Edit: Southwind

Edit: Southwind

image description

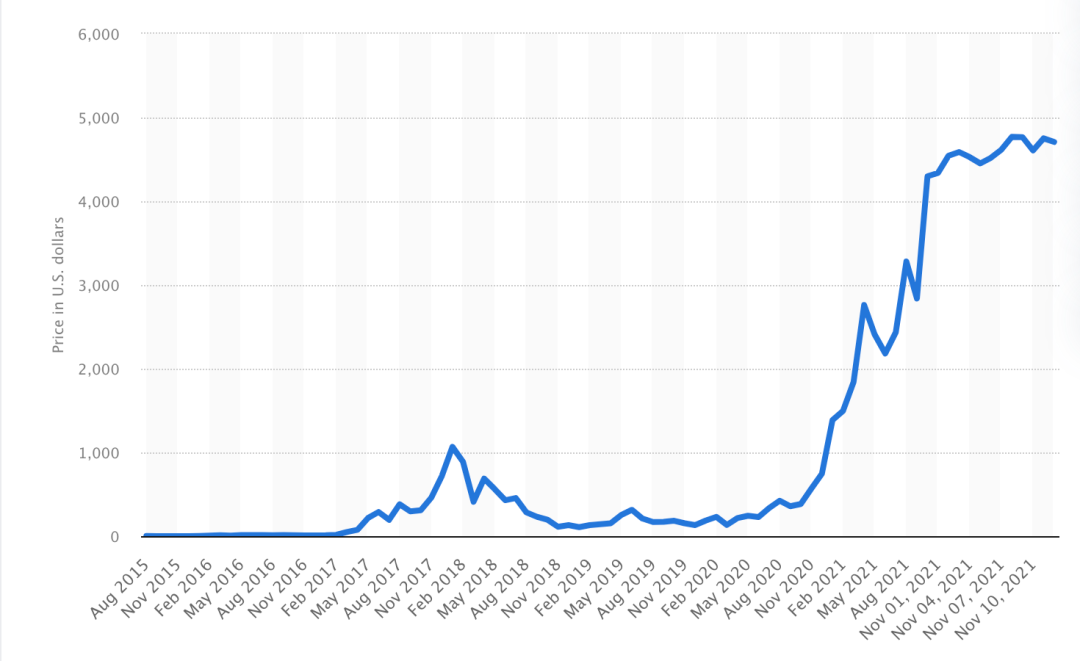

Above: Gas fee increases on the Ethereum network from 2015 to November 2021

first level title

01. Understanding the scalability debate

Blockchain was created as a mode of processing transactions and recording them in blocks in a decentralized manner, avoiding the double spend problem and reliance on trusted authorities. Early blockchain networks, such as Bitcoin and Ethereum, processed and recorded these transactions based on their PoW (Proof of Work) consensus model.

In the PoW mode, once a transaction is initiated, the transaction will be put into a transaction pool waiting to be processed and broadcast to all nodes in the network. Although it is broadcast to all nodes, only one node successfully solves the computational puzzle and adds this transaction along with other transactions to a block, and is rewarded with a transaction fee.

First, transactions take a long time to process because they must be broadcast to the network before and after they are validated. Second, the computing power required to solve mathematical puzzles consumes a lot of electricity. Finally, each block has a limited amount of block space for how many transactions it can contain, which creates competition among users and drives up gas costs, sometimes even exceeding the transaction value. This situation is becoming increasingly problematic as more and more dApps (decentralized applications) use blockchain technology to process and store transactions (about 3,000 dApps currently).

