Today, the popularity of the NFT market is obvious to all.

According to the latest data from DappRader, the total transaction volume of the NFT industry in the third quarter exceeded US$10.67 billion, an increase of 704% month-on-month and 38060% year-on-year; among them, the world's largest NFT trading platform OpenSea, the total transaction volume in the third quarter exceeded US$8 billion, a record high.

But it is undeniable that there are many problems hidden in the prosperous NFT market, such as the short life cycle of NFT projects and rapid depreciation. At the same time, the incompatibility of NFTs on different chains also forms transaction barriers.

On the evening of October 15th, Alexander Shedogubov, the founder of the cross-chain packaging NFT protocol ENVELOP (NIFTSY), was a guest in the Odaily Chaohua community, explaining "Cross-chain protocol ENVELOP, adding new functions to NFT".

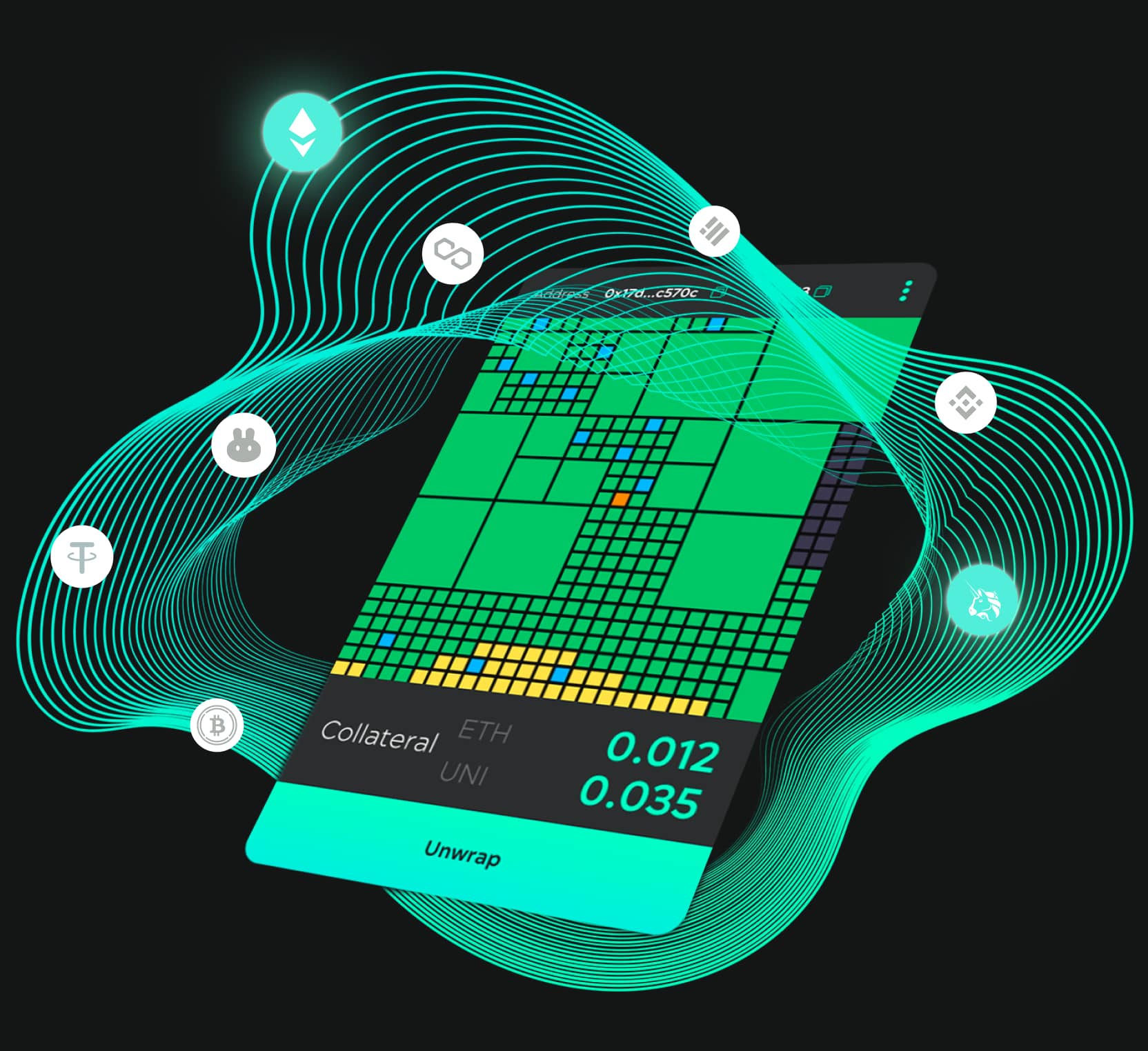

Alexander said that as a flexible cross-chain toolset, ENVELOP can support new NFT functions (such as economic settings, on-chain royalties, leasing mechanisms, time/value/event locks), provide depreciation protection, and anti-fraud systems. The ENVELOP project has three core components:

