On November 18, the cross-chain payment network cBridge launched by Celer Network, a Layer 2 expansion project, officially launched version 2.0 on the mainnet. cBridge official link:cbridge.celer.network。

In version 2.0, cBridge has greatly optimized the liquidity provision mechanism, node operation rules, and user operation experience, in order to bring users a better asset cross-chain experience. Among the many improvements,The most core change is that on the basis of the liquidity "self-management" of version 1.0, a new liquidity "co-management" mechanism has been added, becoming the only "self-management" + "co-management" mechanism on the market Liquidity management mode Two-line parallel asset cross-chain bridge.

secondary title

cBridge 1.0, a successful start

Before talking about 2.0, let's look back to see the development of cBridge.

cBridge was first proposed at the beginning of this year (February 18), and version 1.0 was officially launched on the mainnet in the middle of the year (July 23). At that time, there were frequent security incidents in the cross-chain field. Many cross-chain concept projects such as Chainswap and THORChain were attacked by hackers one after another. Poly Network was directly stolen by hackers with 610 million U.S. dollars, becoming the largest amount involved in DeFi and even the entire cryptocurrency history. Top Hacking Events.

Under the clouds, security has become the primary criterion for users when choosing cross-chain bridge services, and the characteristics of cBridge 1.0 can be said to meet the needs of users, because this is based on the original state channel product of Celer Network. The new cross-chain bridge has improved security at the infrastructure level.

Regarding the design framework of cBridge 1.0, Odaily interviewed Dong Mo, co-founder and CEO of Celer Network, in early August. For details, please refer to "Interview with Celer: What kind of cross-chain bridge do users need"One article.

Specifically, cBridge 1.0 jumps out of the previous common logic of cross-chain bridges to centrally execute liquidity swaps through a unified liquidity pool (that is, the "co-management" mentioned above), but adopts a new liquidity provider A mechanism that allows liquidity providers to manage funds and respond to users' liquidity swap needs by running nodes (that is, the "self-management" mentioned above).

The core difference between these two models is that under the cBridge 1.0 solution, the contract layer no longer needs to undertake the work of collecting liquidity on the initial chain and releasing liquidity on the target chain, so there is no need to directly carry any funds, all funds It will be completely under the control of the node itself from beginning to end. In this way, the risk of fund loss from contract attacks can be greatly reduced, thereby achieving a higher level of security.

Relying on the security advantages of the "self-management" model, coupled with extremely fast ecological coverage (Ethereum, BSC, Avalanche, Fantom, Polygon, Arbitrum... basically all mainstream ecological coverage) and good user experience (due to the contract layer It is thinner, so the transaction fee is closer to the ordinary transfer fee; the transfer time is extremely short, for example, it takes seven days to transfer from Arbitrum, but only a few minutes through cBridge; the operation interface is simple and easy to use), cBridge 1.0 quickly opened up the market, and it is widely used in many cross-border transactions. Stand out from the Chain Bridge.

As of November 18, less than four months after version 1.0 was launched on the mainnet, the total cross-chain transaction volume of cBridge1.0 has exceeded 1 billion US dollars.

secondary title

"Self-management" is so successful, why do "co-management"?

Undoubtedly, version 1.0 in "self-managed" mode is a pretty successful start for cBridge. So the question is, since "self-management" is so successful, why does cBridge still want to add a "co-management" mechanism in version 2.0?

To answer this question, we must find the answer from changes in market demand. Since September, with the collective explosion of public chains such as Solana, Avalanche, and Fantom, the wealth creation effect of emerging ecology has begun to rise. In order to pursue these brand new wealth opportunities, users’ demand for cross-chain assets is increasing day by day. The liquidity depth of the bridge puts forward higher requirements.

In this context, the standards for users to choose cross-chain bridges have also undergone certain changes. While emphasizing security, they will also take into account the depth of the bridge itself. Based on the situation of cBridge 1.0, although the "self-management" liquidity management solution is safe enough, there is a very high threshold for self-operating and maintaining nodes. The things that node managers need to do include but are not limited to:

Maintain a secure hot wallet environment for private keys;

Ensure operational reliability;

Manage the RPC of each access chain;

managing liquidity;

Adjust fee profiles and more.

Such a high operating threshold has virtually shut out many users who intend to provide liquidity for cBridge, thus limiting the liquidity expansion capability of cBridge.In reality, cBridge 1.0 is excellent in terms of cost and speed when processing medium and small cross-chain transactions. Condominium-type schemes will produce relatively large losses.

secondary title

How does cBridge 2.0 implement "co-management"?

