Written by Footprint Analyst Vincy (vincy@footprint.network)

Data Sources:

Data Sources:Cross-Chain Bridge Dashboard(https://footprint.cool/ccb)

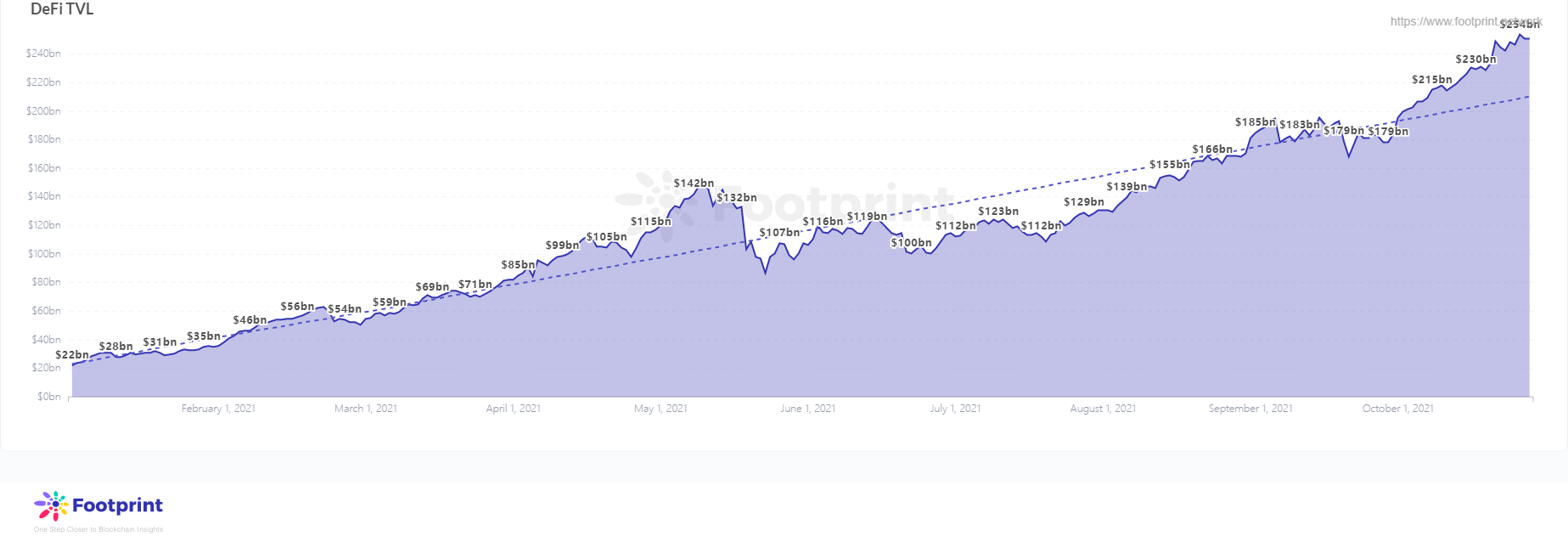

image description

image description

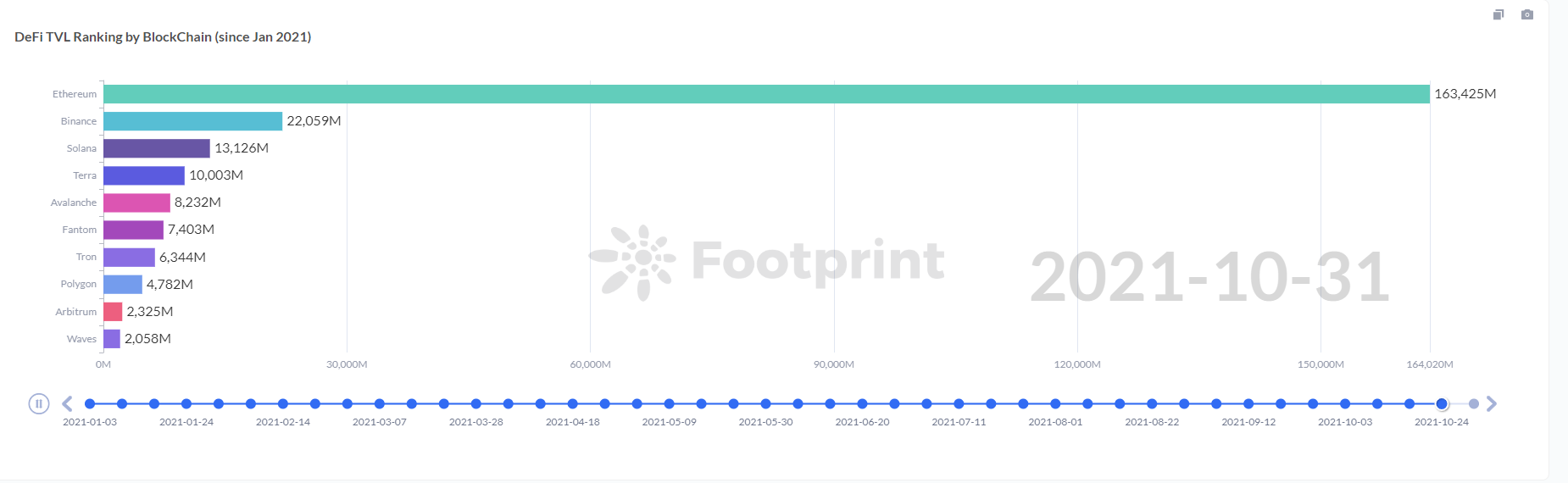

TVL ranking of different chains (since January 2021) data source: Footprint Analytics

This article will take you to understand the cross-chain bridge from the following four perspectives:

1. Definition of cross-chain bridge

2. Cross-chain bridge data performance

3. What problems does the cross-chain bridge solve?

4. How to choose a cross-chain bridge

1. What is a cross-chain bridge?

image description

Source: anyswap.exchange

Through an example, briefly describe the transfer method of cross-chain assets.

When the user needs to change the asset [ERC20 A] on the Ethereum into the asset [BEP20 A] on the BSC chain through AnySwap, [ERC20 A] will be locked on the source chain, and then notify the bridge, on the BSC chain Generate [BEP20 A] and send to users.

The entire operation process of the cross-chain bridge takes about 5-20 minutes, and the gas fee is estimated to be 10-20 US dollars, depending on the situation before the Ethereum congestion at that time.

The cross-chain bridge has the following characteristics: when the user operates the transaction, it is fast and convenient, the operation is low in difficulty, and the transfer fee is low.

2. What is the recent data performance of the cross-chain bridge?

At present, the main cross-chain bridges on the market are mostly two-layer extended cross-chain bridges, and they are mainly built on Ethereum, with the goal of realizing interconnection with Ethereum.

