trade options to hedge risks. The two agreed that one month later, Xiao Zhang would buy 100 SOL from Xiao Qin at a price of 190 USDT. In order to facilitate the timely performance of the contract, the two generate a SOL/SUDT call option through the PsyOptions option agreement. Xiao Zhang is the buyer of the call option, and Xiao Qin is the seller of the call option. In the above case, the underlying asset is SOL, the quote asset is USDT, the contract size is 100, the strike price is 190 USDT, and the expiration date is one month later.

In terms of specific operations, Xiaoqin needs to mortgage 100 SOLs into the option agreement first to ensure normal repayment in the later period; after the mortgage is completed, he will receive two tokens—the option token and the equity token, both of which are SPL Token Standard.

"Option token", Xiao Qin can sell it to Xiao Zhang, the specific price can be set by himself, and can be sold at a premium; after the expiration, if the SOL price rises to 170 US dollars or more, Xiao Zhang can use the option token to sell at a price of 170 US dollars Buy the agreed amount of SOL at the exercise price; if the SOL is less than 170 US dollars, Xiao Zhang can choose not to exercise the option and directly abandon the exchange. In either case, option tokens are destroyed upon expiration.

"Equity token" is a claim on the underlying asset. After the option expires and the debt of the option buyer is repaid, the remaining underlying asset belongs to the equity token. For example, after the expiration date, Xiao Zhang took away 70 SOL, then Xiao Qin's "equity token" only has 30 SOL left; if Xiao Zhang abandons the exchange, the equity token is still 100 SOL.

Through the above introduction, we found that,PsyOptions options are represented as SPL tokens, which means that they can be traded on any DEX that supports SPL tokens, becoming a basic module for integration with other DeFi protocols.in addition,

in addition,The final delivery of PsyOptions options is physical settlement, and users can obtain the underlying assets (that is, SOL in the previous article, or other currency-based assets), and most options or futures currently adopt cash settlement (that is, stable coins such as USDT as settlement).

Both ways have pros and cons. For loyal currency-based users, they may be more willing to use physical settlement; however, on some infrastructures with underdeveloped cross-chain tools, such as the current number of BTC locked on the Solana blockchain is less than a few thousand, physical settlement will Due to restrictions, it is more advantageous to adopt cash settlement at this time. Furthermore, the PsyOptions protocol will require users to lock the underlying assets, resulting in locked tokens that cannot be used for governance or other revenue generation strategies.

In terms of financing, in October last year, PsyOptions announced the completion of the first round of financing of US$3.5 million, led by Alameda Research, and participated by CMS Holdings, Ledger Prime, MGNR, Wintermute and Airspeed18.

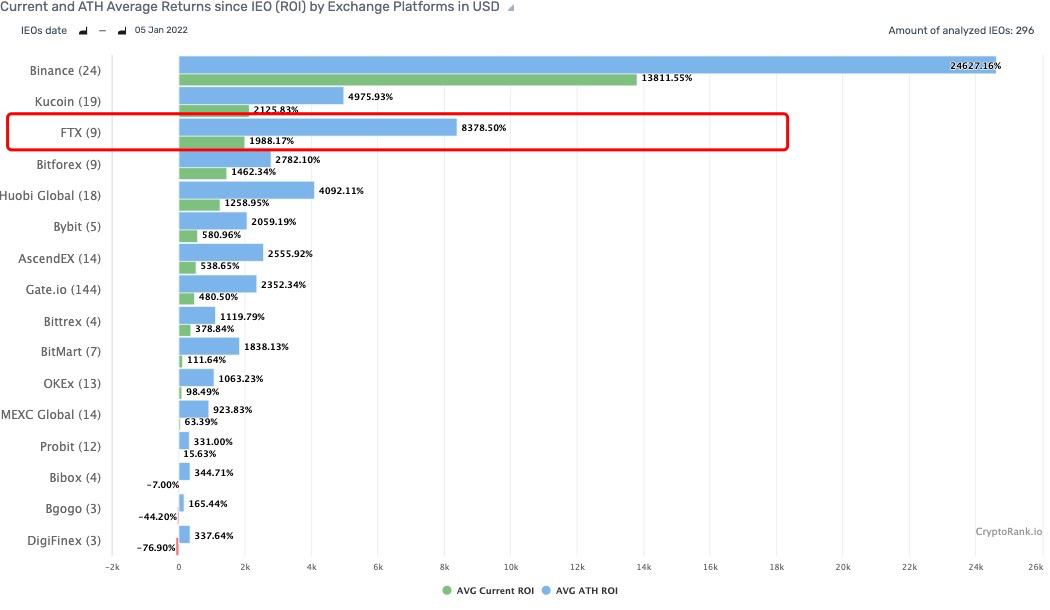

In terms of tokens, the native token of the PsyOptions protocol is PSY, which is also the governance token of the project. It can vote and manage the revenue generated by the protocol, and a pledge mechanism will be launched in the future. According to the official plan, 3% of the total PSY tokens will conduct IEO on FTX and Gate in the near future. Cryptorank data shows that the return rate of FTX IEO projects has been generally high in the past two years, with the highest return rate in history ranking second and the current return rate ranking third, as shown below:

FTX also announced the specific rules for participating in the PsyOptions IEO today. For details, please refer to the official announcement:https://help.ftx.com/hc/zh-cn/articles/4414515394836

FTX also announced the specific rules for participating in the PsyOptions IEO today. For details, please refer to the official announcement:https://help.ftx.com/hc/zh-cn/articles/4414515394836

Before 13:00 (UTC) on January 17, 2022, users who have pledged ≥150 FTT and passed KYC level 2 certification can participate in this round of PsyOptions pre-sale

Due to the recent surge in identity verification applications, all users who submit identity verification applications after 13:00 (UTC) on January 11, 2022 will not be guaranteed to participate in the pre-sale event.