On August 3, the decentralized derivatives trading protocol dYdX announced the launch of the governance token DYDX, and airdropped to addresses that had previously interacted on the platform. The total amount of governance tokens is 1 billion, and the airdrop ratio accounts for 7.5%, that is, 75 million DYDX airdrop rewards.

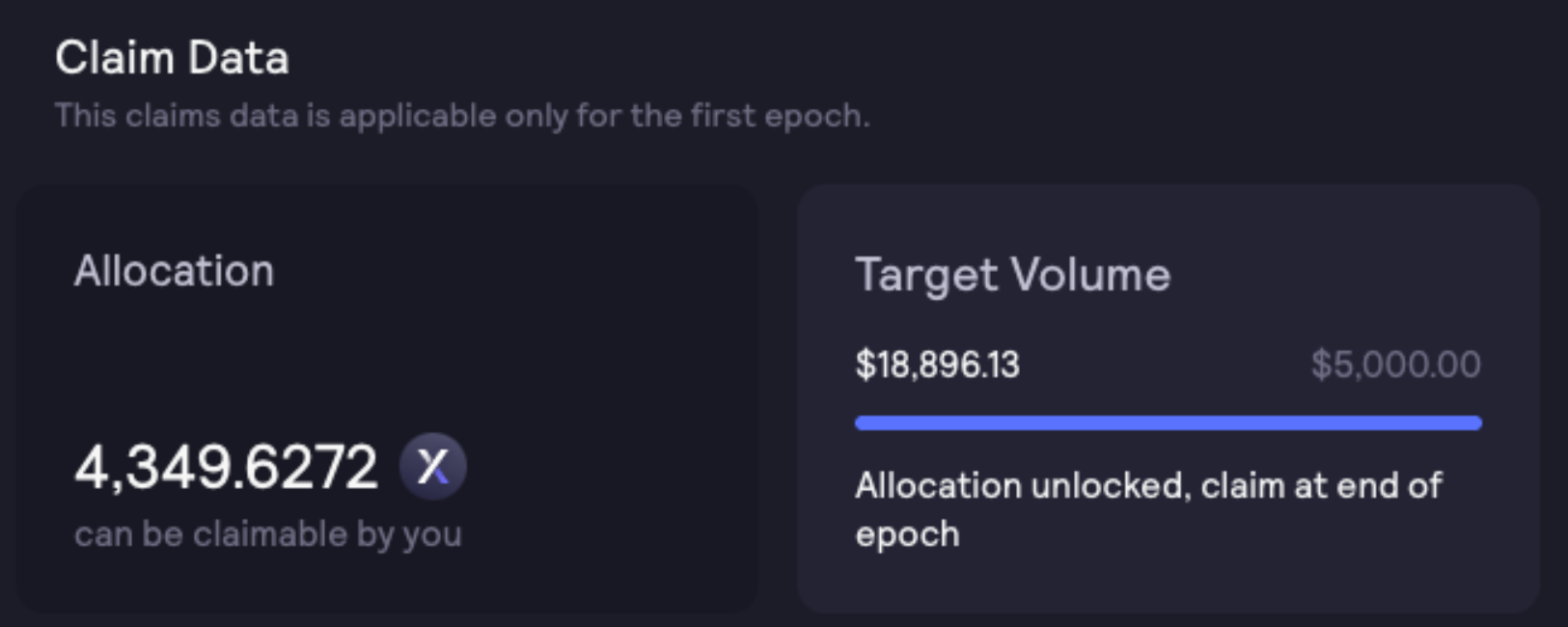

dydx stated that it has taken a snapshot of all historical interactive users of the dYdX protocol on July 26, and a total of 36,203 users have the qualifications to receive air investment. dYdX allocates the number of historical users to claim according to the historical transaction volume. If there are 787 addresses with a transaction volume of more than 1 million US dollars before the snapshot, each address can receive 9,529.86 DYDX.

To put it simply, if you made a simple interaction in Dydx before, such as making a deposit, you can get 310 Dydx, if you make a transaction, then congratulations, 1163 Dydx have entered your account , the more transactions, the more you get.

Observers had previously interacted with two wallets on Dydx, and this wave received an airdrop of 8,600 Dydx.

So how much is Dydx worth?

