There is no doubt that the vast majority of traffic in the encrypted world this year is contributed by the NFT boom. according toDappRadar report, In Q3 of 2021, the total transaction volume of the NFT industry exceeded US$10.67 billion, an increase of 704% over Q2 and a year-on-year increase of 38,060%. The surge in the size of the NFT market is obvious.

As of October 16,The total transaction volume of the leading NFT trading platform OpenSea has exceeded 9 billion US dollars. Among them, some players choose to hold expensive NFTs for a long time.How to use this part of NFT as "idle assets" for mortgage lending like long-term holding of homogeneous tokens, and earn "property income" in the encryption circle has become a new market demand.

Recently, Odaily paid attention to XCarinval, a mortgage lending platform focusing on NFT and long-tail assets, accurately identified this demand, and acted quickly. The slogan put forward by the platform is to be a metaverse asset-backed lending aggregation platform available to everyone.

secondary title

1. XCarinval tries to solve the pain point of NFT pledge difficulty

The inherent indivisibility, uniqueness, and certain scarcity characteristics of NFT determine that NFT is less liquid than token assets, and cannot complete asset delivery in a standardized, large-scale, and non-differentiated manner. This has led to difficulties in NFT pricing. Therefore, NFT cannot form a mature mortgage lending market in a short period of time like players in the DeFi track.

Based on this essential feature, XCarinval founder and CEO Leon Liu further analyzed that the NFT pledge lending market is now facing the following two major challenges:

First of all, as an illiquid collateral, the value of NFT depends more on the valuation of buyers and sellers, similar to art transactions. Similarly, the value of an NFT needs to be determined after a game between the buyer and the seller. In this regard, XCarnival chose to build a peer-to-peer platform to allow pledgers and funders to "negotiate" and finally reach an agreement, rather than the platform pricing NFT.

Secondly, XCarnival refers to the rules of the traditional pawn industry, and does not liquidate NFT when the market fluctuates violently, but takes time as the only liquidation condition. If the time is up and the NFT mortgager fails to repay the loan on time, the NFT will be directly auctioned by the platform, and the auction proceeds will belong to the lender to avoid losses.

The solution ideas around these two core pain points have laid the underlying logic of XCarinval products. The core members of the team, including Leon Liu, rely on their rich experience in the encryption world to discover the hidden opportunities under the new trend and fill the gap in the market.

secondary title

2. The operating mechanism and core advantages of XCarinval

According to reports, XCarnival, as a mortgage lending platform for metaverse assets, uses four components: "XBroker", "Megabox", "XArena" and "XAdapter" to solve the current NFT asset mortgage lending platform. Difficult pain point.

Among them, XBroker is a peer-to-peer NFT lending platform, where users can negotiate interest rates and loan amounts and mortgage their own NFT assets in exchange for liquid loans. Megabox focuses on sub-mainstream token mortgage lending, and its unique pool mortgage rate setting model and risk control system can effectively provide liquidity release for users holding various long-tail asset tokens and expand income exposure. Therefore, in addition to the NFT asset pledge lending function, XCarnival has similar functions to lending platforms such as AAVE and Compound, which is more diversified and also catches up with the explosive trend of NFT.

In addition, as a multi-chain protocol, XCarnival was first built on the BSC public chain, won the BSC Hackathon Southeast Asia Division Champion in June, and will also complete deployment preparations on Ethereum Layer 2 (Polygon) and Solona to maximize Minimize the cost of Gas fees and increase the running speed.

It is worth mentioning that XCarnival's original auction liquidation mechanism has considered several possible problems between the two parties in the process of NFT mortgage lending in many aspects, so it is designed more comprehensively. Let's follow the steps to sort out the complete NFT lending process in the XCarnival protocol:

1. The borrower and the lender jointly agree on the loan amount, repayment date and interest obtained by mortgage NFT;

2. Put the NFT into the XBroker module for mortgage, the NFT mortgager gets the loan, and the lender releases the loan. When the repayment date is reached, the NFT mortgager pays off the loan and interest, retrieves the mortgaged NFT, and the transaction ends;

3. If the borrower fails to pay off the arrears when due, the mortgaged NFT will be forced to auction by the platform. If the auction price is lower than the loan amount, the auction proceeds will belong to the lender; if the auction price is higher than the loan amount, the lender will receive the due amount and share the higher part of the premium with the platform in proportion.

It is worth mentioning that both parties can fully negotiate loan information, including specific NFT prices, repayment time and loan interest. Because NFT is more uncertain than homogeneous tokens, buyers and sellers need to negotiate prices flexibly based on their own subjective judgment + risk preference, combined with market conditions.

For example, in order to obtain more income, a lender with a high risk tolerance can charge higher interest to the mortgager and give a lower valuation, but the corresponding loan amount is higher to ensure Both borrowers and lenders can agree. For lenders with low risk tolerance, they can offer a lower valuation while controlling the total loan amount within an acceptable range, but the corresponding loan interest rate needs to be lower, making it easier for borrowers to accept. In short, for both parties of different conditions and types of transactions, it is necessary to start a game around elements such as NFT valuation, total loan amount, mortgage interest rate, etc. XCarnival, as a platform party, will also create more opportunities to match the transaction rate of the two in the later stage and improve platform efficiency.

