first level title

The "battle of positions" between CEX and DEX

Due to the huge profit potential of exchanges, the number of exchanges has continued to increase like mushrooms after rain. According to incomplete statistics, there are already 419 exchanges in the world. Of course, the market elimination rate in this field is very high. In addition to the competition in this field, the more inadvertently strong profit sharers come from the DEX layout. The development of this track last year was like a broken bamboo. With its huge trading liquidity, it has captured a large number of trading users. The strongest opponent to replace CEX. However, in this year's general environment, the development of CEX has become more and more difficult.

From domestic to foreign, major regions around the world have implemented a series of regulations on the trading environment of cryptocurrencies. In the first half of the year, China issued a notice to crack down on the hype of virtual currency transactions such as Bitcoin and shut down mining operations. In September, it further issued a notice to rectify the hype of virtual currency transactions, and the supervision of virtual currencies is being upgraded. In foreign countries, South Korea has also issued the "strictest supervision" policy, requiring encrypted exchanges to complete a series of audits before September 24. Similarly, Asian countries including Thailand, Indonesia, and Turkey also have clear regulatory frameworks. Even though there are still many countries that have not issued a ban, they have expressed their continued concern for the cryptocurrency market. It can be said that for the encryption market, global regulation is becoming increasingly strict, and this pressure on exchanges that buy and sell cryptocurrencies cannot be underestimated.

So, in an environment where policy regulation is becoming clearer, does it mean that DEX, a candidate for CEX, will usher in a more impetus for development than before. Judging from the policy response, including Binance, Huobi, CoinBene, BHEX, etc. have successively announced to shut down or restrict users in China. Simultaneously, many centralized exchanges experienced a sharp drop in platform tokens under the influence of the turmoil. In stark contrast, DeFi tokens have ushered in a slight rise, including DeFi blue-chip tokens such as Uniswap, dYdX, Aave, Compound, and Sushiswap, all of which have increased by more than 10%. Among them, the 24-hour trading volume of the decentralized exchange dYdX reached 3.68 billion U.S. dollars, surpassing Coinbase’s 3.61 billion U.S. dollars for the first time.

first level title

Although DEX is growing rapidly, CEX is still difficult to shake

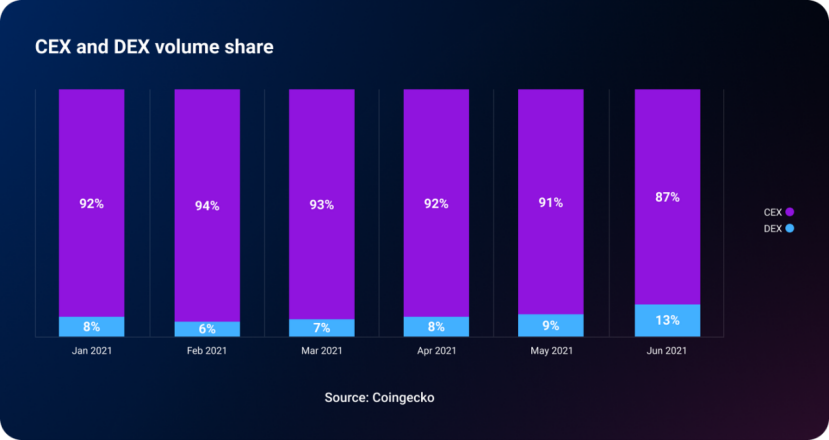

From a more macro point of view, the popularity of DEX is attributed to the fact that it is becoming more and more difficult to use centralized service providers in areas with uncertain or certain regulations, that is, CEX, and such services are becoming more and more strict. It is also becoming more and more difficult to use, and DEX is different. This is an open, permissionless system. These products allow users to trade directly without going through a third party. Especially for a market that is constantly evolving and actively absorbing external investment and assets, we see more and more development and use of innovative projects such as DEX protocols. It also shows that the restrictions on CEX by the cryptocurrency trading policy may provide some opportunities for DEX, and from the latitude of the entire industry, the source of its steady growth comes from the iterative update of DEX in this field and the integration of new and old projects. Continue to attack.

In fact, decentralized exchanges have been developing for a long time. As early as 2014, when Vitalik introduced Ethereum again, he mentioned decentralized exchanges. It was not until May 2020 that DEX was truly integrated with centralized exchanges. Exchanges competed with each other, and the share of trading volume accounted for by their activities began to increase sharply. In September, it entered a stage of increasingly fierce competition with CEX, and this year it showed a trend of steady growth. These activities are mainly driven by Uniswap, Promoted by AAVE, 1inch, and DyDx, the internal competition of this track shows a lot of upgrade points. Regarding the lack of transaction depth of DEX, the inability to support large transactions and the platform itself cannot be independently priced, Uniswap-like DEX products are experiencing A series of upgrades.

