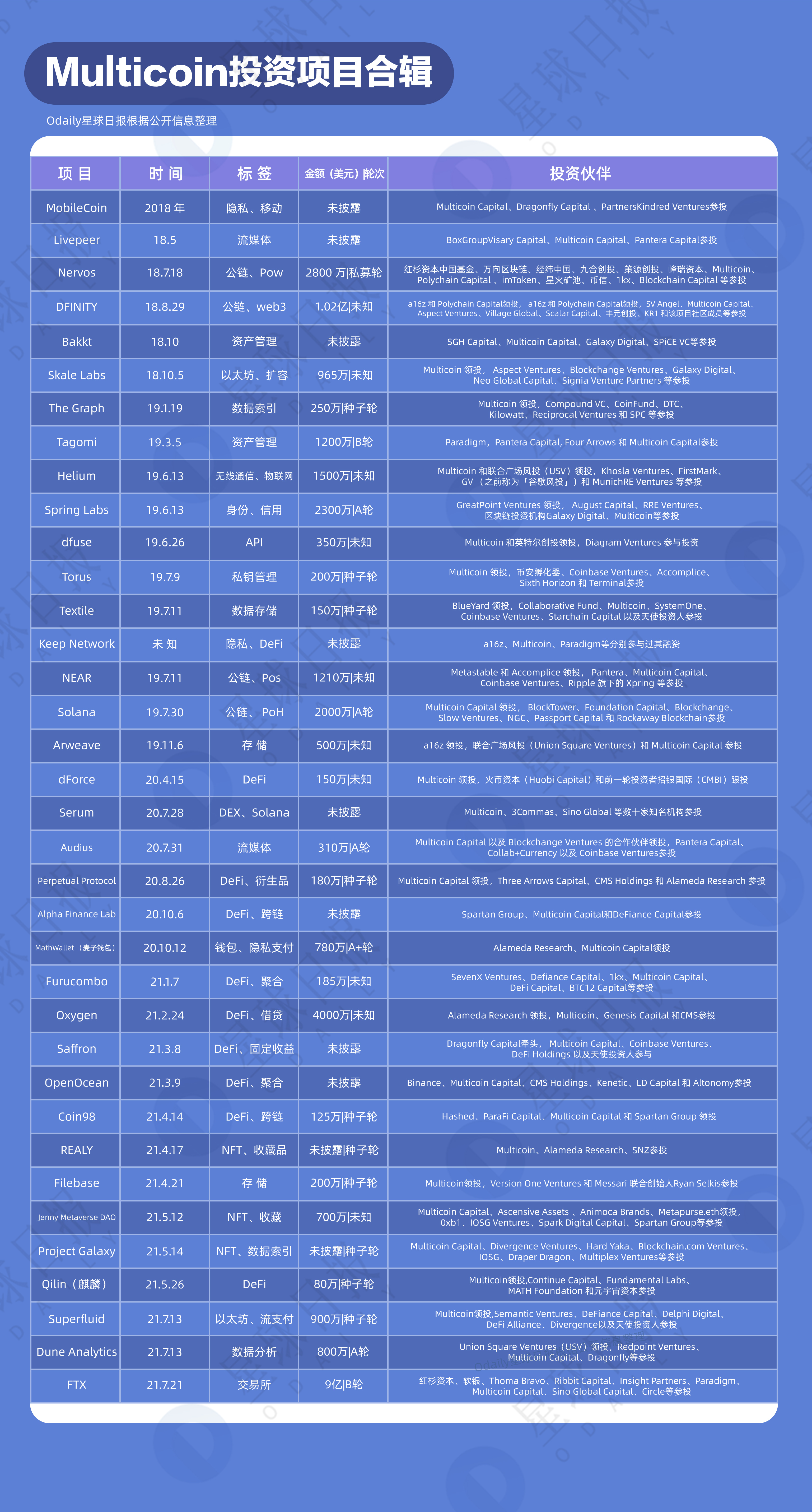

From the sharp drop on May 19 to the recovery at the end of July, the encryption market has undergone another round of baptism of time. In the process of sorting out and reviewing the investment and financing of the primary market every week, we feel that no matter what stage of the long or short cycle it is in, top investment institutions have not stopped. As one of the "leaders", Multicoin Capital (hereinafter referred to as Multicoin) mainly participated in 12 projects such as FTX and Oxygen in the first half of the year.

Started in 2017, Multicoin initially made a name for itself with sharp insights and insightful writing. In May 2019, founder Kyle wrote"On the Three Core Investment Themes in the Multi-Trillion Dollar Cryptocurrency Market", Point out the three investment themes of Multicoin - "Open Finance", "Web3" and "Borderless Currency". Around these three themes, Kyle updates an edition every year《Web3stack, he also released in March 19andLayer 1andLayer 2Value Capture ofmarket《DeFimarket3big risk with8a solution;Recently, on the track that Multicoin is more concerned about, the managing partner Tushar Jain"Decentralized Derivatives Track Competition and Tradeoffs"discussed in depth.

Of course, these papers and blogs only represent Multicoin’s research capabilities at most. Accurate judgments on the industry, repeated bets on high-quality projects and excellent actual combat results have verified Multicoin’s various theories and helped it become a top encryption investment institution. .

secondary title

Multicoin has these application areas in focus

Mable said that compared with 2018-19, the overall investment style in the past year has gradually developed from more emphasis on infrastructure and middleware to more application layers.