according to

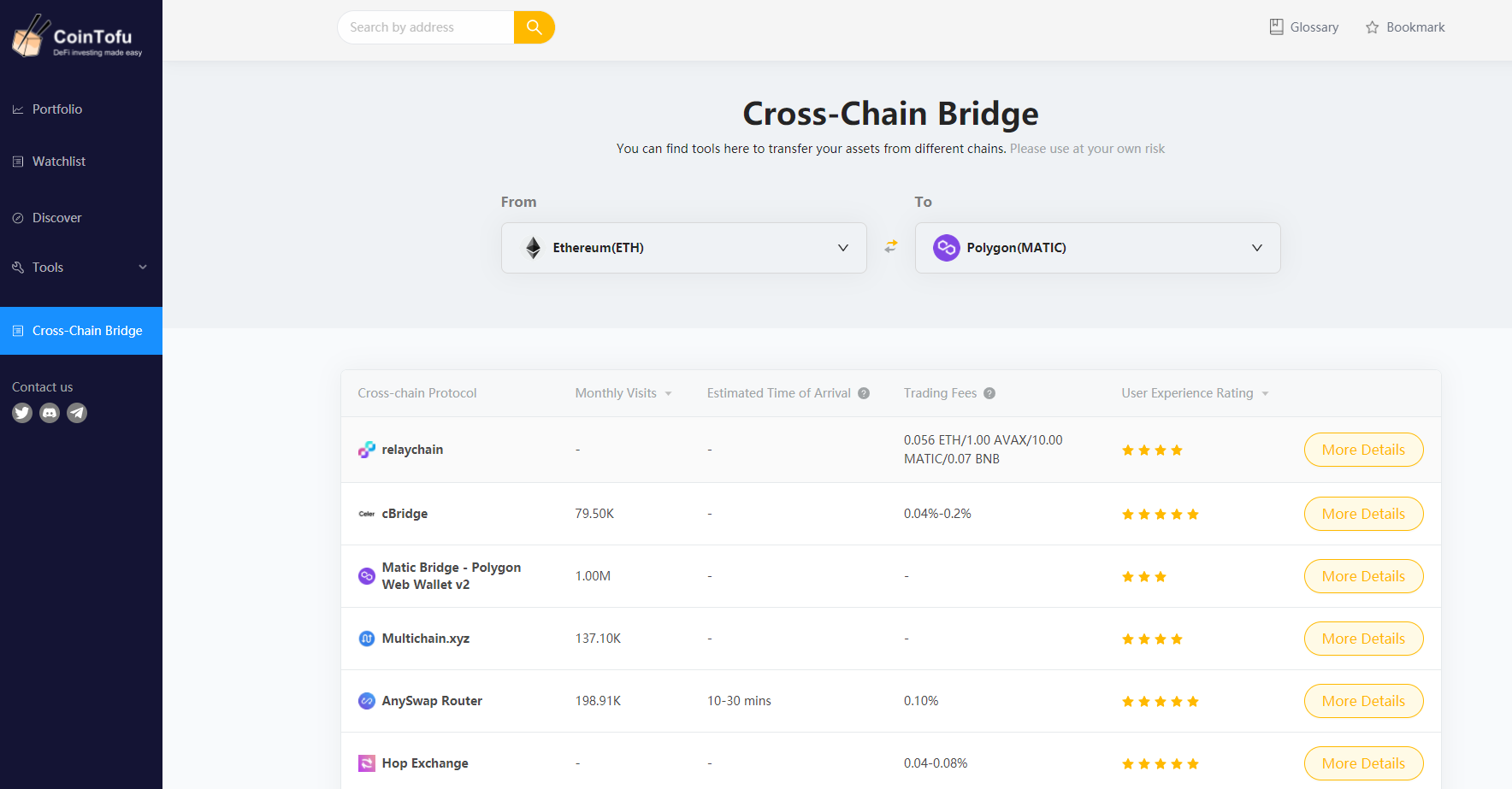

according toCointofu's Cross-ChainBridge toolimage description

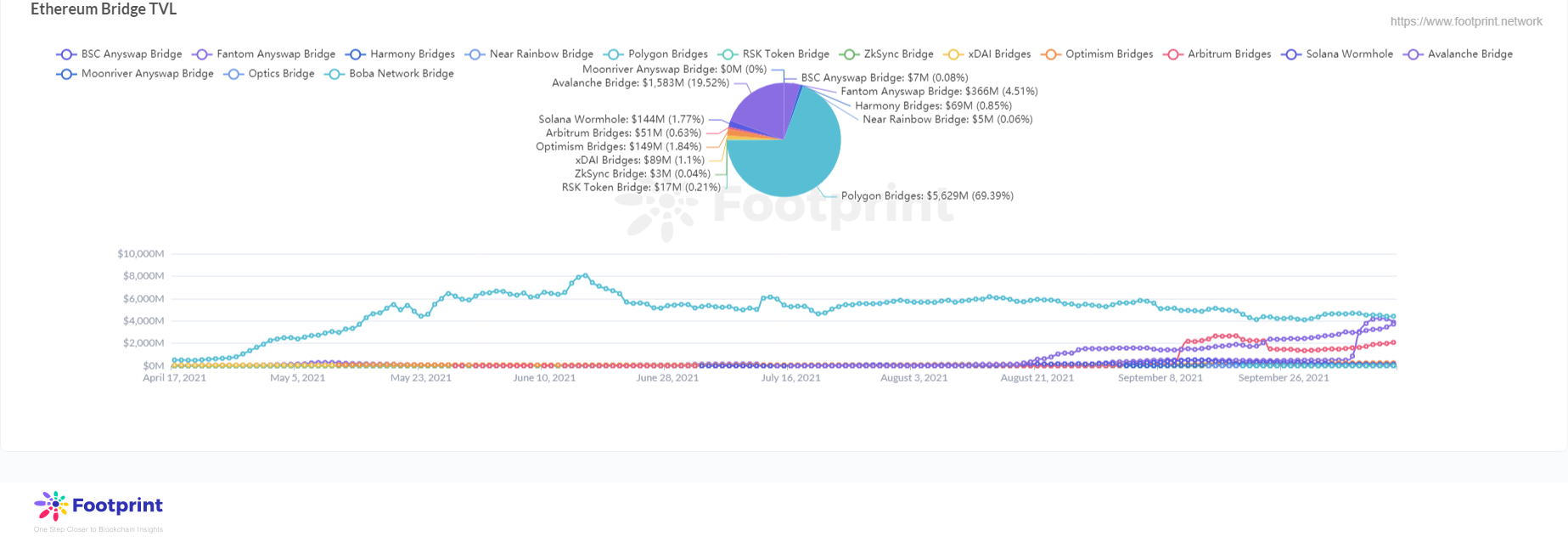

