Original title: "A look at the recent status of CBDC in the world's major economies", by Chenglin Pua

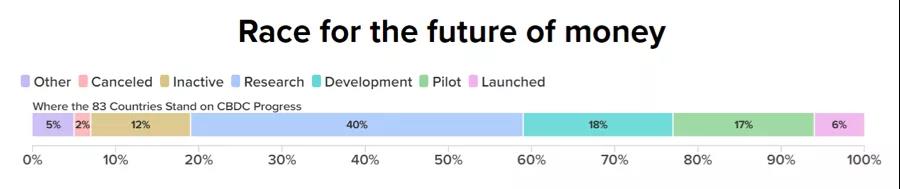

Since the second half of the year, central bank digital currencies (CBDC) in Venezuela, India and other countries have made significant progress.

A few days ago, the Bank for International Settlements (BIS), the International Monetary Fund (IMF) and the World Bank jointly called for global central banks to cooperate on CBDC. The BIS said it was fully committed to the development of a CBDC as a way to modernize finance and ensure that "big tech" does not control the currency. Benoit Coeure of the Bank for International Settlements warned that without a CBDC, digital currencies will increasingly be dominated by big tech companies, who can rely on their large social media user bases to do so. The BIS report "Central Bank Digital Currency and Cross-Border Payments" stated that only a few central banks have made decisions on issuing CBDC.

image description

image description

image description

image description

secondary title

Countries that have issued CBDCs

Bahamas

Bahamas

On October 20, 2020, the Bahamas became the first country in the world to officially launch a CBDC, a project called Project Sand Dollar. A total of 393,000 residents of the Bahamas started using Sand Dollar (1 Sand Dollar corresponds to one Bahamian dollar). Sand Dollar aims to drive greater financial inclusion across the more than 700 islands of the Bahamas. Chaozhen Chen, deputy manager of the Central Bank of the Bahamas, said the Sand Dollar will help underbanked and unbanked residents access digital payment infrastructure or banking infrastructure.

image description

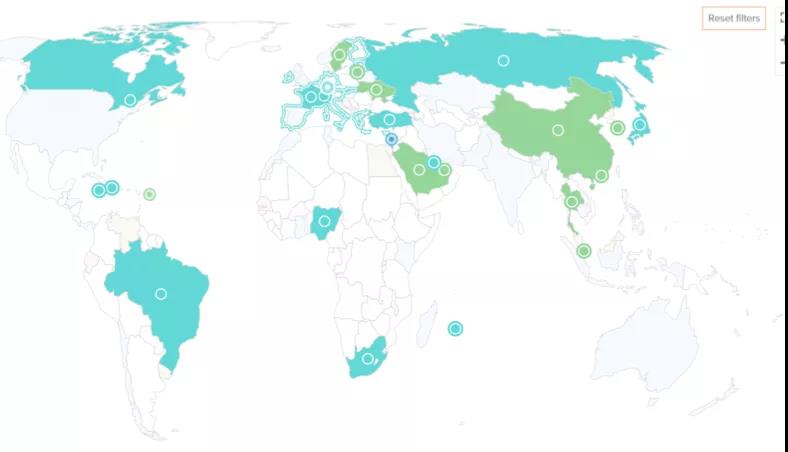

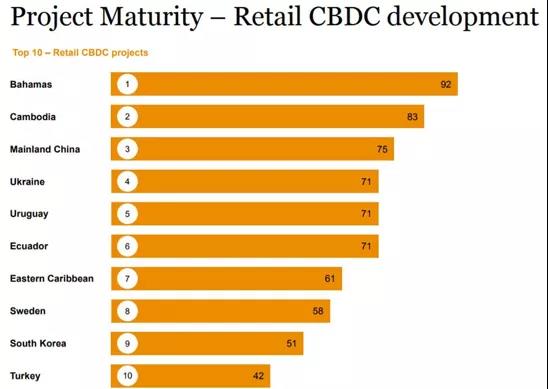

CBDCs are mature in various countries, source: PwC CBDC Global Index, a report by PwC

The Sand Dollar of the Bahamas leads the way in the CBDC space, according to a new report from PwC, the PwC CBDC Global Index. PwC used data from global central bank websites, news sites, the Atlantic Council and Google Trends, among others, to track the mainstream global reaction to CBDCs. Reports show Sand Dollar in the Bahamas is making world-leading progress.

Henri Arslanian, partner and global cryptocurrency leader at PwC, said: “All residents of the Bahamas can access the digital wallet through a mobile app or a physical payment card. Records such as income and expenditure information can be collected during day-to-day operations. support applications for small loans.” The report evaluates that Sand Dollar has a clear set of goals: to improve the speed, efficiency and security of payments; to reduce the cost of financial services and build inclusiveness across age and status; and other financial fraud. It can be seen that in addition to leading the world in launching CBDC, the Bahamas is also leading the world in the maturity of CBDC applications.

Antigua and Barbuda, Grenada, Saint Kitts and Nevis, Saint Lucia

In April 2021, the Eastern Caribbean Central Bank (ECCB) launched its central CBDC project, DCash. Established in October 1983, the ECCB is the financial authority for the following countries: Anguilla, Antigua and Barbuda, Commonwealth of Dominica, Grenada, Montserrat, St. Kitts and Nevis, St. Lucia and Saint Vincent and the Grenadines. DCash will cover only four of these countries: Antigua and Barbuda, Grenada, St. Kitts and Nevis, and St. Lucia. The public can now freely use the app in the above countries. "The future of money is digital, so let's make history together," said Eastern Caribbean Bank Governor Timothy NJ Antoine.

secondary title

Cambodia

Cambodia

India

India

Venezuela

Venezuela

The Central Bank of Venezuela announced on August 6, 2021 that it will launch a CBDC in October. Venezuelan President Nicolas Maduro first foreshadowed the idea of a CBDC back in February — an initiative he will issue as one of his government’s efforts to modernize and rebuild the economy. Maduro is no stranger to state-issued CBDCs, having launched the oil-pegged Petro coin in 2018 as a tool to circumvent U.S. sanctions. However, the official Petro coin white paper does not mention some theoretical basis (such as how to transfer and store funds, and how to ensure the security of funds). In addition, the development system of Petro currency has not been announced to the public. For this purpose, Venezuela developed the BioPago platform to support the circulation and use of Petro coins. But in practice, many merchants have complained about errors and payment failures in the platform marketplace. Additionally, many citizens complained that they were forced to wait in lines of up to six hours at stores that accepted Petro to spend their money. All of the above reasons eventually lead to the disappearance of the Petro currency developed in Venezuela.

Singapore

Singapore

Ubin is a CBDC jointly researched and developed by the Monetary Authority of Singapore (MAS), the Association of Banks in Singapore and a number of international financial institutions. It aims to study the application of distributed ledger technology in clearing and settlement transaction scenarios. Since the first internal test in November 2016, Ubin is currently undergoing a total of 6 stages of testing.

Canada

Canada

Japan

Japan

Europe

Europe

The research and development of CBDC by financial regulatory authorities in European countries is still in the stage of demonstration and small-scale experimentation. In 2020, the European Central Bank announced that it will make research on the digital euro a priority. It has successively set up a senior working team to research CBDC, develop a CBDC payment system that protects user privacy, and release the "European Chain" based on R3. Although the team was formed, its progress has been slow.

The Federal Reserve has two voices on CBDC but still hopes to play a leading role in setting standards

The United States had no interest in CBDC earlier, but in 2020, the Federal Reserve released some of the research results of the FooWire pilot project to evaluate the application potential of distributed ledger technology in the payment field. The outside world regards this as an important signal that the Federal Reserve is quietly deploying CBDC research and development.

On May 20, 2021, Federal Reserve Chairman Jerome Powell mentioned in a video speech that the Federal Reserve will release a research paper on the US CBDC this summer, and stated that "this paper will represent the beginning of a deliberate process." Powell said he hopes the Federal Reserve will play a leadership role in setting international standards for CBDC, which will be a complement to, not a substitute for, cash and the digital dollar. In addition, he criticized the large fluctuations in the value of cryptocurrencies such as Bitcoin, which is not a convenient payment method, and is relatively more supportive of stablecoins linked to legal tender.

However, Randal Quarles, vice chairman of the Federal Reserve's financial supervision, expressed his cautious attitude towards CBDC on June 28. He said, "I think the United States must set a high threshold for issuing CBDC." He pointed out that in addition to being a target for cyber attacks, CBDC also has a huge cost burden problem. In addition, Quarles also said, "I don't think foreign currencies or CBDC will threaten the US dollar's status as a global reserve currency or its role in international financial transactions." “The Fed’s CBDC could become an attractive target for cyberattacks. Ultimately, the Fed itself could become as much a retail bank to the public as a commercial bank.”

Quarles is a cautious faction of CBDC in the Federal Reserve. He believes that even if other central banks are issuing CBDC, it does not mean that the Federal Reserve should also issue it. He also has a negative attitude towards cryptocurrencies represented by Bitcoin, and believes that everyone's current interest in Bitcoin is mainly due to its novelty and anonymity. "Once law enforcement agencies forcibly break this anonymity, gold will still be If it is not strong, interest will disappear. Cryptocurrencies will almost certainly remain a risky speculative investment vehicle rather than a payment revolution.”

It can be seen that although the Federal Reserve has plans to implement CBDC, there are still two voices inside. One supports the issuance of CBDC, hoping to keep up with or even lead the times; the other side believes that the Federal Reserve does not need to follow the pace of the times to issue CBDC. Specifically, whether the Fed will actually issue a CBDC depends on the future speeches and actions of the Fed.

Chinese digital yuan

The digital renminbi is a CBDC issued by the People's Bank of China, and designated operating agencies participate in the operation and exchange it with the public. The digital renminbi exists in electronic form, and its value is equivalent to that of renminbi banknotes and coins. The digital renminbi is currently in the pilot testing stage in 11 provinces and cities, with more than 1.32 million pilot scenarios, covering wholesale and retail, catering, cultural tourism, education and medical care, public transportation, government payment, tax collection, subsidy distribution and other fields.

