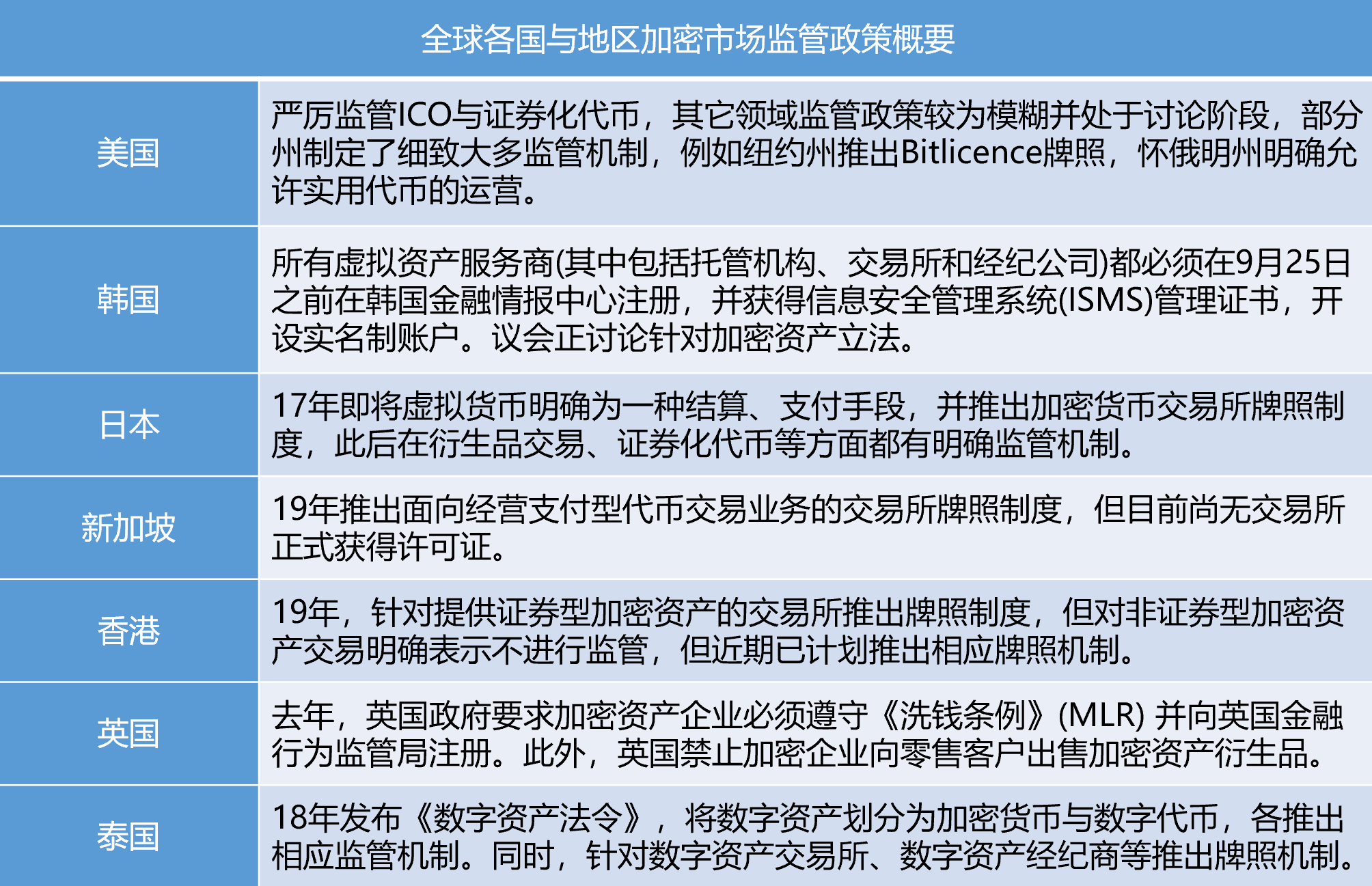

Recently, the supervision of the encryption market has become one of the most concerned topics inside and outside the encryption industry. Many countries represented by the United States have stepped up their supervision of the encryption market. At present, the supervision of various countries will play an increasingly important role in the encryption industry.

Therefore, Chain Catcher sorted out a number of countries with clear encryption market regulatory policies around the world, and analyzed from the identification of the nature of cryptocurrency and corresponding regulatory policies, exchange regulatory systems, tax policies, etc., hoping to provide encryption market practitioners It is also helpful for industry followers to further enhance policy awareness.

secondary title

01 America

Further reading:

Further reading:Speech by Gary Gensler, Chairman of the US SEC

ICOs are often vulnerable to regulation by the SEC. Under the federal securities laws, if a crypto asset is determined to be a security, the issuer must register the security with the SEC or offer the security pursuant to an exemption from the registration requirement. The SEC has been leaving room for whether a token is considered a security, saying it "depends on the characteristics and use of that particular asset." But in general, the SEC is more inclined to treat cryptocurrencies as securities, while fully applying securities laws to digital wallets, while affecting exchanges and investors.

In December 2017, the then chairman of the SEC issued a statement on cryptocurrencies and ICOs, stating that potential buyers were sold for the potential of token appreciation, the ability to lock in these appreciation by reselling tokens on the secondary market, or based on other Human efforts are profited from tokens, which are key hallmarks of securities and securities offerings. So overall, the chairman said, the ICO structure he sees involves the offering and sale of securities, with the SEC taking enforcement action against ICOs that violate the federal securities laws.

In terms of cryptocurrency exchanges, they are mainly regulated by the US Financial Crimes Enforcement Network (FinCEN), focusing on fund transfer and anti-money laundering (AML). FinCEN regulates money services businesses (MSBs) under the Bank Secrecy Act. In March 2013, FinCEN issued guidelines to identify cryptocurrency exchange service providers as MSBs. Under this framework, cryptocurrency trading platforms must be licensed by FINCEN to implement a comprehensive anti-money laundering risk assessment and reporting mechanism.

In December last year, FinCEN proposed to add new data collection requirements such as KYC to cryptocurrency trading providers. Under the proposed rule, banks and money services businesses would be required to file reports, keep records and verify customer identities, including private digital wallets hosted by non-financial institutions. This proposal has caused considerable controversy. FinCEN announced in January this year that it would extend the period for soliciting comments, but there is no latest movement yet.

In terms of encrypted derivatives, the U.S. Commodity and Futures Trading Commission (CFTC) regards cryptocurrencies as commodities. According to the Commodity Exchange Act, cryptocurrency futures, options and other derivative contract transactions must be publicly traded on exchanges regulated by the CTFC. Currently, the Chicago Board Options Exchange and the Chicago Mercantile Exchange offer futures trading tied to the price of Bitcoin.

In terms of crypto investment taxation, the IRS treats cryptocurrencies as property and taxes them. For individual citizens, those who hold cryptocurrencies as capital assets for more than one year and have realized gains are required to pay capital gains tax; those who hold for less than one year and earn gains are subject to ordinary income tax.

In addition to the aforementioned decentralized regulation at the federal level in the United States, each state government can formulate specific rules and regulations within its jurisdiction.

New York State took the lead in proposing BitLicense, a comprehensive regulatory framework for the encryption market in August 2015, which is also the most influential license in the encryption industry. BitLicense includes key consumer protection, anti-money laundering compliance, and cybersecurity guidelines. The regulation regulates any company or individual residing in New York that uses cryptocurrencies, requiring companies involved in dealing with virtual currency businesses to apply for a license. At present, more than 20 companies such as Circle and Ripple have obtained BitLicense licenses.

In addition, New York State has also launched a trust charter (Charter) for cryptocurrency custody companies. At present, nearly 10 companies such as Paxos, Gemini, NYDIG, Coinbase, Bakkt, and Fidelity Digital Asset have obtained the Charter.

Wyoming is a more cryptocurrency-friendly region in the United States, enacting more than a dozen related bills. The most influential of these is the HB70 "Open Blockchain Token Exemption" bill passed in March 2018, which proposes an asset class similar to "utility tokens". According to the act, tokens issued are exempt from the federal securities laws if they are issued not as investments but only for consumption purposes such as exchange, receipt of goods and services, etc.

Since then, well-known encryption companies such as Ripple and Cardano development company IOHK have moved to Wyoming. Since September 2020, three companies including Kraken and Avanti have also received approval from Wyoming regulators to establish encrypted banks under the authorization of the SPDI Act to provide commercial banking and custody services for tokenized assets and digital currencies.

In May of this year, the US SEC stated that it had urged Congress to legislate to give the SEC more regulatory power over digital assets. At the same time, the SEC is still working to lead the establishment of a broad regulatory framework for encrypted assets, allowing multiple regulatory agencies in the United States to clearly divide the scope of market regulation and perform their duties, and even all digital assets are included in the regulation.

Recently, the US SEC has begun to tilt the focus of supervision towards DeFi.The chairman of the SEC also stated that any DeFi project that provides security token services is within the scope of SEC supervision, and any stock tokens or encrypted tokens that provide underlying securities exposure are subject to securities laws,secondary title

02 Japan

Perhaps it was affected by the bankruptcy of the Mt.Gox exchange,Japan is currently the world's leading country in the regulation of cryptocurrency exchanges.

In May 2016, the Japanese Diet passed a bill to amend the "Fund Settlement Law" and it came into effect in April 2017, adding a chapter of "virtual currency" to the law, which clearly defined virtual currency as a means of settlement and payment, and has property value. At the same time, the bill also clearly introduces a regulatory mechanism for encrypted asset exchanges. Only companies registered with the Japanese Financial Services Agency/Financial Bureau can provide encrypted currency exchange services in the country.

It is understood that the registration requirements generally include: a minimum capital of more than 10 million yen; providing transaction asset information, contract details, etc. to customers; separate management of user property and operator property; KYC confirmation, etc.

In 2017, the Japan Financial Services Agency issued licenses to 16 cryptocurrency exchanges, but because Coincheck was stolen at the beginning of 18 and lost nearly 500 million U.S. dollars, the Japan Financial Services Agency suspended the license issuance in that year, and at the same time settled in major Japanese exchanges. Inspections ranging from 2 to 6 weeks, ranging from financial statements, anti-money laundering systems, employee background checks, to the system version of each computer, passwords, and employee attendance, have since been conducted on many unqualified exchanges Corrective warnings, fines and even shutdowns.

Since then, the Japanese Financial Services Agency has reopened the issuance of licenses. As of June 2021, 31 encryption companies have passed the registration, including bitFlyer, Coincheck, and Coinbase, which was newly approved in June this year. The official website of the Japan Financial Services Agency will occasionally publish a list of unregistered companies engaged in encrypted asset trading in the country, among which Binance and Bybit have recently been warned.

In terms of encrypted asset trading and management, margin trading and STO, the amendments to the "Funds Settlement Law" and the "Financial Instruments Transaction Law" that have been implemented since May 2020 and recent decrees have put forward more specific regulations:

In terms of encrypted asset trading and management, in response to the risk of encrypted asset leakage, for user assets managed by hot wallets, companies are forced to retain the same amount and type of encrypted assets as repayment resources; in terms of transaction risk screening, transactions need to create and save transactions record and notify the authorities of suspicious transactions; in terms of protection of user rights and interests, regulations require that crypto assets under custody be returned to users in the event of an exchange’s bankruptcy; in terms of crypto asset custody, relevant service providers also need to obtain a crypto currency trading license from the regulator.

In terms of cryptocurrency derivatives transactions, relevant operators need to be registered as both cryptocurrency exchanges and first-level financial instrument operators. At the same time, Japan capped the leverage ratio at one time.

In terms of securitization tokens, Japan has also specified relevant regulatory mechanisms in the Financial Instruments and Exchange Act. In March of this year, Japan's Sumitomo Mitsui Banking Corporation and Securitize, a security token platform, launched the first asset-backed security token, which is also the first security token compliant with the Financial Instruments and Exchange Act.

Japan also attaches great importance to the role played by industry associations in the encryption market. The "Financial Instruments and Exchange Law" has certified the Japan Virtual Currency Exchange Business Association and the Japan STO Association as self-regulatory organizations in the field of cryptocurrency transactions and ST, in order to communicate with The law is relevant to specific operations and sets specific rules and guidelines for the industry.

secondary title

03 Singapore

Further reading:

Further reading:Singapore may become a safe haven for crypto companies

Officials from the Monetary Authority of Singapore (MAS), the main agency responsible for regulating the crypto market in Singapore, said in 2018 that MAS divides tokens into utility tokens, payment tokens, and security tokens. MAS does not plan to regulate utility tokens, but payment regulations for payment tokens will be enacted by the end of the year, and security tokens are subject to existing Singapore securities and futures laws.

According to the official website document, MAS defines digital payment tokens as digital representations of any value. They are not denominated in any currency, are not linked to any currency, can be transferred, stored or traded electronically, and are intended to be accepted by the public or part of the public. A medium of exchange, as a means of paying for goods or services or settling debts, such as Bitcoin and Ethereum.

As early as 2017, MAS had issued the "Guidelines for the Issuance of Digital Tokens" to guide and supervise the issuance of digital tokens in the country. Since then, it has been revised many times and the latest version was launched in 2019, in which 11 specific cases were also proposed.

According to the guidelines, when it comes to issuing security tokens, the issuer needs to obtain a capital market service license; when it comes to trading security tokens, the trading platform must obtain a certified capital market operator (RMO) license; When it comes to providing token-related financial advisory services, the company needs to obtain a financial advisor license. At the same time, all relevant business operators should abide by the relevant laws and regulations on anti-money laundering and anti-terrorist financing.

MAS introduced the "Payment Services Act" in 2019 and it came into effect the following year. This bill requires companies engaged in specific payment services to obtain a license to carry out business activities, including digital payment token services, specifically referring to the "purchase or sale of digital payment services." Payment Tokens (DPT) (commonly referred to as cryptocurrencies), or provide a platform that allows people to exchange DPT.”, which is widely considered a license for cryptocurrency exchanges.

However, so far, Singapore has not issued licenses to encryption companies, but some encryption companies have obtained license exemptions for encrypted payment services within a specific period, including at least 20 companies such as Paxos, Coinbase, and Genesis. At the same time, MAS requires encrypted payment service providers to take strong control measures, such as fulfilling customer due diligence and transaction monitoring obligations, and submitting suspicious transaction reports to the Department of Commercial Affairs (CAD) to detect and prevent illegal funds from passing through Singapore's financial institutions. The system flows.

At the same time, MAS also launched a regulatory sandbox mechanism in 2019, enabling financial institutions and financial technology participants to experiment with innovative financial products or services in a real environment but within a clearly defined space and duration. Bond exchanges BondEvalue, At least two crypto companies, including the security token platform ISTOX, were shortlisted.

secondary title

04 UK

The UK Financial Conduct Authority (FCA), the main agency responsible for overseeing the regulation of the crypto market, is solely for the purpose of anti-money laundering and anti-terrorist financing. In January 2020, the FCA obtained regulatory powers to supervise how encrypted asset companies manage money laundering and anti-terrorist financing risks. Since then, British encrypted asset companies must comply with the Money Laundering Regulations (MLR) and register with the FCA.

Currently, registered encryption companies include Ziglu, Gemini, Archax, Fibermode, and Digivault. In addition, there are more than 80 encryption companies on the temporary registration list, which can temporarily operate before March 31, 2022, including Wintermute, Revolut, Galaxy Digital, Fidelity Digital, eToro, Huobi, etc.

If an encryption company is not on the temporary registration list, it will not be allowed to carry out any encryption business activities. The FCA also published a list of hundreds of unregistered encryption companies on its official website, including Binance, which was recently warned.

On the official website, the FCA stated that it issued a serious warning to users investing in encrypted assets. If users purchase encrypted assets and problems arise, they will be unlikely to receive the Financial Ombudsman Service or the Financial Services Compensation Plan. "Encrypted assets are considered very high-risk speculation. sex buying. If you buy crypto assets, you should be prepared to lose all your money.”

The FCA does not regulate specific encrypted assets and related businesses, but will still regulate encrypted asset derivatives (such as futures contracts, contracts for difference, and options), as well as those encrypted assets that are considered securities (security tokens). The FCA has banned the sale of crypto asset derivatives to retail clients due to concerns about the volatility and valuation of crypto assets.

In FCA's view,Security tokens are tokens that provide certain rights, including ownership status, repayment of a specified amount, right to share in future profits, etc. All the rules involved in traditional securities apply to security tokens.

Currently, the UK government is also consulting on stablecoins as a means of payment. If the government's proposals are adopted, the FCA will consult on the rules to apply them. This means that stablecoins used for payments and services will be regulated in the future, providing consumer protection according to the rules.

secondary title

05 Hong Kong

The Hong Kong Securities Regulatory Commission is the main regulator of encrypted assets in Hong Kong. For many years, it has mainly supervised security tokens. It has no clear regulatory policies for other encrypted asset types and trading platforms.It is also currently the actual headquarters of well-known cryptocurrency exchanges such as FTX, BitMEX, and Bitfinex.

In 2017 and 2019, the Hong Kong Securities Regulatory Commission issued statements on Initial Coin Offerings (ICOs) and Security Tokens (STOs), clarifying that cryptocurrencies that can represent shares, debentures, and collective investment schemes are considered " Securities”, transactions, consulting, fund management, and distribution activities related to security tokens will be regulated by Hong Kong’s Securities and Futures Ordinance. Relevant institutions must be licensed or registered with the SFC. As for encrypted assets that do not fall within the legal definition of "securities" or "futures contracts," according to the regulatory framework statement issued by the Hong Kong Securities Regulatory Commission in November 2018, their markets are not regulated.

The "Statement on the Issuance of Security Tokens" in March 2019 also clarified that security tokens are only sold to professional investors (in Hong Kong, individual professional investors refer to those who have 8 million Hong Kong dollars in circulation assets and have abundant assets in the past year. investors with an investment record).

In terms of trading platform supervision, Hong Kong has started the exploration period of the regulatory framework since 2018, and it has recently become more stringent. For a long time, Hong Kong has not specifically enacted legislation or amended laws for encrypted assets and related businesses. Regulators can only introduce regulatory policies under the existing legal framework, with relatively limited regulatory power and space.

In November 2019, Hong Kong SFC issued the "Position Statement on Supervision of Virtual Asset Trading Platforms", formulated the trading platform licensing system, and announced specific licensing terms and conditions. The system is only aimed at "platforms that provide at least one security-type virtual asset trading service."

The licensing conditions mainly include: the platform can only provide services to professional investors, formulate strict asset inclusion criteria and only provide services to customers who fully understand virtual assets, operate an external market monitoring system, and ensure risk-related purchases of custody encrypted assets The insurance is effective at all times.

Under this mechanism, on December 15, 2020, the Hong Kong Securities Regulatory Commission issued a license to OSL, the first encrypted asset trading platform. The digital asset trading platform OSL under the listed company BC Technology Group has obtained Type 1 and Type 7 licenses under the SFC regulatory framework, which are respectively licensed to operate securities transactions (brokerage services) and provide automated trading services.

Therefore, under the current regulatory regulations, non-securities encrypted assets and their financial activities have been in an unregulated state. Until the end of 2020, the Financial Affairs and Treasury Bureau of the Hong Kong Special Administrative Region Government issued a legislative consultation document, which proposed to fully implement a similar "mandatory licensing system" for all encrypted asset trading platforms in the "Anti-Money Laundering and Terrorist Financing Ordinance".

secondary title

06 South Korea

South Korea is one of the more active countries in the cryptocurrency trading market. Due to the high enthusiasm of cryptocurrency investors in the country, the bitcoin price market in the country’s exchanges is higher than other exchanges in the world, known as the “kimchi premium.” In recent years, South Korea's regulatory authorities have gradually strengthened the supervision of the encryption market, and it has become one of the countries with the clearest regulatory mechanism for the encryption market.

In September 2017, the South Korean Financial Services Commission (FSC), which is responsible for managing and supervising digital assets, stated that it prohibited all forms of ICO behavior, but formulated regulatory policies for cryptocurrency exchanges, mainly promoted by the Korean Blockchain Association to implement self-regulation. Since then, Korean exchanges such as Bithumb and Upbit have developed rapidly.

In March 2020, the South Korean government approved the revised "Reporting and Use of Specific Financial Transaction Information Act" and it came into effect in March this year. According to this law, all virtual asset service providers (including custodians, exchanges and brokerage companies) All must register with the Korea Financial Intelligence Unit by Sept. 25 to regularly report transaction data, or face severe penalties.

At the same time, virtual asset service providers also need to obtain an information security management system (ISMS) management certificate and open a real-name account under the guidance of a bank to prevent money laundering. Currently, only exchanges such as Korbit, Bithumb, Coinone, and Upbit comply with the real-name trading regulations.

Due to the aforementioned stringent regulatory rules, many exchanges such as OKEx Korea have decided to withdraw from the Korean market before the new regulations take effect. At the same time, more than 10 operating exchanges began to delist high-risk currencies in large numbers.

At present, the South Korean government has not identified cryptocurrencies as financial assets, but announced in December 2020 that it will tax investors' income. If investors earn more than 2.5 million won (approx. $2,200), you must pay a 20% tax rate.

secondary title

07 Thailand

Thailand is also one of the countries with a relatively complete regulatory system for encrypted assets in the world. Since 2018, it has introduced a number of clear license mechanisms to regulate the development of the domestic encryption industry.

In May 2018, Thailand's SEC officially issued the "Digital Asset Act" to encourage technological innovation, provide various financing tools to capable companies, and ensure that the purchase, sale or exchange of digital assets is fair, transparent and responsible. And establish a mechanism to maintain the country's financial system and macroeconomic stability.

According to the law, digital assets are divided into cryptocurrency (Cryptocurrency) and digital tokens (Digital Token), in which the first type of digital assets is used to exchange goods and services or as a medium of exchange like ordinary currencies, while the second type of digital assets is According to the regulations of the Securities and Exchange Regulatory Commission, it is used to invest in projects/businesses and exchange for goods/services/any other rights and interests.

At the same time, the law divides digital asset business operators in Thailand into digital asset exchanges, digital asset brokers, and digital asset dealers. Operators of each type of business need to apply for corresponding licenses to operate related businesses. In addition, the Thai SEC has also set up a licensing mechanism for ICO portals that publish ICO information.

Up to now, the Thai SEC has issued digital asset exchange licenses to 8 companies including Upbit, Huobi, and BITKUB, issued digital asset dealer licenses to 6 companies including Upbit, and issued ICO portal licenses to 4 companies including Longroot.

The Thai SEC has also formulated a corresponding taxation mechanism for digital asset transactions. Individual investors should pay 7% value-added tax and 15% return capital gains tax on their digital asset transactions.

However, under these relatively complete encrypted asset regulatory mechanisms, the Thai SEC still maintains a strict regulatory attitude towards the development of the domestic encrypted industry. However, the SEC soon issued a warning to it, saying that activities related to DeFi may require permission from financial regulators in the future.

In June of this year, Thailand’s SEC also announced that it would prohibit exchanges from providing trading services for the following types of encrypted assets: (1) Meme tokens: there is no clear goal or substance or basis, and their prices follow social media trends; (2) fan generation Fan Token: Tokenized by the popularity of Internet celebrities; (3) Non-fungible Token (NFT): A digital creation used to declare the ownership or rights of objects or the granting of specific rights; (4) by Digital tokens issued by digital asset exchanges or related personnel for blockchain transactions.

secondary title

08 Other countries

In January 2020, Germany's government draft for the implementation of the "EU No. 4 Money Laundering Directive Amendment" came into effect. This law states that encrypted assets do not have the legal status of currency or money, but can be accepted by natural or legal persons as a method of payment, or used for For investment purposes, it is considered a financial instrument by the German Banking Act. At the same time, all encryption escrow companies that manage digital keys for investors must be regulated by the German Federal Financial Supervisory Authority, and Coinbase is the first company to obtain this license.

From August 2 this year, Germany’s newly effective Fund Positioning Law will allow some institutional-level funds to invest in cryptocurrency assets on a large scale for the first time, with a maximum investment portfolio of no more than 20%.

In June 2020, amendments to Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act came into effect. One of the amendments confirmed the asset attributes of cryptocurrencies such as Bitcoin and incorporated cryptocurrency exchanges, payment processors and other Cryptocurrency companies are legally recognized as Money Services Businesses (MSBs) and thus regulated.

In January 2021, Russia's "Law on Digital Financial Assets" came into effect. According to this law, Russian officials or individuals holding public office must disclose their own digital assets, as well as those of their spouses and children. At the same time, the law prohibits certain Russian officials from holding any cryptocurrency, such as the board of directors of the Russian Central Bank, employees of public companies owned by the Russian Federation, etc.

secondary title

09 summary

According to data released by the Financial Action Task Force (FATF) in July this year, 58 of the 128 jurisdictions currently indicate that they have implemented the revised FATF standards, of which 52 jurisdictions regulate virtual asset service providers, 6 jurisdictions prohibiting the operations of virtual asset service providers.

Recently, governments of many countries have issued warnings to some cryptocurrency exchanges, mainly because they provide derivatives transactions and are not registered in their own countries.

At present, encrypted assets are playing an increasingly important role in the global financial market, so more and more countries are formulating corresponding regulatory mechanisms. However, most countries currently conduct corresponding regulation mainly based on the defensive purpose of anti-money laundering and anti-terrorist financing risks, while It is not regulated with the primary purpose of advancing the industry.

Further reading:

Further reading:Many countries adjust the legal framework of cryptocurrency

In addition, Japan, Singapore, South Korea, the United Kingdom, Germany, and New York State of the United States have introduced license systems for encryption companies. Among them, Singapore, Hong Kong, Japan and other Asian regions are the most friendly, attracting many encryption companies to establish businesses or even relocate their headquarters locally, becoming The current heartland of the crypto market.

With the rapid development of new things such as DeFi and NFT, the regulatory issues facing the encryption market in countries and regions around the world are becoming more and more complex. How to deal with the balance between market innovation inclusiveness and financial stability risks will especially test the governance capabilities and strategic vision.