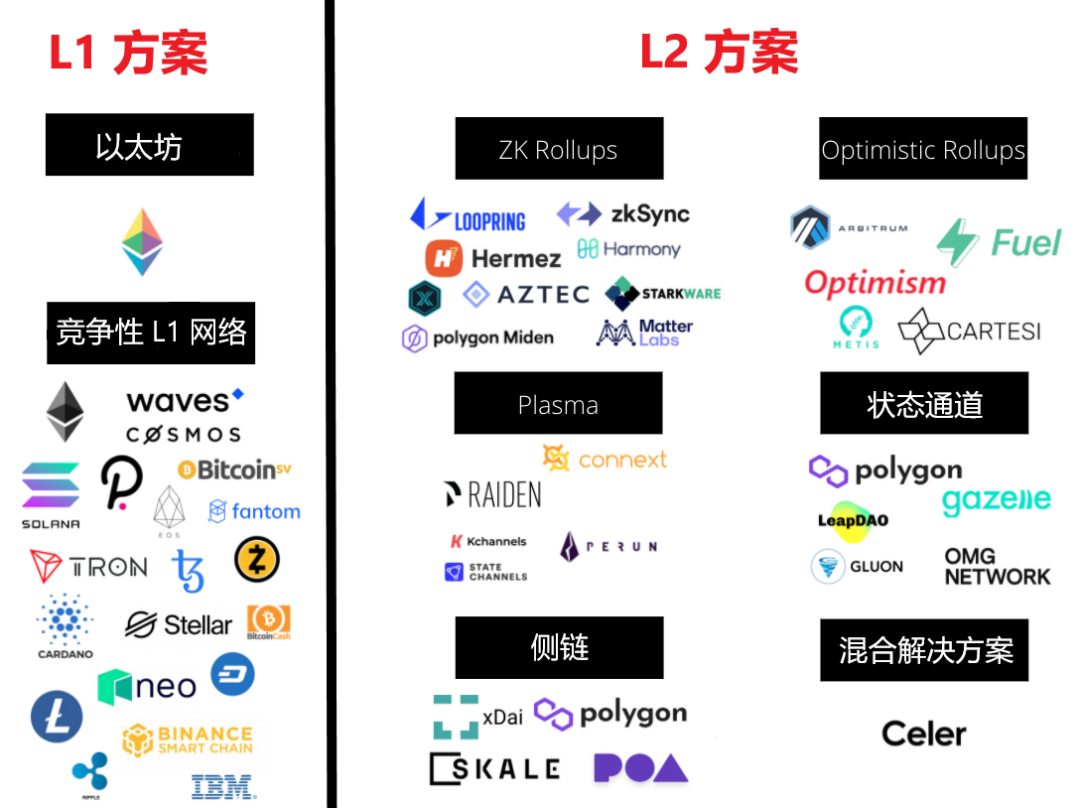

Therefore, in order to solve these problems, Ethereum must scale, thereby increasing the number of transactions (measured in TPS (transactions per second)) that the network can handle, as well as the transaction speed. To this end, many scalability solutions have been developed, mainly includingEthereum 2.0, other competing L1 blockchain networks, sidechains, and L2 solutions. L1 networks such as Ethereum 2.0, Polkadot, and Solana have structurally changed the underlying consensus and block generation rules of the current Ethereum network, while the L2 solution is built on the Ethereum main network and its protocols.

The few blockchains/L2 networks that emerge from this competition will power the entire DeFi space, NFTs, sustain DAOs, and virtual worlds, while also supporting the entire creator economy and metaverse. Below we elaborate on why we believelike Arbitrum(Invested by Marc Cuban, Polychain Capital, Pantera Capital, etc.)first level title

02. Overview of Ethereum scalability solutions

image description

Above: Scalability Solutions Landscape 2021, Mapped by @yasminekarimi_

secondary title

L1 solution

L1 (Layer 1) solutions increase the transaction throughput of the blockchain by processing the underlying protocol of the blockchain, which is the code of the mainnet blockchain itself. They can be further divided into:

1) Protocol improvements

Protocol improvements refer to changes made to the underlying protocol to expand transaction throughput, primarily by increasing the number of transactions that can be included in a single block (sustainable only in the short term), reducing the time lag between block creations, or from The structural transformation of the PoW consensus model to PoS is realized. Different from the PoW model, PoS selects verifiers based on the number of blockchain native tokens pledged by the verifier. Since validators are selected on this basis, there is no need for a large amount of computing power, and there is no competition between miners that leads to astronomical gas fees. It takes much less time to verify transactions because individual nodes don't need to devote as much processing power, as demonstrated by PoS-based blockchains such as Solana (50,000 TPS) and Polkadot (1000 TPS). In comparison, current Ethereum can only handle 16 TPS.

