Original Author: Nansen

Compilation of the original text: The Way of the Metaverse

introduce

Original Author: Nansen

Compilation of the original text: The Way of the Metaverse

introduce

Avalanche is an EVM-compatible Layer 1 platform focused on speed and low transaction costs. It aims to solve the scalability issues that Ethereum is currently facing today. It is able to realize their vision through some of its core features, such as sub-second finality of transactions, unique consensus protocol upgrade via Snowball++, high transaction throughput, and having more than 1,200 full block producing nodes to validate the network. In short, Avalanche delivers what users know and love, at a fraction of the cost.

In the trend of multi-chain future, Avalanche has built one of the best bridging experiences through their Avalanche Bridge. It makes bridging assets from Ethereum safer, cheaper, and faster, and has already facilitated the transfer of over $27 billion worth of tokens into and out of the Ethereum network. It's also important to note Avalanche's shared security model, which is handled at the subnet level and allows applications to choose the level of security required for their applications. This is a key difference from Ethereum, where applications tend to overpay for security.

Just over a year old, Avalanche has a vibrant ecosystem of native applications and a popular protocol based on Ethereum. Much of the activity was kicked off with the $180M liquidity mining incentive announced in July, but we’ve seen continued growth and activity in TVL, transaction volume, cross-chain bridge activity, and many other metrics. In TVL alone, Avalanche has grown from less than $200 million in July to well over $13 billion today -- a 65-fold increase in less than six months.

Major Ethereum projects such as Aave and Curve have also migrated to Avalanche through yield farming incentives, further driving traffic in the chain. Avalanche is quickly becoming a home for DeFi, crypto dApps, and enterprise solutions.

Avalanche ecological map and head dApp

The Avalanche ecosystem is very powerful, covering all major aspects of blockchain, from DeFi, NFT, DEX, P2E, etc. CCK Ventures can see the breakdown of the ecosystem in the image below.

image description

Avalanche Bridge

Source: CCK Ventures

Due to EVM compatibility, major Ethereum DeFi projects such as Aave and Curve were able to easily migrate to Avalanche, further driving traffic on-chain. All Avalanche projects have a TVL of more than $13.9 billion, with Aave taking the lion's share at 25.82% with a TVL of $3.59 billion. They are followed by Trader Joe's and Benqi, native projects of Avalanche, which are also popular.

Other notable Avalanche-native dApps include Wonderland (the most successful OHM fork with over $2 billion staked), Cradaba (a play-and-earn casual and combat game revolving around an underwater world of fiercely fighting hermit crabs) .

For the transfer of ERC20 tokens from Ethereum to Avalanche's C-Chain, users can use the Avalanche Bridge. It is a trustless bridge that supports multiple ERC-20 tokens, most notably WETH, USDC and WBTC. The transfer takes a total of 10-15 minutes and costs as little as $3 (from Ethereum to Avalanche). More details on fees and other FAQs can be found here.

