How much can an electronic picture sell at most?

The answer is $69.3 million. Digital artist Beeple auctioned such a picture on Christie's not long ago: This picture called "everyday: the first 5000 days" (everyday: the first 5000 days) was created by Beeple over the past thirteen years A collage of everyday paintings.

After being made into an NFT, the auction of this picture started at $100, and was sold at a price of 700,000 times. It's hard to imagine that before getting on the NFT express, Beeple was just an unknown painter who worked hard, and his works could only sell for a few hundred dollars at most, but now, the price of the painting "Every Day" is basically auctioned by living artists price third.

Behind this 40-year-old American painter's overnight wealth and freedom, NFT (Non-Fungible Token, non-homogeneous token) is actually not a new term, but it often takes some imagination to understand.

The value of a hundred-dollar bill is only one hundred yuan, but if Kobe's signature is added on it, the value will exceed 100, and it is incalculable. If the original Bitcoin, etc. (FT) represents a form of currency like this hundred-dollar bill, then NFT represents a unique asset that cannot be split.

This Christie's auction just caused a splash in the art circle, and the blessing of celebrity effect is still accelerating NFT out of the circle.

On one side are Ethereum fanatics practicing their faith. Not long ago, Twitter founder Jack Dorsey auctioned his first tweet as an NFT, and the final transaction price was 2.9 million U.S. dollars; "Currency leader" Musk and his girlfriend even sold each other for nearly 20 minutes. At a price of 6 million US dollars, the song in the form of NFT was auctioned.

On the other hand, basketball star Curry, film star Xu Jinglei and other celebrities have also become interested in collecting NFT avatars, and they have replaced avatars at high prices on ins——Curry’s latest avatar, a mosaic color block The monkey style cost 200,000 US dollars.

text

image description

secondary title

$200,000 to buy an ID

Not everyone can understand the fun of spending hundreds of thousands of dollars to buy an NFT avatar—although all NFT works relying on blockchain technology are traceable, but digital ownership in the virtual world has no way to match reality Ownership of the world is equated.

For example, although the first Weibo of the founder of Twitter belongs to the person who is willing to spend a lot of money to buy it, other people can still forward/comment/like this tweet;

The mosaic color block INS avatar that Curry bought with a lot of money can also be copied, pasted, or even used by everyone on the Internet. It seems that the people who bought these works can only prove that they are the real owners of this work in the Ethereum environment.

But in the eyes of NFT enthusiasts, this split does not matter. A person in the currency circle analyzed to 36 Krypton that the currency circle has already been graded, and a few people who entered the industry early have made a lot of money. For these people, NFT avatars are a status symbol. Make it look rich and fun."

The reason why this kind of showing off is established is that although NFT has opened up cognition, it is not a popular game that everyone can play on the poker table.

At present, the largest NFT platform is "OpenSea". According to the rules, buyers need to pay 2.5% of the transaction amount to the platform as a handling fee. Every transaction is a burning of ETH. For some people in the currency circle who are not very well-off, especially after experiencing the flash crash in May, the trading rules of the NFT platform are equivalent to setting an invisible entry threshold for many people.

"Generally, people who have money and leisure can afford it," another person in the currency circle said bluntly.

Whether it's changing to an NFT avatar or buying a digital artwork, how to maintain this "noble" identity label largely depends on the collective consensus in the small circle. The aforementioned person told 36 Krypton that the general default rule is that if someone uses an NFT avatar that is not their own, everyone will think it is a very shameful thing.

Although this seems to have a sense of self-deception and absurdity, if you look at it from the perspective of collections, it is not incomprehensible. It is not uncommon for the behavior of collecting antiques/calligraphy and paintings in real life to be mapped to the virtual world. To a large extent, people in the currency circle who collect NFT also have the consideration of investment appreciation.

Players who started with NFT in the early days have already created wealth stories one by one without any effort.

image description

CryptoPunks pictures from the Internet

These avatars may not seem to conform to the mainstream aesthetics, and even have a strong subcultural atmosphere.

text

secondary title

A game of drumming and passing flowers

Back to the story of artist Beeple.

It is reported that the buyer of the work "Every Day" is not a collector, but a senior player in the currency circle.

This buyer, who is well versed in market operation skills, has quickly released the token named "B20" a few months before the auction, under the slogan "making art collection more democratic". This project and art There is a strong connection with the collection of works, and before that, he spent millions of dollars to buy many works of Beeple.

After winning the bid, the price of these 10 million tokens soared from $0.36 to a peak of $28. And this behind-the-scenes player, through this method of related transactions, not only made a gimmick in this auction, but also made a lot of money after deducting the fees paid for the auction.

Interestingly, in this auction, Sun Yuchen, who is also good at hype, also participated in it, and was the second-ranked buyer.

Stimulated by star power and staggering wealth stories, more and more people are attracted to the poker table. Various data point out that the number of NFT sellers and buyers continues to expand.