A protocol for adding digital assets to NFTs and setting on-chain royalties;

Score collateral and assess the quality of assets within NFTs through oracles;

The following is a record of the community dialogue, organized by Odaily:

The following is a record of the community dialogue, organized by Odaily:

Odaily: I learned that Envelop participated in the "Binance Hackathon" event, won the top ten in the competition and was recognized by Binance CEO CZ; in addition, Envelop also received funding from the NFT head platform Rarible. There is no doubt that Envelop can be regarded as a star project. First of all, I would like to ask you to introduce to the audience, why did you choose to create Envelop? What is the original intention or background of the project?

Alexander:First of all, we chose to start the ENVELOP project because we saw some problems in the market that hindered further development and innovation in the industry. In summary, these issues are mainly: currency devaluation, liquidity and royalties. We brainstormed about this and came up with a protocol to solve the above problems, which is ENVELOP. It is a flexible cross-chain toolset that can provide new features for any NFT (economic settings, on-chain royalties, leasing mechanism, time/value/event lock), anti-fraud system for depreciation protection, and can be easily distributed on GameFi, Implemented in Marketplaces, Art, Metaverse, and non-collateralized NFT leases.

Odaily: Many members of the Envelop team have several years of experience in the encryption field. Could you please give us some background information on the team members?

Alexander:Our team has diversified experience, and is composed of professionals with backgrounds in blockchain, encrypted transactions and start-ups. I believe this is also our strongest and most core competitiveness. Our team has more than 8 years of professional knowledge in the encryption field and 15 years of management experience in financial technology, e-commerce, IT consulting and other fields. In addition, we also have successful entrepreneurial experience in high-tech projects. Having such a team will help our business succeed in this emerging market.

Odaily: The current NFT market is very prosperous, and many traditional games, film companies, and artists have also begun to enter, and a large number of emerging projects have also emerged in the native NFT market. However, it has to be admitted that there are many problems hidden under the performance of prosperity. For example, many NFTs have no value and are just hype. In your opinion, what are the problems in the current development of the NFT market?

Alexander:As we mentioned before, we have identified several issues such as depreciation, liquidity and royalties.

Devaluation includes that the price discovery mechanism for NFTs is not efficient and transparent; most NFTs lose value in the medium term; buyers do not get any economic benefit/guarantee from the purchase.

Liquidity issues mean that most NFT sales are complicated because there is not enough liquidity in the market; existing NFT liquidity pools offer poor prices; and there is no guarantee that NFTs will be sold.

Another big issue that comes up when we talk to artists is royalties. Authors can only receive royalties when minting NFTs, and subsequent transactions cannot be profitable. There is no advanced royalty setting in the market.

These problems have seriously hindered the healthy development of the NFT market, and are also the direction that the ENVELOP project is committed to solving.

Odaily: As a flexible cross-chain toolset, Envelop can endow any NFT with new functions, such as economic settings, on-chain royalties, leasing mechanisms, time/value/event locks, and more. I understand that Envelop is composed of three parts: protocol, oracle, and index. Can you give us a detailed introduction to the specific functions and use cases of each part.

Alexander:Envelop is a DAO created in 2020, which consists of four elements: protocol, oracle (Oracle), index and Token (pass).

The "protocol" protects users who purchase NFTs from complete depreciation of assets by creating a mortgage storage facility that only applies to on-chain activities.

"Oracle" protects users by analyzing the on-chain and off-chain behavior of assets within NFTs. It creates a map of NFT minting generation, transfers, freezes, and other transactions. In addition, Oracle considers the main players related to NFTs: issuers (distributors), distributors (platforms, etc.), buyers, etc.

Oracle also includes a scoring system for valuing assets, and an anti-fraud system. On the one hand, it can notify the owner of changes in asset data embedded in wNFT; on the other hand, it provides complete information for all parties involved in transactions such as sale, lease, and pledge.

"Index" aims to tokenize market segments and industries as micro-indices by using secured wNFTs; the sum of wNFTs can provide industry data, the sum of industry indices, market indices, etc. At the same time, the resulting index is not directly tied to any fiat currency basket or crypto assets, as it is merely an objective indicator of the NFT segment.