2) Fragmentation

Sharding refers to dividing the computing tasks and data space of a blockchain into multiple chains. For example, in Eth2.0, there will bemany shard chainsL2 Solutions

L2 Solutions

The above-mentioned L1 solution is mainly to change the blockchain protocol, while the L2 (second layer) solution is to expand the L1 by building smart contracts on the chain. This creates additional headroom for pending transactions by outsourcing transaction execution to the L2 network, which then reports transaction processing results to the L1 network. There are currently multiple ways to achieve this:

1) Sidechain

You can transfer assets to Sidechains with better transaction fees and speed, such as xDai uses a delegated proof-of-stake consensus mechanism to achieve fast transaction times (5 seconds) and low transaction fees ($0.000021). Cross-chain asset transfer is realized through a two-way peg protocol (2WP), which first locks assets in the first blockchain network (such as Ethereum), and then locks assets in the second blockchain network (such as Polygon), the input of this transaction contains cryptographic proof that the lock operation of the asset is correct. One of the great examples of sidechains is Polygon.

2) Plasma

Plasma is building blockchains within blockchains. Assets are sent to smart contracts that govern the Plasma chain. The Plasma chain executes the transaction, only the block header hash will be submitted to the root chain (such as Ethereum), unless there is a fraud proof that there is a fraud problem, in which case the Plasma block will be rolled back, and the block created will be punished. This mechanism brings great scalability, as the minimal state updates of the root chain allow transactions to proceed much faster.

3) channel

Channels are an open source protocol and smart contract that allow participants to conduct X number of off-chain transactions but only need to submit 2 on-chain transactions to Ethereum. When a user first opens a channel, they must create and pay for an Ethereum transaction; when they are ready to close the channel, they must pay again to process a transaction on the Ethereum chain. This reduces the number of transactions that must be processed and stored, and reduces gas fees to only opening and closing a channel. Major projects utilizing state channels on Ethereum are State Channels, Celer, Perun, and Raiden.

4) Rollups

Rollups bring scalability to L1 mainnets (such as Ethereum) by using compression tools to verify transactions off-chain in batches before storing the data on L1. Compression and batching enable higher throughput, speeding up transactions and minimizing cost per transaction.

There are two different types of Rollups that rely on this method of validation:Optimistic Rollupsand ZK-Rollups. Verifying the transaction refers to checking whether the state root (including the account balance, contract code, etc. in the Rollup) after the transaction is executed in the Rollup batch is correct.ZK-RollupsA validity proof called zk-SNARK is generated for each transaction batch; while Arbitrum et al.Optimistic RollupsIt will "optimistically" assume the validity of the transaction, and only when a certain node suspects that a certain transaction is fraudulent, it will perform the calculation proof (that is, submit the fraud proof), so that the transaction speed and throughput can be further improved.

How do I interact with Arbitrum as a user?

As a user, you will likely be interacting with Arbitrum to use any of the above dApps (like Uniswap or Aave), which are usually also available on Ethereum but require higher fees. Specifically, the Arbitrum One network is firstAdd to your Metamask walletfirst level title

03. Why Arbitrum will lead the scalability of Ethereum in the near future?

1) Arbitrum solves the blockchain trilemma: scalability, decentralization, and security.

TrilemmaTrilemma". up to now,The only Ethereum scalability scheme that satisfies all three properties is a Rollups network like Arbitrum.image description

