Original author: Vikram Arun, BlockTower Capital, compiled by Odaily.

This article will discussthree main topics, although the three have not been fully discussed, but are increasingly relevant and important:

1. MEV after EIP-1559 and before The Merge (August 5 - early 2022);

2. 2-layer Rollup MEV (Optimism, Arbitrum);

secondary title

First, let's briefly understand MEV

The root cause of MEV is that within a certain time window, you cannot fully control the operations you want to perform. Specifically on Ethereum, when you submit a request (such as a transfer), it will enter the waiting list for miners to choose, and during this time you basically cannot control who it is "accepted" or whether it will are added to the block on time. On an ETH Rollup (like Optimism or Arbitrum), once your request is submitted to a centralized sequence operator, you lose control.

The time window between submitting a transaction and confirming it is an opportunity available to others (miners), and the value of this opportunity is MEV.

MEVs can be roughly divided into three types: benign MEVs (included in the protocol), bad MEVs, and catastrophic MEVs. Examples are as follows:

1. Benign MEVs:The operation of some protocols depends to a certain extent on MEV capture, such as the liquidation of Aave, Maker, and Compound, or through arbitrage between Uniswap and SushiSwap to maintain market effectiveness.

2. Bad MEVs:Robot front-running, sandwich arbitrage trading(Odaily Note: Please refer to "etc.》)etc.

3. Catastrophic MEVExample: by restructuring(Odaily Note: Please refer to "Detailed explanation of the reorganization attack after the merger of Ethereum》), time-bandit chain reorganization attacks pose a threat to the consensus layer - if we don't have a way to enforce this probability to end, they are always likely to appear in some form.

In the discussion that follows, I will focus on the latter two types of MEVs.

As Ethereum users, the best we can do to avoid being the victim of a large "bad MEV" is to use a dedicated relay network like Flashbots, Archerswap, MistX, or use the request for quote RFQ system ZRX, Hashflow, Cowswap, It is to set a maximum allowable deviation, which DEX calls "slippage".

But is that enough?

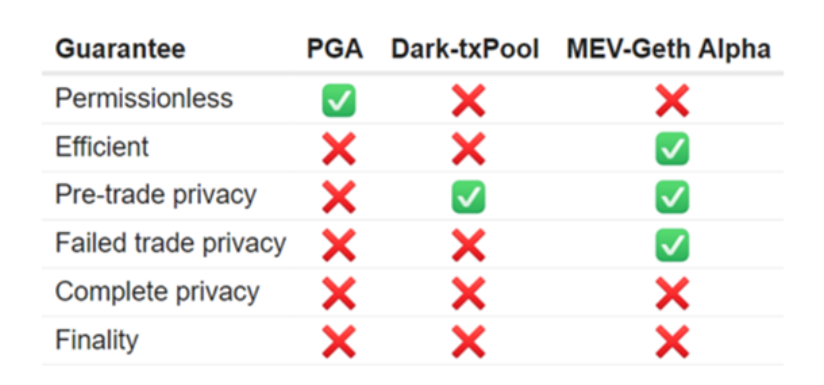

At least not yet. MEV-Geth's private relay system running Flashbots is permissioned (miners must be whitelisted to forward groups of bundled transactions). It's not really private either, as miners can still see bundled transactions before they go on-chain, and bundled transactions on-chain can likewise be exploited. While we haven't seen this issue for a while, it may become a problem after EIP-1559, as miners will have to ban this behavior.

In fact, some "loophole bribers" choose to submit transactions through other (non-public) channels. An interesting tidbit from this morning: Cypto Punk's #3860 NFT was listed for sale at less than $0.01 due to a seller error, and a "dodgy" buyer submitted a transaction via Flashbots for a directed payment of 22 ETH Miner's fee to queue up the transaction for buying #3860 into the first block. It's a win-win for bribers who get priority and miners who get high gas fees, but it's an unfair competition for ordinary users (other #3860 buyers).

If you're interested in learning more about the future of Flashbots, a truly amazing white hat community. please checkRobert Miller Research Proposal on MEV-SGXimage description

MEV solution for existing Flashbots robots

thisthisinsideFound some great papers that concluded: "These high frequency traders are paying for expensive services such as hosting and data services. By preempting trade orders, high frequency traders levy false Tax without providing anything in return." Sounds very much like bad MEV in the crypto world, except that the crypto world follows "code is law" and is not regulated by the SEC.

herehereRead this article by Paradigm and Vitalik aboutPost-merger restructuring (Re-orgs)article.

secondary title

What will the MEV look like after the upgrade in London?

Most people are focusing on the upcoming London hard fork EIP-1559. Let's summarize the changes brought about by 1559:

· Instead of a single gas fee, after the upgrade, each request order will include a "tip" and a "fee cap";

· Base gas fee Requests will only be included in a block if the fee cap is at least the block's base fee.

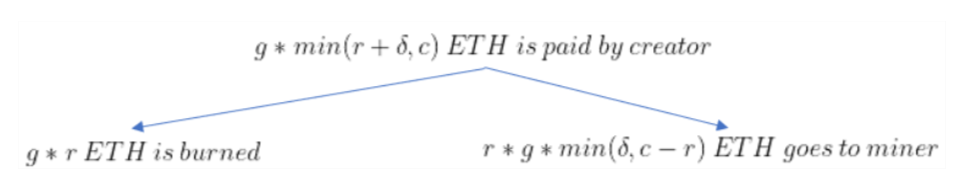

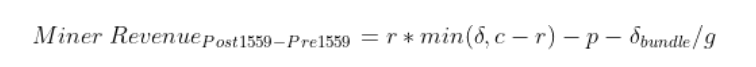

The calculation formula is as follows: g = gas limit, δ = hint, c = fee limit, r = base fee, p = gas price (only relevant before EIP-1559 upgrade):

The current MEV-Geth that miners are earning is based on more than 85% of the hash rate, where δ is the "tip" per Flashbots package (~ . 3 ETH/block):

Therefore, assuming that the gas fee upper limit g remains unchanged, the income difference of miners before and after the 1559 upgrade is roughly:

Since the gas fee was very high before the upgrade, miners' income thereafter may be lower than before the 1559 upgrade. While we haven't considered how much the "tips" for the upgraded Flashbots bundle will be (and the transaction volume between these "tips" may increase significantly), it is very unlikely to change the results, because the increased traffic through Flashbots also would lower the base fee r...which also means less ETH than expected would be burned.

although it may be necessary to restate someprevious articlecontent, but I still want to emphasize:

1. As miners’ profits are squeezed, it is expected that the capture of Layer1 MEV will become more competitive.

2. According to EIP-1559, you cannot submit transactions with 0 gas fees - which means that there may be more useless blocks because you have to pay a base fee to be included.

secondary title

How do Layer 2 respond?

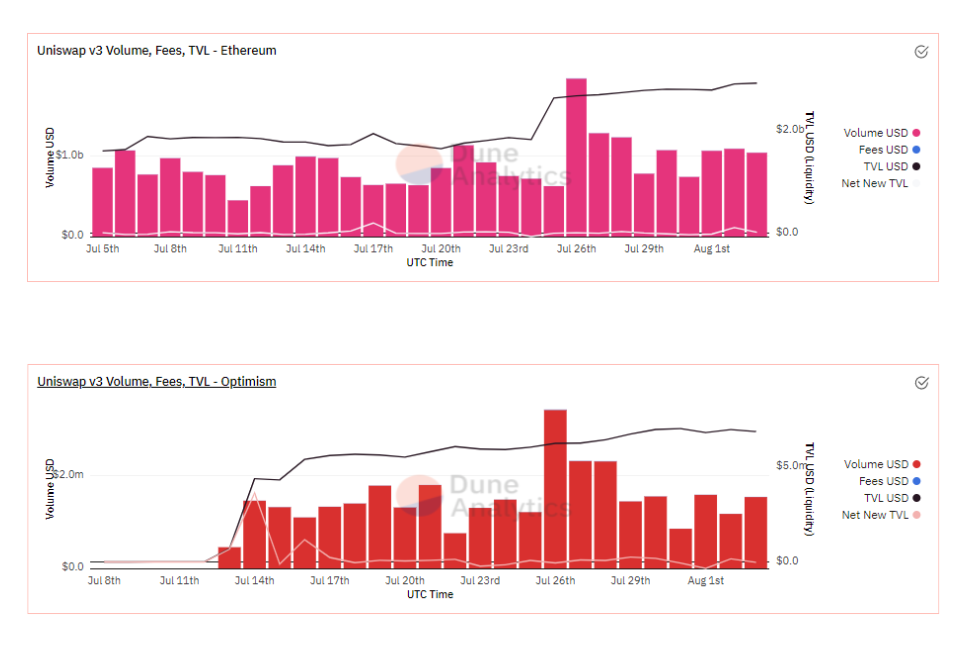

The chart I have been paying attention to recently is that MEV on Ethereum frequently appears in Uniswap v3 transactions, and the situation of Optimism is also here. Optimism currently has a total lock-up (TVL) of only $7 million, but I don't think anyone would expect it to fall far behind the $2 billion total lock-up on Layer1 at only 1/10 the cost (the first generation of Optimism There are only ETH, DAI, SNX, USDT and WBTC in the version).

So what does it matter? Following the trajectory of the funds, we eventually found that MEV on Layer 2 has become the biggest point of contention for DeFi adoption, whether it is from Layer 1 to Layer 2 or the Layer 2 solution itself.

image description

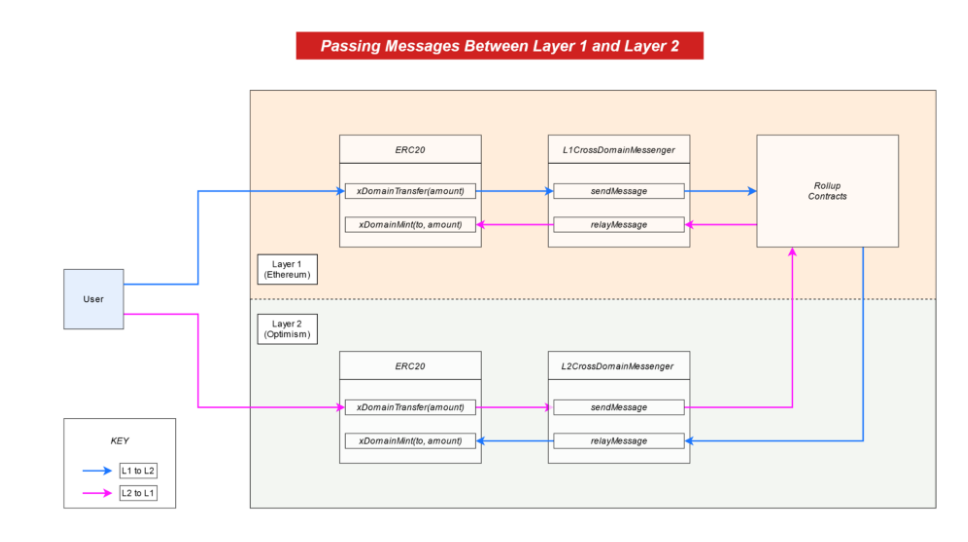

L1 >L2 Deposit Withdrawal Process (For more about summarization, please check Paradigm's article

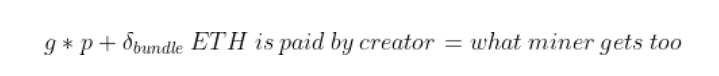

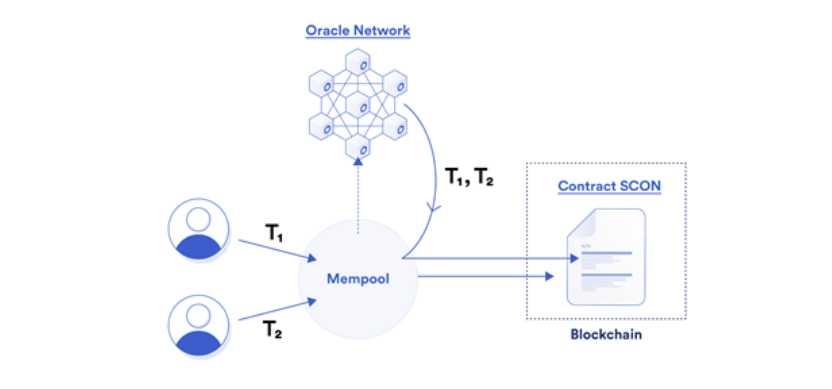

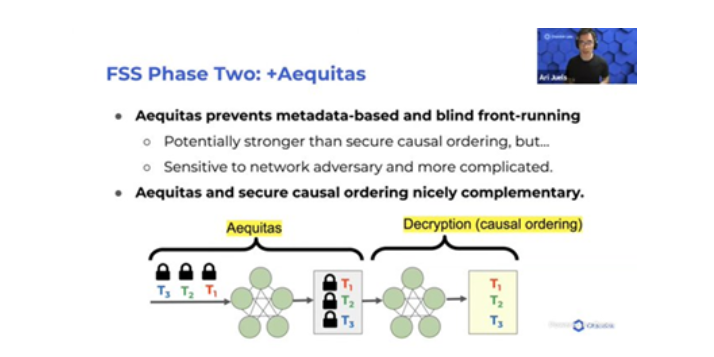

Assuming these centralized orderers run by Optimism and Offchain Labs are altruistic and do not pursue MEV profits, then transactions should be processed purely by delay and time for orderer pick-up. However, this is understandably a significant strain on Ethereum's permissionless ethos, so both protocols propose to target strong Layer 2 fairness, despite Optimism's MEV Auction (MEVA) and Arbitrum's fair ordering service (FSS) is weak in fairness on Layer1.

In theory, MEVA is fairly simple: ordering power is a valuable commodity, so the best way to value it is to provide the ability to reorder transactions as an auction, and then give it to the highest bidder. Similar to how mining creates revenue streams for miners to keep the network largely consistent, MEVA allows orderers to monetize their contributions and economically secure the chain in a centralized winner-takes-all fashion. Safety.

herehereThere's a great article on that). But at the end of the day, this still doesn't address any economically detrimental motives behind bad and disastrous MEVs.

MEVA is the full version of 0xbunny about reassembly requests, but only for Layer2, not Layer1. They legitimize frontrunning in their code, and in return make frontrunners pay a small percentage of their income to the sequencers, who are complicit. (It's like a corrupt state where the rich get richer at the expense of users.)

image description

image description

Enforce order of transactions when they are received

in conclusion:

in conclusion:

1. Layer2 Optimistic's solution brings a kind of usability that has never been seen before for ETH, but at the beginning, we put a lot of trust in a centralized sequencer run by a team to extract MEV (operating as efficiently as BSC).

2. We should be prepared that once these solutions are closed, MEV may flood on Layer2 - solutions like MEVA and FSS will not be released on time, I am not saying that they are not optimistic about them until they are implemented In the initial stage, it is important to predict how Ethereum will change in the next year.

3. I think the bidding wars around MEVA and the resulting collusion will be a big theme for both Optimism and Arbitrum. It will be a technical race to submit transactions to DON most efficiently with the lowest latency (finally pulling MEV on Arbitrum should be much harder).

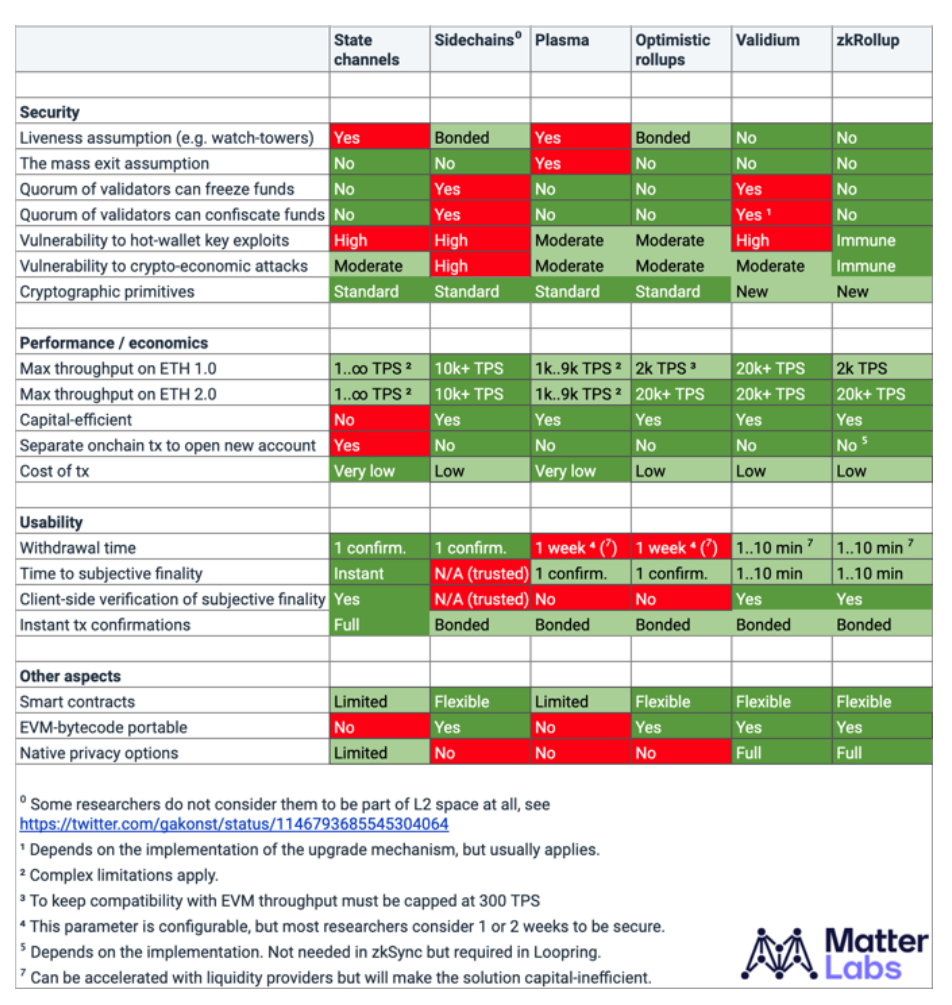

4. We created something bigger and better! It's great to see that zkrollup and their Optimistic counterparts solve a lot of problems together.

Finally, I want to touch on an argument that many in the community were very resistant to earlier this year-cross-chain DeFi is more likely to be inevitable.

MEV proves that the block space has the ability to extract value: multi-chain (whether it is Layer1, or different schemes of ETH Rollup) is only a matter of time scale, because there are so many different ways to balance the block space to minimize it and democratize while retaining some form of decentralization.

Besides Ethereum, what are the other Layer 1 related to DeFi? Solana and Avalanche are also considered base public chains for minimizing MEV, more information on this will be forthcoming.

Thanks to Blake Richardson, Avi Felman and Steve Lee for their general feedback on the BlockTower team (followOur new media page MediumRelated Reading:

Related Reading:

"Understanding Miners' Extractable Value (MEV) in One Article"

"A hunt in the dark forest of Ethereum: arbitrage robot arbitrage 130 ETH"

"The dark forest of Ethereum is no longer dark. Is Ming MEV good or bad? "