Compilation of the original text: The Way of the Metaverse

Compilation of the original text: The Way of the Metaverse

Interest in Web3 has exploded over the past 12 months. NBA superstars are paying six-figure fees for NFTs and proudly displaying them. OpenSea has more transactions than Etsy. The world's fastest growing game ixuo runs on Ethereum. While this surge in interest has driven new users into the space, usage of cryptocurrency products pales in comparison to its predecessors.

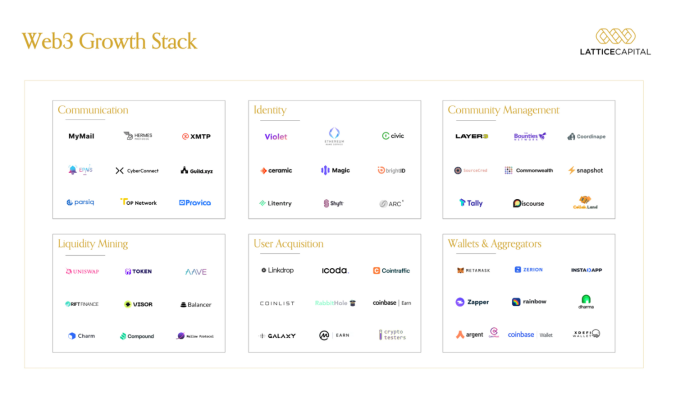

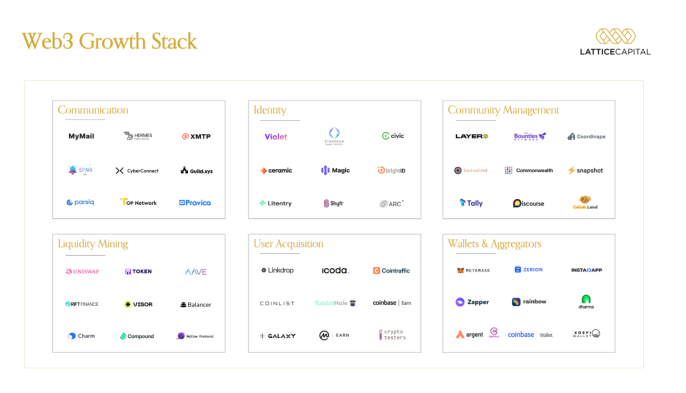

There are hundreds of Web2 apps and games with over 10 million monthly active users - and Metamask is the only Web3 app of this scale. We believe that the nascent growth strategy of Web3 is the main reason why these applications are difficult to scale. While Web2 companies have a decade of successful growth strategies to draw on and a rich platform ecosystem to leverage, Web3 projects are starting from scratch.

Web3 applications support a decentralized architecture, anonymity, and user-owned data. The core principles of Web3 break down every mainstream growth strategy. Leading Web2 consumer applications achieve scale by leveraging centralized platforms such as Facebook, bringing identities online to generate trust, and having large proprietary data sets. Web3 applications have no app store, no knowledge of who the users are, and no way to communicate with them.

Entrepreneurs need new strategies for growth if Web3 is to succeed in building an internet governed by open, community-controlled services. Web3 needs a new playbook for growth.

1

Challenges and opportunities for Web3 growth

identity

identity

Most Web2 growth strategies start with the assumption that the (potential) customer is known. Viral growth often happens on platforms that build social graphs based on IRL identities. Paid growth requires knowing who your users are so you can build target profiles. Many multi-billion dollar companies were built to help companies do this effectively. However, Web3 breaks this assumption, as the vast majority of on-chain activity is currently conducted anonymously.

account"account"--Easier to be read. Ceramic and other DID vendors are also working to establish a consistent account model for Web3.

whitelist"whitelist"license"license"’s lending pool requires participants to pass KYC. Violet is solving this problem in a more general way by building an identity protocol to bring off-chain identities to Ethereum.

Meanwhile, other projects are working to build on-chain identities in a bottom-up fashion, rather than bringing offline data on-chain. Galaxy is building a crypto-native identity solution that leverages users' on-chain behavior to build their profiles. ARCx has launched a"DeFi Passport", according to the user's chain activities to give the corresponding credit score.

communication

Web2 businesses use Facebook ads to reach new customers, emails to reactivate lost customers, and push notifications to tell users about new products. (But for Web3) There are currently no widely used crypto-native growth tools, which poses a major obstacle for teams to establish effective growth loops.

Web3 communication tools are more nascent than identity tools, but there are a few teams building crypto-native solutions. The Ethereum Push Notification Service is developing a protocol that will generate mobile push notifications based on on-chain activity. CyberConnect and others are working on decentralized social graphs that could power user-owned social networks.

Additionally, other companies are taking a different approach and integrating Web3 into existing communication tools. Collab Land allows Discord servers to set entry barriers based on token balances in users' Ethereum wallets. Lit Protocol is building a decentralized access control platform to manage content, software and data using tokens or NFTs.

platform restrictions

In the context of the Internet's massive paradigm shift, the crypto space is often compared to mobile products. We believe this comparison is also useful for thinking about market size. All mobile products have platform dependencies - for example, if you're making a mobile meditation app, your addressable market is limited by the number of Android and iOS phone installs. Given that almost every adult on the planet owns a smartphone, this"limit"It's largely theoretical.

