As cryptocurrencies grow into an asset class of approximately $1.5 trillion plus, and with broad expectations for their continued exponential growth, regulators, lawmakers and tax authorities around the world are increasingly concerned about how cryptocurrencies will fit into existing compliance framework and develop new regulatory rules for cryptocurrencies.

Authorities around the world have already taken enforcement actions against major institutions such as BitMEX, Binance, and Ripple, and we believe this is just the beginning of the scrutiny that crypto companies are about to face from authorities around the world.

In this context, for crypto companies, compliance is a critical issue, and sometimes a matter of institutional survival, so working with the right compliance vendor is a top priority for most players in the space . Jump Capital is an investor in more than a dozen of the world's leading crypto exchanges and brokerages, a topic we often discuss with our portfolio companies.

To help understand the types of services involved in compliance providers, we recently completed a survey of cryptocurrency exchanges, brokerage firms and financial institutions to find out which providers they are currently using and how satisfied they are with them degrees, and which vendors they would consider using in the next 12 months. We hope the findings of this survey will inform crypto companies, regulators, and others in the industry looking to implement the best possible compliance solutions.

survey results

survey results

We divided the investigation into the following areas:

Customer Acquisition (AML/KYC)

Blockchain analysis

Data Transfer Rules

market surveillance

communication monitoring

tax compliance

We received responses from 27 companies, including many of the largest crypto companies in the world. Companies that responded were from North America (59%), Europe and the Middle East (22%), Africa (7%), Asia (7%) and Latin America (4%). In our survey, we asked about the use of providers that provide compliance in several service categories: customer acquisition (AML/KYC), blockchain analysis, data transfer rules, market surveillance, communications surveillance, and tax compliance .

Customer Acquisition (AML/KYC)