Token is the connecting element of protocol, oracle and index, and can be used.

Outwardly, through a micro-DAO structure, when everyone can pledge through NIFTSY and become a member of such a DAO, the expenditure and possible income will be allocated in proportion to the contribution. Internally, royalties can also be paid in NIFTSY tokens, but it is not mandatory.

Odaily: Envelop, as a cross-chain protocol, currently only supports Ethereum and BSC. Next, what development plans do you have, and which public chains/side chains will you support? Will Solana, FLOW, Enjin, etc. become your goals? Can you introduce your criteria for choosing a public chain?

Alexander:Yes, that is exactly the case. The Envelop protocol was initially built on the Ethereum blockchain (including via L2 - eg, Polygon) and BSC.

In the future, Envelop also plans to complete cross-chain integration with the following blockchains: Flow, WAX, Solana, Polkadot, Cosmos, Avalanche, and other DRS.

We firmly believe that cross-chain is the future of all decentralized and distributed systems. Our criteria for choosing a public chain are very simple - safe, stable, flexible, and practical, which is very simple and clear.

Odaily: I'm curious about Envelop's "index" function. What are your criteria for selecting NFT project portfolios? I want to know, can users build their own indexes in the future, and even enable trading functions?

Alexander:Only users can create. The internal assets of wNFT are scored according to the selected standard, which itself is a micro indicator. We pull everything together and only display the final market index through the Oracle. As for transactions, we can't do prohibition, it's open source.

Odaily: Envelop adopts DAO governance, and the importance of the core NIFTSY token is self-evident. I would like to ask you to introduce the NIFTSY economic model and usage scenarios? In addition, please also introduce the recent launch and distribution of NIFTSY?

Alexander:The NIFTSY token has one main function for the DAO - staking governance. Anyone can use the protocol, oracles, indices, and no tokens are required. However, if he wants to participate in the creation of a micro-DAO, for example, we implement the NIFTSY protocol in the game, then the participant needs to stake a certain amount of tokens specified by the DAO envelope.

Thus, the final pattern of the token model depends on: a) the chosen micro-DAO; b) the timing of blocking the token; c) the validity of the specific case (one game may be more active than another).

Odaily: There are currently many protocols that focus on NFT-Fi. Which projects do you think will become competitors of Envelop? What do you see as Envelop's competitive advantage compared to these rivals?

Alexander:In fact, there are not many protocols for NFT-Fi. Every month we feature some contenders on the blog such as Emblem Vault, Wrap Protocol, Charge Particles.

Our mission is not to beat the competition or get ahead of them, our strengths are different: a) Envelop is cross-chain in a unique way (see above); b) every other protocol is inevitably part of our oracle , every NFT created is part of our "index"; C) we are not focused at all on the b2c market, so we can easily fend off another 100+ competitors. In addition, multi-blockchain and cross-chain mechanisms are the future trend, which means that there is no need to compete within Ethereum, for example, you can go to Solana;

Our final product focuses on creating a closed ecosystem and earning profits through practical implementation with partners, while not relying on competitors.

Our main plan for the next one to three years is to launch a secured derivatives market and tokenization of payment channels. In my opinion, we are not ready yet because the track is too big.

Odaily: In addition to receiving funding from Rarible, what institutional investments has Envelop received? Could you please introduce the financing situation? What will be the future arrangements for these financings?

Alexander:Among our awards you can find: Top 10 winners of the Binance Hackathon Russia, funding from Rarible and funding from Polygon. Polygon's funding is primarily for development needs, specifically the integration of Matic and the Polygon blockchain solution within the ENVELOP protocol.

Odaily: In addition to establishing partnerships with institutions such as ArtWallet and Blocsport.one, what other partners does Envelop have? Can you please elaborate? How did these partners help Envelop develop?

Alexander:We have signed partnership agreements with PureFi, DotOracle, DeathRoad, WOW Summit and ScaleSwap. Other than that, we cannot reveal the names of other partners, but you can subscribe to our channel to get timely announcements.

Our CBDO, Alexander Kuzin, is working hard to bring in as many partners as possible who can not only help us develop the envelope, but also further develop the entire ecosystem.

Odaily: Next, what other development plans does Envelop have?

Alexander:We will launch IDO on October 21, 2021. Our next steps will be release of Oracle MVP version in December 2021; Oracle v.Alfa in February 2022; Index v.Alfa in March 2022; Protocol+ in June 2022 Oracle + Index v Ultimate Beta".