For a long time, the U.S. authorities have been reluctant to allow themselves to participate too much in the complex encryption world, and the supervision is not too great. But the market has developed to a stage where it can no longer be ignored, so the United States is also preparing to issue a substantial regulatory framework for the encryption market.

While some countries have already started working on regulation, such as South Korea, most are just starting to work on it. Many major countries will follow the example of the United States, so the upcoming regulations may have a significant impact on the markets of various countries.

In the United States, the exact nature of cryptocurrencies is unclear. While the U.S. is unlikely to enforce any draconian laws, it is unlikely that it will leave the crypto market completely unfettered. Key figures in the administration have repeatedly voiced the importance of investor protection, including SEC Chairman Gary Gensler. At a hearing in March, Gensler said: "Bitcoin and other cryptocurrencies have brought new ideas to payments and financial inclusion. If confirmed as SEC chairman, I will work with other commissioners to promote new innovations. At the same time, it is also about ensuring that the protection of investors is at the core.” He will have ample opportunity to develop regulations specific to the cryptocurrency industry, or to determine the specific implementation of existing regulations.

secondary title

Two Latest Cryptocurrency Tax Law Proposals May Exempt Some Taxes

1. For the taxation of the US infrastructure bill in the field of encryption

The U.S. Congress is seeking more than $1 trillion in funding for the Infrastructure Act, some of which (valued at $28 billion) will be provided through taxes on decentralized market participants. This means that Congress will impose new tax requirements on those classified as "Broker Brokers."

"The administration believes this rule will enhance tax compliance in this nascent financial sector and ensure that high-income taxpayers pay what they owe as required by law," said White House deputy press secretary Andrew Bates. Having said that, extensive third-party reporting could deal a major blow to Bitcoin’s decentralization, without which Bitcoin has little value.

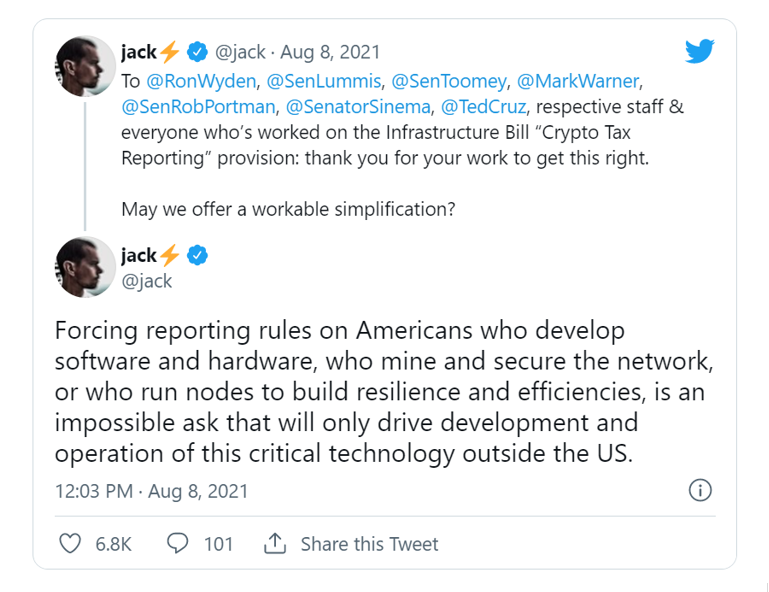

Bitcoin community supporters Senators Pat Toomey, Rob Wyden and Cynthia Lummis proposed an amendment that would limit the definition of a “broker” and exempt miners, validators and software developers from the term. In other words, they want to exclude anything that sacrifices the value of Bitcoin's decentralization.

Unfortunately for them, the Senate closed its debate on the topic by a vote of 68 to 29, with a final vote on the bill to wait until later.

However, the bill's definition of "Broker broker" is ambiguous. There will be further guidance from the taxation department when it comes to specific taxation.

2.Forked coins may not be taxed

Forks are everywhere, which raises some interesting questions in terms of taxation as these new coins flood the market.

Recently, a Minnesota congressman introduced a “Tax Haven for Fork Taxpayers” bill in the House of Representatives.

For cryptocurrency users in general, this seems to bring some good news. At the very least this could provide a moratorium or tax loophole in difficult times. In the current version, crypto tax laws require users who receive additional inflows of funds as a result of a fork to declare such income. Therefore, active taxation must be done in the year in which these token forks occur.

If the bill passes the House, it could provide holders of forked assets with a strong incentive to move to tax havens and shift more attention to such tokens.

secondary title

Background to the debate: Current crypto tax policy vs. the stance of the industry’s biggest players

Current U.S. crypto taxes are based on a 2014 IRS ruling that all crypto assets are taxed like capital assets. That makes them closer to stocks or bonds than to fiat currencies like the dollar or euro.

The decision has had considerable repercussions for crypto enthusiasts and holders, subjecting them to complex tax filing requirements. As long as the big capital is sold for a profit, it will be taxed. Individuals also have taxation requirements. Whenever a person uses cryptocurrency assets to purchase goods or services, and the value of the corresponding cryptocurrency exceeds the amount originally paid, his next expenditure will generate capital gains tax, which is mainly for value and income. Increase.

For a more concrete example, imagine some crypto enthusiast buying $20 worth of Bitcoin and holding on to it when its value rises to $200. If bitcoins were used to purchase certain products or services worth $200, the buyer would pay capital gains tax on the $180 profit earned during that time. The IRS doesn’t care whether bitcoins are sold or spent, it cares about taxing capital gains.

The decision by the IRS to tax cryptocurrencies as capital assets may be based on the belief that it is an asset rather than a viable currency. To be honest, most people just see bitcoin as an investment and hope it appreciates; on the other hand, the IRS is just looking for a source of income for the country through taxes. Therefore, its decision to view cryptocurrencies as an investment is more pragmatic than dramatic.

Related Reading: