This article comes fromCryptonews, original author: Jarosław Adamowski

Odaily Translator |

![]()

Odaily Translator |

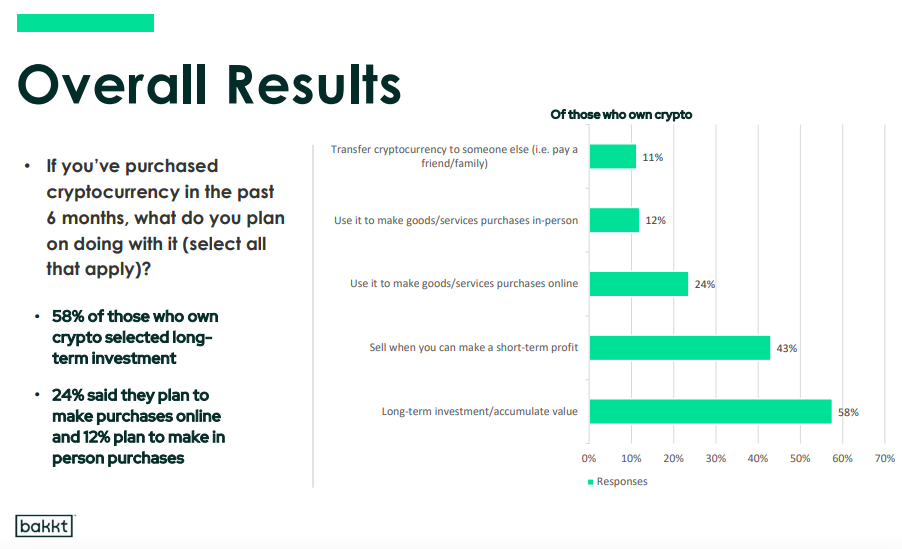

According to a recent survey commissioned by digital asset marketplace Bakkt, some 48% of U.S. consumers surveyed said they had already invested in crypto assets in the first half of 2021. Of those who have already bought cryptocurrencies, 58% see it as a long-term investment that could help reduce market volatility, while 43% plan to sell their cryptocurrencies for short-term profits.The platform's onlineAmerican Consumer Crypto Survey

Gather answers from over 2,000 US consumers in July 2021.

One of the questions in the survey was "If you have purchased cryptocurrency in the past 6 months, how do you intend to use it (select all that apply)?" 58% of them selected "long-term investment/accumulation of value".

The purchasing power of cryptocurrencies is important to 24% of respondents who said they plan to use cryptocurrencies for online purchases, while 12% said they plan to use cryptocurrencies for in-person purchases. About 11% of people intend to use cryptocurrency to send it to friends and family, the survey said.

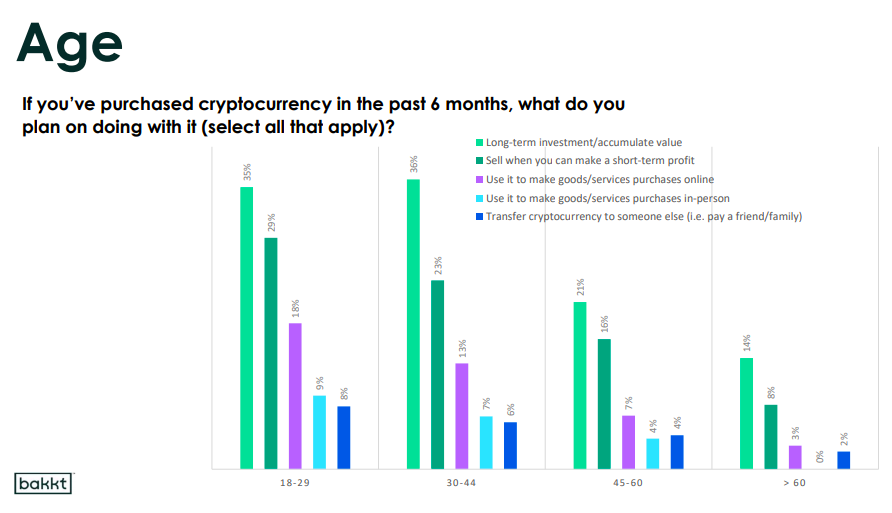

In addition, respondents of all age groups are more inclined to use their cryptocurrency holdings for "long-term investment/accumulation of value."

