image description

(Provence Farm, Van Gogh)With the evolution of DeFi, encrypted derivatives trading will be the next important trend. Before Blue Fox Notes introduced the Perpetual protocol "Perpetual's Curie

picture

picture

image description

(Perpetual's trading volume in the past 24 hours at the time of writing, from the DuneAnalytics website)

In addition, the dYdX project currently has perpetual contracts and leveraged transactions. Its perpetual contracts are built on StarkWare. StarkWare is an L2 solution that is superior to L1 in terms of transaction speed and fees. This is also an important basis for the rapid increase in dYdX transaction volume.

secondary title

picture

image description

(Discount relationship between trader's wallet balance and transaction fees, dYdX website)Perpetual's Curie》。

secondary title

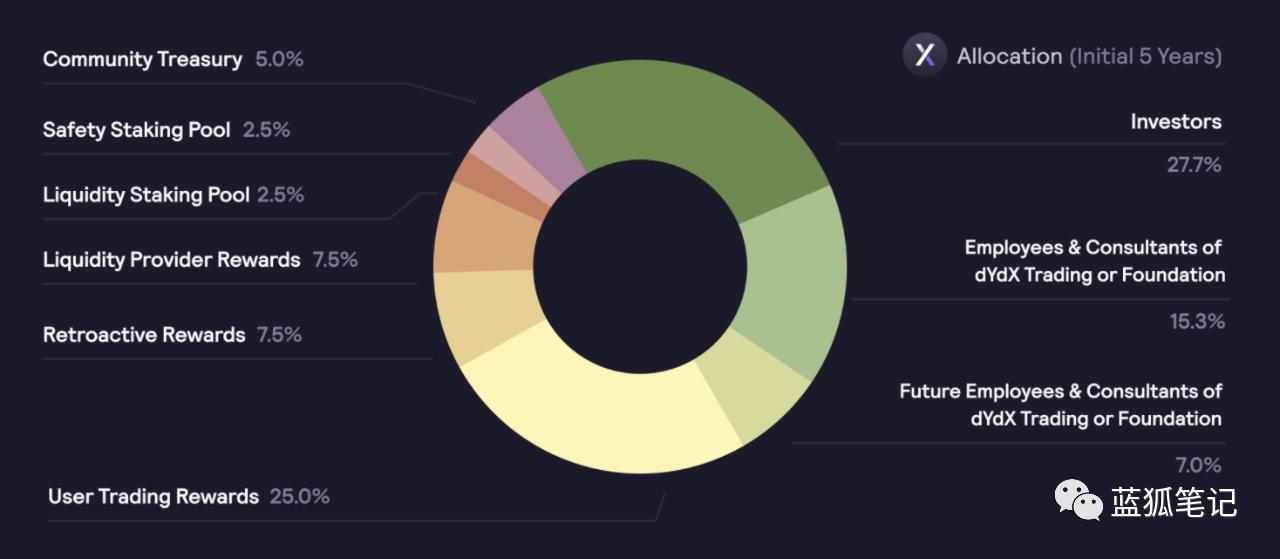

There are a total of 1 billion DYDX tokens, which will be released in 5 years. After that, there may be an increase of 2% per year, but the specific decision will be made by the community, which will happen after 5 years. In the five-year release ratio, liquidity provision and pledge will receive a total of 10% token rewards (2.5% pledge, 7.5% liquidity provision); community treasury 5%; backtracking reward 7.5%; transaction reward 25% %. The remaining 50% is allocated to investors and teams.

image description

picture

(The total circulation of DYDX at the time of writing, dYdX website)

secondary title

*DYDX lies in promoting its liquidity and trading network

The contribution of DYDX to its ecological development is that it promotes the development of its network through transaction rewards and liquidity staking rewards. This in itself is nothing new, and many DeFi projects had similar incentives before. DYDX token rewards will bring more users to trade and bring more people to provide liquidity. Better liquidity brings more traders. Some traders do it for rewards, others for a better trading experience, or both.

At present, dYdX incentives about 5 million DYDX per month, according to the current value of more than 60 million US dollars. Of course, there will be a certain balance between these. As more traders and liquidity providers enter, the proportion of rewards that can be divided will decrease, and the cost of obtaining rewards will increase. As the rate of return reaches a certain equilibrium, liquidity miners or traders may enter other platforms, such as Perpetual, etc., and eventually an equilibrium will be formed.