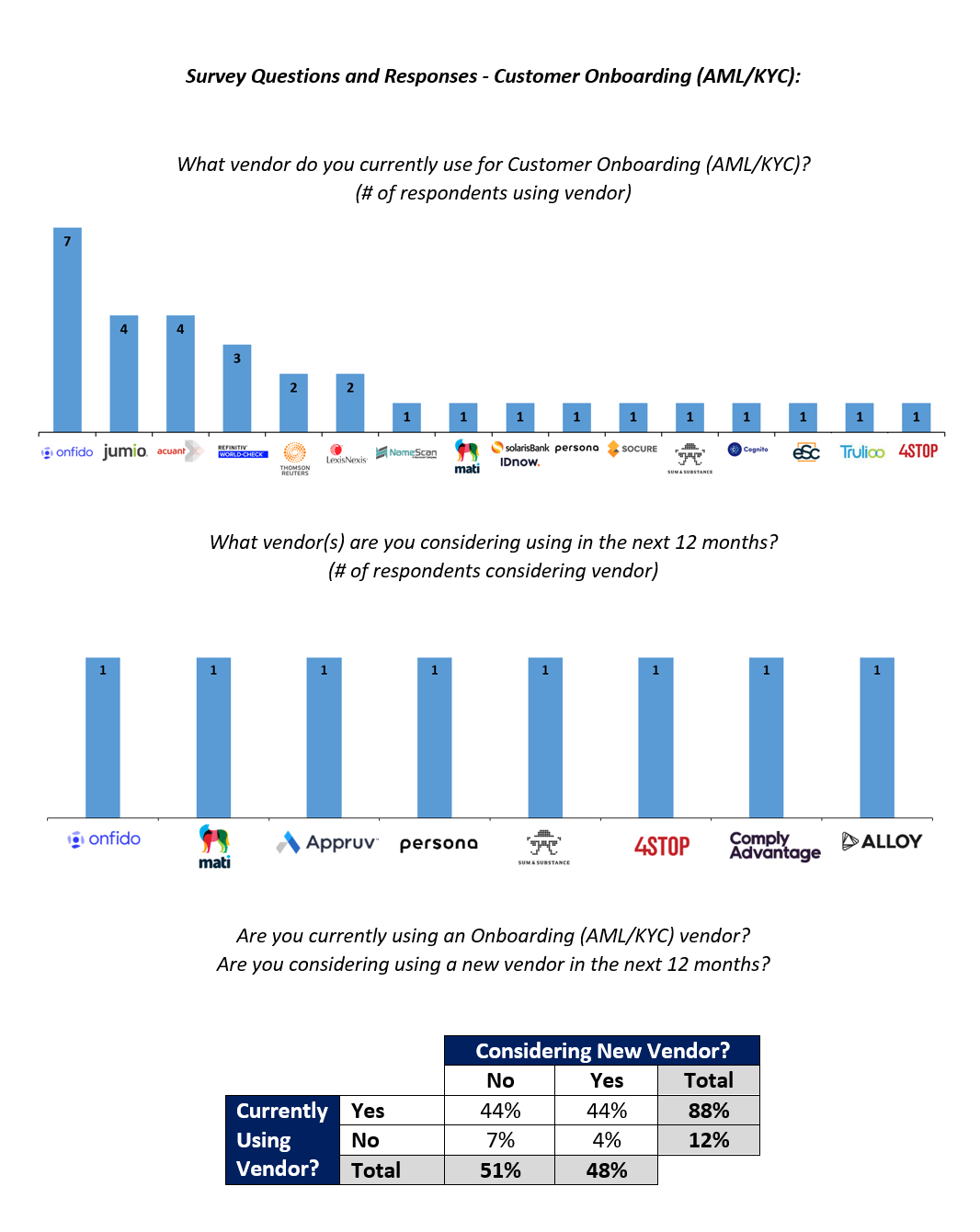

A key part of handling new clients is ensuring they comply with anti-money laundering and KYC regulations. Services provided by such vendors include obtaining data from customer and third-party databases, confirming customer identity, performing watchlist checks, and providing decision-making process management. At Jump Capital, we see onboarding as a new area of great opportunity, which is great news for startups.

It is a very common phenomenon to cooperate with suppliers who can provide customer onboarding services. 88% of the respondents said that they are currently cooperating with relevant suppliers. Also surprisingly, respondents are also looking for new solutions for the service, with 48% saying they are considering using a new customer lead provider in the next 12 months, which includes half of Respondents who already work with onboarding providers indicate that crypto companies are looking for new and better solutions in onboarding services. Respondents cited reasons for seeking a new supplier, including the need for a supplier with better coverage of regional identification documents, to reduce manual review of documents, and to provide a better customer experience and workflow.

Solutions for this service are highly fragmented in terms of vendors being used and considered, with 27 respondents currently using a total of 16 vendors. This is partly because many companies use multiple complementary products in this category (for example, identity verification and sanctions screening). There also appear to be no emerging leaders in this category, as eight separate vendors were named when respondents were asked which vendors they were considering, and each was mentioned only once.