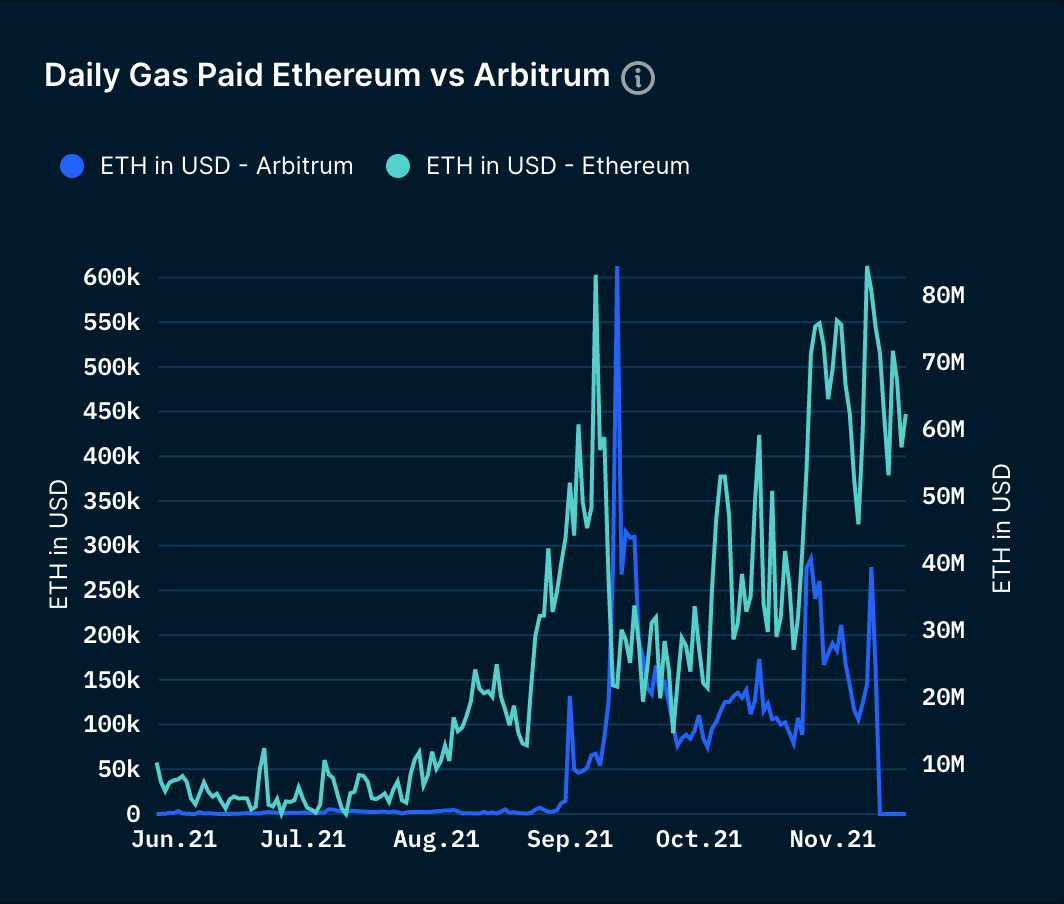

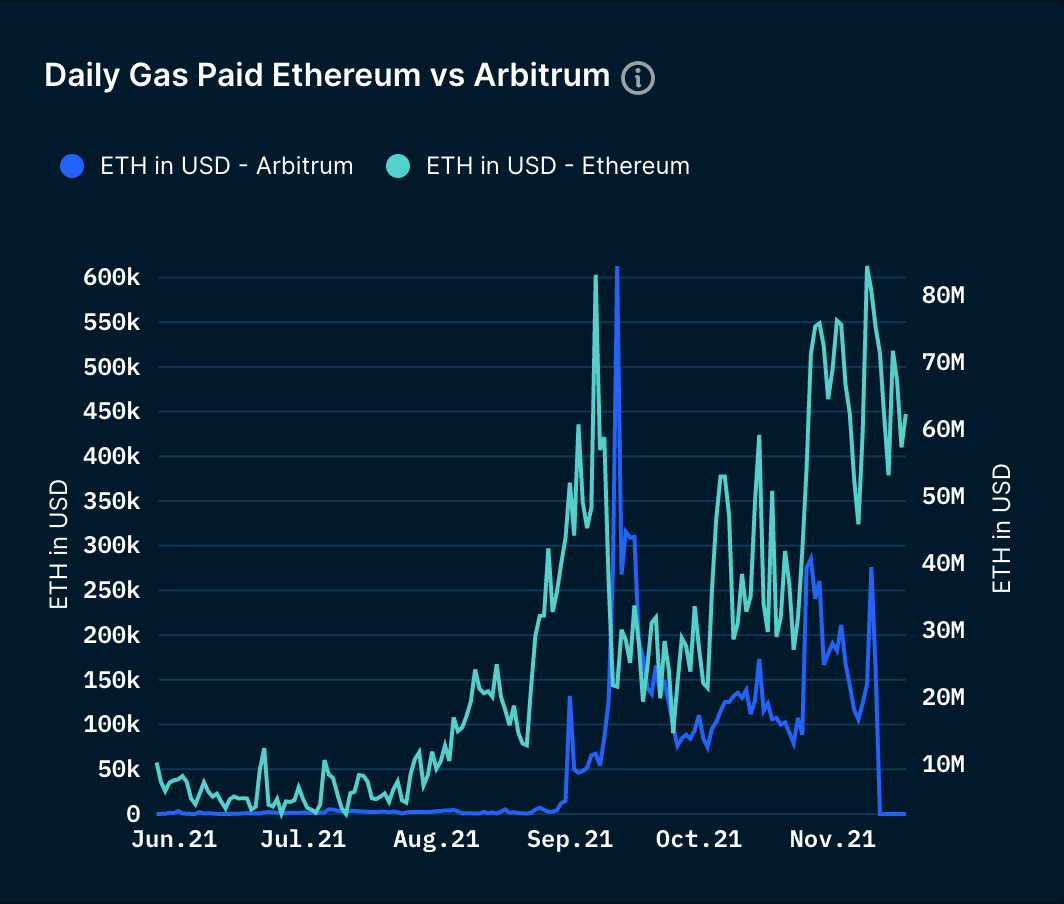

Above: The trend of the total daily transaction volume (blue line) and the total daily gas fee (green line) on the Arbitrum network

In terms of processing power, the Arbitrum network should be able to achieve 40,000 TPS at an average cost 5 times lower than using the Ethereum base layerimage description

Above: Arbitrum network’s total daily Gas cost (blue line) vs. Ethereum network’s daily Gas total cost (green line)

Arbitrum gains security from Ethereum L1 consensus while achieving higher throughput.In contrast, early L1 blockchain networks (such as the current Ethereum and Bitcoin networks) prioritized decentralization and security at the expense of scalability, as evidenced by the high gas costs of the current Ethereum network. at this point. Similarly,Other Competing L1 Blockchains(such as Solana and EOS, etc.) sacrificed decentralization, because these two networks only have 150 and 21 nodes respectively able to control their networks. In turn, this centralization affects the security of the network as it increases the likelihood of a 51% attack.

