original:

original:Nansen

By Paul Harwood

I remember a scene from an old movie once. I forget the name of the movie, but that scene is etched in my memory forever. It's about a veteran of a top Wall Street trader who reveals he's been copying trades based on overheard backseat conversations. In the end he no longer needed the job. Because he is already a millionaire.

1

information wants to be free

Traders can benefit themselves directly by taking advantage of first-hand information, but in the big picture this can create a more efficient market. In short, information wants to be free. The more open the infrastructure for delivering information, the faster and more equitable the transfer of knowledge. Illegal wiretapping of government press releases to trade, hosting a financial exchange's servers to front-end retail, and analysts forecasting quarterly earnings based on satellite images of cars parked at McDonald's are all examples of traders looking for an intellectual edge -- new knowledge.

2

trust needs to be earned

The advent of encryption and blockchain has accelerated the speed at which information can be transferred. The personal privacy of "being your own bank" comes from the tradeoff of all transactions being broadcast publicly. This turns everything we know upside down. Transactions aren't being made by shady executives behind chauffeur-driven limousines, and numbers aren't hidden behind balance sheets protected by fraudulent rating agencies -- it's all online. We call this "on-chain". In this new economy, trust is earned through verification, not hidden behind institutions and credentials.

3

transparency is king

The privacy afforded by encryption comes at a price. transparency. Transparent transactions on the blockchain mean that everyone is driven to listen to transactions. We can listen to every transaction that happens in the world and spy on every wallet and bank account. But, it's also doable for normal people, really? As a researcher, I am fascinated by the human behavior encoded on-chain in this new open economy. But listening to blockchains is difficult in practice, so bringing clear signals to the surface becomes a complex exercise in big data analysis. This is where I first stumbled upon Nansen.

4

uncharted territory

Nansen's team has been instrumental in building open source tools that turn code into meaningful transactions. You can check out the Ethereum ETL developed by Evgeny Medvedev, one of the founders of Nansen. Nansen continues to refine these open-source tools with a proprietary business model to secure the funding needed to dig deeper into these uncharted territories.

5

name is important

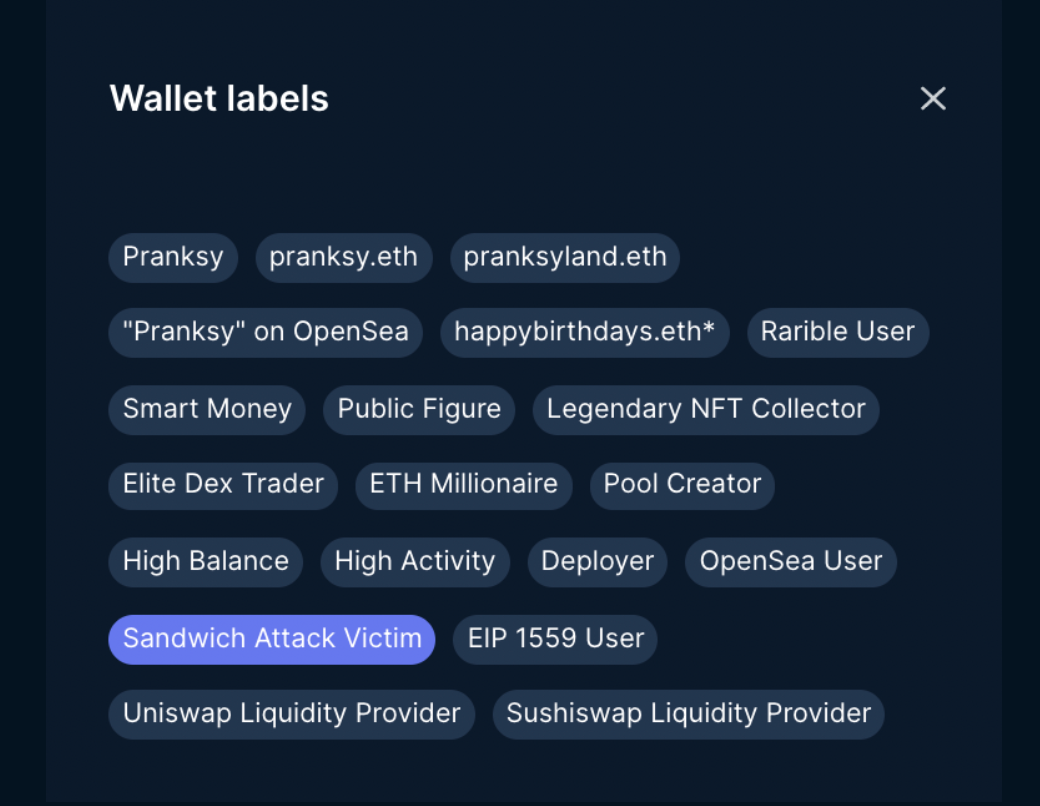

With labels, the data will be real. Nansen tags are descriptive and behavioral names for individual blockchain wallets. They do not do-doze or reveal the private identities of these wallets. They do something more interesting: they doxx behavior. Nansen has over 100 million wallets with tags that can be attributed to an aspect of user behavior.

The core of Nansen's value creation comes from a team that seems to be simply named "Attribution". On this team, you'll find some of the brightest minds in the world continually coming up with and refining "heuristics" to track behavioral trends. Labels range from simple attributes like "token millionaire" to more complex attributes like "smart liquidity provider".

The tag at address “0xd387a6e4e84a6c86bd90c158c6028a58cc8ac459” is known as the influential NFT investor “Pranksy.”

6

smart money matters

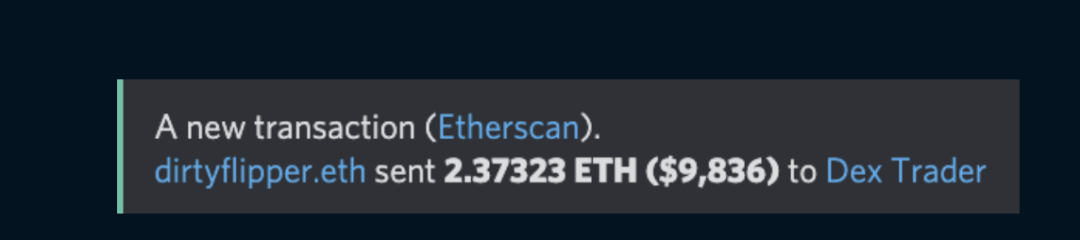

At the very top of the Nansen label is smart money. These are the wallets owned by the elite of the crypto world. These wallets have a long history of making smart investment decisions and staying one step ahead. Nansen allows users to set highly customized smart alerts to notify them in real time of new transactions and investments made by these wallets.

Smart Alerts allow users to track crypto activity in a highly customizable manner

7

Signals from 'smart money'

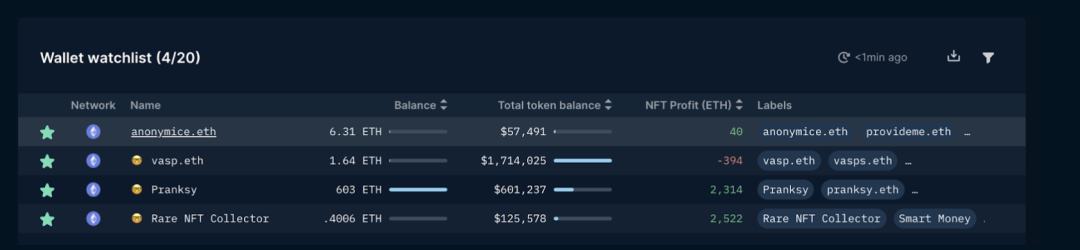

Tracking smart money wallets alone is a powerful tool for understanding the trading strategies employed by successful investors. New Nansen watchlists are constantly being updated to allow users to easily make and track personally crafted wallet lists. However, when we think of smart money as a set of wallets, they provide a more fundamental overview of the market. Take Nansen’s smart money flow as an example, which tracks the total flow of smart money deposits and withdrawals across crypto tokens.

Custom watchlists allow for a manually curated list of wallets and their latest activity.

Earlier this year, when smart money started investing in Shiba Inucoin, many people asked why Nansen showed that smart money was investing in a seemingly pointless memecoin. A few months later, Shiba Inu is already among the top cryptocurrencies. The flow of smart money provides entry and exit signals, allowing new investments to be discovered and existing investments to be re-evaluated.

The Nansen homepage utilizes the smart money tab to track important money movements.

8

DeFi and smart liquidity providers

The rapid pace of crypto innovation has kept many innovations out of reach of the outside world. For those dabbling in cryptocurrencies, the financial innovation known as decentralized finance (DeFi) has revolutionized what we can do with money. Smart contracts that reward liquidity provide smart functionality for what is often more commonly referred to as programmable money. Smartphones unlocked new types of apps, and smart contracts unlocked money.

Nansen’s “smart liquidity provider label” appeals to the most sophisticated DeFi users by combining precise pricing sources with advanced systems for valuing ambiguous values such as impermanent losses. Read more about these updates here.

9

NFTs are great for smart money

The recent boom in NFTs has made wallet tags more relevant than ever. NFTs are intimate social marketplaces. When wallet '0xd387a6e4e84a6c86bd90c158c6028a58cc8ac459' (labeled 'Pranksy') made a transaction, the community quickly followed and made the transaction. Nansen discovered early on that smart money is often only smart at what they do best. DeFi liquidity providers usually have no idea which NFT to buy.

In particular, the social layer of NFT markets tends to make them immune to outside influence. Some NFTs frequently change hands for millions of dollars. A slight tweak to the texture of the Bored Ape Yacht Club (BAYC) ape fur, or a few pixels arranged in a different way in the CryptoPunk can drastically increase or decrease the value of these NFTs.

In order to reflect the depth and maturity of the NFT market, Nansen has further subdivided its smart money into market segments. In addition to existing tags such as the popular "Legendary NFT Collector" tag, Nansen now offers an improved NFT smart money tag. These new segments reflect the nuances and sub-communities that make up the NFT market.

Smart NFT early adopters

Let's start with the early birds. These are the OGs (Original Gangsters) who buy the best projects before they hit the ground running. However, it’s not just the early birds, they’re also the ones who didn’t sell their NFTs in the first place — holding on to them despite the lure of dizzying return on investment. These first movers are true market makers, long-term investors and influencers in the NFT community.

Smart NFT Trader

Next is the trader. Unlike early birds and seasoned collectors, NFT traders often book their profits. Their net ETH balance is positive. They have a proven track record of making smart investment decisions. They control gas costs and rebalance portfolios to ensure they have enough liquidity for reinvestment. They employ strategies to acquire valuable NFTs and minimize risk. Studying these strategies with Nansen is like getting a Harvard degree in crypto, at a fraction of the cost.

Smart NFT minter

Minting NFT collectibles from contracts or websites is not easy. There are security risks, frontrunning, gas costs, and all kinds of choices among NFT projects. Aside from casting challenges, the short lifespan of projects makes choosing the right exit time critical. Our Smart NFT minter is the best. We calculated the most profitable wallets across multiple projects over the past 60 days.

Smart NFT holders

Summarize

10

Summarize

Nansen Smart Money is not just an alpha tool for investors and traders. These labels represent a new type of economy in which knowledge is open and powerful players cannot hide their actions. Our financial future is no longer in the hands of institutions we are forced to trust. Instead, all actions are public and publicly broadcast for verification. Trust is not a risk blindly taken for lack of alternatives, but a valuable asset that is continually validated and earned.

This article comes from Tao of Yuan Universe, reproduced with authorization.

This article comes from Tao of Yuan Universe, reproduced with authorization.