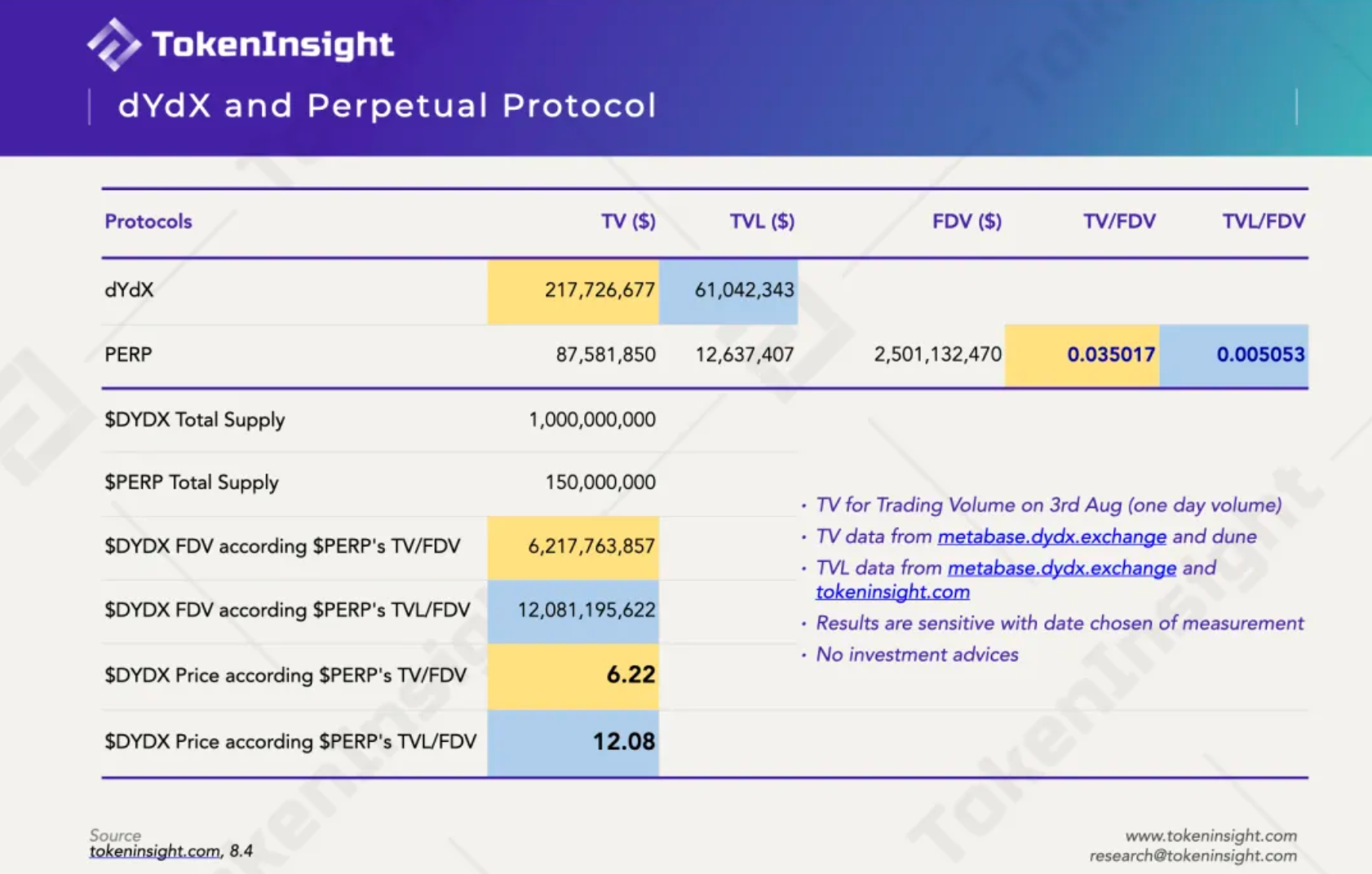

TokenInsight did the math and compared Dydx with its competitor Perpetual Protocol in terms of TVL and circulation:

According to the calculation of TokenInsight, the price of Dydx should fluctuate between 6.22-12.08 knives.

So, even if you only made one interaction with Dydx, then you have already got 1800U, and if you made even one transaction, then you can get an airdrop of at least 6000U.

If Dydx really reaches 6U, then the airdrop received by observers is 50,000 USDT, which far exceeds the airdrops given to me by Uniswap, TokenLon and 1inch.

The airdrop of DeFi projects, the way to make a fortune.

Well, in this issue, observers will also summarize some DeFi star projects that have not yet issued coins. You can completely interact with them. You only pay a small amount of Gas fees (the current Gas is not expensive at all), but the possibility of obtaining It is a high-value project airdrop:

Of course, what I sorted out may not be complete, and there are also some platforms that I personally think will not issue coins (such as OpenSea, which is optimistic about countless people, observers think that it will follow the same equity model as Robinhood and Coinbase, and will not involve issuing coins). will not be listed in the article

text

1. OpenLeverage

OpenLeverage, the first project introduced, belongs to the decentralized leveraged trading track like Dydx, and also does not issue coins like Dydx. Observers saw this project on CoinTelegraph. The seed round received $1.8 million in financing led by Signum Capital and LD Capital. After Dydx becomes popular, it is entirely possible to drive the same track to take off (this track also has projects such as Perp, Kine, and Futureswap).

Product interaction address: https://kovan.openleverage.finance/app

2. Beta Finance

Beta, a decentralized leveraged trading product incubated by Alpha, this project is almost exactly the same as OpenLeverage above. Both projects are doing on-chain leveraged trading, and they haven’t issued coins yet, but the backstage of Beta is more eye-catching and is a star Project Alpha is directly incubated, but Beta currently has no products. After the follow-up products are released, observers will take everyone to experience them together.

text

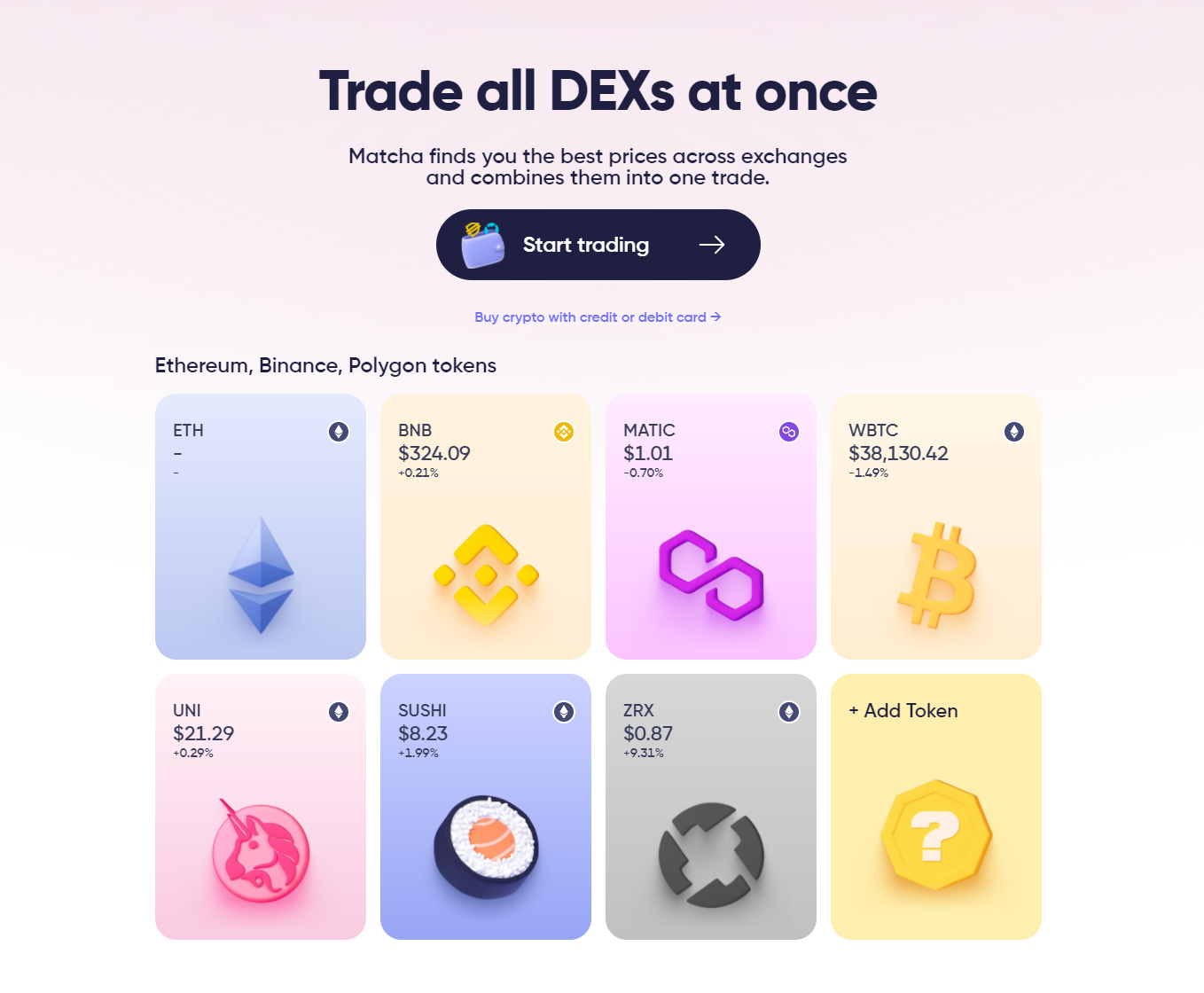

3. Matcha

Matcha is an aggregator that benchmarks against 1inch. Aggregators are already a well-known concept in the DeFi field. The feature of Matcha is that in addition to Ethereum and BSC, it has also added the currency of Polygon (Matic), and its UI and product experience are good.

