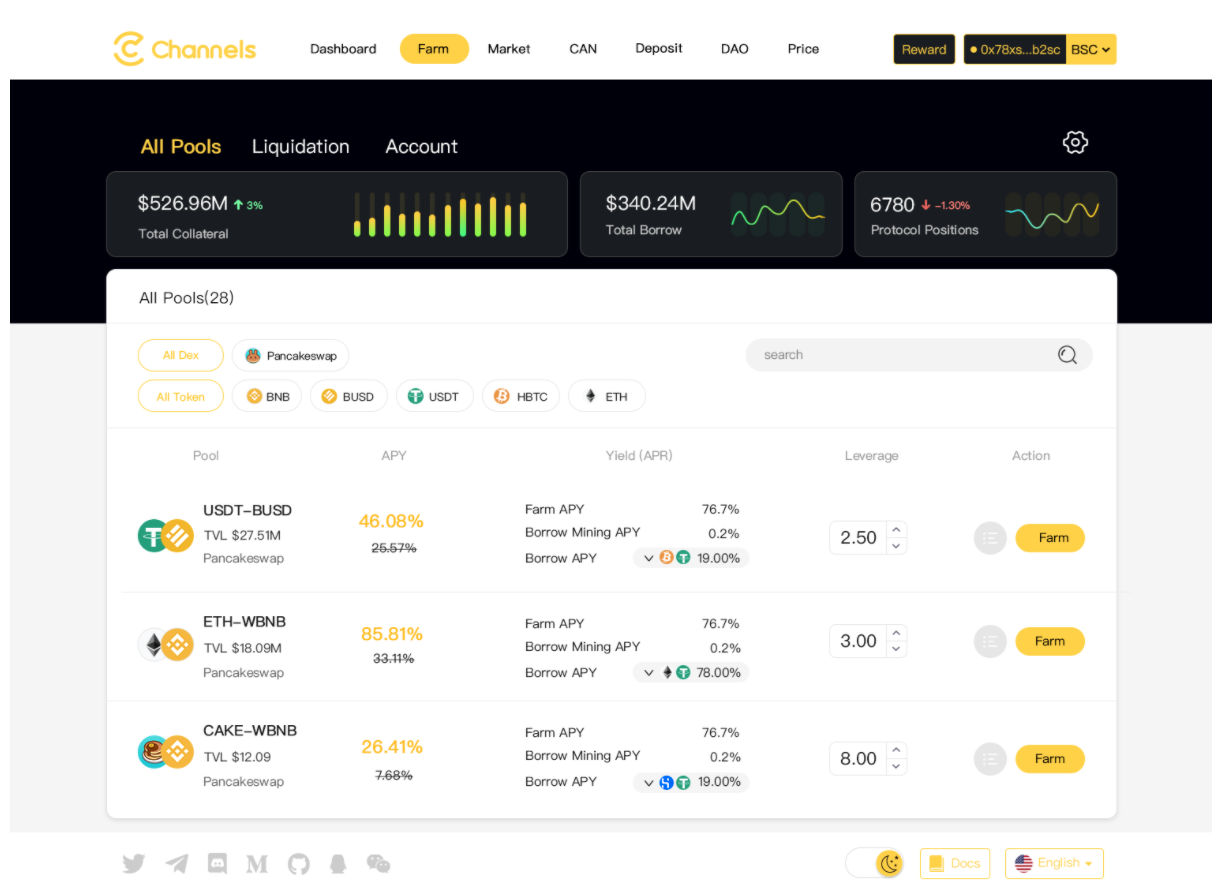

Channels is a multi-chain innovative DeFi lending protocol. It has never had any security incidents in the year since its launch. Heco, BSC and Arbitrum are currently on the line, which are cross-chain mortgage lending platforms. Recently, Channels is about to launch the V2 version, so what innovations does V2 have compared to V1 and other lending products?

text

secondary title

Mortgage lending means that users deposit certain tokens into the platform as collateral, and lend out another type or multiple tokens for other investments. Leverage lending means that users deposit funds into the platform and open leverage, and the platform automatically implements liquidity mining on DEX. Leverage lending is essentially a loan scenario evolved from mortgage lending. It assumes that users use the loaned funds to mine liquidity on DEX after mortgage lending, but leverage lending helps users realize this process automatically.

