The blockchain world is always advancing in iterations. Since the beginning of this year, public chains are booming, NFTs are shining brightly, and cross-chains are in the ascendant. Coupled with the out-of-the-circle assists of the Metaverse, the entire blockchain world is full of splendor, ushering in a broader space for development.

As the cornerstone of the blockchain world, DeFi, after experiencing the sluggish liquidity mining boom, returned to the attention of the mainstream crowd again in October this year, and brought a brand new 2.0 narrative, which is refreshing and at the same time improved. Persistence and imagination in DeFi.

If you often see Twitter and Weibo names in the format of (3, 3), don’t panic and think that you have entered a different-dimensional world. This is actually a trend brought about by DeFi 2.0. If you don’t sell them, the price keeps going up.” It is the DeFi 2.0 flag-carrying application Olympus that leads this wave. Its innovative design in terms of liquidity and gameplay completely breaks the bottleneck of the DeFi protocol and explores a new world for DeFi users.

first level title

What are the advantages of DeFi 2.0?

Simply put, the innovation of DeFi 2.0 lies in:Brings better incentives。

As we all know, liquidity mining has always been the core of DeFi. This incentive mechanism has a huge disadvantage: Liquidity Providers (LP) continue to "digging, withdrawing and selling". When the value of the agreement is drained, LPs will withdraw and find other places, resulting in the gradual drying up of the agreement's liquidity.

The solution to DeFi 2.0 isLet Protocol Control Value (PCV), fundamentally changed the relationship between the protocol and LP. It introduces the concept of "bonds",Issue token bonds at discounted prices to purchase user liquidity. In this way, when users exchange LP tokens for discounted tokens, the LP tokens are essentially controlled by the protocol itself. This approach not only ensures market liquidity, but also allows these liquidity to be in the hands of the protocol itself.

The unprecedented PCV mechanism subverts the liquidity mining mechanism of the old DeFi, making DeFi more sustainable. And it is its specialPledge play。

In order to introduce more liquidity, these stable projects introduce a new pledge mechanism. Generally speaking,That is, the more tokens entered into the pledge contract, the more rewards the users participating in the pledge will get, and this high return can offset the price risk brought about by token fluctuations. This mechanism encourages everyone to be a "Hodl" that only buys but not sells, and it is also the fundamental reason why we always see the price of the stable project soaring.

In fact, regular user engagement with Olympus is hampered by its complexity and user interface limitations, compared toThe function of the new generation of stable Gyro is obviously much simplerfirst level title

How does Gyro capture liquidity?

Like previous Suan stable projects, Gyro tries to solve the problem of high reliance on stablecoins directly linked to the U.S. dollar in the application process of DeFi. Therefore, it is not a stablecoin in the traditional sense.Rather, it is an entirely new asset class with stable properties.

Gyro will use treasury assets to ensure that its value is always supported by $1. Currently, its treasury assets are USDT, and DAI, BUSD, USDC, etc. will be added later. In addition, Gyro also implements an inflation-deflation algorithm to ensure that it is always equal to or greater than 1 USDT, which can be simply understood as:

When the GYRO transaction price is < 1 USDT, the protocol will buy back and destroy the corresponding GYRO;

When the GYRO transaction price > 1 USDT, the protocol will mint and sell new GYRO.

It should be pointed out that whether the transaction price of GYRO is greater than 1U or less than 1U,The agreement can benefit from the, because when GYRO>1U, Gyro can receive sales fees exceeding 1U, when GYRO<1U, it can buy GYRO for less than 1U.

In order to ensure the liquidity of the agreement and the stability of the system, Gyro introduced the "bond mechanism" we mentioned above, which is the key to controlling inflation and deflation and balancing prices.

Through this mechanism, users can purchase GYRO at a cost lower than the market price in return for selling LP.

In addition to obtaining more liquidity for the protocol, the "bond mechanism" also generates profits for the protocol by dynamically minting GYRO tokens.

90% of all initial profits of the protocol are distributed to stakers and the remaining 10% to the DAO.It uses a super high sharing ratio to stimulate users to hold and pledge GYRO for a long time. In this way, it will attract countless profit-seeking users to buy GYRO and directly pledge, forming a positive cycle. According to the official website, the current pledge rate of GYRO is as high as 83%.

Through the innovative pledge mechanism and bond mechanism, Gyro does not need to obtain liquidity through liquidity mining like the previous DeFi protocol. It uses a new incentive model to allow LP to provide more durable liquidity for the protocol, allowing users to obtain more in the pledge. Multiple GYROs can achieve a win-win situation between users and the agreement, and also give the agreement room for further development.

first level title

GYRO's bonds and pledges

1. Pledge

1. Pledge

Click "Stake", fill in the pledge amount, and the user can participate in the pledge.

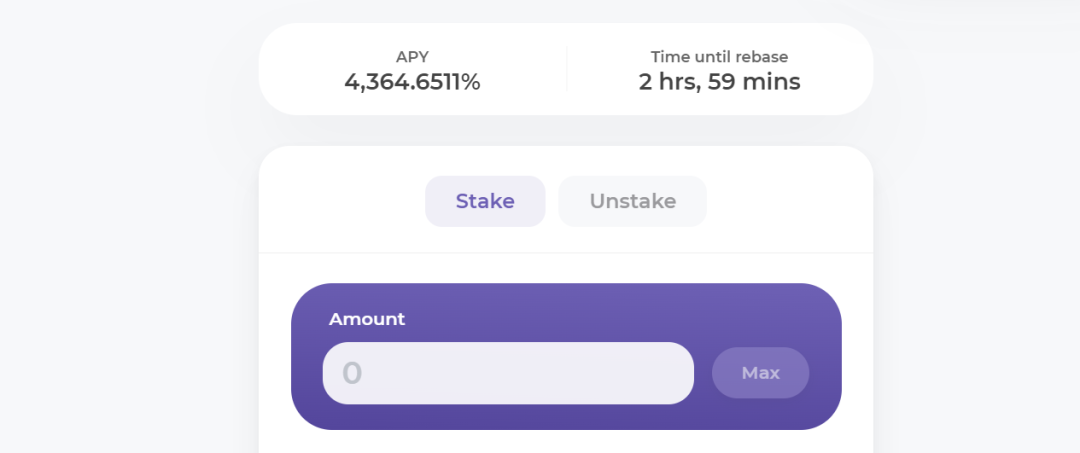

Once participating in the pledge, the user will receive the same amount of sGYRO, as well as 90% of the rewards generated by the assets in the vault (calculated every 8 hours). The pledged APY will change with the number of tokens pledged in the agreement and the algorithm policy. Currently, according to the official website, the APY is around 4364%. These rewards do not require daily staking and withdrawal of interest, and each sGyro will automatically increase to the value of 1 GYRO.

2. Bonds

Unlike other programs, Gyro simplifies the process of buying bonds into a single step. Users only need to have asset pairs in their wallets to buy bonds directly.

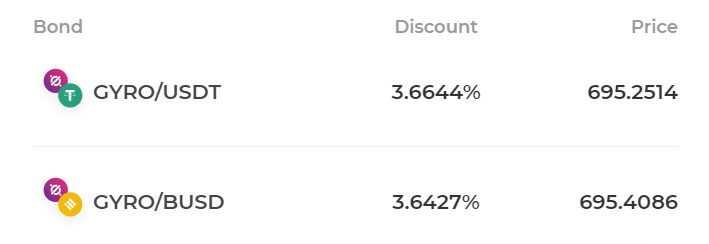

At the time of the screenshot, the price of GYRO is 721u, the discount of (USDT + GYRO) bond is 3.66%, the discount of (BUSD + GYRO) is 3.64%, and the price of GYRO bond is around 695u.

At this point, if you have 1442 u, you can buy 1 GYRO at a price of 721 u, and then add this GYRO and the remaining 721 u to the prize pool, which will lock a liquidity share of 2.07 GYRO.

Note thatBonds have a 5-day vesting period, 20% is released every day, and the release is completed in 5 days. These bond income will enter Gyro's treasury, and Gyro will mint corresponding GYRO according to the amount of bond assets.

epilogue

epilogue

Suanwen has always been an indispensable branch of the DeFi ecosystem. After experiencing the rise and demise of generations, it has been iterated to what it is today, allowing people to see the high possibility of breaking the curse of the death spiral.

As of now, GYRO's TVL is close to 30 million US dollars, its market capitalization has reached 35 million US dollars, and its treasury assets exceed 5.4 million US dollars. This is just the beginning for an agreement established less than half a year ago.

The innovative models brought by projects such as GYRO and OHM are very inspiring, and it prompts people to think about how to improve the loyalty of funds and the utilization rate of capitalNote: The above content is for communication only and does not constitute any investment advice. The currency market is risky, so you need to be cautious when entering the market.

Note: The above content is for communication only and does not constitute any investment advice. The currency market is risky, so you need to be cautious when entering the market.