Author | Bridget Harris

Translation | Mike Jin

first level title

NFTs as Alternative Assets

A central theme of cryptocurrencies is community:Return power to content creators without middlemen, promote accessibility by removing barriers to entry, and creatively leverage developers, artists, and creators to build amazing protocols. Non-Fungible Tokens (NFTs) and their use cases illustrate this theme well. NFTs are unique digital assets — like art, music or collectibles — that live on the blockchain — allowing artists to sell their creations as merchandise.Fragmentation allows users to decompose NFT into smaller replaceable fragments, and has various application scenarios.

Compared with traditional art,NFTs are becoming a highly versatile asset class with an explosion of creative use cases.first level title

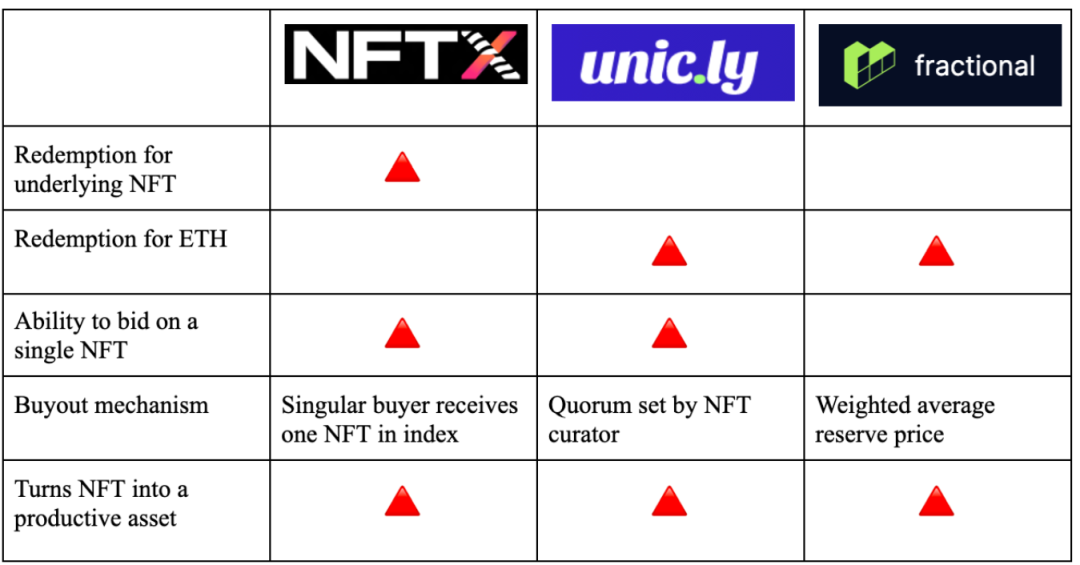

NFTX - Index Fund Methodology

NFTX is a decentralized protocol that aggregates NFTs of equal value into index funds.Users earn ERC-20 tokens by contributing artwork to the index or by purchasing a shard of the index. This ERC-20 token from NFTX is called a vToken, and it is a 1:1 replica of a random NFT in the index in which your NFT is minted. NFTX has advantages and disadvantages. How does it fragment the collection of NFTs? First, it assumes that all NFTs in an index are of equal value. In practice, this rarely happens and can become a problem when vToken owners redeem their tokens. Instead of receiving a token payment, the owner of the vToken randomly receives an actual NFT from the index basket.

When you cash out of the fund, you receive the actual NFT in the index, not just ETH, potentially creating a more personal dynamic between the index and the buyer. NFTX users may be more likely to believe in the long-term value of the NFT, as some investors will receive it (with ETH, etc.) when redeeming it from the vault. Index tokens are a more efficient way of capitalizing floor assets, since a single Fractional or Unicly vault needs to form capital for each vault/asset. Greater capital efficiency allows the protocol to have lower collateralization ratios due to the increased depth of assets. However, the value model can be problematic,Because the value of each NFT is constantly changing, depending on what the market thinks, similar to how stocks behave.For example, if certain information about a National Trust is discovered, such as negative press about previous owners, its face value may rise. In a fast-growing ecosystem, influence is important, information spreads quickly, and similarly NFT indices can be complex.