secondary title

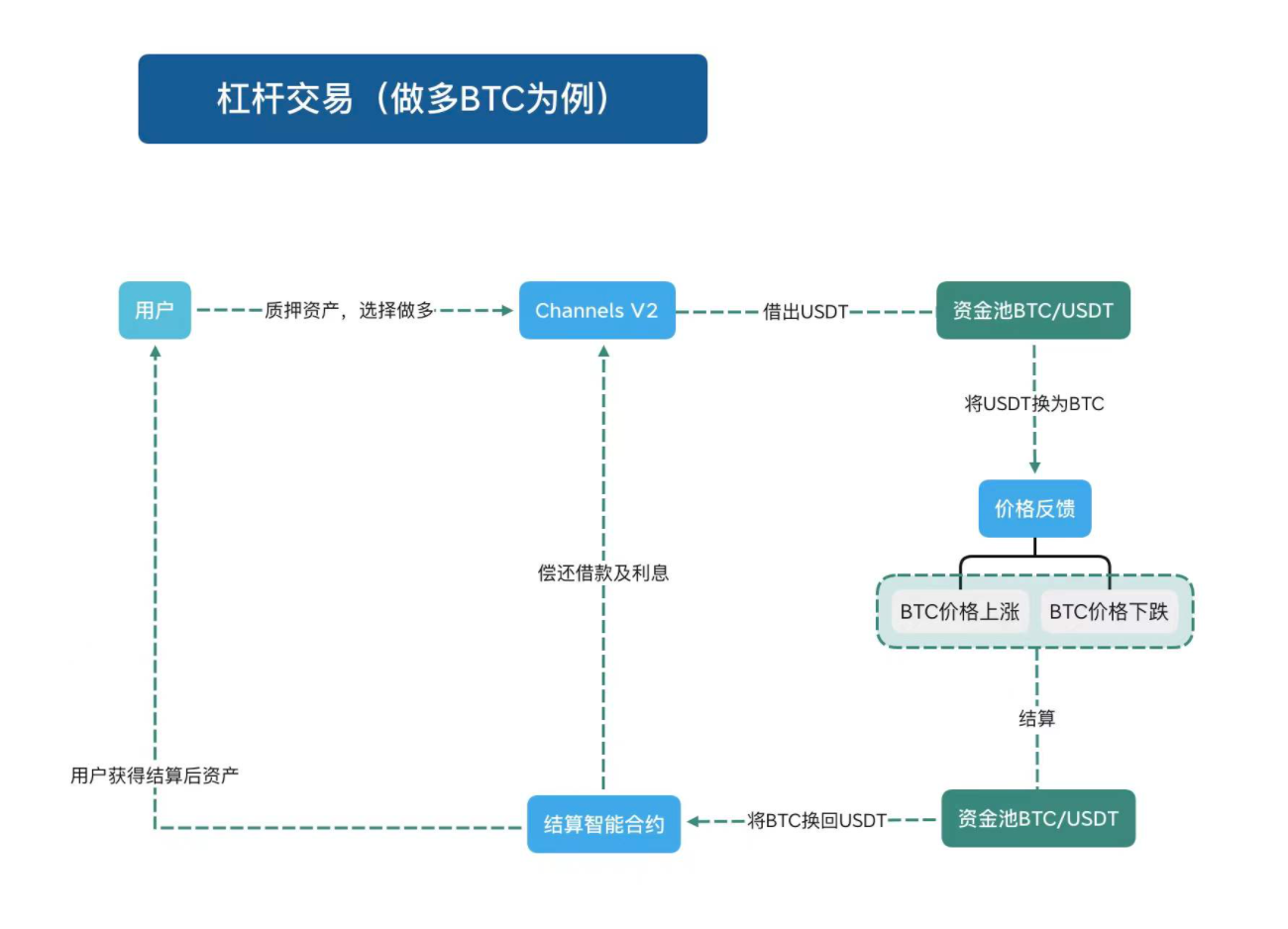

leveraged trading

leveraged trading

For example, if Bob wants to do more BTC, he first pledges BTC worth 1000 U on Channels, and then he can use the function of leverage trading to directly convert his pledge into BTC worth 3000 U, and at the same time add 2000 USDT loan. In this way, when BTC appreciates, he can get 3 times the original income. At the same time, using the leverage trading function also increases the total amount of funds for users, so the mining rewards obtained by users will also increase. This undoubtedly satisfies the investment needs of high-risk and high-yield users, and greatly simplifies their operating procedures. As shown below.