Specifically,

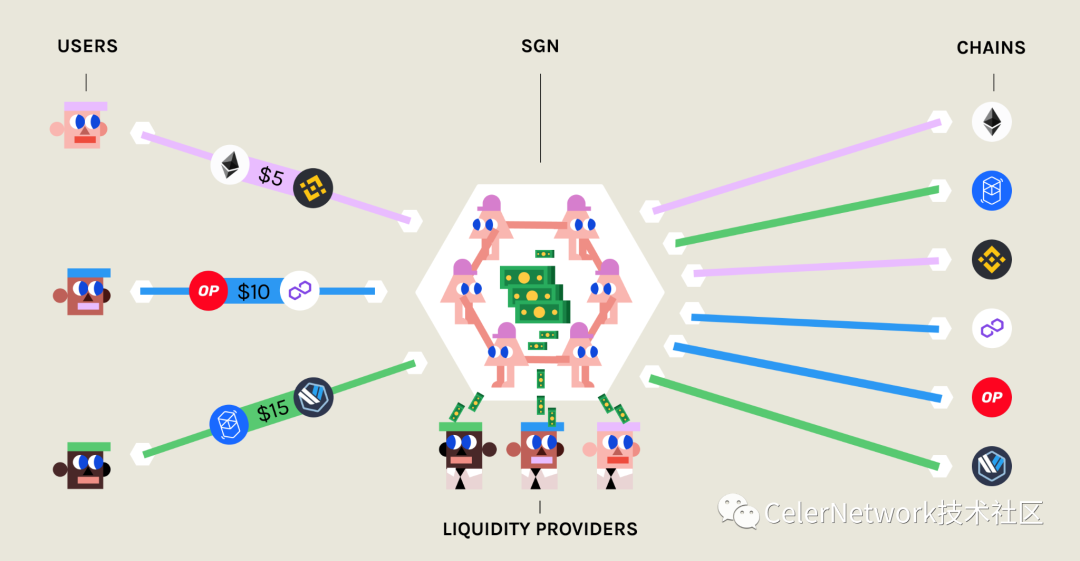

Specifically,In version 2.0, cBridge allows Celer's State Guardian Network (SGN) to manage shared liquidity pool contracts on multiple chains as a whole, and SGN can be regarded as an open node alone. Users who intend to provide liquidity for cBridge but find it difficult to operate and maintain nodes by themselves can choose to directly entrust funds to the SGN network to obtain cross-chain fee income.Of course, those who have the ability to operate and maintain nodes by themselves can continue to use the 1.0 "self-management" model.

Celer put a lot of emphasis on its State Guardian Network (SGN) when it launched cBridge 2.0. In Celer's overall system architecture, SGN is a special PoS chain that monitors L1 events related to L2 status and faithfully passes L2 information back to L1 when needed.The structure of SGN is no different from other PoS public chains. Its security is shared by all verification nodes of the network (not the cross-chain bridging nodes mentioned above, but the nodes of the SGN chain itself). Therefore, compared with some A cross-chain bridge using a multi-signature scheme will have great security advantages.

After further deliberating on the design of the new mechanism, we found that cBridge 2.0 has cleverly achieved a win-win situation among multiple parties in the ecology:

Needless to say, liquidity providers, the new mechanism provides a simpler and more convenient entry channel, allowing more people to participate directly and share the benefits of cross-chain handling fees.

As the number of liquidity providers increases, the overall liquidity depth of cBridge will also increase, thereby improving the experience of using large amounts of funds across chains.

In addition, CLER holders can also benefit from it - users who pledge CELR to SGN can obtain pledge rewards and corresponding service fees by providing verification services.

Of course, everything has pros and cons. Although the design of cBridge 2.0 to use SGN to manage the liquidity pool has greatly improved system security, given that the security situation in the cross-chain field is still severe, many users still have concerns about entrusting funds to a cross-chain liquidity pool doubt.

In order to further dispel potential concerns and give liquidity providers a more assured participation experience, Celer Network has made great efforts on three other levels:

One is to open source cBridge 2.0 and the upgraded version of the SGN smart contract;

The second is to entrust three leading security companies including CertiK, Peckshield, and SlowMist to conduct independent audits;

The third is to cooperate with ImmuneFi to launch a $2 million bug bounty program to security researchers and white hat hackers.

Even with so many security guarantees in place, Celer Network did not dare to take it lightly. According to the official plan, cBridge 2.0 will be gradually launched in three stages (currently in the second stage: liquidity depth guidance). At different stages, cBridge 2.0 will gradually release restrictions on the size of liquidity, and gradually add iterative functions to observe the operation of the protocol to ensure nothing goes wrong.

On December 3rd, cBridge 2.0 launched its first functional iteration. The specific content includes: completing the liquidity migration from cBridge1.0 to 2.0; supporting cross-chain native assets on the source chain, such as directly transferring native ETH from Ethereum to Other chains; support native bridge as a service (Bridge as a Service) function to serve cross-chain requirements in the absence of native bridges; extend message mode to cater for arbitrarily complex logic and cross-chain delivery of large messages.

On December 15th, cBridge 2.0 launched liquidity mining incentives. The TVL of its liquidity pool has reached 74 million US dollars, an increase of 164% in the past two days.

secondary title

Sit firmly in the first echelon of cross-chain bridges, cBridge has done these three things right

From the proposal of cBridge research and development direction in February to the launch of version 1.0 in July, and then to the launch of version 2.0 in November, with the explosion of the cross-chain trend, cBridge has gradually entered the first echelon of the cross-chain bridge track. And feed back the development of the parent project Celer Network.

Looking at the development history of cBridge, combined with the different actions of the project at different points in time, we try to summarize some of the successful elements of the project, which may serve as a reference for other emerging projects.

The first is market foresight ability. The project party must dare to predict the future development direction of the track and even the industry. cBridge was first proposed in February of this year. At that time, the demand of the cross-chain market was not as clear as it is now. Celer Network, which focuses on Layer 2 expansion, launched a new technology research and development direction-cross-chain bridge, which is somewhat strategic.

The second is the ability to understand demand. The project party not only needs to accurately grasp user needs, but also needs to be able to adjust product design in a timely manner following changes in market demand. This is also the main line of this article. The realization from version 1.0 to version 2.0 clearly shows how cBridge views the changes in the needs of the cross-chain market.

The next thing to fight is the product delivery capability. The release date of cBridge version 1.0 to version 2.0 is only a few months apart. Celer Network can quickly deliver and iterate products in such a short period of time, and ensure the ease of use and security of the products, which is enough to show that the team has a very high execution efficiency.

In an interview with us in August, Dong Mo once said that "an ideal cross-chain bridge should be safe, easy to use, and cheap." A few months have passed, and from the perspective of product performance and user reputation, cBridge is getting closer and closer to its ideal appearance.