Official website: https://matcha.xyz/

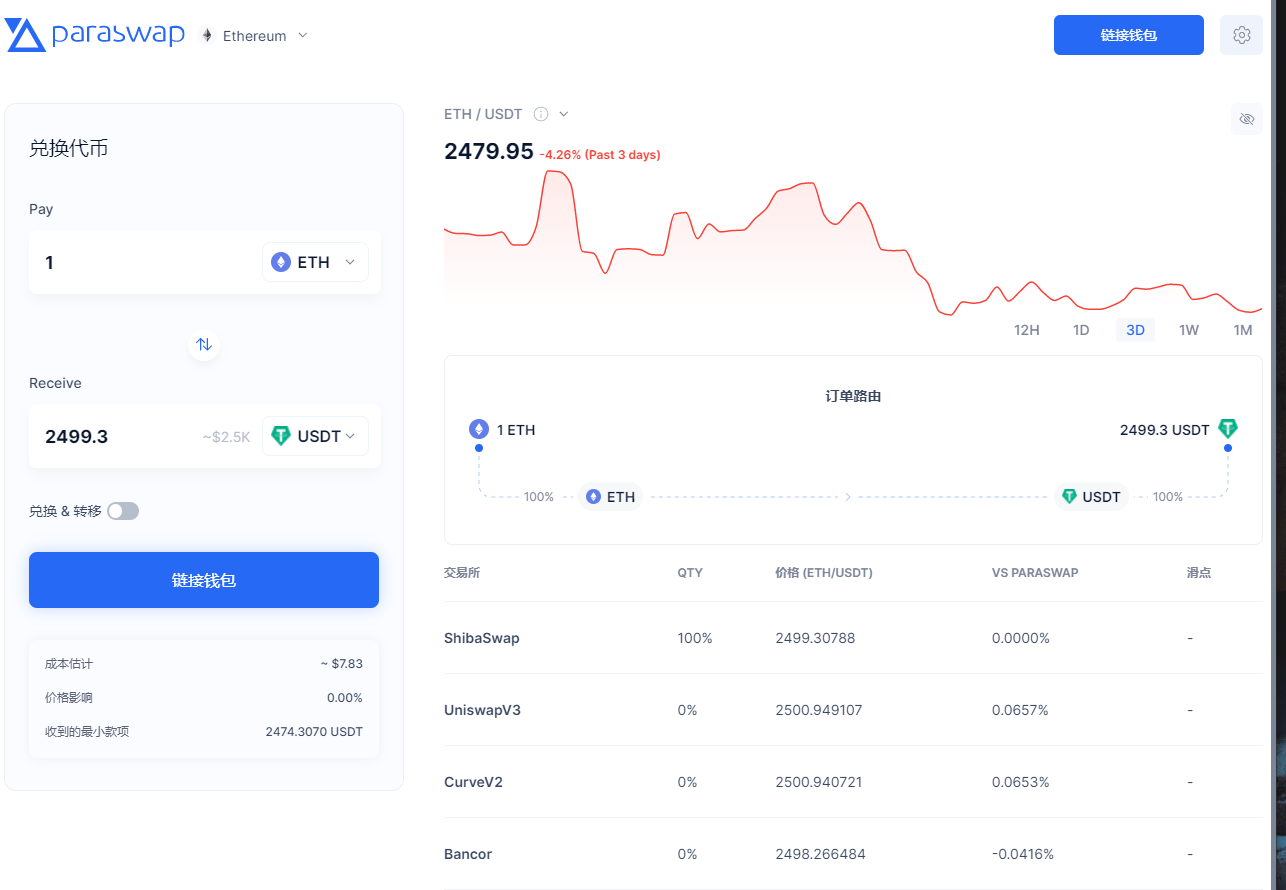

4. ParaSwap

In the DeFi Summer last year, the aggregator Dex headed by 1inch made a splash. After the 1inch airdrop, its two important competitors, Matcha and Paraswap, both appeared a large number of robots and scientists to roll their tokens, but Until today, these two projects have not issued coins (presumably soon?), you will fall behind if you don’t play.

