Compiler: Zion Editor in charge: karen

Compiler: Zion Editor in charge: karen

As September came to an end, the cryptocurrency market recovered from the so-called "September Curse" with a market capitalization of $2.32 trillion. The decentralized finance (DeFi) market has been an integral part of this growth. According to Dappradar, the total value locked (TVL) in DeFi protocols has grown by more than 20%, from $113.5 billion on September 28 to $137 billion on October 6.

Even global banking giant Bank of America (BoA) has revealed a bullish outlook for DeFi and NFTs. In a report published Oct. 4 by Bank of America subsidiary Bank of America Securities, the firm assessed the spectrum of crypto assets beyond just “bitcoin.”

“Bitcoin’s advantage is that it can execute automated procedures,” the report said. Ethereum, Cardano, Solana, and other blockchains can do more than just securely record payment contracts. In decentralized finance (DeFi) Among them, smart contracts automate the manual processes of traditional finance.”

It also compares tokenization to the early days of the internet and talks about the current decentralization and tokenization of many aspects of finance.

Cointelegraph discussed the rapid expansion of the DeFi market with Johnny Kyu, CEO of cryptocurrency exchange KuCoin. He explained:

As more and more people start to realize that smart contracts can replace traditional loans or bank deposits, the DeFi market is becoming more and more popular. The amount of funds locked in DeFi reflects the market adoption of private investors, who are moving funds from the traditional financial system to the decentralized industry.

While the TVL of the DeFi industry has grown amid rising prices of various projects’ native tokens, Kyu also attributes the growth to the attractive interest rates offered by DeFi platforms.

A recent report from Dappradar shows that in the third quarter of 2021, the TVL of the DeFi industry increased by 53.45% quarter-on-quarter. In September, the number of unique active wallets (UAW) connected to any decentralized application reached a daily average of 1.7 million. The quarterly average UAW was 1.54 million.

Cointelegraph spoke to Balancer Labs CEO Fernando Martinelli about the importance of the DeFi foundation built on Ethereum. “A new wave of DeFi projects are building on the infrastructure established by the first generation, bringing new use cases and more advanced products to advanced users of DeFi,” he said.

first level title

next generation

The DeFi ecosystem started with the Ethereum blockchain as it provides smart contract functionality. However, several other blockchain networks have since deployed smart contract functionality on their networks via layer-1 or layer-2 solutions. The most prominent of these networks are BSC, Solana, Avalanche, Terra, and Polygon. Recently, the Cardano network enabled the deployment of smart contracts as part of the Alonzo hard fork.

Even though the growth of these networks can be considered organic, a major problem with the Ethereum blockchain may have contributed to this growth: gas fees. As part of the London hard fork, the EIP-1559 proposal includes burning ETH tokens in an attempt to make ETH eventually a "super-sound currency," improving scalability and reducing gas fees.

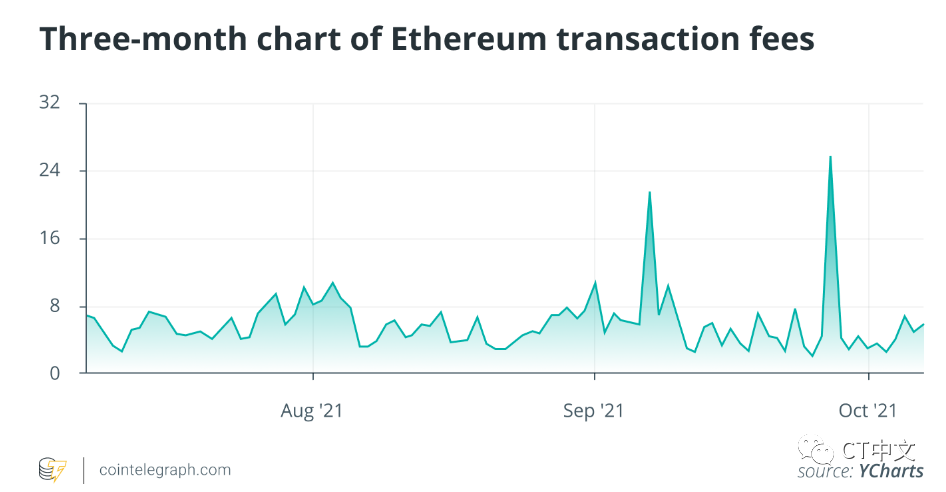

However, while fees aren’t as ridiculous as they were at the height of the bull market in May, the average transaction fee on the Ethereum network has seen a massive spike over the past few weeks. Notably, on September 7, the fee rose to $21.29, while on September 27, the gas fee rose to $25.43, the highest level in four months.

Martinelli said: “There is no doubt that Ethereum’s high gas fees — especially recently exacerbated by NFT-induced congestion — have helped facilitate rapid adoption by other networks. (…) Layer 2 Solutions is helping Ethereum scale, and we're excited to see continued development in this space."

The continued popularity of NFTs is also a big driver of this growth. Dappradar mentioned in the above report that the NFT field has also seen exponential growth. In the third quarter, the market transaction volume exceeded 10.67 billion US dollars, an increase of 704% over the second quarter and a year-on-year increase of 38,060%.

While most major NFT sales were on the Ethereum blockchain earlier this year, now blockchains like BSC, Solana, Polygon, Avalanche, and Tezos are starting to catch up. Most recently, the Solana Monkey Business, the largest collectible in the Solana ecosystem, sold for 13,027 Solana (SOL) and is currently worth over $2.1 million, breaking the platform’s previous NFT record.

Shane Molidor, head of global business development at cryptocurrency trading platform AscendEX, spoke to Cointelegraph about the potential of NFTs:

first level title

Mistakes, Vulnerabilities and Hacks

The rapid expansion of the DeFi ecosystem has not been without setbacks. Several bugs and hacks arose throughout the formative stages due to a lack of understanding and caution on the part of players.

On September 30, DeFi interest rate protocol Compound Finance announced that there was a token distribution loophole in its newly implemented Proposition 062. The exploit accidentally rewarded users with $70 million in COMP tokens. In hindsight, another $65 million in COMP tokens was at risk because an update in the code would not take effect for the next three days due to a time lock. In total, the bug left $162 million "up for grabs," making it an extremely costly loophole. On October 7, the agreement passed a proposal to address the issue.

In another example of a technical error, cryptocurrency exchange Bittfinex paid more than $23 million in transaction fees to transfer $100,000 in Tether (USDT) on the Ethereum blockchain to second-tier affiliate platform DiversiFi. However, the miners kindly returned the funds to the exchange.

While the DeFi market is lucrative, high-profile incidents such as hacks, bugs, and bugs may act as a deterrent to both institutional and retail investors. Retail investors are more vulnerable to such financial losses because they lack the experience and knowledge that institutional investors possess. Therefore, they often become the benchmark for retail investors. Molidor told Cointelegraph:

It's almost like a feedback loop for institutions and retail investors to enter DeFi. As more retail users enter the space, [the market capitalization] continues to grow, and institutions are starting to look more closely at the industry to explore economic opportunities. As institutions enter DeFi, the field is given more attention. Judging from this level of attention, DeFi has entered the mainstream discourse, and more retail users are becoming familiar with the benefits and economic returns that DeFi provides.

But these negative examples are only a small part of the development of the DeFi market, which is trying to revolutionize finance. The independence of users and the innovation that DeFi protocols offer investors will only allow the space to grow further.