Web3 products have more practical limitations, as they are constrained by the installed base of cryptocurrency wallets. If you build a DeFi application on Ethereum, your immediately solveable market is defined by ~25 million people actively using Ethereum wallets (although this is growing rapidly).

We're starting to see some products that can expand the market beyond the current installed base. Some products do this by abstracting away the wallet experience, thus reaching an audience that might not care about controlling their private keys. Dapper made NBA Top Shot one of the most widely used Web3 applications by simplifying the concept of blockchain. Everbloom is using a similar approach to a mobile-first NFT experience, which we believe sets them up for real mainstream adoption.

Other products are circumventing current platform limitations by getting new audiences excited about blockchain-based products. Helium, for example, has reached an installed base of 350,000+ by getting people excited about mesh networks and their hotspot revenue potential (rather than the fact that they run on a blockchain). We believe that DIMO will join a similarly large car enthusiast audience in Web3.

In addition, there is a final category of products that are meant to get more people excited about crypto itself. CoinList and Coinbase offer centralized products that incentivize people to try Web3 products. Rabbithole has done a good job of getting new users into Web3 in a crypto-native way, and Galaxy has done a good job of getting the community to use the new product. At the same time, applications like Layer3 are making it easier for people to start making money in Web3.

2

Web3 Growth Strategies

Partnerships, user ownership, and token-driven growth pools are the pillars of Web3's growth strategy

Cooperation and Integration

It is not new for software companies to grow through large BD deals, and many Web3 projects have adopted this strategy. For example, ChainLink executed a strategy of closing partnerships during the 2018-2019 bear market, and $LINK outperformed as a result.

However, business development will look very different in Web3 when these partnerships are negotiated transparently in governance forums rather than behind conference room doors. Given that these integrations often do not require permission from one of the parties, they are not always mutually beneficial. For example, some platforms integrate Curve in ways that don't necessarily benefit Curve itself.

A few examples of Web3 partnership categories:

Token Utility - Projects with a native token want to make it as useful as possible. This could include exchange listings, collateral listings (such as adding $LINK to Compound), or partnering with DEXs to drive additional liquidity.

Distribution - All users interact with DeFi protocols through wallets (Metamask, Rainbow) and increasingly aggregators (Zapper, Zerion). These front-ends control which protocols they expose to users, so integrating your yield aggregator with a wallet can be a big deal.

Lego Bricks - Leverage another DeFi primitive to bring extra utility to your product. For example, Notional utilizes Compound to increase its effective yield.

Mergers - Facilitating mergers of protocols, notable Keep and NuCypher and Fei and Rari, recognizing that two teams are building in similar directions and no longer meaningfully compete.

Given the growing importance of Partners/Business Development Executives, we will start to see them being hired as a priority.

Liquidity Staking and Token Economics

Growth hacking has become very popular over the past decade as marketing has become more analytical and engineering-driven. While growth hacking in Web2 has historically been about building affordable, repeatable growth loops, the crypto space is focused on leveraging a project's native token to fuel the growth loop.

Liquidity staking is a"Network participation strategy, where users contribute capital to the protocol in exchange for the protocol's native token". Just like VC funds help subsidize markets until they reach scale, Web3 protocols can leverage their native tokens to steer their growth.

Community

Community

If Web2 companies focus on increasing user loyalty in the form of engagement and retention, Web3 companies focus on increasing user ownership. One of the most exciting and unique features of Web3 is the"Users...finance the products, information and services they consume". We are still very early in understanding all the downstream implications of this innovation.

We believe community is critical in the context of network growth, as an engaged community will give the network leverage in everything they do. This is evident if you look at the Twitter feeds of projects with community engagement - every announcement gets a ton of engagement and retweets.

The community can replace or complement key stakeholders in a Web3 project:

Early customers (and cheerleaders) - Having a small group of enthusiastic customers is critical to any start-up. And community members can fill that role (and more), as they are both early customers and have meaningful upside.

Leverage the core team - community members can help with recruiting, token design, fundraising (something investors have historically helped with).

Extending the Core Team - Community members can provide technical and non-technical support to the core team. Sometimes they step up and join the core team, other times it happens more like ad hoc.

Distribution - Newly launched token projects want to collaborate with other projects with large communities, just like new products want to be distributed in channels with high influence.

While crypto-twitter and the crypto-market are often captivated by the latest shiny toy, we've been impressed by the teams and communities that continue to build even when the spotlight is turned off. We've seen firsthand that some of the biggest successes in the industry didn't happen overnight. Teams like Audius, Dune Analytics, OpenSea, and Terra were working on it for years before the spotlight fell on them. We want to partner with founders who share the same determination.

In an industry built on open source interoperable software, we believe partnerships and communities are the only sustainable moats. We've spent years helping drive the growth plans of leading companies in the space, including Aztec, Celo, CoinList, Index Coop, and Solana. We built Lattice after witnessing the challenges of growing crypto projects.

Explanation: Lattice holds stakes in CyberConnect, DIMO, Galaxy, Layer3, Lit, Maple, Rift and Violet. Lattice employees hold individual positions at ARCx, Audius, Dune Analytics, EPNS, LUNA, INDEX, Notional, Rabbithole and OpenSea。