Blockchain analysis

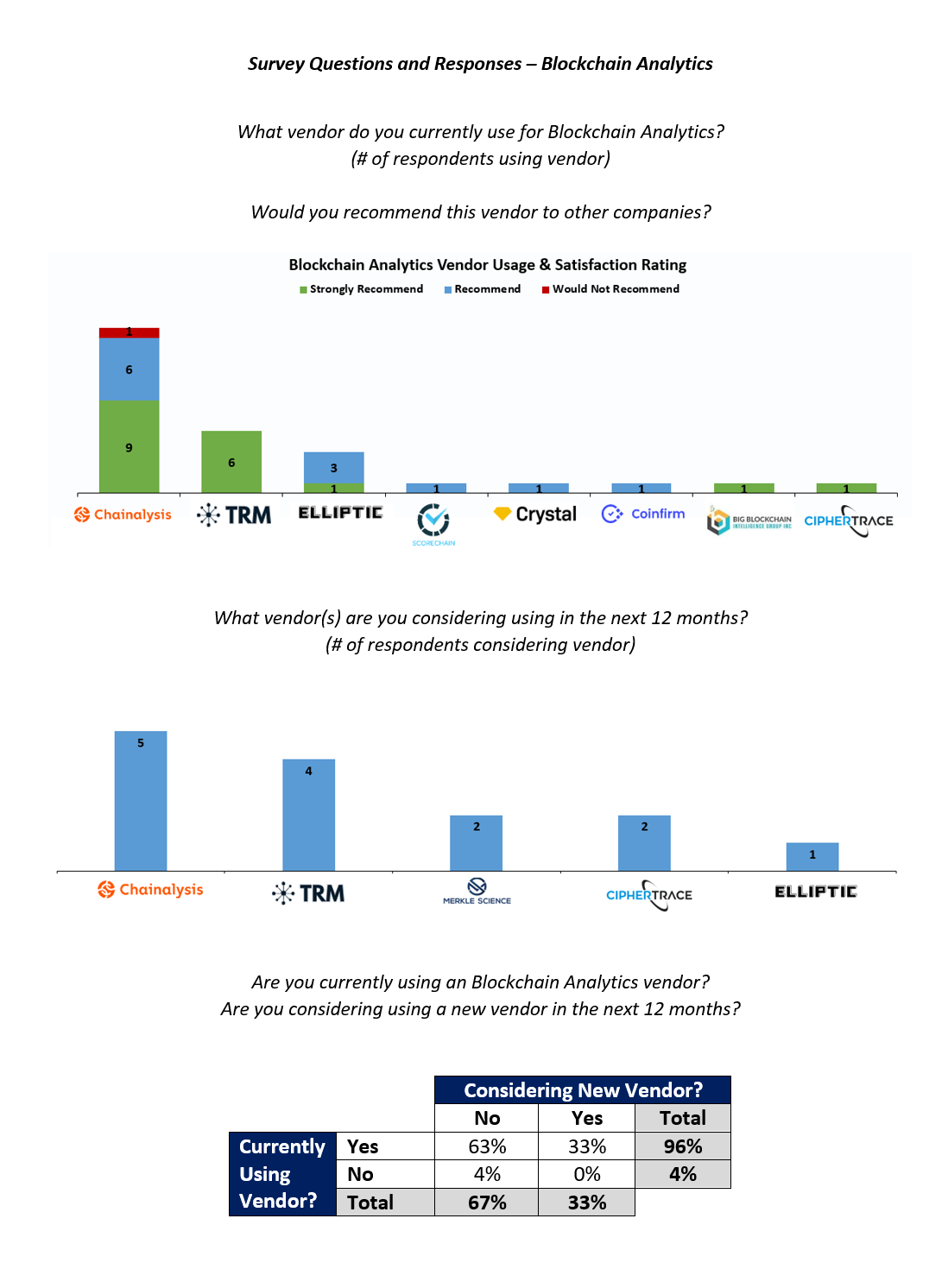

Blockchain analytics vendors provide crypto companies with information on wallet addresses where cryptocurrencies are moved in and out, connect those wallet addresses to real-world entities, and identify suspicious behavior and patterns in cryptocurrency transfers.

The use of blockchain analytics solutions has become an inevitable requirement in the cryptocurrency industry, with 96% of respondents currently using them and the remaining 4% considering using them within the next year. In this regard, companies are also looking for new and better solutions, as 33% of respondents are already using one vendor but are still considering using others.

As mentioned earlier, all satisfaction ratings are provided only to survey respondents, but to demonstrate these results, we publish here (below) a satisfaction survey of blockchain analytics providers. Chainalysis is the market share leader and so accounts for a large portion of the market share score, but TRM Labs has the highest satisfaction score - highly recommended by every company that uses it. Chainalysis and TRM are also the most considered blockchain analytics vendors to use in the next year, and they appear to be establishing themselves as leaders in the category.

Data Transfer Rules

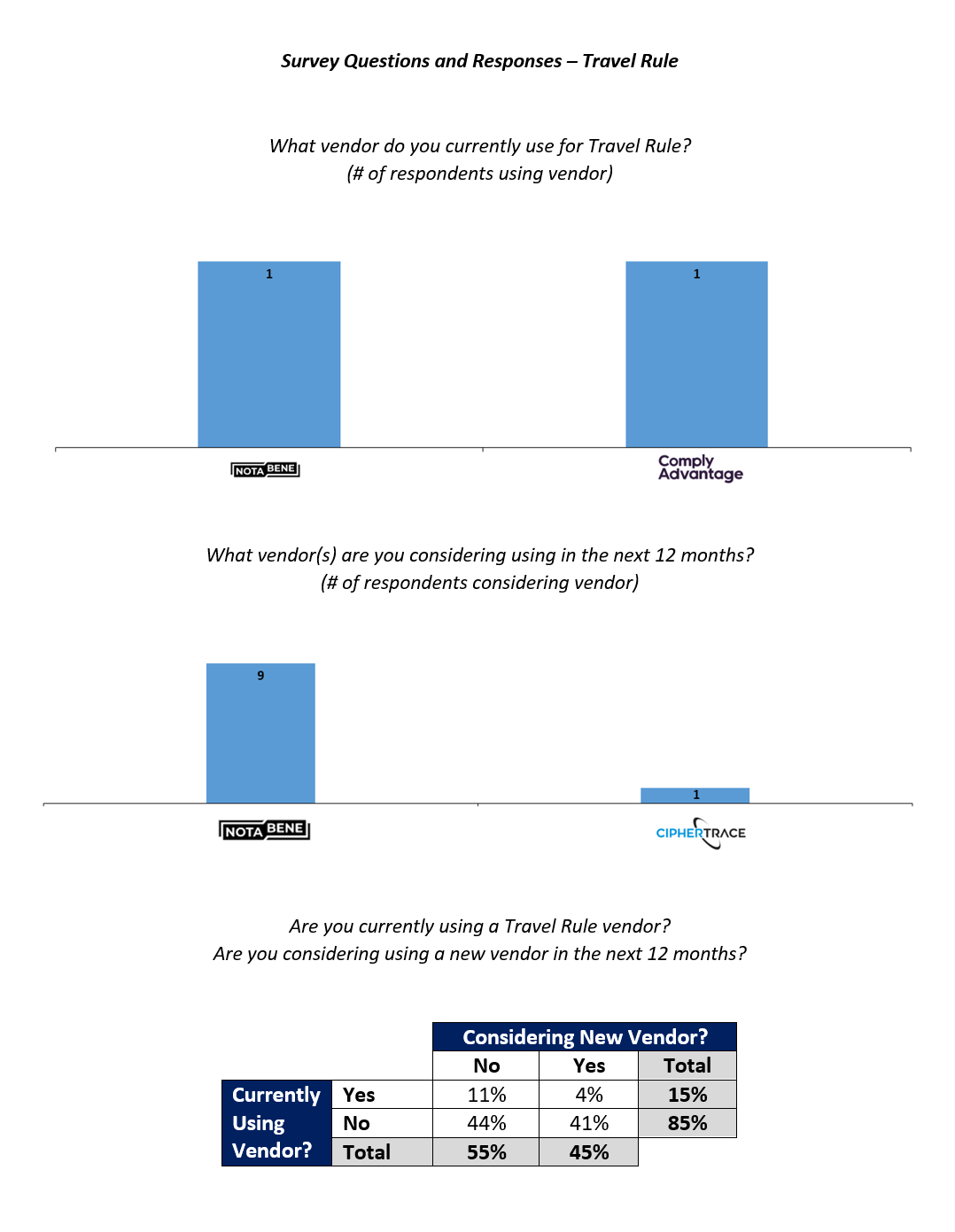

The Data Transfer Rules are designed to require financial institutions to collect and share data on senders and receivers of financial transactions. The Financial Action Task Force (FATF) provides guidance that cryptocurrency companies must comply with data transfer rules, which are enforced by local authorities.

As this is a new requirement for cryptocurrency companies, many local authorities have yet to start implementing the rules, with only 15% of respondents currently working with a provider that can provide data transfer rules, and 44% are considering doing so in the future. Use within one year.

Of the companies currently using suppliers in this category, only two chose to disclose the names of the suppliers they are using, Notabene and Comply Advantage. Among them, Notabene focuses on the exchange of sender and receiver data, and Comply Advantage focuses on the screening of sender and receiver after these data exchanges. We found that more than 10 companies have signed up to use Notabene's solution, but did not complete this satisfaction survey. Notabene's strength in this regard is also shown by nine respondents who said they would consider using their service within the next year. Two of the respondents are members of the U.S. Data Transfer Rules Working Group (USTRWG), so we do not include their interview results in the analysis below because this is a working group and not technically a provider of encryption products and services.