Of course, in order to ensure the fairness of the price so that it is not completely influenced by the subjective assumptions of both parties, XCarnival adopts a price feeding mechanism combining Chainlink + self-developed oracles to ensure a stable, objective and diverse reference price source.

In addition to mechanisms, security at the technical level has also been given equal priority. At present, the two main modules of XCarnival, XBroker and Megabox, have passed the security audit of CertiK, and have launched a bug bounty program in the white hat community. With the development of various functions and stable guarantees, the number of fans of XCarnival is also increasing. At present, the number of Telegram users of XCarnival exceeds 120,000, and the number of Twitter fans is close to 40,000. Many heavyweight KOLs have also actively participated in the Chinese and English communities. building.

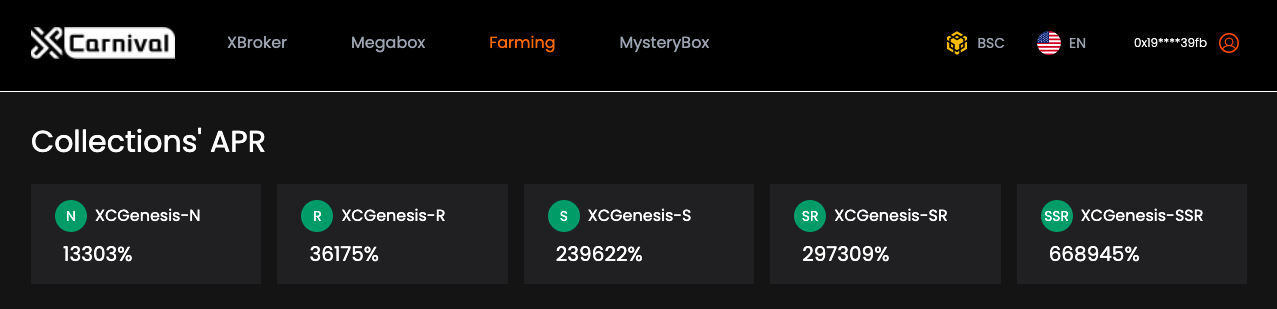

Just on October 18, the 5,500 Genesis Blind Boxes that XCarnival put on its official website platform have all been sold out, and all Genesis Blind Box holders are currently using the blind boxes for mortgage and loan mining.

secondary title

3. It is intended to realize "everything can be mortgaged" in the Metaverse

Leon Liu mentioned in an interview with the media that as a senior miner, he frequently encountered problems such as poor product experience when using traditional loan mortgage tools. In addition, the explosive growth of NFT, a new species in the encrypted world , Let him have the idea of creating an NFT mortgage lending platform. In his view, traditional loan and mortgage tools have high barriers to use, are difficult to get started, have high transaction costs, and require users to master a lot of new knowledge. At the same time, their functions are simplistic and cannot adapt to the ever-changing pace of development in the encrypted world.

For this reason, XCarnival's product design is as simple as possible, and users can use it directly without having a deep understanding of the concept of the NFT loan mortgage platform. Behind this is the team's philosophy of "creating products that more people can use easily". With the wide application of NFT and the popularity of the metaverse concept, the boundaries of XCarnival product functions will also be extended.

But it should be noted that XCarnival is not the only player who quickly entered the NFT mortgage lending platform. From the perspective of product details, XCarnival has relatively obvious advantages, such as lower handling fees, higher rewards for users, cross-chain deployment, and the launch of new functional applications such as auction mode + NFT whitelist filter.

In the future, more high-governance players may flood into this brand new track, but XCarnival currently has a certain first-mover advantage. In the face of subsequent challenges, XCarnival may come up with better iterative solutions to upgrade itself in the metaverse.

The underlying technology of the blockchain can be used as the record book of the metaverse, permanently storing the ownership information in the metaverse, and cannot be tampered with. The vision of XCarnival is to use simpler products to achieve more diversified functions in the metaverse space in the future, starting from NFT transactions, and finally realizing "everything can be mortgaged". In XCarnival, a new mortgage lending model, the collateral and transaction methods cannot be found in the traditional financial world, but they can create real value flow and resource allocation. The majority of users also rely on the characteristics of NFT to create art through encryption Participate more deeply and play their own unique role. This is highly connected with the underlying logic of the Metaverse world.

Whether XCarnival can realize the ultimate vision of "everything can be mortgaged" is currently unpredictable. But it is worth affirming that, as an advance planner of NFT and metaverse world, XCarnival has designed a logical and rigorous solution from discovering demand, creating demand to satisfying demand, and won a certain degree of recognition in the early stage. Whether successful or not, XCarnival will bring valuable reference and reference to the explorers of the Metaverse.