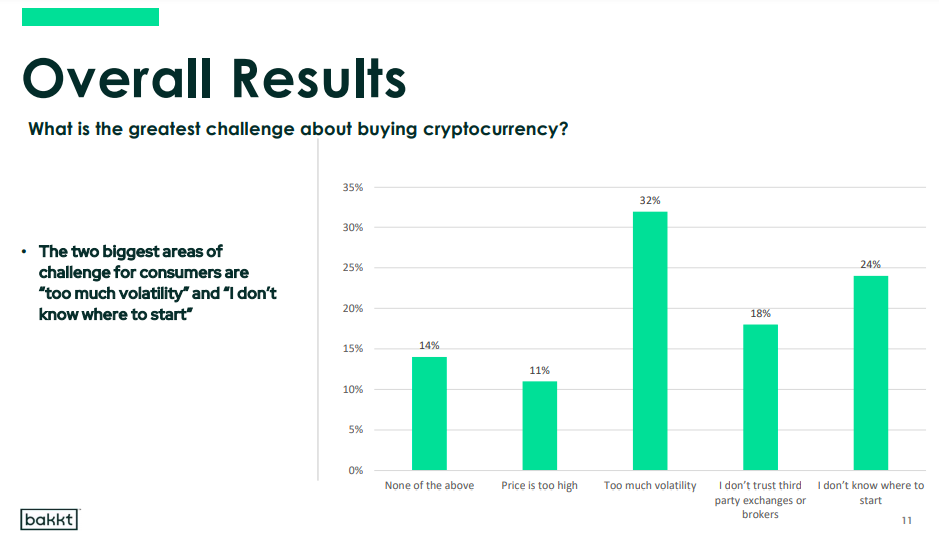

According to the survey results, 32% of respondents believe that "too much volatility" is the main obstacle to buying crypto assets, while 24% said they do not have the necessary knowledge to start investing in crypto assets.

Relatively few people (11%) claim that cryptocurrency prices are currently high, the smallest barrier found across all age groups, according to Bakkt.

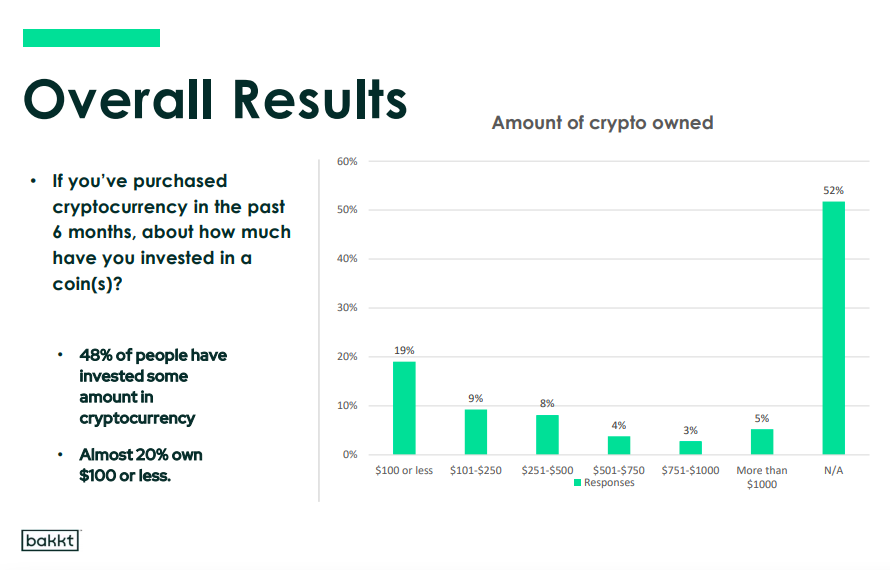

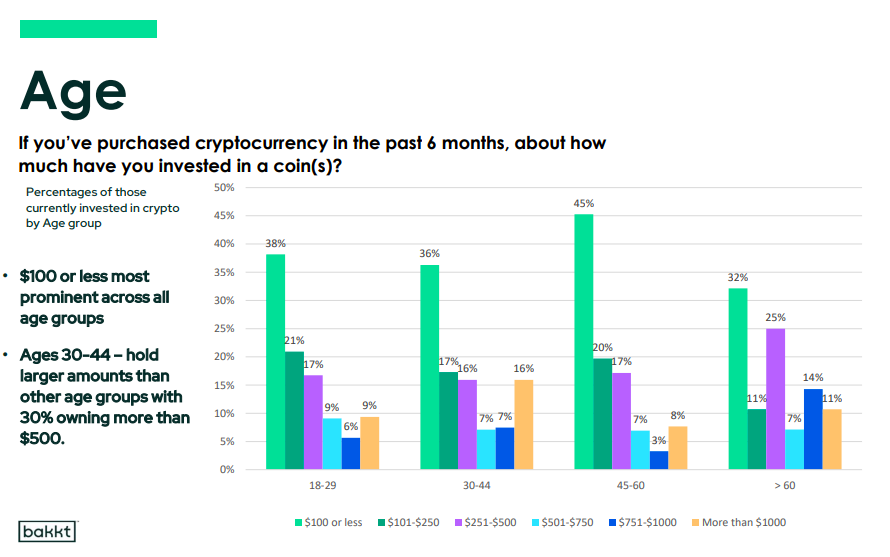

In the first half of the year, 52% of respondents did not purchase cryptocurrencies, and of the 48% who had, the largest group (19%) owned cryptocurrencies worth $100 or less. Only 5% own cryptocurrencies worth more than $1,000.

Looking at specific age groups, 30% of people aged 30-44 bought more than $500 in cryptocurrency, and 16% of them bought more than $1,000 in cryptocurrency.