It can be seen from the investment map that Multicoin’s early investment is mainly concentrated on the infrastructure level, while the frequent shots on the application layer such as DeFi projects began last year. In this regard, Mable said,Multicoin for application layer protocol(Not just DeFi, but also in other fields), on the one hand,Tend to wait until its market and product fit before making a targeted layout; On the other hand, the early (autumn 2018) batch of Silicon Valley DeFi, and even a few earlier ones, had some design limitations. For example, Ethlend's previous direction was completely different from what it is now. Since the end of 2019, Multicoin has placed more bets on AAVE.

The "DeFi Stack: 2020 Edition" published by Multicoin last year also gave a good overview of the cognition and layout of the DeFi protocol in the application layer in the past two years.In the DeFi sector, Multicoin is optimistic about the decentralized perpetual contract in the derivatives trackSecondly,

Secondly,On-chain data governance is also the direction that Multicoin continues to focus on. From the Graph at the end of 2018 to Dune Analytics in 2020 and then to Project Galaxy in 2021, they all continued the exploration and layout of this area. (We are also) thinking more about the key role that NFT as a "metadata container" can play in the application of data on the chain.

Cross-chain infrastructureimplementation, Ethereum infrastructure, developer and community governance tools and algorithmic stablecoins, etc.secondary title

Post-investment operation service is a highlight of Multicoin

For projects that have been supported in the early stage, Multicoin will continue to provide in-depth assistance in terms of token design, product mechanism design, and market public relations. Mable said that the post-investment operation service is a job that Multicoin spends a lot of time on, especiallyIn the direction of market public relations, these tasks are crucial to the operation of the project at critical points.Its public relations partners are deeply involved in the planning and operation of many important promotional activities of flagship investment targets.

secondary title

Team members have different investment styles, and I value these characteristics of the team more

When talking about team members and their investment style, Mable said that Multicoin's team style has always been lean and cautious in expansion. Today, the investment team has 8 people, and the financial, investor relations, legal, and public relations teams have 7 people, including six partners. We are located in Austin, New York, Shanghai, Hangzhou and other places.

Every member of the investment team will participate in research and writing (public research reports and opinions), and readers may find that even in public, there are quite different opinions among team members. But the team seeks common ground while reserving differences, which is reflected in the fact that everyone who is also optimistic about a project will have different reasons. A common feature isEveryone at Multicoin has fairly distinct opinions on certain things.In investment decision-making, even if there are great differences in the discussion process, once the investment is decided to seek common ground while reserving differences, the whole team will support it. This is mainly because there is a part of the team work that frames the investment thesis and is strictly oriented towards it.

Since joining Multicoin, some of the investments Mable has led (including primary and secondary) include dForce, Alpha Finance, SushiSwap, Project Galaxy, Math Wallet, Coin98, REALY, JennyDAO, Burnt Finance, Beta Finance, Community Gaming, Tibles, etc. Among these projects,Some are partial to creator ecology and the infrastructure of the “Metaverse”, and some are more closely integrated with the Asian DeFi community.

Regarding personal investment logic, Mable believes: "My investment logic is also constantly iterating. One of my great insights over the past few years is that even in the open source world where everything can be forked,Whether there is basic respect for technology is decisive for whether a project can become a top project.”

Product ideas are clearIt is also a fundamental quality to possess. also,The founder's market communication ability and community operation abilityIt is also very important. If the product idea is good enough and the technical implementation is strong enough, it doesn’t matter that the token design is relatively vague in the early stage. This is what Multicoin is willing to work hard to complete with the team. third point,The founding team needs to clearly know their trade-offs in product design:secondary title

NFT can be abstracted as a "metadata container"

In terms of discussion on the specific track, we noticed that in May Multicoin raised a US$100 million second-stage venture capital fund, and one of the main investment directions is NFT and digital collectibles. Regarding the creator economy and NFT, Mable put forward some personal opinions: "For some tracks that are not in our team's ability, I will give up strategically more resolutely, orDevelop a systematic theme for targeted investing.”

Mable cites the example of JennyDAO here: When positioning the investment in JennyDAO and Unicly, the former can obtain "leveraged" exposure to NFT rare collectibles, while Unicly's platform currency UNIC (via uJENNY liquidity mining Obtained) can obtain the systematic exposure to the demand of "NFT unlocking liquidity".

In Mable's view, NFT can be regarded as a "metadata container", not limited to collectibles or game props.For NFT, Mable is more concerned about how to use this container to help more information on the chain find value.

In addition, when talking about web3, Mable believes that the concepts in the encrypted world-smart contract platform, middleware, and application layer (DeFi, creator economy) are all web3.The concept of web3 is data sovereignty.

In the conversation with Mable, we can perceive that for the encryption investment in the second half of the year, challenges and opportunities coexist. On the one hand, institutions such as Multicoin are becoming more and more mature in terms of investment strategies and scale systems. With the support of capital, many large-scale adoptions of blockchain are close at hand; on the other hand, due to the "de-bubble" policy Under the pressure of regulation and macroeconomic conditions, the real "blowout" cannot come immediately.