Likewise, sidechains may introduce attack vectors in the network, as sidechains rely on their own consensus and block validation models. Another example of limited security is protocol improvements, as blockchains with larger block sizes are inherently more difficult to verify and are likely to become more centralized and thus less secure. It is important to note, however, that not all Rollups networks are decentralized in their early stages, although most (if not all) Rollups are committed to gradually becoming decentralized.

2) From EVM compatibility to EVM equivalence

As of now,Arbitrum is one of the most EVM (Ethereum Virtual Machine) compatible L2 solutions.EVM compatibility makes it a breeze for developers to migrate existing Ethereum applications to the Rollups network because they don't need to rewrite most of their code.Arbitrum is currently the largest Ethereum L2 network,The total value locked (TVL) in its DeFi protocols exceeds $2.5 billion at the time of writing.

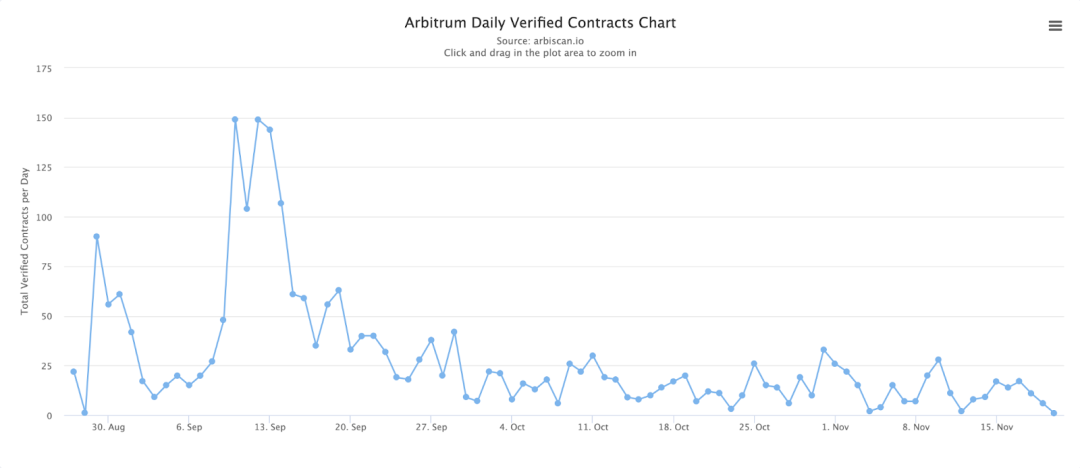

image description

Above: Daily number of contracts verified in the Arbitrum network. Source: Arbiscan.io

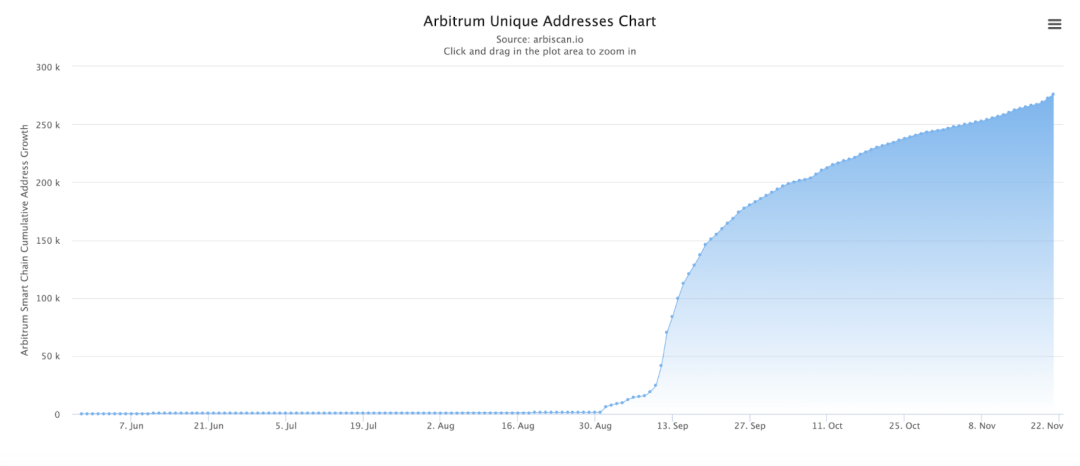

image description

Above: Growth in the number of unique addresses in the Arbitrum network. Source: Arbiscan.io