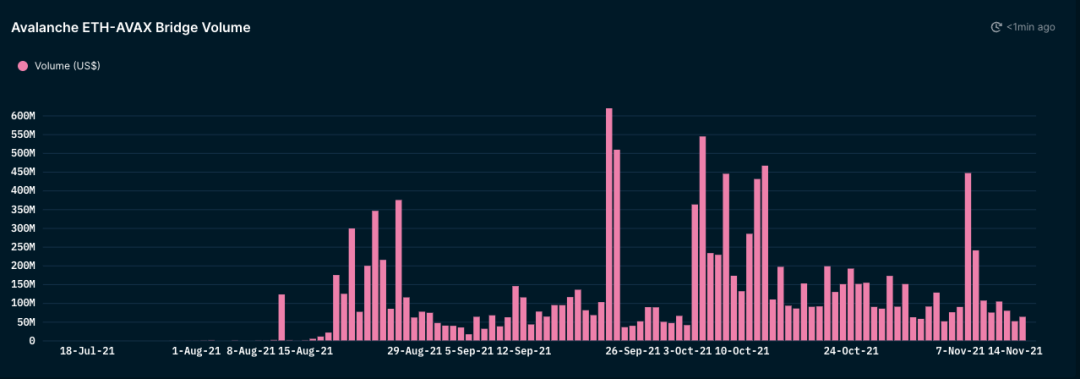

Avalanche bridge activity can be monitored on Nansen Dashboards. After the Avalanche Foundation announced 180mm of DeFi in mid-August, we saw a surge in transaction volume on the Avalanche Bridge, reaching over 370mm on August 27th alone. With more dApps launched, and backing from reputable VCs and liquidity mining schemes (Curve, Aave, Trader Joe, Benqi) Avalanche is growing in popularity - activity on the bridge continues to grow and remain at high volume , reaching a peak volume of more than 600 mm on September 23.

Avalanche bridge transaction volume (Eth to Avax only)

image description

Transaction and gas fees

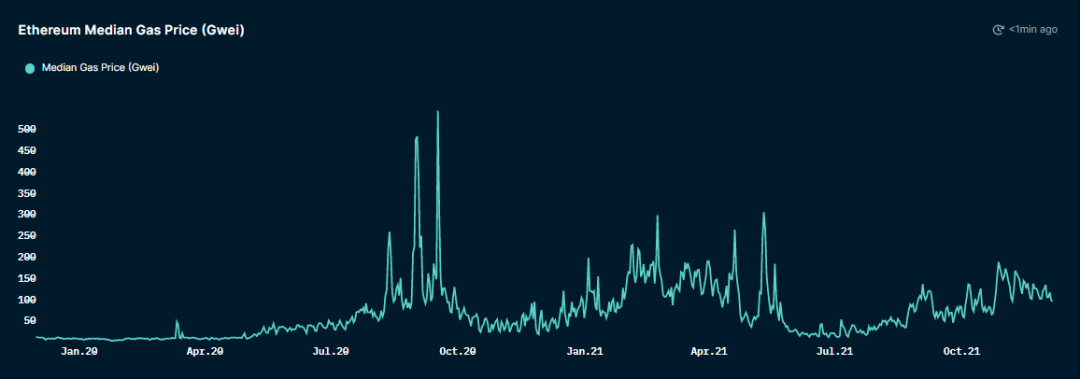

Scalability issues are a major issue limiting the growth and adoption of many blockchain networks. On the Ethereum network, high gas costs due to congestion have prompted many developers to migrate to other L1 chains and L2 solutions. When the cost of completing a simple transaction is higher than the value of the assets being transferred, high gas fees become very prohibitive. High gas fees cost retail players and cannibalize business models by making them financially unviable. Large token holders and bots are pricing retail, forcing them to incur high gas costs and congestion at the base layer (and poor user experience). This of course limits the growth of the network and thus stifles innovation in the wider crypto space. The chart below shows how gas prices have increased over the past two years, easily available on Nansen's gas tracker dashboard.

Ethereum gas median price (Gwei)

Source: Nansen.ai丨As of December 3, 2021

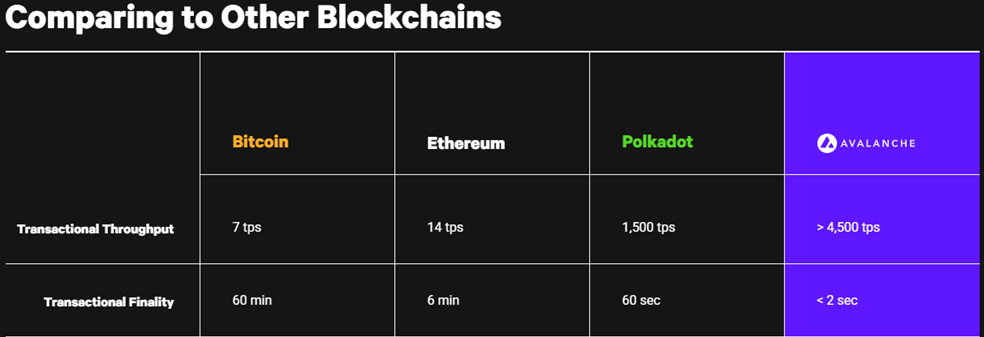

Avalanche has a transaction throughput of more than 4,500 tps and a transaction finality time of less than 2 seconds. This is very promising compared to other blockchain networks.

Transaction throughput and finality comparison

Source: https://www.avax.network/ as of December 3

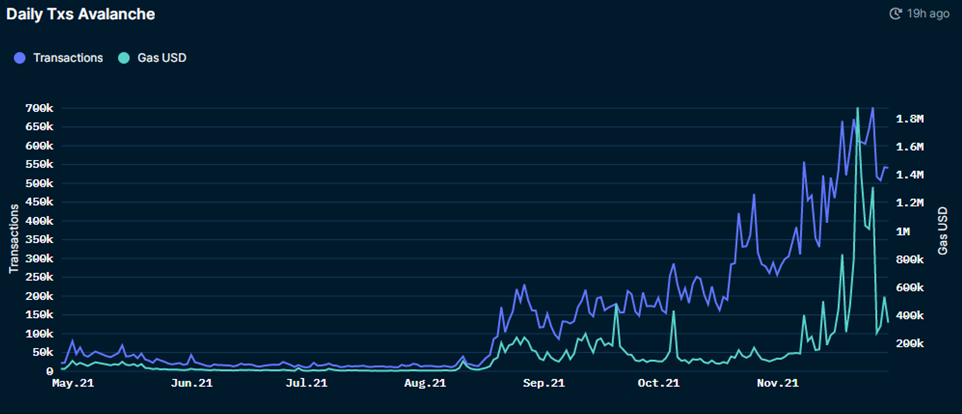

The graph below highlights how the daily transaction volume on the Avalanche network has grown steadily over the past six months. This appeal corresponds to a growing number of projects joining the ecosystem, from DeFi primitives (such as DEXs, money markets, asset management protocols) to NFTs and enterprise adoption.

Daily volume

Source: Nansen.ai丨As of December 3, 2021

A significant increase in daily transaction volume can be seen in early August. This coincides with the launch of the “Avalanche Rush” program — a $180 million DeFi incentive program that has attracted blue-chip DeFi applications to deploy on Avalanche. Additionally, another major increase can be seen in November, as major announcements such as a partnership with Deloitte were made during this period. Additionally, with the recent partnership with Fireblocks, a leading provider of digital asset custody and settlement solutions, the number of daily transactions is expected to increase significantly in the coming months.