A simple example: On NFTX, a user cashes out from a base CryptoPunk index. He receives a punk of relatively low value from the vault, since the index is made up of floor punks. However, personal preference comes into play here - a user might want a particular punk in the index, but not be happy with the punk he received.

up to now,

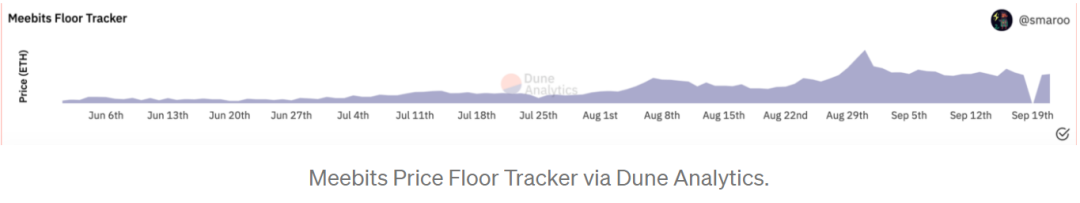

up to now,NFTX's platform mainly has relatively low-value artwork such as floor CryptoPunks, rather than high-end NFTs, so it is relatively the most interesting platform for floor assets.Users can mortgage NFTX's floor index token in an agreement such as Compound for lending. However, from the perspective of the liquidator, these floor assets may lose value due to slippage when they are redeemed. If there isn't a lot of depth behind the index token, liquidators may sell it as soon as the price drops in exchange for USDC because they don't want to have an asset on their balance sheet that is declining in value. Likewise, if multiple individuals have a Floor Index token that they borrow against, if the price of the token falls, there may be a shortage of liquidity in the market.

The issue of NFTs used as collateral also comes into play here: when liquidation occurs, the block may be partially liquidated. In a partial liquidation, the defaulted NFT is deposited into an index fund. In theory, some tokens representing index funds will be owned by lenders and some will be owned by borrowers. Then, half-collateralized NFTs can continue to be used as collateral, but only with a proportional amount of shards. Once an NFT is split, it is very difficult to turn it into a full NFT again, so this use case can prevent investors from using their NFT as collateral. Whether partial liquidations will become mainstream (or even justified) is up to the community to decide, but we will undoubtedly continue to see creative efforts to turn NFTs into productive assets.

The NFTX token is the most effective way of tracking the value of ground assets among the three protocols. This is because investors have a lot of liquidity when depositing or redeeming from index funds compared to other protocols. The less liquid approach in other protocols means that the price of the underlying asset shows a lag behind the true valuation, as there is not as much incentive to keep up with the market because:

1. Investors are not redeeming for actual assets

first level title

Unicly & Fractional - direct fragmentation

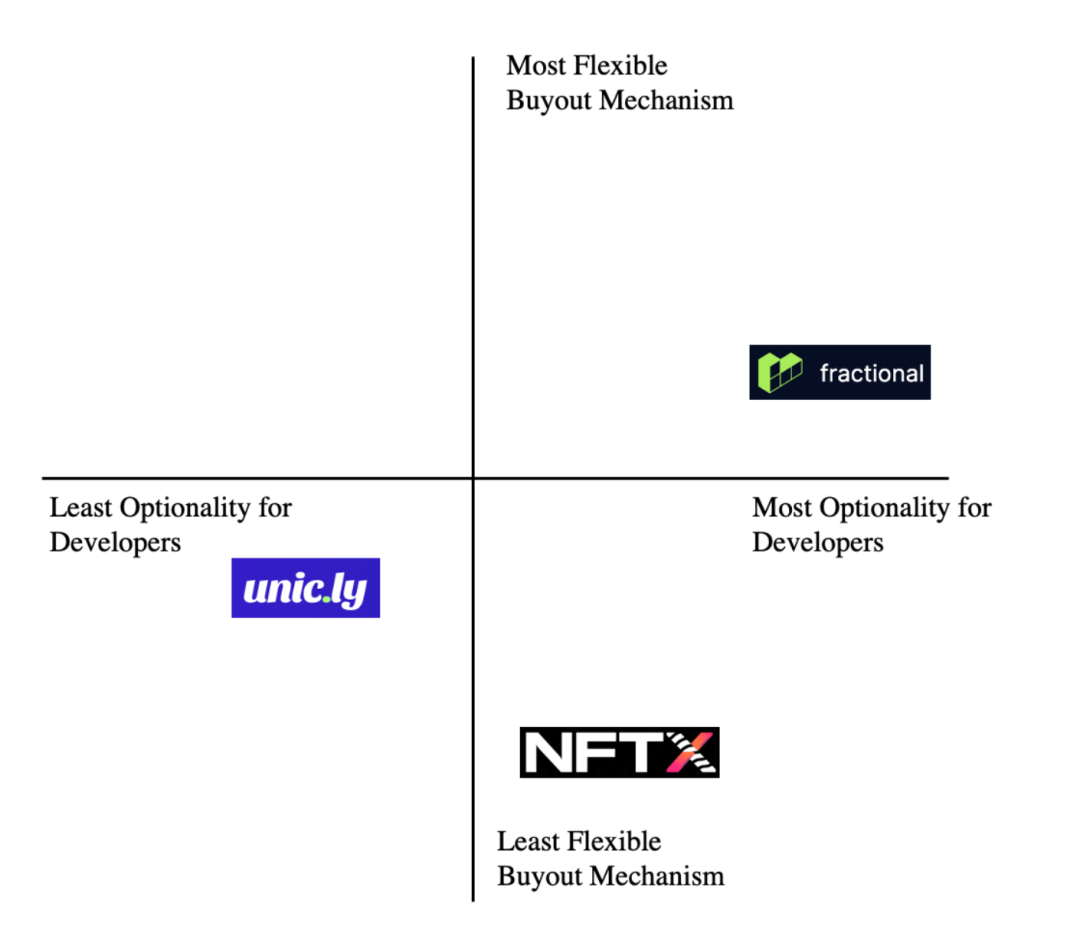

NFTX operates as a series of index funds composed of NFTs,Unicly and Fractional directly fragment a single NFT or a collection of NFTs.Fractional and Unicly’s vaults are fixed in size, while NFTX is variable in that it allows anyone to deposit and withdraw assets from the fund without restrictions according to the vault’s criteria. Another difference between NFTX and Unicly & Fractional is the redemption mechanism: In NFTX, users redeem artwork for the index. If a user creates an index of 10 CryptoPunks on both NFTX and Fractional, the user will not be able to buyout a Punk on Fractional/Unicly. Unlike NFTX, Fractional and Unicly are not suitable for index funds, because it is impossible to enter and exit the fund after the NFT is created.

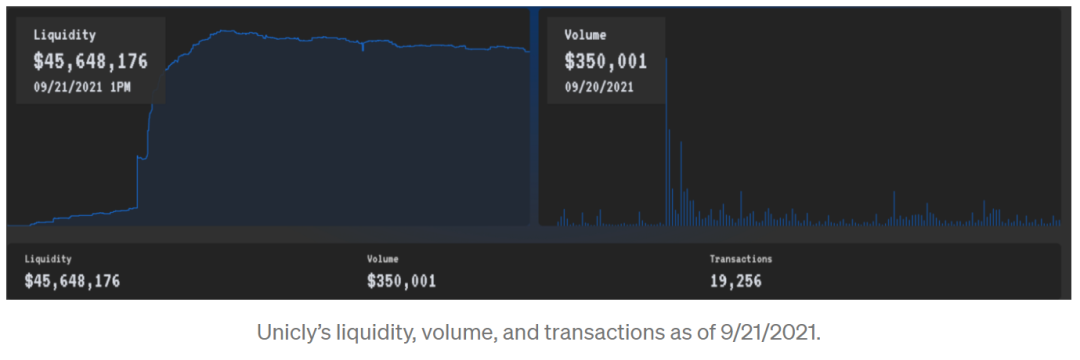

On Unicly, NFT owners wishing to fragment create a uToken (an ERC-20 token) that represents a collection of NFTs on the platform, or a single NFT. Once the collection is created, users can interact with it by purchasing its uTokens, bidding on NFTs in the collection (including bidding on individual NFTs), and governing the collection. While NFTX allows you to redeem the underlying assets in the fund, in Fractional and Unicly, users receive ETH when the pool is unlocked. A certain percentage of the total uToken supply must be in favor of unlocking the collection in order for the NFTs to be distributed to bidders and their prorated payments paid to token holders. In Unicly, this percentage is set by the creator of uToken at the beginning of the differentiation process. Since users have to rely on other people also wanting to unlock collectibles, Unicly has a more community-dependent approach to governance with less flexibility.

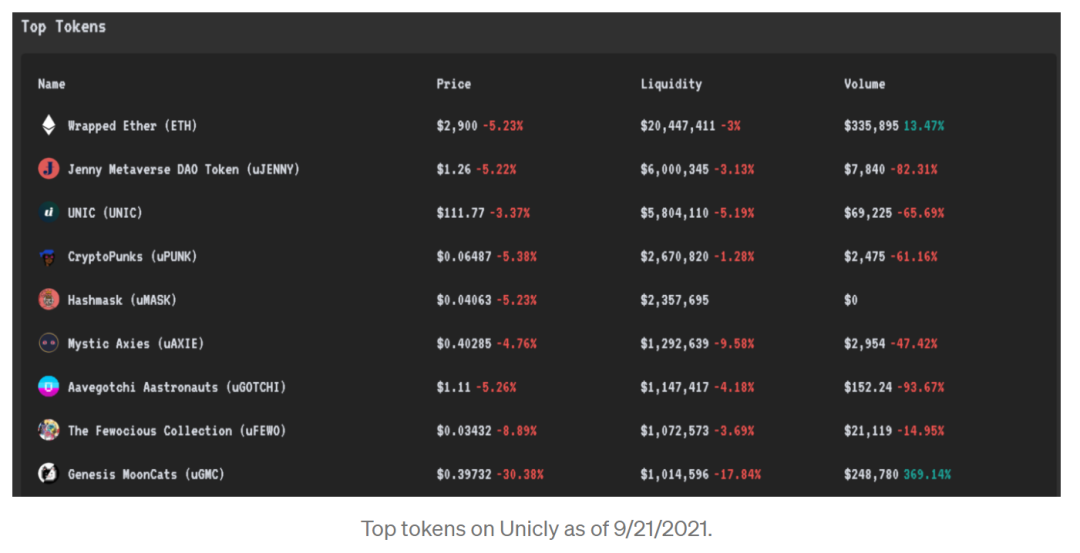

High-quality NFT collections will be rewarded by Unicly through the whitelist, which means that the pool can liquidly mine UNIC (Unicly's governance token) by staking LP tokens. Additionally, Unicly plans to enable Farming, so users will be able to stake their UNIC to earn more UNIC. This may have the effect of reducing selling pressure on UNIC. Currently, users can add liquidity to the network and earn 0.25% fees on transactions that are proportional to their share of the pool—meaning that whenever a transaction enters or leaves the pool, they can earn fees.Anyone can list their uToken on Unicly, so it's the buyer's job to make sure it's priced right.