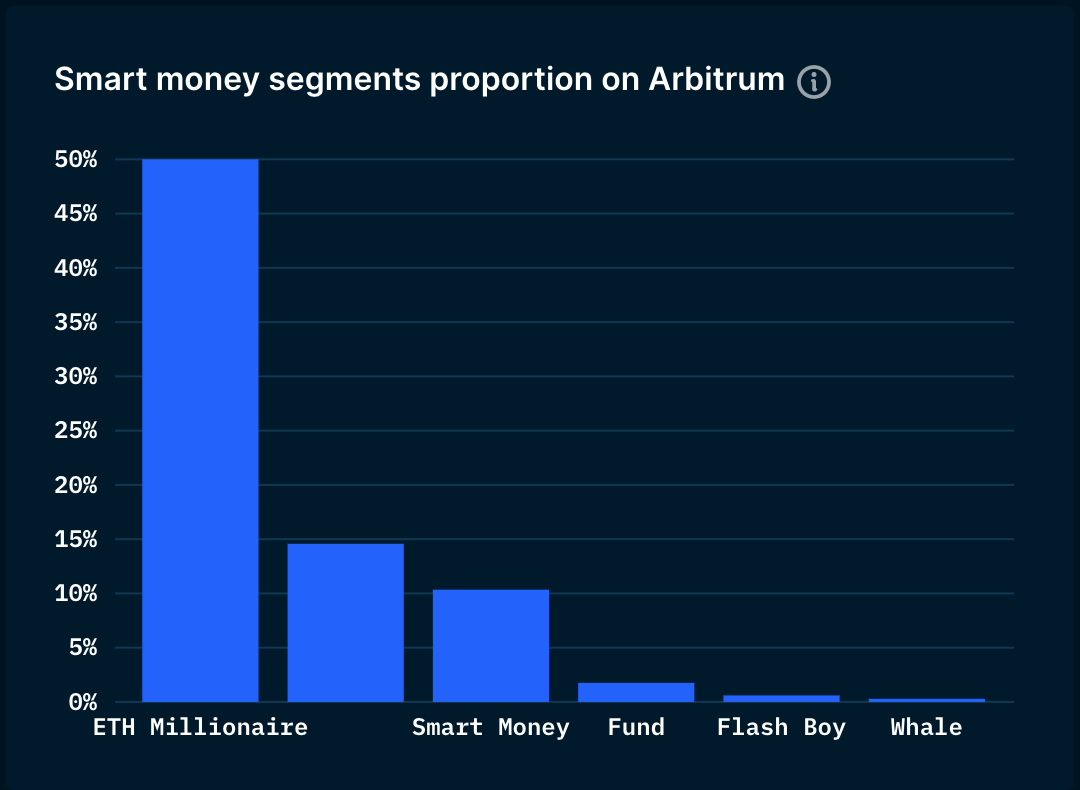

Of these addresses, the Smart Money address appears to have been transferred to Arbitrum. As the chart below shows, 50% of ETH millionaires who use the Ethereum network also use Arbitrum. (Note: An ETH millionaire address is one with an ETH balance of at least $1,000,000.)

3) Arbitrum is built on top of the king of smart contracts (that is, Ethereum)

Another reason we believe Rollups like Arbitrum will dominate Ethereum scalability for years to come is that they are built on top of Ethereum, which is the king of smart contracts. This gives them a first-mover advantage. First, Ethereum is still the most used blockchain protocol in the world, with over 3,000 dApps powering the entire DeFi ecosystem, NFT projects, DAOs, and virtual worlds. Bitcoin is the only comparable blockchain in this regard, but Bitcoin lacks the ability to host the Rollups network.

However, unlike most people think that Ethereum 2.0 will eliminate Rollups, considering that Ethereum 2.0 will not be fully deployed in a few years, Rollups such as Arbitrum are actually the primary scalability solution. The data sharding that Ethereum 2.0 will implement will focus on accelerating Rollups. The transaction history is divided by sharding, and Rollups registers itself in a specific shard chain, and the scalability throughput of Rollups will usher in exponential growth, which may reach 14 million TPS by 2030.

first level title

04. Some current challenges of Rollups

The first criticism of Rollups is that Optimistic Rollups have very long withdrawal times (can take up to 7 days). Withdrawals require a delay to allow observers time to issue fraud proofs and cancel withdrawals in the event of suspected fraud.

At the same time, the conditions to ensure the security of the Optimistic Rollups network areAt least one node is honest and identifies fraudulent transactions.

Furthermore, Rollups is still in its early stages andnot interoperable, although we can expect to move assets and data across Rollups will become increasingly easier. Having said that, we already have interoperability solutions like Hop Protocol, Connext, cBridge, and Biconomy.

Finally, many believe that Ethereum'sLiquidity is fragmented between different Rollupsfirst level title

05. Future scalability paradigms

In fact, the potential of Rollups is not limited to Ethereum in the long run. In reality, future scalability solutions will be a more complex system consisting of interdependent scalability projects on multiple L1 blockchains. Nonetheless, in this complex future, we can expectAs mentioned above,

As mentioned above,In the short term, Rollups on Ethereum (such as Arbitrum) will dominate the landscape of scalability solutions, which will be further enhanced by the deployment of Ethereum 2.0 and its sharding scheme.L2 solutions (including but not limited to Rollups) will continue to evolve and improve performance to compete with other L1 networks in transaction execution.

The second trend is thatWhen other L1 networks reach full capacity, they will start building Rollups on mainnet.In fact, what most people still don't understand is that,Every L1 network needs Rollups, Ethereum is just the first L1 network that has been preparing for this for a long time (since 2015). Tezos, for example, is adopting a Rollup-centric roadmap. The same goes for NEAR, Celestia, and Polygon, which recently announced its advanced zk-STARKs solution, Polygon Maiden.

In fact, given the growing demand for Ethereum and blockchain technology, we can also expect,06. Summary

06. Summary

In short, the high Gas fee is indeed just the tip of the iceberg. Ethereum has faced scalability issues since its inception, and there are many scalability solutions working on solving this problem today. Among them, Arbitrum is currently the largest Ethereum L2 network, and it is also the Rollup network most likely to dominate scalability solutions in the next few years.

Arbitrum has proven capable of scaling Ethereum without sacrificing decentralization and security. As users want the best possible price, more and more developers will build on Arbitrum, as it is one of the most EVM-compatible L2 schemes. In addition to Ethereum, Rollups will be adopted in other competing L1 networks and merged into an increasingly complex landscape of scalability solutions.