In Washington, Wall Street and Silicon Valley, figuring out where Securities and Exchange Commission (SEC) Chairman Gary Gensler stands on cryptocurrencies has become a guessing game. Crypto industry lobbyists tuned in to his testimony before Congress. Lawyers analyze his speech. The wealth advisors of Goldman Sachs recently boasted in a research report that they had listened to Gary Gensler’s 29 lectures on “Blockchain and Money” taught at the Massachusetts Institute of Technology (MIT) in 2018 for the purpose of writing the report. Hours of public lectures. It's laborious work, but perhaps not so surprising, given that Gensler's course videos have racked up millions of views online, surprising even Gensler himself.

In his first interview on crypto mania, Gensler is signaling to the crypto industry that his deep interest in the subject doesn't mean he subscribes to the hands-off regulation that many crypto enthusiasts would like to see. Policymakers have been grappling with the largely unregulated crypto market, worth more than $1.6 trillion, which has experienced explosive growth and wild price swings.

Gensler is considering a robust oversight mechanism with safeguards at its core for the millions of investors who hold cryptocurrencies in their portfolios. Gensler will speak on cryptocurrencies at the Aspen Security Forum on Tuesday. "While I'm neutral and even interested in the technology -- I've spent three years teaching it (at university) and becoming part of it -- my position on investor protection is Not neutral." "If anyone wants to speculate, that's their choice, but as a country we have a responsibility to protect those investors from fraud."

Gensler has asked Congress to pass a law giving the agency legal authority to regulate cryptocurrency exchanges, but he said the SEC’s powers are already broad. For years, there has been discussion about what types of digital assets fall under the SEC's jurisdiction. Some digital assets like "currency" like Bitcoin are considered "commodities" rather than "securities" by the SEC, but there are thousands of other cryptocurrencies, most of which Gensler considers unregistered securities, subject to compliance. Regulations of the SEC.

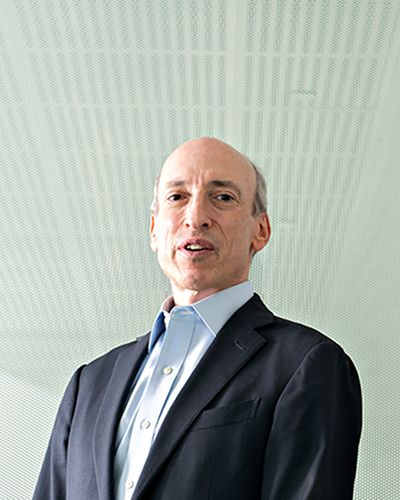

image description

Gary Gensler says regulation can drive new technology

The SEC's Republican commissioner, Hester Peirce, is known for advocating light regulation of digital assets, and she said she was eager to work with Gensler. "A lot of people just want regulatory clarity. My view is that people should have the greatest freedom to voluntarily engage in the transactions they want to have. Society needs to discuss what is the right regulatory framework," she said.

Gensler did not give a timetable for the SEC's action. He has a to-do list that includes 49 non-cryptocurrency policy-related reviews that could slow progress on cryptocurrency regulation. Many were high-profile, time-consuming jobs, like dealing with the GameStop deal frenzy and the collapse of the Archegos family office. The SEC is also working to implement new rules requiring U.S. companies to disclose carbon emissions and other environmental risks, a priority for the Biden administration.

Gensler also declined to comment on the possibility of approving a bitcoin ETF (exchange-traded fund). Many in the cryptocurrency space are eagerly awaiting this decision, as it will provide an easy entry for investors. A bitcoin ETF would invest in the cryptocurrency and then trade its shares on the stock market. The SEC has so far refused to approve such funds, citing concerns about the risks of fraud and manipulation in the bitcoin market. Gensler once expressed positive views on the Bitcoin ETF when he was teaching at MIT, convincing supporters that he is a supporter of the Bitcoin ETF. SEC Commissioner Hester Peirce even said that now is the "time" for the SEC to approve a cryptocurrency ETF.

Behind the scenes, Gensler has urged the agency's staff to consider a range of potential policy changes. He said there are currently at least seven SEC actions looking at different cryptocurrency issues: ICOs (initial coin offerings), trading venues, lending platforms, DeFi, stablecoins, crypto custody, ETFs and other crypto funds. "I have asked the SEC staff to use all of our powers wherever possible," Gensler said.

Gensler said he believes regulating cryptocurrency exchanges may be the easiest way for governments to quickly get a grip on digital asset trading. But he also worries about new ways people are getting into the crypto space, such as peer-to-peer lending on so-called DeFi platforms. Those loans could be subject to SEC oversight if the company advertises a specific interest rate return on a crypto asset, Gensler said. Platforms that aggregate digital assets could be considered similar to mutual funds, potentially allowing the SEC to regulate them.

Gensler served as chairman of the US CFTC (Commodity Futures Trading Commission) during the Obama administration, responsible for implementing federal regulation of the huge derivatives swaps market in the wake of the financial crisis. Patrick McCarty, who teaches a course on cryptocurrencies at Georgetown University School of Law, said Gensler's understanding of digital assets means he will give the industry a "fair hearing," even though he may disappoint many of his supporters. “When crypto enthusiasts say they want legal clarity, they don’t mean it, they want non-regulation,” McCarty said.

Christine Trent Parker, a legal partner at New York law firm Reed Smith who focuses on crypto assets, said that while the SEC's new rules will bring more certainty to the industry, they may also more clearly demarcate market regulation -- CFTC Focus markets related to virtual currencies such as Bitcoin, while the SEC is responsible for most other matters. “Right now, the lines are blurry because we don’t have clear regulation,” Parker said. “If the SEC had a broad framework that included all other digital assets, then there would be this bisected market.” Others argued, New crypto asset developers need some regulatory flexibility to encourage innovation.

Gensler is also a member of the FSOC (Financial Stability Oversight Committee) led by the U.S. Treasury Department and the President's Financial Markets Task Force, which recently held aConference on Stablecoin Impactstable currencystable currencyWhat would happen if the value of the issued dollar assets did not reach the expected level. That could trigger a run on a bank or money market fund, sending investors fleeing in droves. Gensler's point on the panel carries weight because unlike the likes of U.S. Treasury Secretary Janet Yellen or Federal Reserve Chair Jerome Powell, Gensler has real expertise in cryptocurrency regulation. reliability.

Gensler's understanding of blockchain and digital assets comes largely from the years he spent at MIT. In addition to creating courses on cryptocurrencies, he is a frequent participant at industry conferences (sometimes giving 30-50 related talks a year) and interacts with thoughtful thinkers and entrepreneurs. He can cite from memory the writings of Satoshi Nakamoto, Bitcoin's anonymous creator, and knows some of Bitcoin's core developers.

The 63-year-old former Goldman Sachs partner took the unlikely path of becoming one of the U.S. government's foremost cryptocurrency experts. It all started in 2017, when, as chief financial officer of Hillary Clinton's failed presidential campaign, he took on a single job: closing offices, paying final bills, deciding what to do with discarded computers and office supplies. Like many of his overwhelmed former colleagues, Gensler was looking for something to do.

MIT professor and economist Simon Johnson gave Gensler the answer, and he encouraged Gensler to teach at MIT in Cambridge, Massachusetts. Hoping to foster his longstanding interest in the intersection of technology and finance, Gensler jumped at the opportunity.

Although he didn't know much about digital tokens at the time, he connected with members of the school's burgeoning Digital Currency Initiative and even sat in on a crypto-programming class. When he suggested that MIT teach more about finance and digital currencies, he was awarded the job. Little did he know at the time that a few years later, he would have the opportunity to apply his academic research to real life.

"Sometimes life is just a little bit of serendipity," he said.