secondary title

Loan pool

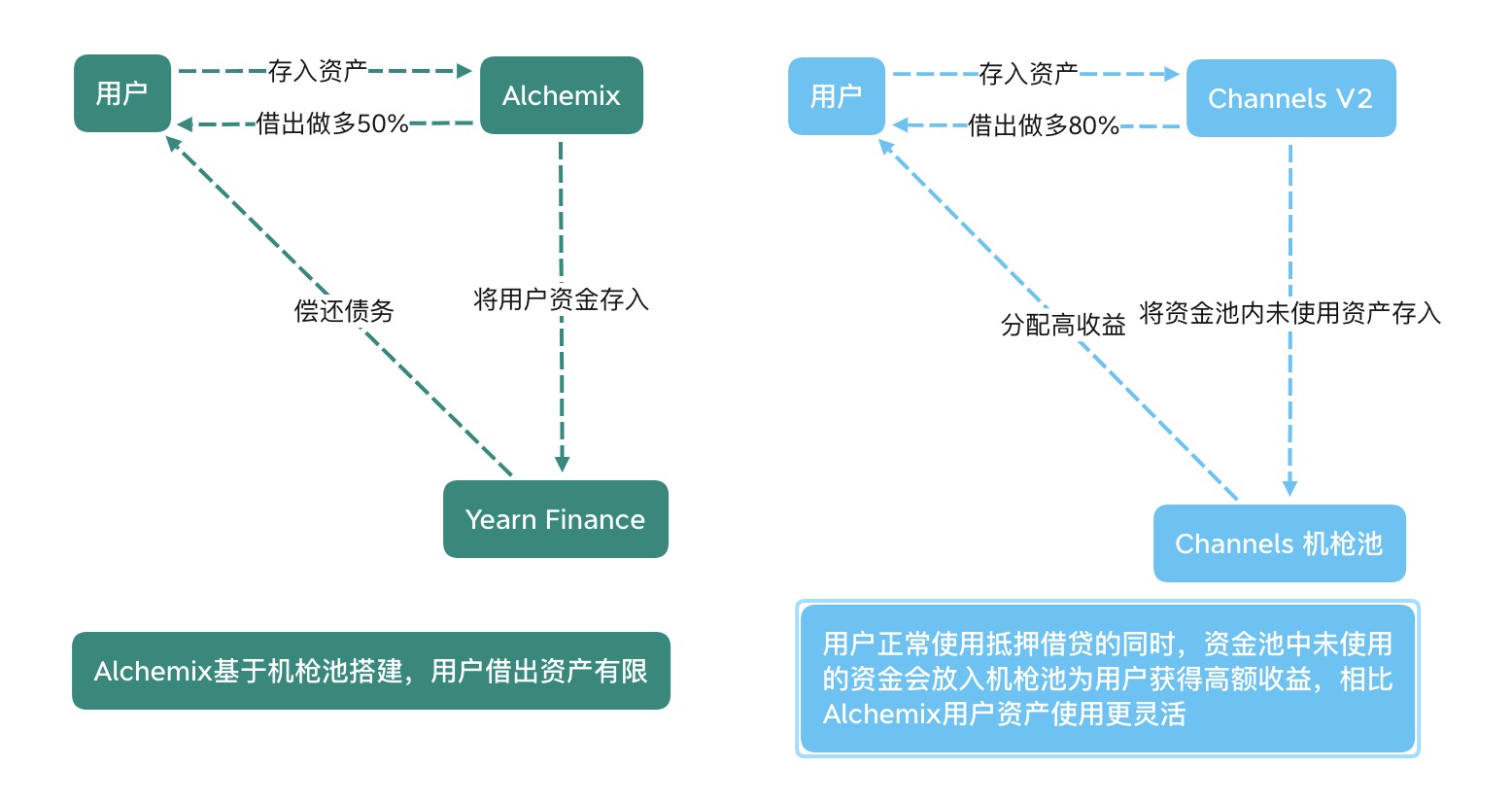

There is an inherent shortcoming in the over-collateralized lending model, that is, the capital utilization rate is not high, even the overall capital utilization rate of Compound, a leading lender, is less than 40%. It can be said that low capital efficiency is a problem that plagues the entire industry.

In theory, the value of the collateral is always higher than the value of the loaned assets. For example, when the mortgage rate is 80%, if you mortgage 100 yuan, you can only lend 80 yuan at most. In theory, at least 20 yuan will never be used. In reality, the remaining unlented funds are often far more than 20 yuan, or even more than 70 yuan. But in fact, the platform may only need to keep 30 yuan to meet the normal user withdrawal needs. These unlended and unused funds have not produced any economic benefits for the platform and users, and have become a huge waste of resources. The rate of return of the lending platform is not high, and the very important reason is that the utilization rate of funds is not high.

Channels V2 creatively alleviates this problem to a large extent through the borrowing machine gun pool strategy. The specific implementation method is that through a set of liquidity management mechanism, under the premise of ensuring that the withdrawal of users is not affected, part of the idle funds in the liquidity pool will be put into other platforms in the form of a machine gun pool to obtain income. In addition, in order to ensure the absolute safety of funds, funds will only be put into the top DEX, such as Pancake on BSC.

secondary title

Conclusion:

Conclusion: