The original title: "Multiple Bitcoin ETF applications, once passed, can it bring the long-awaited effect? ", by Hebao

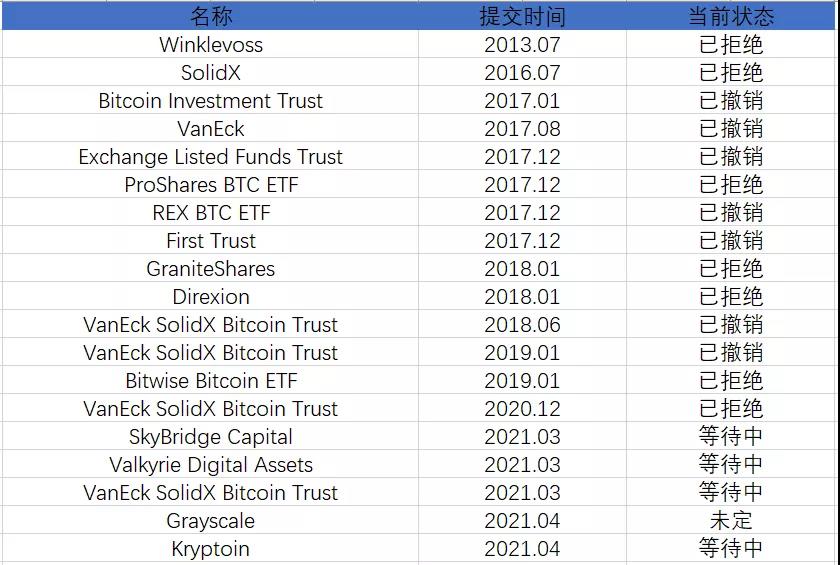

Since the Winklevoss brothers first opened the Bitcoin ETF in 2013, in the past 9 years, different institutions in the United States have filed Bitcoin ETF applications every year, but without exception, they all ended in failure (either rejected by the US SEC, or voluntarily withdrawn), or even Both became a "pass forever next year spell".

secondary title

01 "Pass is always next year" US Bitcoin ETF application

After experiencing the wave of the traditional financial world accelerating its march into the encryption field in 2020, the US Bitcoin ETF application situation in 2021 remains unabated.

image description

(USA) Incomplete Statistics on Bitcoin ETF Applications (2013-2021.04)

First of all, different from the sources of applications from institutions with strong colors in the circle before, since the beginning of this year, especially in the past three months, key roles in the traditional financial migrant worker world such as asset management companies and investment banks in the traditional financial world have also begun to gather Entering the market can even be called a blowout, with obvious intentions to share the profits.

According to the author’s incomplete statistics, American asset management company Victory Capital, asset management company Simply, Ark Investment Management (Ark Investment Management), Swiss cryptocurrency ETP issuer 21Shares, and asset management giant Invesco have been reported since May. (Invesco), ETF issuer Volt Equity, and more:

On May 21, ETF provider Teucrium submitted a bitcoin futures ETF application to the SEC;

On May 25, digital asset hedge fund One River applied to the SEC to create a carbon-neutral Bitcoin ETF;

On May 27, the asset management company Simply issued a fund with Bitcoin in its portfolio;

On June 8, ETF issuer Volt Equity applied to the SEC for a bitcoin-related ETF;

On June 10, Victory Capital, a Texas-based asset management company plans to enter the encryption market by setting up a private equity fund for qualified investors;

On June 29th, Ark Investment Management and 21Shares, a Swiss-based cryptocurrency ETP issuer, jointly issued a new product "ARK 21Shares Bitcoin ETF". ;

At the end of July, Goldman Sachs submitted an application for an exchange-traded fund (ETF) to the SEC;

In early August, asset management giant Invesco (Invesco) submitted application documents to the SEC, planning to launch an exchange-traded fund based on Bitcoin futures, Invesco Bitcoin Strategy ETF;

Secondly, in terms of the implementation form of Bitcoin ETF, it is no longer limited to the traditional ETF form that mainly revolves around the "buy, buy, buy" of Bitcoin spot, but many new design ideas have emerged. The most traditional financial flavor is the idea of the ETF issuer Volt Equity above - 25% of the net assets will be invested in MicroStrategy stocks,

I think this is a promising compromise idea, providing investors with the opportunity to invest in companies in the cryptocurrency space, allowing them to invest in the cryptocurrency market without directly owning encrypted assets such as Bitcoin and Ethereum , Bitwise, an asset management company that has been applying for Bitcoin ETFs for many years, has also launched similar products.

At the same time, the encryption fund of Victory Capital mentioned above mainly tracks the Nasdaq Crypto Index (NCI), which is equivalent to not only covering Bitcoin, but a basket of cryptocurrencies including Bitcoin (of course, the tracking index may not necessarily be You need to hold the corresponding spot assets).

In addition, there is also the latest Bitcoin Strategy Fund (Bitcoin Strategy Fund), a Bitcoin ETF application veteran VanEck, which plans to invest in Bitcoin futures contracts as well as collective investment vehicles and exchange-traded products (ETP) involving Bitcoin, without Invest directly in Bitcoin and other digital assets, as does Invesco mentioned above.

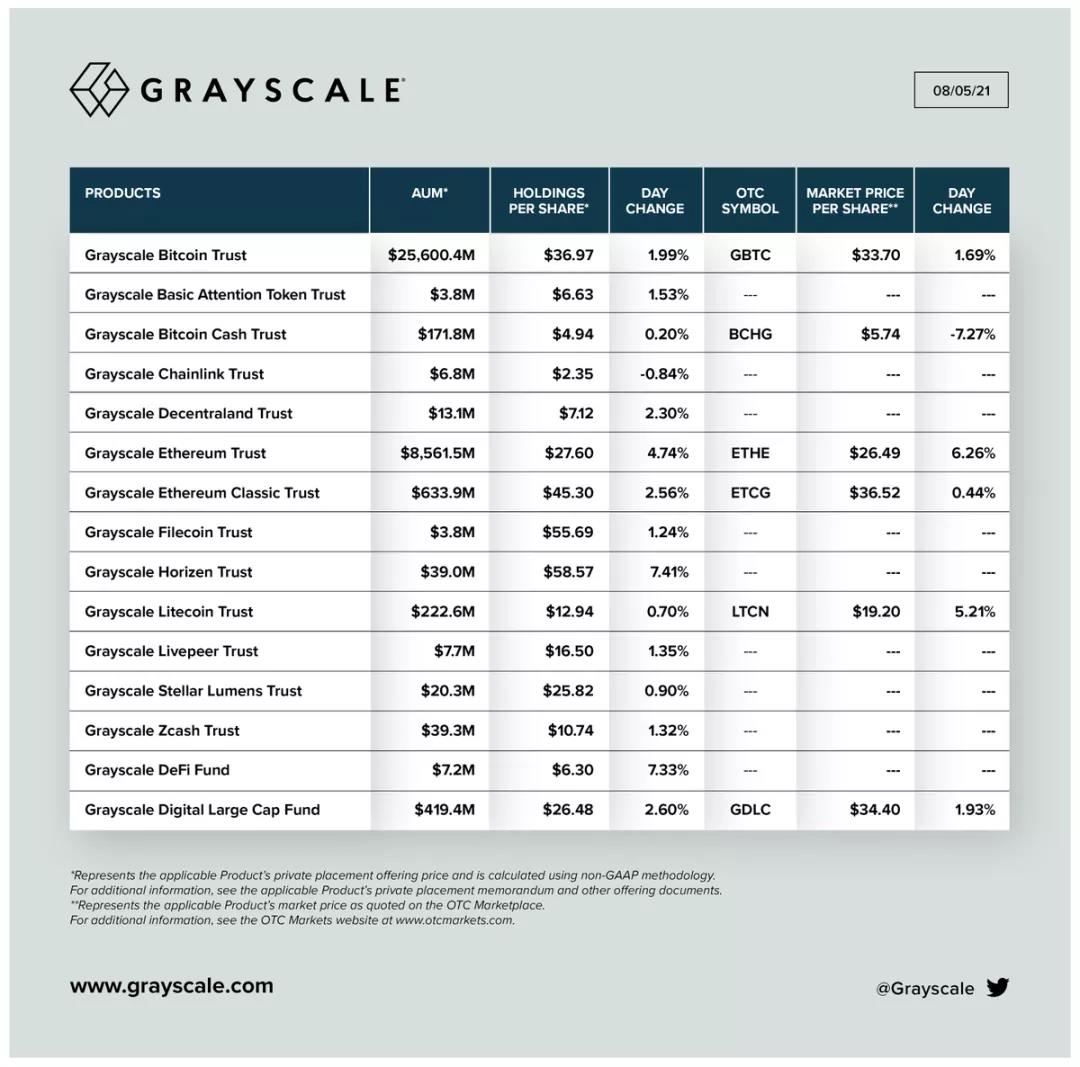

The market generally has expected grayscale, and recently hired David LaValle, the former CEO of Alerian, an index customization provider, as the global head of its exchange-traded funds (ETFs), aiming to promote the $25 billion Grayscale Bitcoin Trust (GBTC) is converting to an ETF, with Grayscale CEO Michael Sonnenshein saying Grayscale is "100% committed" to the process.

And this is also a new way to realize the Bitcoin ETF on the curve, and GBTC has been listed on the US stock pink sheet market, and the current secondary market volume is as high as 25 billion US dollars, and it has been verified by transactions for many years.

secondary title

02 "In full swing" outside the United States

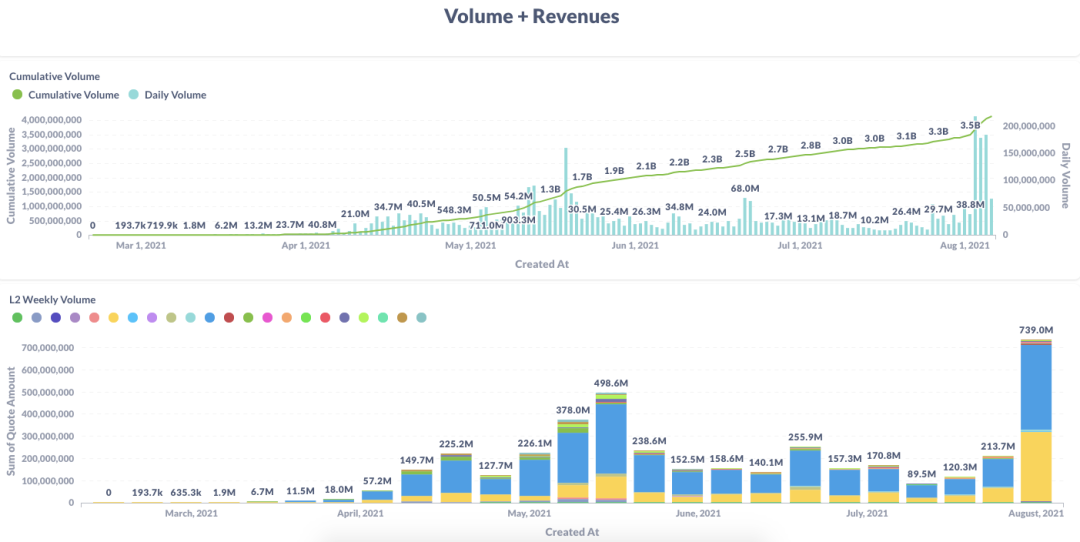

Unlike many Bitcoin ETFs in the United States who had to wait for several years to apply, on February 18 this year, the Canadian Purpose Investment Company ate the "first crab of Bitcoin ETF" - Purpose Bitcoin ETF.

And since the listing of the Purpose Bitcoin ETF, the number of bitcoins it holds has also continued to increase, reaching 22,032 as of August 5, with a current market value of more than 800 million US dollars.

At the same time, the positive premium corresponding to GBTC began to decline continuously, and entered the negative premium range on the 22nd, while the latest premium data on August 3 was -11.84%. Funds flowed out of GBTC and flowed into Bitcoin ETFs, which also shows that the market The enthusiasm and expectation for ETF will undoubtedly bring pressure on the United States that has not yet passed the Bitcoin ETF.

At the same time, ETFs in other parts of the world have also made good progress in the past two months. First, on June 23, the Brazilian Stock Exchange (B3) listed the first Bitcoin ETF transaction in Latin America launched by QR Capital.

secondary title

03 Undecided supervision should be the biggest obstacle to the approval of ETF applications

For the many Bitcoin ETF applications in the United States, the most noteworthy thing at present is the attitude of the regulators. Although the new US SEC chairman Gary Gensler was considered a friendly person in the encryption industry before taking office, he has not been involved since he took over at the end of last year. There is no obvious positive statement (ETF still fails).

Earlier this month, Bloomberg revealed that Gary Gensler had asked Congress to pass a law to empower the SEC to regulate encrypted transactions, and he did not give any timetable for the Bitcoin ETF that the market is currently looking forward to.

Even at the Aspen Security Forum (Aspen Security Forum) held on Tuesday, Gary Gensler took a tougher attitude and said that many areas of cryptocurrency may involve securities laws and must be regulated by the SEC.

But what is quite interesting is that just yesterday, Brian Quintenz, commissioner of the US Commodity Futures Trading Commission (CFTC), directly tweeted that the US Securities and Exchange Commission (SEC) has no regulatory authority over pure commodities and their trading venues, whether these commodities are wheat , gold, oil, or encrypted assets with commodity attributes, etc.

This kind of seemingly tit-for-tat remarks actually reflects from the side that the US regulatory authorities still have no public opinion on the legal definition of cryptocurrencies and the division of regulatory powers and responsibilities. This may also be the way for encrypted assets such as ETFs to bridge to traditional finance. The key reasons for the delay in breakthrough:

According to the CFTC Commissioner, derivatives with securities attributes are regulated by the SEC, such as extended financial products such as Bitcoin ETFs; while commodities themselves are regulated by the CFTC, such as cryptocurrencies with other commodity attributes such as Bitcoin.

But there is another core problem, which is the urgent need for legal clarification of the scope of the definition of securities—for example, whether other cryptocurrencies other than Bitcoin may be directly defined as securities in the future (see the SEC’s previous wars with XRP and Telegram) rather than commodities.

So in general, the current Bitcoin ETF applications are actually waiting for the arrival of this last "regulatory point". Once the regulatory attitude is clear, then these backlog requests may "file in."