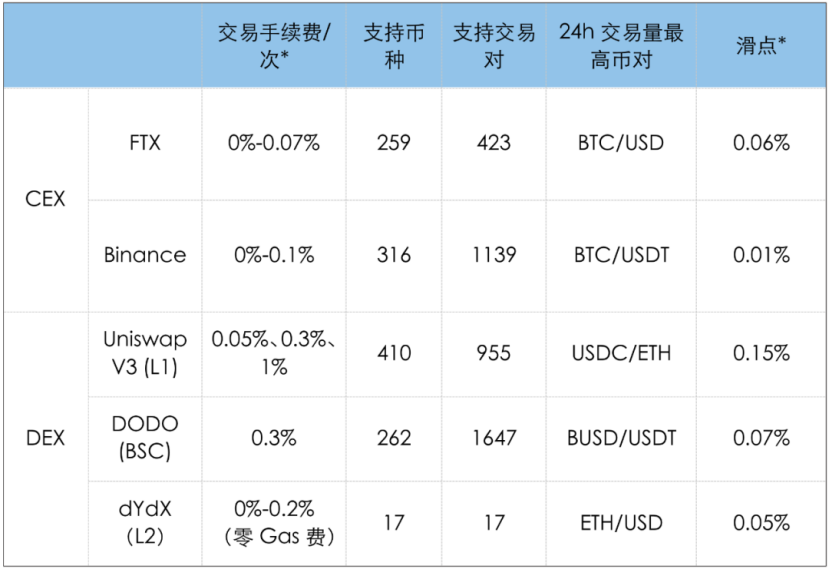

image description

(The picture comes from the Internet)

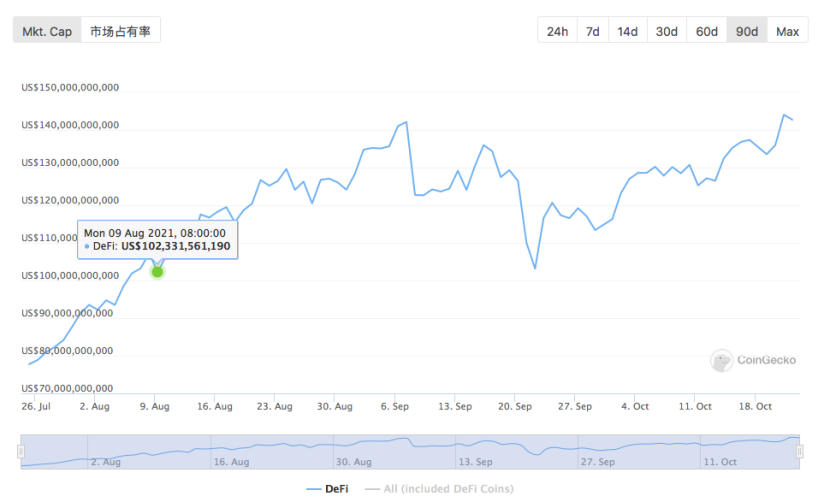

image description

(The picture comes from the Internet)

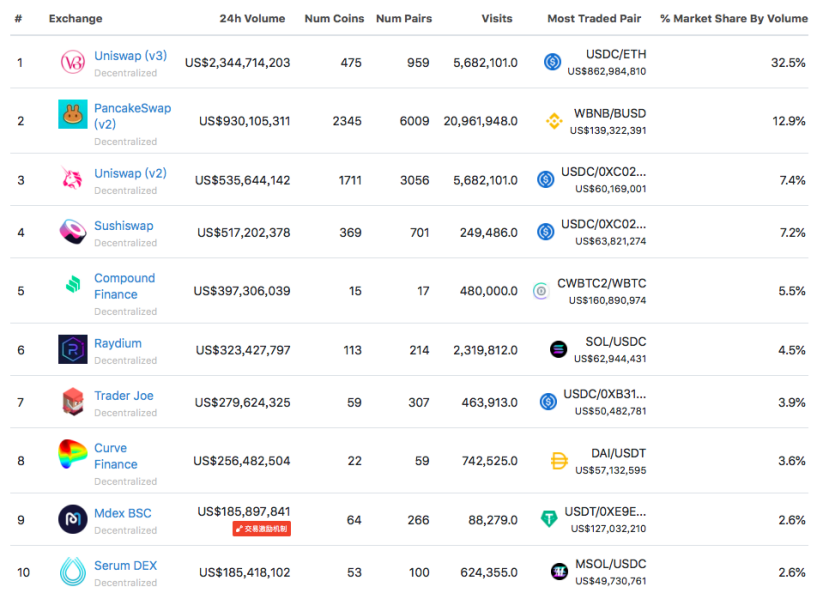

image description

(picture from coingecko)

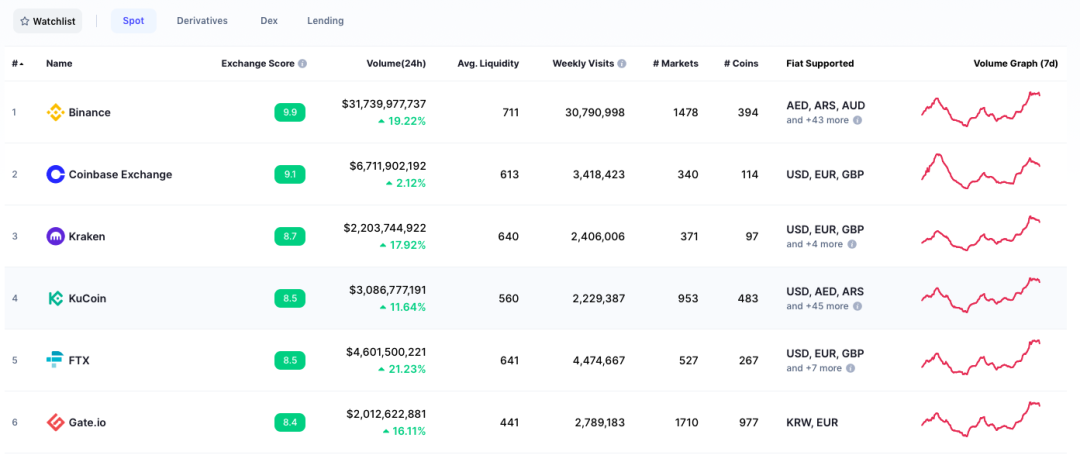

From the perspective of trading volume, there is still a big gap between DEX and CEX. The 24-hour trading volume of Uniswap (V3), which ranks first in DEX, is 2.3 billion US dollars. billion dollars. Comparing the two, it is still not the same.

image description

(CEX trading volume ranking, source CryptoMarket)

This huge gap also does not mean that centralized exchanges can be done once and for all, and the data shows that their outflows are increasing. Over the past month, more than $1 billion worth of ethereum has moved out of centralized exchanges within 24 hours, while exchanges have seen a steady outflow of bitcoin supply since March, according to on-chain analytics firm Glassnode. According to the data, BTC reserves on centralized exchanges have fallen to their lowest levels since February 2018. This also shows that the balance of mainstream coins on exchanges is becoming less and less, that is, the supply of centralized exchanges is constantly decreasing, and this kind of token transfer and outflow will also bring opportunities to decentralized exchanges to a certain extent.

first level title

(The picture comes from the Internet)

Which projects are driving DEX development?

Uniswap

As a leading project in the DEX field, Uniswap has always maintained a relatively active high circulation, and has established a position equivalent to Binance in CEX. It has been at the forefront in the upgrade iteration. Currently, the project has undergone the upgrade from UniswapV2 to Uniswap V3, which provides more aggregated liquidity, flexible rates, and more advanced liquidity oracles. Since its launch, Uniswap V3 has jumped to the top of the trading volume of decentralized exchanges (DEX) in just a few months.

1inch

1inch was incubated by Binance Exchange and is a major player in the industry. Since the first half of this year, the number of users of the project has grown from 80,000 to 600,000 through DEX aggregation trading services. It was one of the few that showed strong performance at the time. The growing number of DEX-based aggregator projects comes from the official introduction. They have low Gas costs, free transactions, secure smart contracts, support for BSC, Polygon, Optimistic Ethereum, and provide mobile applications. At the end of September, 1inch Network announced that the 1inch Aggregation Protocol and 1inch Limit Order Protocol will be launched on Arbitrum One.

Zenlink

Zenlink, Polkadot’s ecological cross-chain DEX protocol, has two core functions. One is the Zenlink DEX module. The project party can deploy the one-click DEX service through plug-in. The other is that it provides a cross-chain DEX protocol based on XCMP. It can realize the cross-chain transaction function while opening up the liquidity of all parallel chains. Although the project is still in the development stage, it has established cooperation with many projects including Plasm, Chainlink, Phala, etc., and placed in Polkadot's huge cross-chain network, it will also get more resource opportunities. When it starts to work, its future value will also be very impressive. Currently, Zenlink has just released an economic white paper, and plans to issue the same set of ZLK Tokens on the Kusama and Polkadot networks.

Serum DEX

The explosion of Solana's new public chain has directly led to the rise of its ecological projects, among which Serum is the best among them, which has attracted the attention of the industry. The project was launched in the first year of DeFi in 2020 and established a decentralized exchange based on Solana , which aims to bring CeFi's high-quality trading experience to DeFi, with a centralized limit order book model and extremely fast speed. It can be predicted that when the core driving force of all basic applications is built, Serum will get many projects that are really aimed at a huge number of users to build on it.

In short, there will only be a lot of project parties deploying DEX in the future, and its internal competition will become more intense. The once seemingly unshakable centralized trading platforms seem to be gradually being pursued in this wave of DEX upgrades, but it will take some time to catch up or overtake the argument that "DEX will replace them", and the two should be complementary and integrated in the future , Complementary relationship, jointly meet the trading needs of future users, and provide users with more trading options. However, in the short term, the trading volume of DEX is obviously unable to compete with mainstream CEX. In the future, DEX will have the opportunity to occupy a large market share, but CEX will still occupy a dominant position.