Official website: https://paraswap.io/

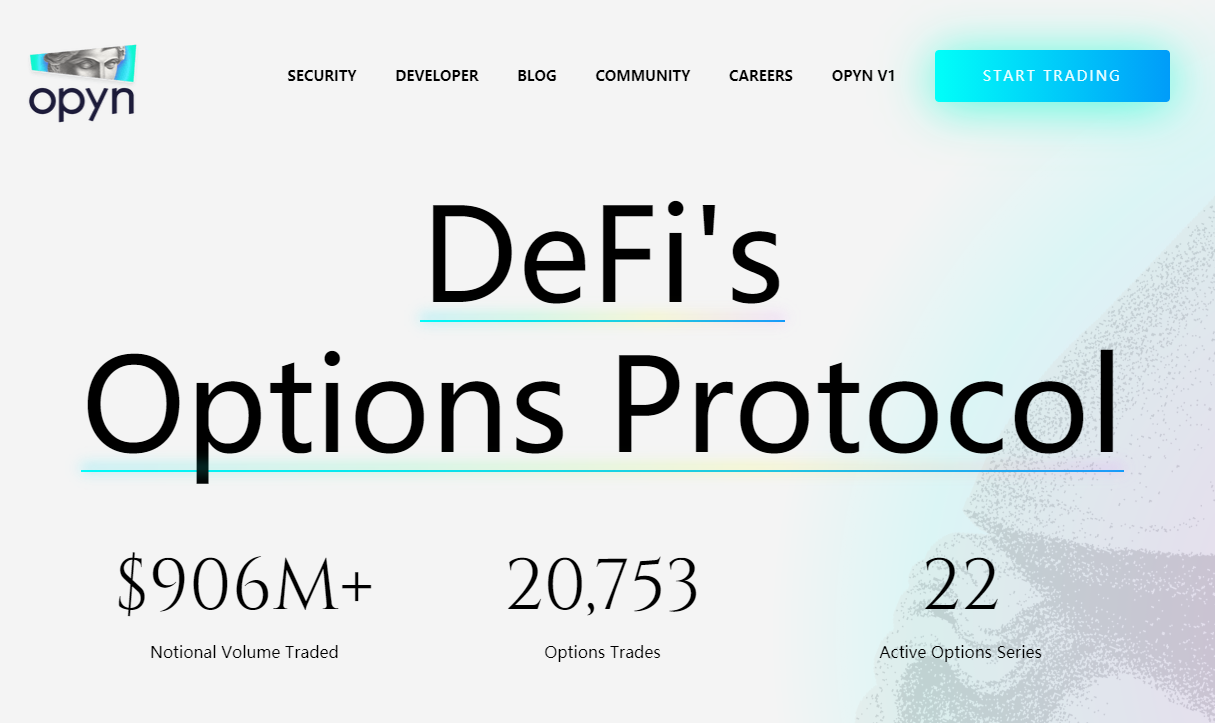

5. Opyn

text

text

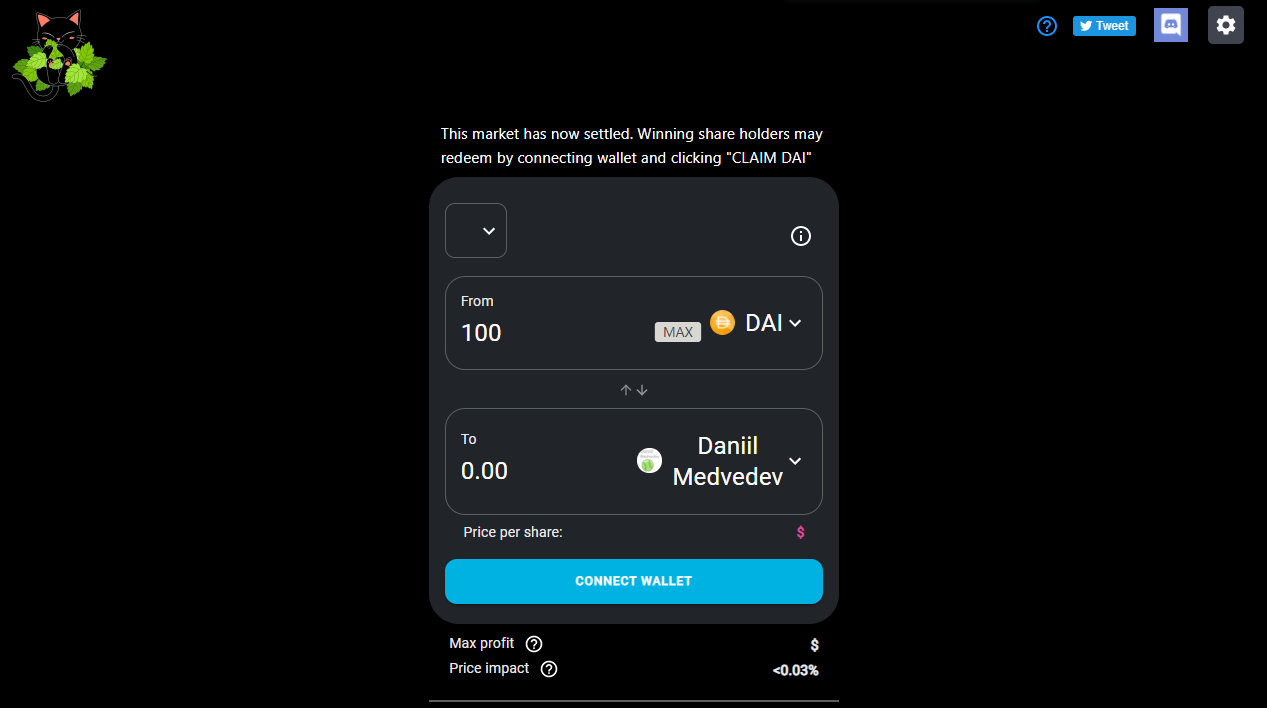

6. Catnip

text

Official website:https://catnip.exchange/

7. Zerion

text

Official website: https://zerion.io/

8. Zapper

Zapper is also a project with very useful scenarios. What they do is decentralized asset management. Simply put, you have assets in MakerDao, Compound, Uniswap, and dydx, but there are too many DeFis. If you have been farming on the farm, what should you do? Zapper is an application that helps you access multiple DeFi protocols with one click and manage them at one time.

text

9. zkSync

Different from the application-oriented products above, zkSync is a zero-knowledge proof protocol, and it is also one of many existing Layer 2 solutions, and it is even a solution favored by many top DeFi investors. Look at their powerful Collaborators and investor lineup (Curve, AAVE, Huobi, Coinbase, Binance), you know what level of project zkSync is.

Official website: https://zksync.io/

In this issue, observers will first introduce 9 projects. In fact, there are many good projects in the market that have not yet issued coins. Some are waiting for the bull-bear cycle to change, some are waiting for the product to mature, and some are waiting for the next round of financing. Of course There are also some that may never issue coins (such as OpenSea?).

We plant a seed and wait for the harvest.

Expectations and dreams are the cornerstones of the DeFi world.