On September 10th, Centrifuge joined hands with Odaily and PolkaWorld to hold "Interstellar Cruise - Explore the new Polkadot DeFi paradigm with Centrifuge, and the Altair Parachain Auction Conference", sharing and discussing the behind-the-scenes of the Kusama auction from the perspective of bidding first-line project parties Stories to explore new opportunities for Polkadot ecology. (Click to enter the live room/watch the video replay.)

image description

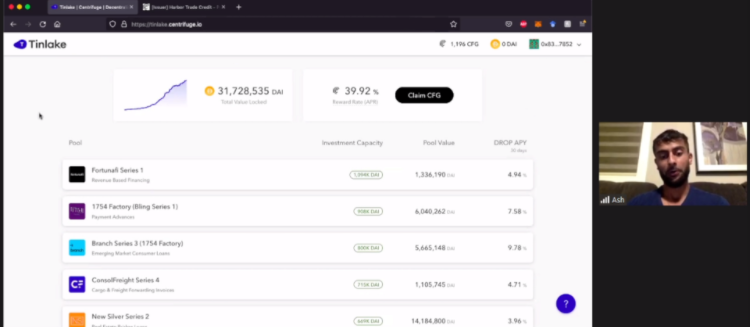

Ash demonstrated Tinlake products while explaining

The following is the full text of the speech, edited by Odaily, enjoy~

Ash: Hello everyone, I am Ash Judge of Centrifuge. Today I would like to introduce Tinlake, a component of Centrifuge, which people can use to finance real assets on DeFi.

It can be seen here that 11 capital pools have been launched so far, as well as various industries, including some companies in the real estate industry and the transportation industry. It can be seen that staking DAI in each fund pool can earn corresponding rewards.

On the right is 39.9%, which is the current rate of return, how is this calculated? It is calculated based on the token price and rate of return. It is a dynamically updated number. On the right is the number of all tokens on Tinlake, which is currently more than 31 million. The Centrifuge project has a vision to reach the number of 100 million tokens by the end of the year.

We can click into a fund pool, see its detailed information, and invest on this page. As long as you do KYC and connect to an Ethereum wallet such as MetaMask, you can pledge. After connecting the cryptocurrency wallet, you can see the balance of DAI and CFG tokens you currently hold in the upper right corner of this page.

After clicking on the CFG logo, you can see the status of CFG rewards, including its daily rate of return, the existing rate of return, including the entire rate of return of CFG. Click on the page of a fund pool, and you can see the project status of this fund pool. For example, here, you can see its asset type, maturity period, and rate of return, including the total agent pledged in this fund pool. In addition, you can also see that this fund pool is directly integrated with MakerDAO. Below you can see further information about this project, including its overall overview. There is a "forum" here, and you can directly communicate with the project initiator by clicking on it.

Each fund pool is divided into two levels, namely DROP and TIN. The risk of DROP is low and relatively stable, but the return is relatively low; the risk of funds in TIN is higher, and of course the return will be higher. It can be seen that there is a TIN buffer quantity of 25.26% in the middle, what does this mean? The risks in this fund pool are first borne by TIN. Even if 25.26% of the debt in this fund pool has not been repaid by the asset originator, these losses are borne by TIN, not by the funds in DROP.

In the column of Asset assets, you can see that each loan initiated so far has been certified by NFT assets. Arranged according to the date, you can also see information such as the maturity period and total amount of the loan.

Everyone is welcome to actively pledge DAI to Tinlake, which can obtain considerable income, and it is guaranteed by real assets, which can resist some fluctuations in the cryptocurrency field.

If you have any questions, please ask them.

Moderator: Next is the question-and-answer session. We collected 5 questions in advance and randomly selected 3 questions in the comment area.

Q1. We all know that Centrifuge is beneficial and transparent. I would like to ask why you choose Polkadot and why you choose to become a Polkadot parachain? Thank you for your answer.

Ash: The main starting point is that there are so many verifiers on Polkadot, and the purpose of Centrifuge is to take advantage of the security feature of Polkadot.

Q2. Among the five projects that have already connected to the parachain, what cross-project interactive gameplay is there, and what kind of composability can be realized in the Kusama ecology?

Ash: Our Altair network is bidding for Kusama's parachain slot. Once the auction is successful, an application similar to Tinlake will also be launched on the Altair chain. Other parachain projects, such as Karura, can also use this protocol for their stablecoins.

Q3. What do you think of the current DeFi liquidity mining model, and what are the characteristics of our mechanism? Recently, the NFT field has developed very rapidly. Does Centrifuge have any plans to enter the NFT field?

Ash: First of all, the current DeFi liquidity mining projects still have high risks. Some Blockchains have not been audited because they are associated with the cryptocurrency market. In this regard, the real-world assets that Tinlake is concerned about do not have any risks in this regard, and the locked-up volume of Centrifuge has been continuously and steadily rising.

The second question about NFT, Centrifuge is already in the NFT field, because the asset certificates in it need to be turned into NFT and put on the chain. As for the development of NFT in the future, there may be a direction, and NFT collections such as Cryptopunks will also be used as collateral to obtain liquidity.

Q4. What is the most likely point of Centrifuge to become the core competitiveness in the future? What is the future direction of project development? What area will you focus on?

Ash: Centrifuge is the first project to connect real-world assets with the DeFi field. The project started in 2017, and Tinlake has been in operation for about a year. So far, there has been no loan outstanding. As for the future direction, we will still focus on real-world assets and increase the amount of real-world assets on the chain. As mentioned earlier, we hope to reach 100 million DAI lock-ups by the end of the year.

Q5. What mechanism will the Altair parachain auction use to attract investors, and what factors will enable later investors to actively join in? I believe this is a long-term project, how will we further promote the development of the ecology?

Ash: We will provide some rewards for crowdlending, such as participating in the pledge winning bid, rewards will be given at the ratio of 400AIR:1KSM, and some early bird rewards will also be provided. Regarding the factors in the later stage, first of all, Altair can allow some assets with higher risks than those on Tinlake to go online, which can greatly expand the boundaries of asset types. In addition, it can launch some more experimental functions, and then wait for it to mature slowly After that, go to the main chain.

Q6. The goal of Centrifuge is to introduce real-world assets into the blockchain. In the process of practice, has Centrifuge encountered any difficulties? Can you introduce them?

Ash: There is a problem, not all assets are suitable for putting on Tinlake, there are some asset return types that are not suitable for putting on Tinlake, its project mechanism is not good, so this is why there is an Altair now, on Altair These new asset classes can be launched, and assets with higher risks can also be launched.

Q7. In what aspect is the importance of the Chinese market to Polkadot DeFi reflected? Is there any targeted marketing and promotion plan for the Chinese market?

Ash: The Chinese market is indeed very important to Centrifuge. Compared with large companies, it is difficult for small and medium-sized enterprises to obtain financing. Therefore, Centrifuge will further strengthen its support for financing methods for small and medium-sized enterprises.

Q8. Is there any way to introduce real-world credit into the chain, so that lenders can be protected by law?

Ash: For example, if a loan fails to be repaid in time, the NFT assets will be taken out as collateral to repay the debt. These are all operated through a legal entity called a "special purpose carrier", and legal rights can be obtained effectively. ground protection.