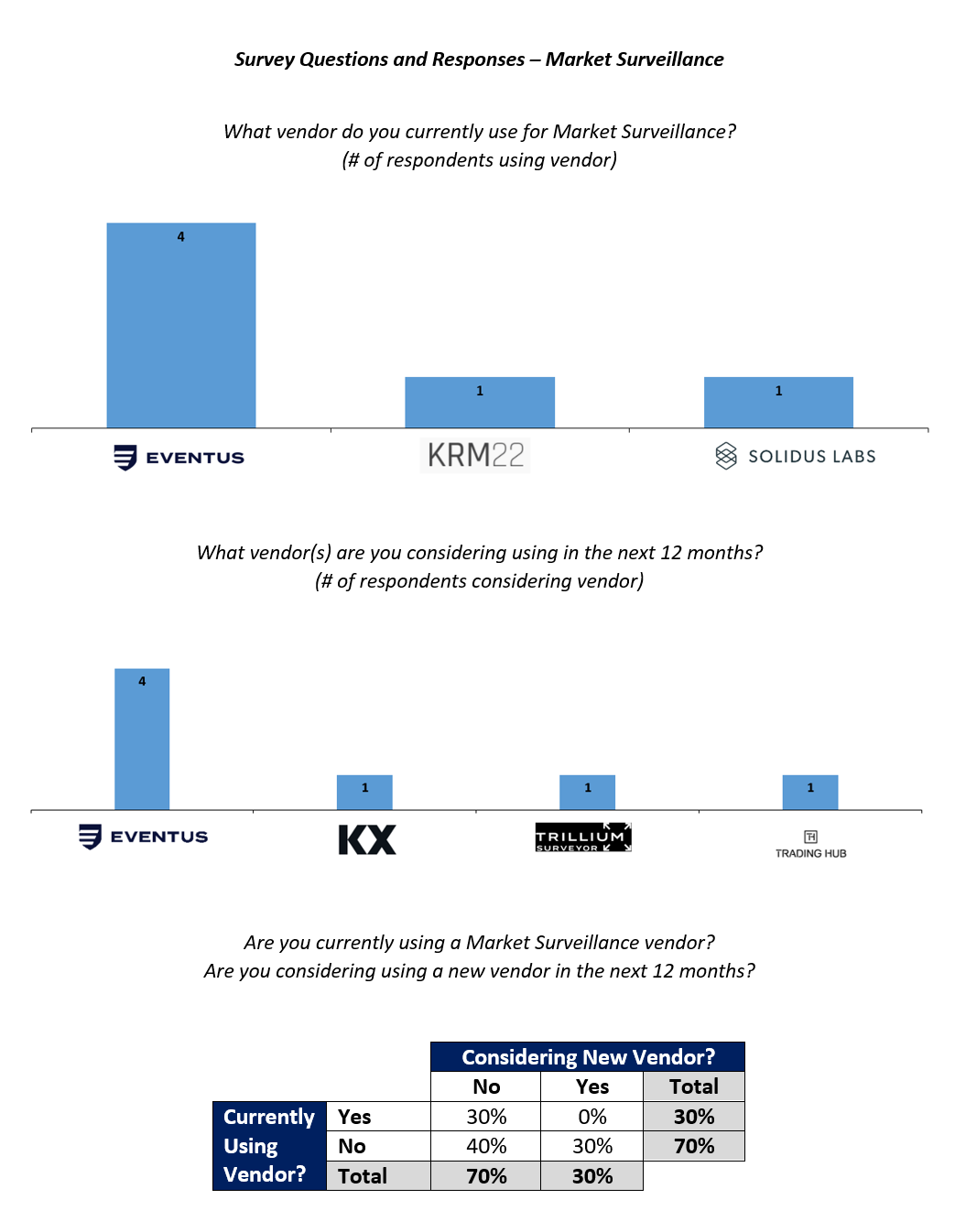

market surveillance

Market surveillance is the monitoring and analysis of market data to identify market manipulation and other illegal or suspicious trading activity. The lack of comprehensive market checks is a hot topic in the industry, and in the U.S., the Securities and Exchange Commission (SEC) has repeatedly cited it as one of the reasons for not approving a Bitcoin ETF. The use of market surveillance providers in the cryptocurrency space is increasing, with 30% of respondents currently using it and another 30% considering using it within the next year.

In this regard, Eventus is the market leader, with 4 respondents currently using Eventus and another 4 considering using Eventus in the next year.

communication monitoring

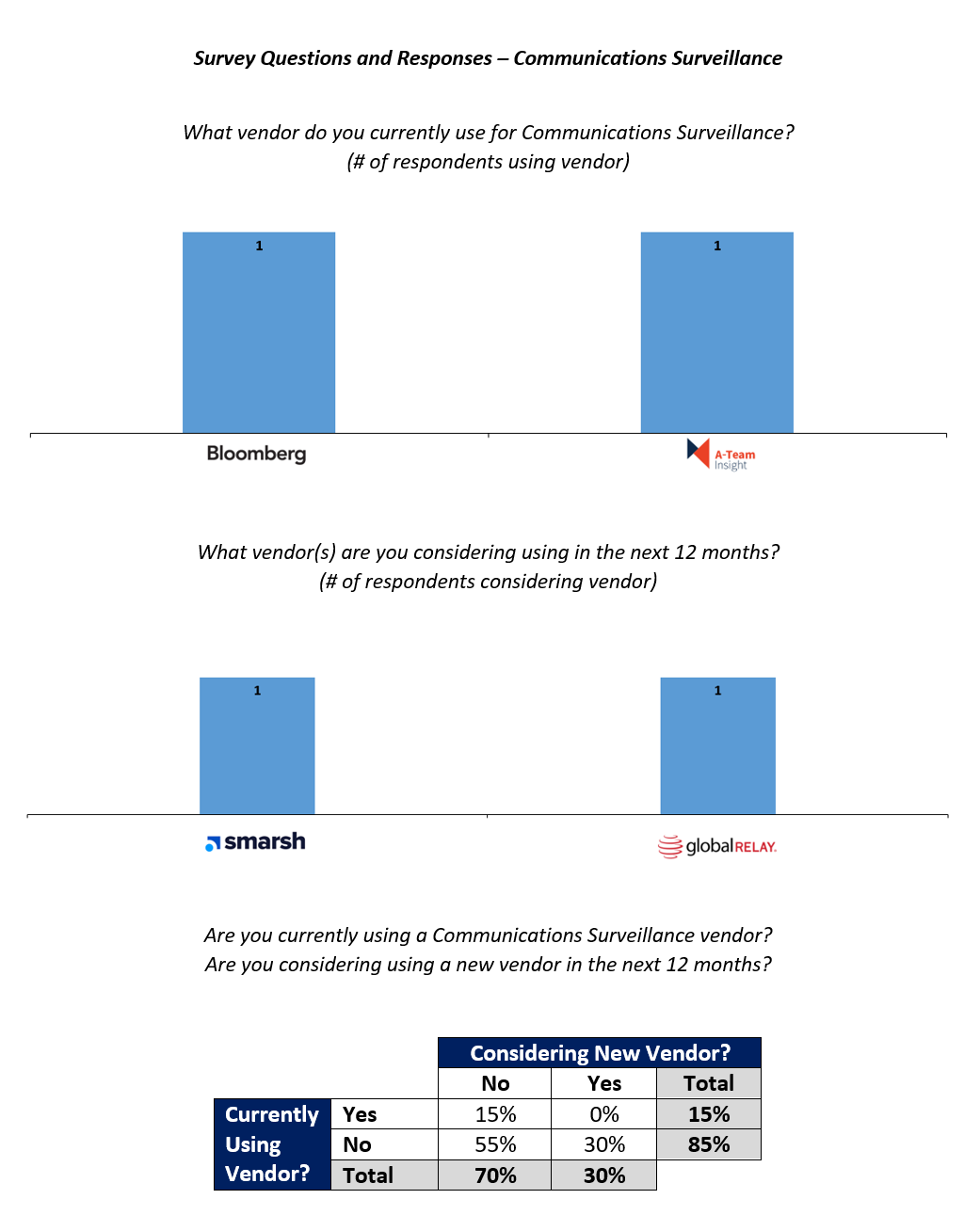

Communication monitoring is the monitoring of employee communications to identify market manipulation and other illegal or suspicious activity. Fifteen percent of respondents currently use a communications monitoring provider, and 30 percent consider doing so within the next year.

In this category, the survey results did not identify a clear leader, as none of the communications monitoring vendors either currently in use or under consideration were mentioned more than once.

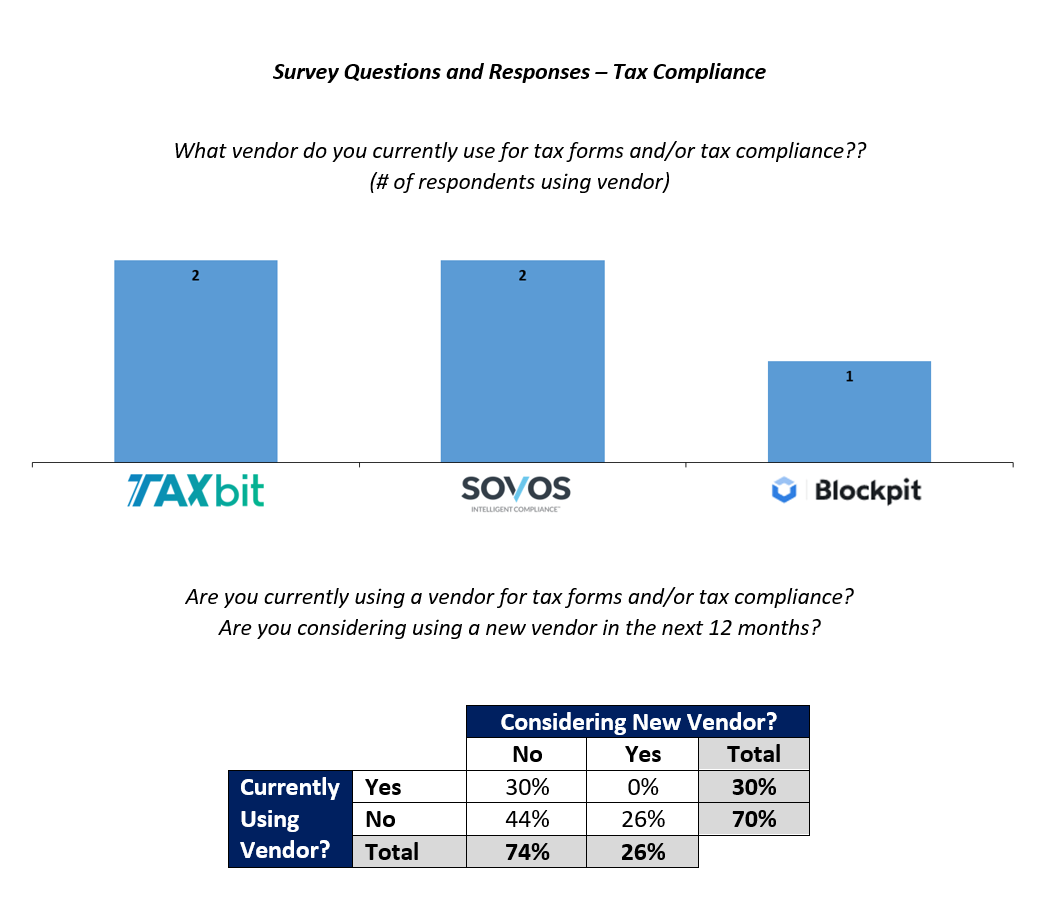

tax compliance

Summarize

Summarize

zCloak Network is a private computing service platform based on the Polkadot ecosystem, which uses the zk-STARK virtual machine to generate and verify zero-knowledge proofs for general computing. Based on the original autonomous data and self-certifying computing technology, users can analyze and calculate data without sending data externally. Through the Polkadot cross-chain messaging mechanism, data privacy protection support can be provided for other parallel chains and other public chains in the Polkadot ecosystem. The project will adopt the "zero-knowledge proof-as-a-service" business model to create a one-stop multi-chain privacy computing infrastructure.

About zCloak Network

zCloak Network is a private computing service platform based on the Polkadot ecosystem, which uses the zk-STARK virtual machine to generate and verify zero-knowledge proofs for general computing. Based on the original autonomous data and self-certifying computing technology, users can analyze and calculate data without sending data externally. Through the Polkadot cross-chain messaging mechanism, data privacy protection support can be provided for other parallel chains and other public chains in the Polkadot ecosystem. The project will adopt the "zero-knowledge proof-as-a-service" business model to create a one-stop multi-chain privacy computing infrastructure.