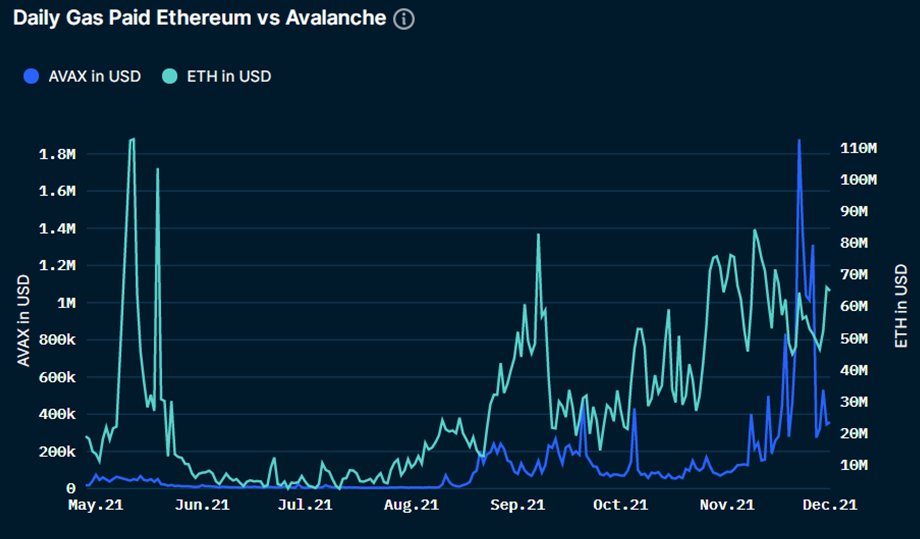

Daily Gas Fee丨Ethereum vs Avalanche

image description

Source: Nansen.ai丨As of December 3, 2021

Avalanche enables the creation of fast, low-cost, and Solidity-compatible dApps. Therefore, various NFT projects have utilized the network for deployment. Examples include the Topps NFT marketplace (designed for the scale and velocity of global sports fans), Kalao (an NFT ecosystem that unleashes the full potential of Metaverse experiences), Venly Market (a peer-to-peer, blockchain-agnostic NFT marketplace) and Crabada (a play-and-earn NFT game). Additionally, a portion of the Avalanche Foundation’s recently raised $200 million in funding will be earmarked for NFT and cultural applications. However, it’s worth noting that the most active applications on Avalanche are still DeFi dApps such as Trader Joe and Pangolin (both DEXs), accounting for 23% and 7.5% of all on-chain activity, respectively.

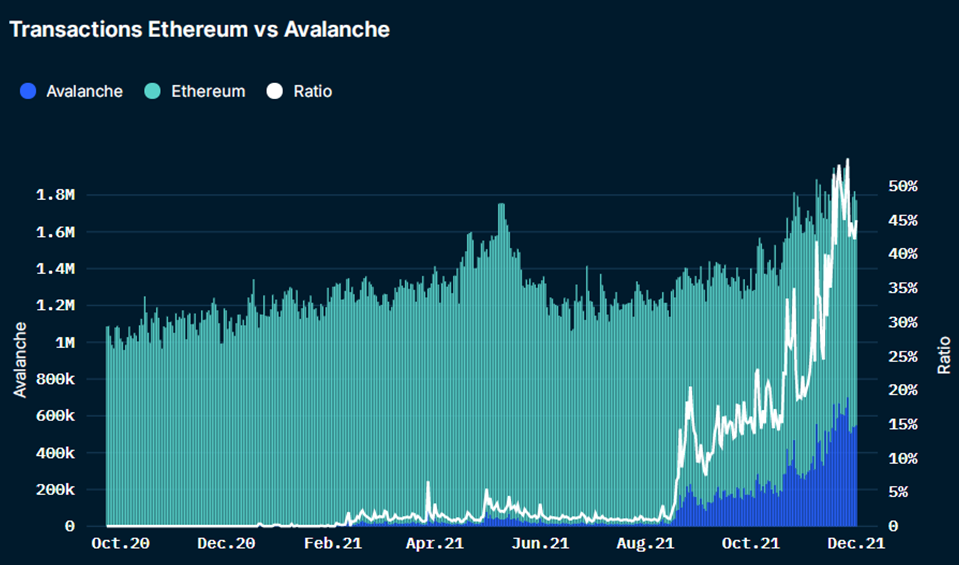

The transaction ratio between Avalanche and Ethereum has been increasing significantly, especially since August.

image description

in conclusion

Source: Nansen.ai丨As of December 3, 2021

The ratio rose from 1% in early August to a peak of 54% on Nov. 26. To highlight Avalanche's performance, let's refer to the previous graph showing the daily gas cost. On November 26, the daily gas paid on AVAX was $1,311,682, while on Ethereum it was $51,389,748. While AVAX accounts for more than half of Ethereum’s transaction volume for the day, the cost of processing these transactions is more than 20 times cheaper than the Ethereum equivalent. This comparison highlights the performance of the Avalanche network at a fraction of the cost.