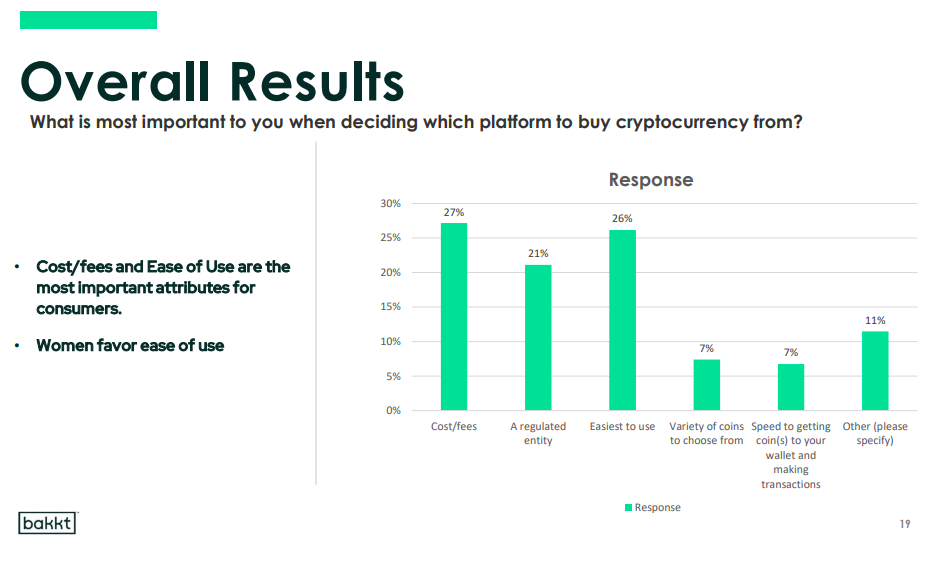

Cost and fees were the most important factors for 27% of respondents when deciding which platform to buy crypto assets from, while 26% said they wanted an easy-to-use platform.

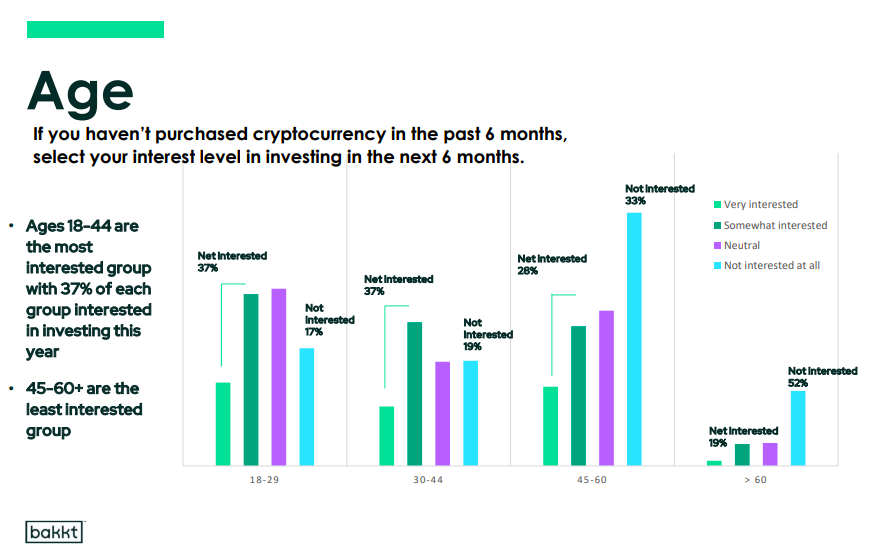

According to the survey, 37% of respondents aged 18-29 and 30-44 who have not purchased cryptocurrency in the past six months are "somewhat interested" or "very interested" in investing in this asset class, In the 45-60 age group, only 25% showed the same performance, and in the 60+ age group, only 19% showed the same performance.

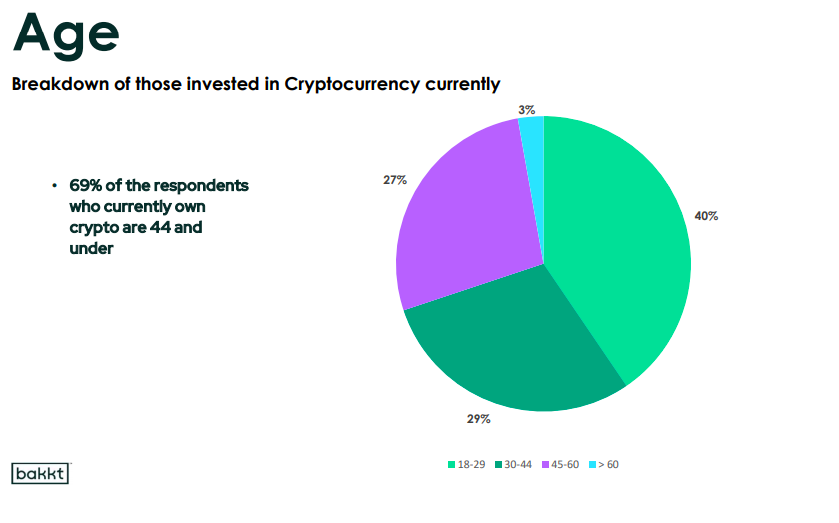

Looking at specific age groups, as many as 69% of respondents who own cryptocurrencies are aged 44 and under.