After 8 years of continuous efforts and exploration, the development of Bitcoin ETF has not slowed down because of the cautious attitude of the SEC. On the contrary, various institutions are striving for the first Bitcoin ETF by improving industry transparency and compliance listing. In February 2021, the Bitcoin ETF of Canadian asset management company Purpose Investments was successfully listed and traded on the Toronto Exchange, making more institutions see hope.

image description

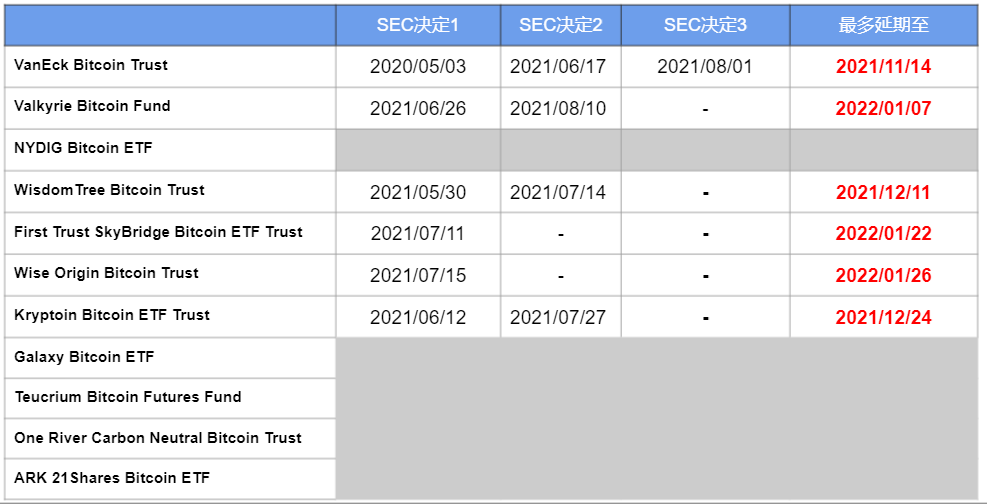

Figure 1. Early US Bitcoin ETF application history Source: Huobi

Longtime ETF investment professional John Hyland (who worked with Bitwise Investments on the first batch of Bitcoin ETF applications) summed up the failure of applications prior to 2019 (see Figure 1) as "a fatal flaw in the application documentation."

For example, both the Winklevoss and VanEck documents propose that they self-custody Bitcoin, which is an obvious security risk. Also, they have a problem with NAV (Net Asset Value) pricing. The Winklevosses are proposing to price it on a single cryptocurrency exchange that accounts for only 3% of global trading volume and which they own. VanEck intends to use OTC quotes.

first level title

"U.S. Cryptocurrency ETF Progress"

image description

Figure 2. ETF timetable for 11 pending approvals in the United States

image description

Figure 3. ETF schedule for 11 pending approvals in the United States

first level title

"Bitcoin Spot-Based ETFs VS Bitcoin Futures-Based ETFs"

From a structural point of view, the ETFs currently submitted to the SEC for approval are mainly divided into ETFs based on Bitcoin spot and ETFs based on Bitcoin futures.

ETFs based on bitcoin spot are designed to reflect the price of bitcoin, and 10 of the 11 ETF applications currently adopt this model. This type of ETF will directly hold Bitcoin and entrust it to a third-party custodian. Normally no cash or cash equivalents will be held.

ETFs based on bitcoin futures are designed to track bitcoin futures prices. For example, Teucrium Bitcoin Futures Fund and VanEck's bitcoin ETF proposal submitted to the SEC in June 2021 adopts this model. This type of ETF mainly invests assets in benchmark futures contracts and cash and cash equivalents, such as short-term treasury bills, money market funds, demand deposit accounts and commercial paper.

secondary title

More popular with issuers:

Spot is not necessarily more stable than futures, because BTC prices fluctuate greatly, while futures have a fixed contract period;

secondary title

More Likely to Receive Regulatory Approval:

With the increase of Bitcoin derivatives regulated by the U.S. Commodity Futures Trading Commission (CFTC), it will bring a lot of liquidity to the encrypted digital currency financial market to a certain extent, thereby further dispelling the SEC's doubts about its legal compliance;

secondary title

More popular in the market:

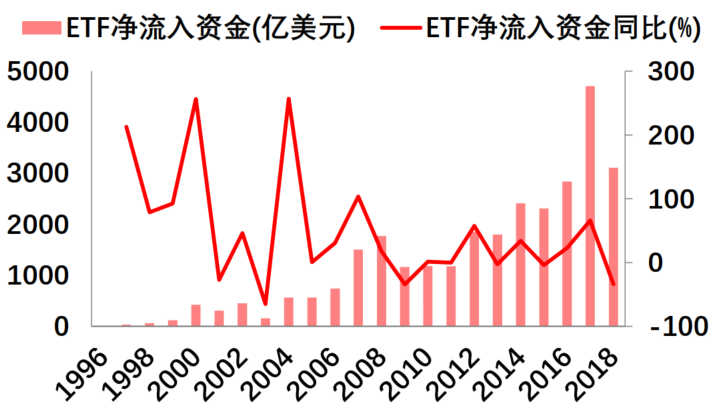

image description

secondary title

But the risks are also greater:

It is necessary to bear the risks of investing in ETFs and the related risks of futures funds at the same time. In addition to market risks, certain operational risks and replication hedging cost risks must also be considered. According to Zou Chuanwei, Chief Economist of Wanxiang Blockchain:

The risk that Bitcoin futures deviate from the spot price. Such as the risk of Rollover after the expiration of Bitcoin futures.

Investing in financial products with low risk and high liquidity may face market risk, credit risk and liquidity risk.

The risk of poor leverage ratio control.

first level title

"Regulatory Attitude"

Since 2017, the SEC has repeatedly rejected applications for Bitcoin ETFs.

The SEC's main concern is that Bitcoin's price is vulnerable to market manipulation. Even if a Bitcoin ETF only gets its price from the most compliant cryptocurrency exchanges, the price of Bitcoin can be manipulated on less reputable exchanges with less restrictive restrictions. And the SEC doesn't have the authority to regulate these exchanges because bitcoin and other widely traded tokens are not securities. The U.S. Commodity Futures Trading Commission (CFTC) also has no corresponding power to regulate.

In addition, the SEC believes that the encryption market lacks transparency and there are potential illiquidity problems. This all means there are risks in terms of investor protection, with no rules or regulations in place to prevent fraud, manipulation and other abuses.

And those who believe that the new SEC chairman Gary Gensler should approve ETFs believe that the size of the encryption market has grown to the point where it is difficult to manipulate. The listing of Bitcoin futures plays a role in price discovery and is traded on exchanges regulated by the CFTC. For the SEC, the two aforementioned developments are helpful, but not enough. The best-case scenario is for a Bitcoin ETF to be approved after Congress tightens its regulations on cryptocurrencies, but the likelihood of that happening in the near future is low.

Gary Gensler is very knowledgeable about cryptocurrencies and has taught courses on them. This may help the SEC to formulate sensible regulatory measures to further regulate the development of the cryptocurrency industry in the future. In the future, if the SEC approves a Bitcoin ETF, it will send a clear signal to traditional investors who have refused to accept it for many years, and Bitcoin has taken another important step towards a legal investment.

This article is from: IDEG (WeChat ID: IDEG_Research), reproduced with authorization