The idea of a digital yuan in China predates 2014. At that time, under the leadership of Zhou Xiaochuan, the People's Bank of China established the Digital Currency Research Institute of the People's Bank of China and a dedicated CBDC research team, and began to conduct special research on issues such as the CBDC issuance framework, key technologies, issuance and circulation environment, and relevant international experience. At the end of 2017, with the approval of the State Council, the People's Bank of China organized some large commercial banks and relevant institutions to jointly carry out the research and development of the digital RMB system (DC/EP).

On August 14, 2020, the Ministry of Commerce of the People's Republic of China issued the "Overall Plan for Comprehensively Deepening the Pilot Program of Innovation and Development of Trade in Services", proposing that digital services should be carried out in Beijing-Tianjin-Hebei, Yangtze River Delta, Guangdong-Hong Kong-Macao Greater Bay Area and qualified pilot areas in the central and western regions. RMB pilot. First, Shenzhen, Chengdu, Suzhou, Xiongan New District and other places and relevant departments of the future Winter Olympics scene will assist in the promotion, and then expand to other regions as appropriate.

Digital renminbi has also begun to appear in daily life. For example, on January 5, 2021, Shanghai Tongren Hospital piloted the use of digital renminbi, allowing people to use digital renminbi to pay for medical treatment. On February 24, 2021, Chengdu City launched the "Digital RMB Red Envelopes to Welcome the New Year" campaign, distributing digital RMB consumption red envelopes totaling 40 million yuan to individuals. The number of red envelopes is about 200,000. Consumption. On June 29, Suzhou Rail Transit Line 5 opened, and citizens can use digital renminbi to buy tickets and ride the train. Starting from June 30, Beijing Rail Transit will launch digital renminbi payment channels on the entire road network.

secondary title

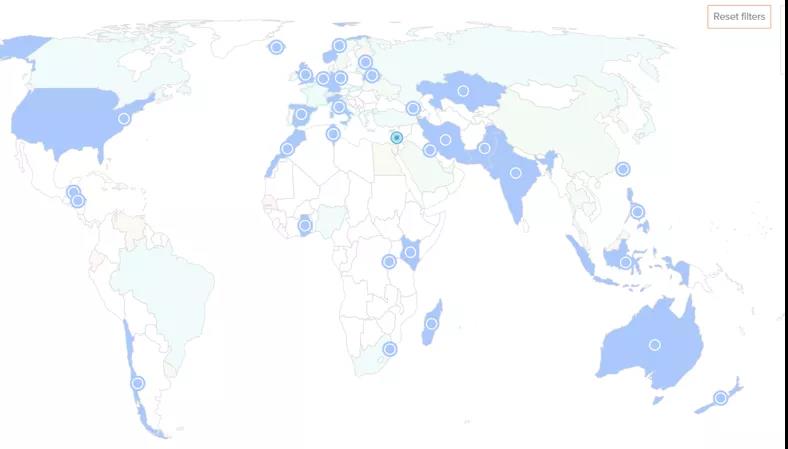

Emerging market countries develop CBDC faster than developed countries

image description

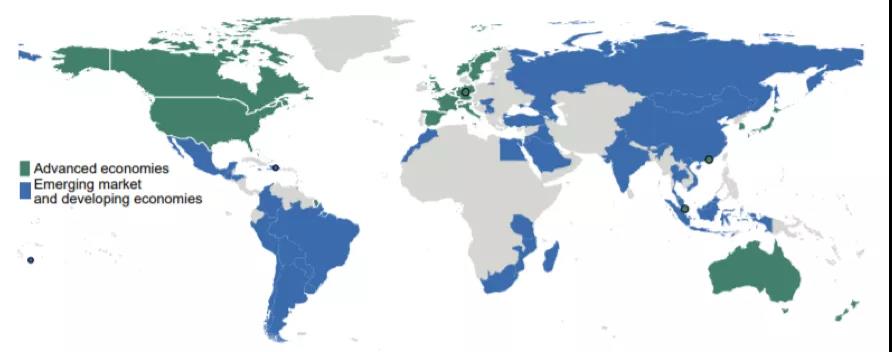

BIS defines emerging economies and developed economies, source: BIS report "Ready, steady, go? – Results of the third BIS survey on central bank digital currency"

The report mentioned that the pace of CBDC research and development in emerging market countries is faster than that in developed countries. The main reason is that many emerging market countries urgently need to launch central bank CBDCs to effectively solve the restrictions on the circulation of domestic banknotes and alleviate the abnormal fluctuations of their currency exchange rates. Improve currency investment tracking capabilities and other issues.

In addition, European and American countries have a long currency decision-making path and relatively decentralized decision-making power. For example, the financial regulatory authorities of European and American countries are still discussing the financial disintermediation that CBDC may cause (meaning that the supply of funds bypasses commercial banks and other media systems and is directly sent to the demand side and In the hands of financiers, resulting in extracorporeal circulation of funds), run-on risks and other issues have also caused them to take longer to reach a consensus on CBDC research and mechanism design.