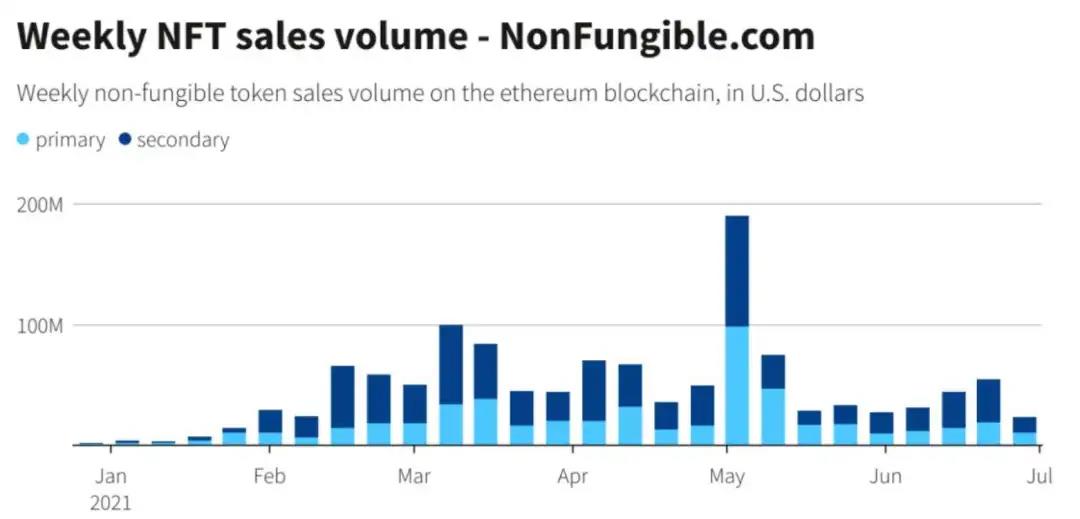

image description

The 2021 NFT weekly trading volume change data comes from NonFungible

Some people are still watching, and some people can't wait to leave.

Beeple himself, a vested interest, once bluntly said, "The bubble in the NFT market is too big", so after the auction, he quickly exchanged the digital currency he obtained from the transaction into real money, and it was safe.

A netizen who lost money was straightforward on Twitter-"NFT doesn't even follow the basic 28th rule, 1% makes money, and 99% loses money."

However, the heat wave continues. Data shows that the sales of major NFT trading platforms such as "Rarible" and "Opensea" increased by 50 to 100 times in the second quarter of this year. Among them, the cumulative sales of Opensea have exceeded 100 million US dollars.

The steep upward growth curve is also stirring up capital influx. One aspect is enough to prove how fierce the fire of NFT is: even these intermediate trading platforms are crazily collecting money for financing. Since this year, major NFT platforms have rapidly completed the A-round financing of more than tens of millions of dollars:

In March, OpenSea and SuperRare successively announced the completion of Series A financing of US$23 million and US$9 million;

secondary title

Metaverse, the correct way to open NFT

The absurd hype and stories of getting rich without the shell of NFT, in fact, the significance of NFT is obvious to all.

Digital art is one of the fastest applications of NFT. With the help of the NFT platform, artists can directly link audiences by monetizing their works and find richer monetization methods. In addition, digital art is highly reproducible, and in the way of NFT, the concept of "authenticity" is shattered, because all products are unique, thus reducing the trouble of copyright issues.

Gamers may be the group that can best adapt to the NFT model. Axie Infinity, a chain game project developed by Vietnamese game developer Sky Mavi, has a daily income of 1.119 million US dollars. Few people know that the average daily income of King of Glory is only 840,000 US dollars. This NFT game has quietly become a global player. The most profitable game.

It's not just what's in front of you. With the resurgence of the "metaverse" concept, NFT applications are gradually moving towards a larger system.

As a continuation of web2.0, Metaverse builds a virtual world that mirrors reality, hiding the next generation of social networking, online office, and e-commerce. Commonplace technologies such as artificial intelligence, 5G, and VR are just infrastructure. To truly mature and operate, commercial and economic activities need to be generated.

In the value system of the blockchain, NFT, as a non-homogeneous token, can represent all unique assets, collectibles, game equipment, digital artwork, etc. This may not be possible with fungible tokens (FT).

Based on NFT, users conduct transactions in the metaverse world and build their own ownership world, so that the metaverse can accelerate the accumulation of application scenarios, build communities, and develop transaction scale.

The origin of NFT originated from the concept of an "encrypted trading card" shared by engineer Hal Finney in 1993. His original idea was that these unique art made of abstract characters would be loved by cryptography enthusiasts, and would also become a topic of conversation among friends, arousing people's desire to collect, and then deriving more interesting new ways to play .

Now it seems that these ideas have been fulfilled, but it is a bit slow.

He himself, 16 years after he proposed the concept, did not actually get the world's first bitcoin transfer from Satoshi Nakamoto in 2009; it was not until 2017 that the appearance of "encrypted cats" triggered the first NFT Upsurge; In 2021, NFT will not be out of the circle, and it will be widely discussed.

Maybe some people still can't understand: why is NFT popular now? NFT collectibles are not very liquid, what is the point of holding these assets? NFT can be copied, why pay a high price for it?

Perhaps if it is placed in the open world of the Metaverse, everything will make sense.

The movie "Ready Player One" once made a beautiful prediction about the future world. In the world of Oasis, everyone has a free character. Here, classic characters of film and television games from different dimensions gather, and rich digital content and items can also be freely circulated. In this flashy virtual world, a loser in the real world can also become a superhero.

"Behind every dream, there is an energetic and adventurous person. They expect nothing but surprises."

What Hal Finney said may be the best commentary on the current NFT craze.