image description

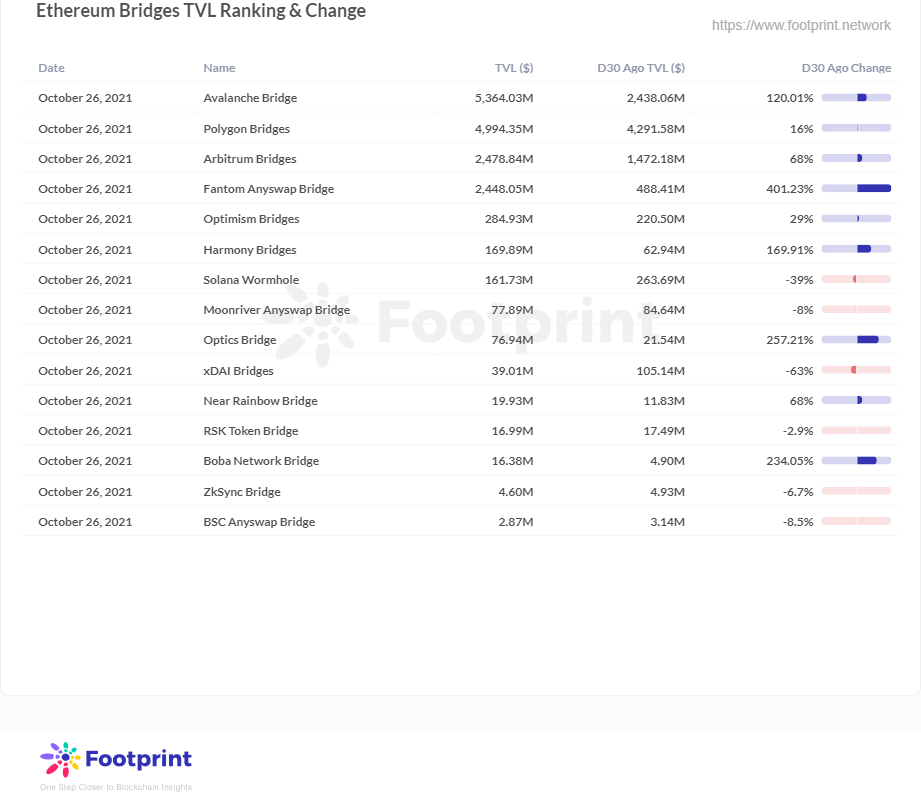

TVL ranking of cross-chain bridges & 30-day TVL changes, data source: Footprint Analytics