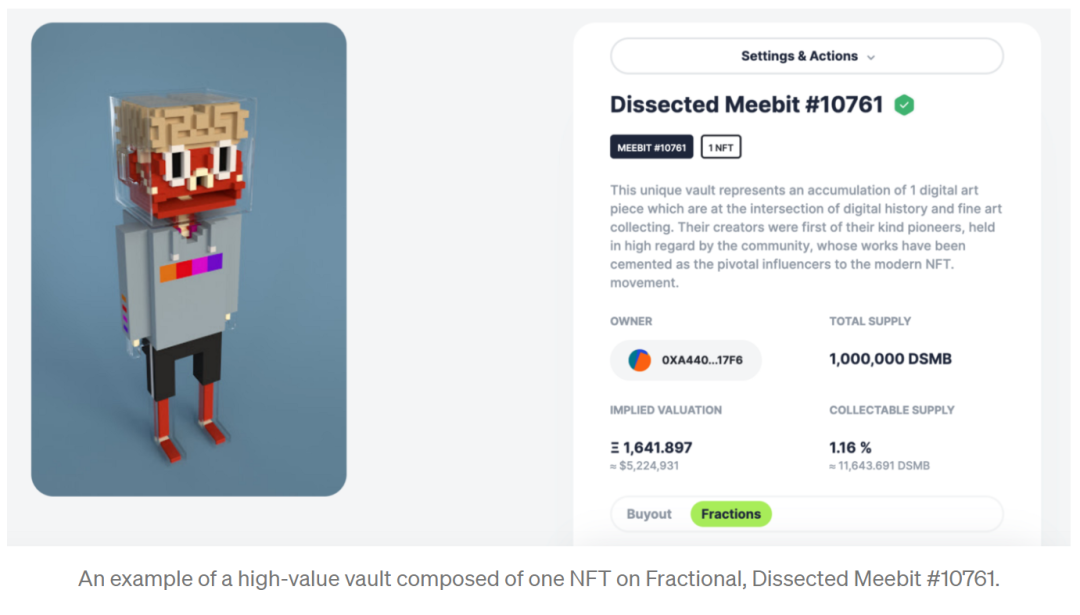

Fractional aims to be the most neutral protocol in this space.They took a very minimalistic approach, providing developers with a bare-bones protocol on top of which to build functionality and mechanisms, depending on how they want to fragment their NF. This flexibility allows for fragmentation in creative ways, with varying levels of complexity for each artwork. Just as every NFT is unique, a fragmented approach cannot be the standard for all artworks; Fractional strives to address this as a user-friendly foundation that provides the essentials of Fragmentation and lets developers design the rest. While NFTX contains more underlying assets, Fractional is likely to be used for single expensive NFTs.

first level title

The Future of NFTs and NFT Fragmentation

The NFT fragmentation landscape is still relatively new, and winners in this space are determined by factors like curator fees/incentive structures for NFT owners, artists, and investors.However, these protocols can also coexist harmoniously, each with a rich, diverse and unique set of funds on their platforms, with new investors entering and exiting the space frequently. Whether or not there will be an eventual winner, NFT fragmentation does provide a more viable and easier approach for the industry, and profoundly expands the financial utility of owning NFTs — in whole or in part. NFTs themselves are also being leveraged for new and exciting use cases such as:

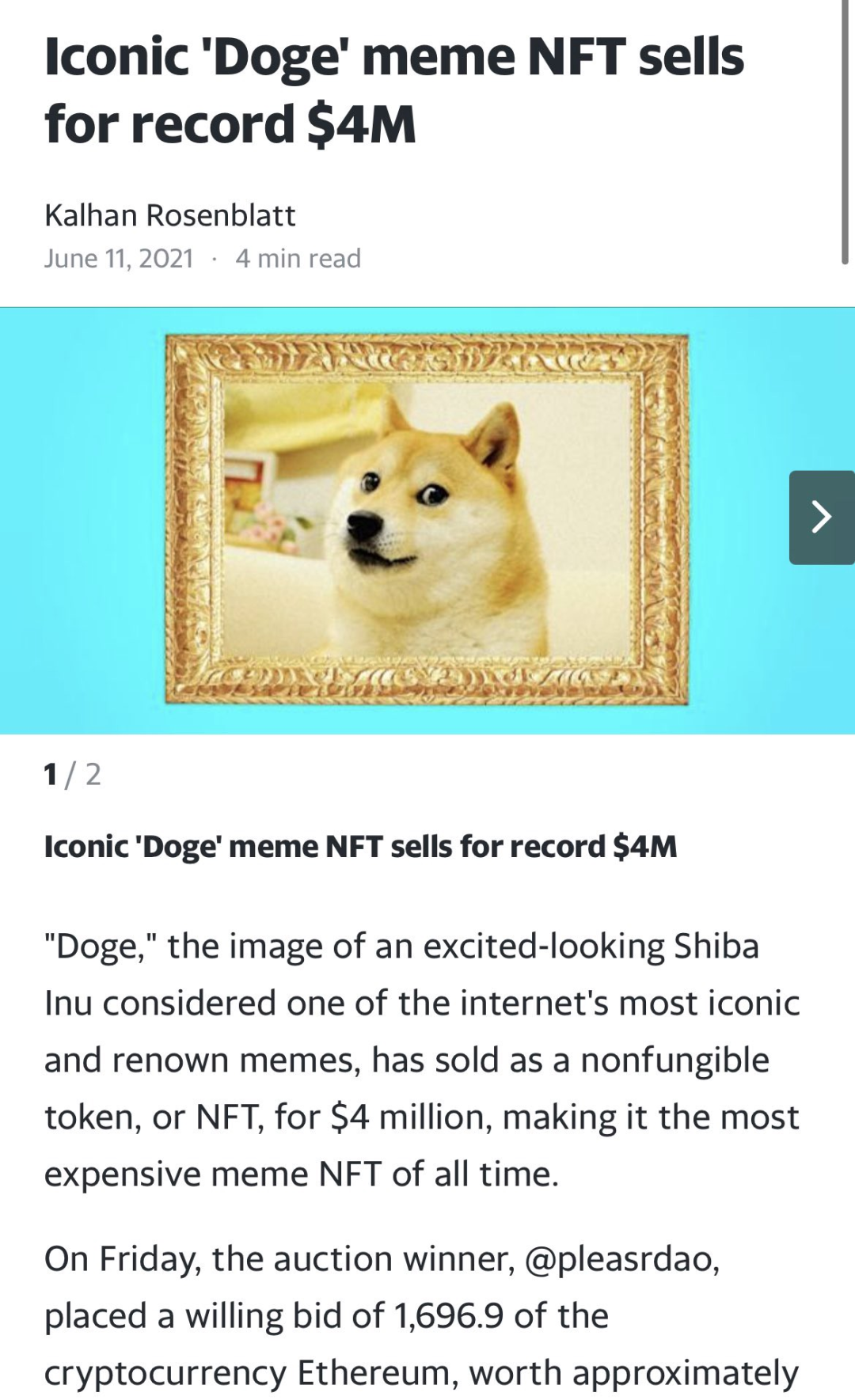

The DAO as an investment vehicle for NFTs: The DAO gained traction by forming a community around a piece of art, increasing the accessibility of rare, expensive NFTs that few individuals could afford. For example, PleasrDAO, owner of the iconic $5.4 million Snowden NFT, is creating a Shiba Inu contender backed by a $4 million Doge NFT. Likewise, JennyDAO — a new DAO with Unicly tokens — offers members perks like access to exclusive research, group chats, and NFT leaders. Funds raised will be allocated to purchase NFTs of the choice of DAO governance token holders.

Social media NFTs:We may start to see posts on social media converted to NFTs and distributed among an individual's original supporters, resulting in community-based rewards for fans. For example, admirers of a celebrity's first Instagram post can be rewarded with a fraction of that post for their initial support. Alternatively, posts can be turned into NFTs, automatically sharded, and sold on a bonding curve. The Minti platform allows users to mint their social media posts into NFTs and create a digital identity around content that can be monetized. This puts the power back in the hands of content creators and allows the underlying community to better support their favorite artists without middlemen taking the lion's share. Social media NFTs also enable fans to become more engaged with content posted by artists and allow artists to generate additional income themselves.

Small community:An exciting community is growing around the National Trust, enabling more people to get involved in unique ways. Permission-free platforms like PartyBid make it easy for backers to collectively bid for funds as a group and create a community around the work. Users can create a PartyBid, target specific auctions on Foundation or Zora, and pool funds to bid on NFTs. As these cohesive communities form around their work, more attention is drawn to the artist and more fans are able to directly engage and support them.

Personalization of NFTs:As metaverse communities expand in breadth and depth, individuals' digital representations will require more individuality and uniqueness. This can be achieved by assigning certain defining characteristics to your NFT, making your image in the metaverse different from others. Filta has entered this market with unique NFT filters that users can buy from their favorite artists and then share on social media.

We are still in the very early stages of NFT adoption, but there is no doubt thatExperimentation with these concepts will lead to new and exciting solutions, which will further develop the rapidly emerging landscape and allow the NFT ecosystem to thrive.

Disclaimer: Divergence Ventures LLC is an investor in Fractional, PleasrDAO, Minti and Filta.

Original link: https://medium.com/@bdharris/an-overview-of-the-nft-fractionalization-landscape-83487874926b