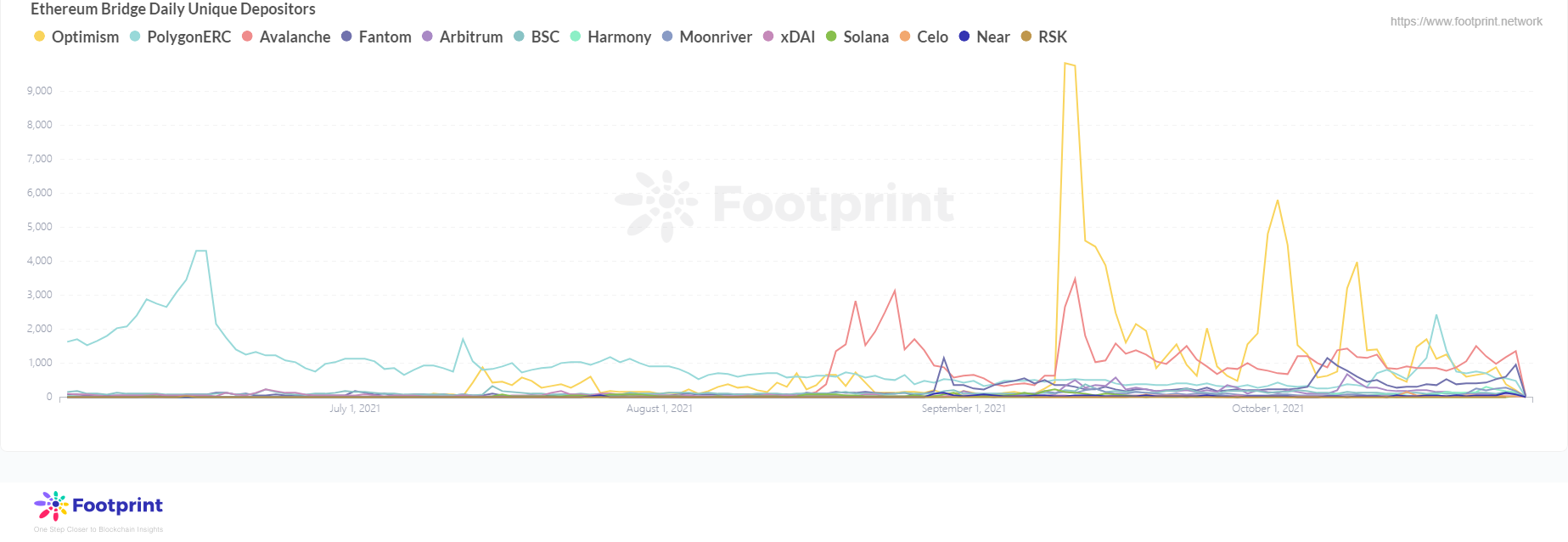

From Footprint's chart, Optimism has the most active depositors from the beginning of September to the present, followed by Avalanche. , the current transfer fee is as low as $0.25 (according to L2 Fees), and the transfer fee is floating, but the change range is relatively small.

Cross-chain bridge daily depositor trend chart (since June 2021), data source: Footprint Analytics

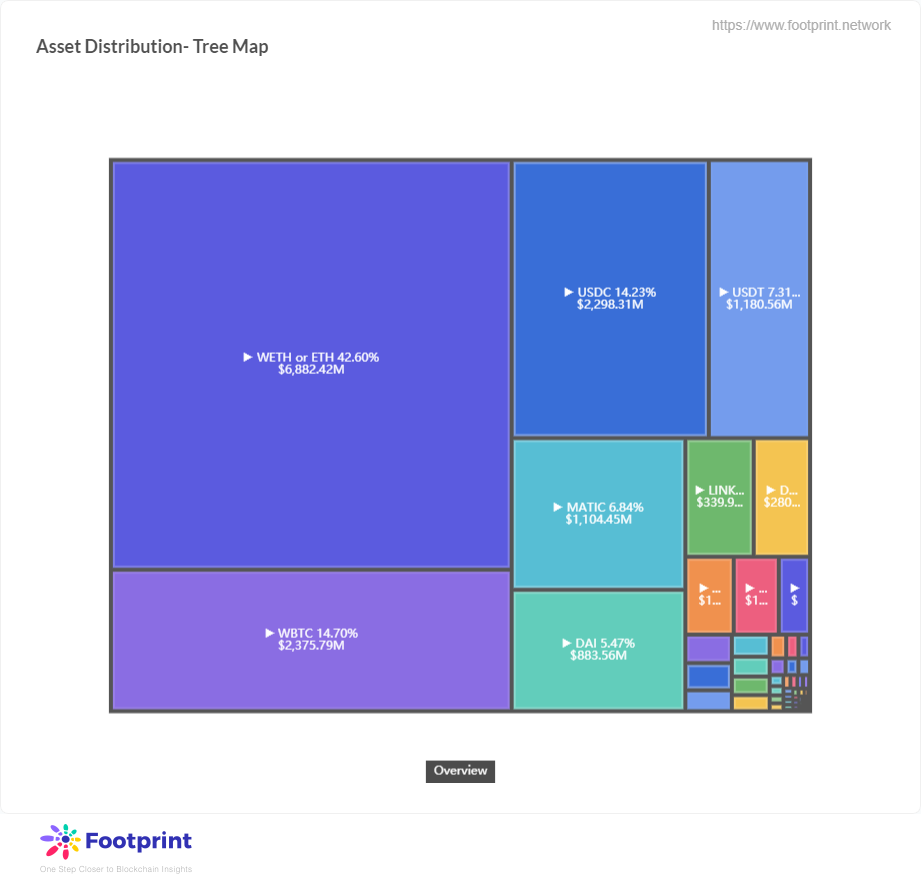

In these cross-chain bridges, what assets are in circulation?

image description

Distribution of cross-chain bridge assets, data source: Footprint Analytics

3. The existence of the cross-chain bridge, what problem has it solved for you?

If the bridge does not exist, investors will have to go through the exchange. They need to transfer the existing tokens to the exchange first, and then transfer them out of the exchange. There will be at least 2 steps to generate a handling fee. This is just a single step. For currency cross-chain, if you want to buy another asset after cross-chain, an additional transaction fee will be generated. When the Ethereum network is congested, the cost can easily cost hundreds of dollars.

When the bridge exists, a situation of multi-chain prosperity will be formed, such asThe public chain Fantom skyrocketed,Avalanche ready to goWait, the cross-chain bridge can not only meet the needs of asset interaction, but also has extremely high security. Investors are more inclined to choose Ethereum Bridges when it comes to asset issues. Many Layer1 blockchains need to use bridges to connect to any other system, and cross-chain bridges play an important role in asset rendition, so they are very valuable.

In addition, the most important thing is to solve the following problems:

Reduced Gas fees while increasing transaction speed

User assets can be freely interacted, and user experience is high

Increase productivity and utility of existing crypto assets

Greater Security, Better Privacy

Solve the problem of capital flow, etc.

Token transfer between Ethereum and a Layer 2 network, assets can be interoperable through cross-chain, such as depositing funds, withdrawing assets, exit time, etc. are faster and more convenient, reducing operational complexity;

High fees and used when Ethereum is congested;

The assets supported by the single chain are thin, while the assets supported by the cross-chain bridge are more;

Investors can use the cross-chain bridge when investing in the new chain to get the top mine faster, but they need to evaluate the complete mechanism and security of the new chain;

Conduct cross-DEX arbitrage transactions on Optimism, Arbitrum and Polygon, etc.

Considering the top-ranked cross-chain bridges that have already reached a considerable scale, it is recommended that the TVL of the cross-chain bridge is higher than 1 billion US dollars, and the TVL change rate is relatively stable, and the change does not fluctuate. There is a complete cross-chain mechanism and a trusted execution environment, including the verification method of cross-chain information and the management method of cross-chain funds, which are suitable for long-term use by investors, and the security is guaranteed;

The transfer fee is reasonable. Generally, the cross-chain cost is between 1-5 US dollars (based on the top Avalanche Bridge); the asset interaction speed is reasonable, and the estimated arrival time is 10-30 minutes); the above two reasonable values are for reference only.

Safety is the first priority. Bridges that have just emerged and bridges with a relatively small TVL volume are not recommended for asset interaction. Generally, the cross-chain mechanism of such bridges is still to be improved, and the cross-chain mechanism that has not yet been perfected is easy to be attacked by hackers to steal coins.

In the following scenarios, cross-chain bridges are suitable:

4. How to choose the right bridge

It is mainly evaluated from the following three aspects:

In addition, there are currently many aggregation tools that provide one-stop cross-chain bridge tools, among whichCoinTofuimage description

Summarize

Summarize

The above content is only a personal opinion, for reference and communication only, and does not constitute investment advice. If there are obvious understanding or data errors, feedback is welcome.

The above content is only a personal opinion, for reference and communication only, and does not constitute investment advice. If there are obvious understanding or data errors, feedback is welcome.

Footprint Analytics is a one-stop visual blockchain data analysis platform. Footprint assisted in solving the problem of data cleaning and integration on the chain, allowing users to enjoy a zero-threshold blockchain data analysis experience for free. Provide more than a thousand tabulation templates and a drag-and-drop drawing experience, anyone can create their own personalized data chart within 10 seconds, easily gain insight into the data on the chain, and understand the story behind the data.https://www.footprint.network/

Discord community:https://discord.gg/3HYaR6USM7

WeChat public account: Footprint Blockchain Analysis (FootprintDeFi)

About Footprint Analytics:

Footprint Analytics is a one-stop visual blockchain data analysis platform. Footprint assisted in solving the problem of data cleaning and integration on the chain, allowing users to enjoy a zero-threshold blockchain data analysis experience for free. Provide more than a thousand tabulation templates and a drag-and-drop drawing experience, anyone can create their own personalized data chart within 10 seconds, easily gain insight into the data on the chain, and understand the story behind the data.