Compilation: Injective, Perpetual Protocol, dYdX

The full video link of this roundtable: https://www.youtube.com/watch?v=I7Y7fNrMczU

This article has edited and summarized the content of the round table, and the following is an excerpt of the content:

The four founders all believe that in the next 5 to 10 years, the trading volume will gradually shift from CEX to DEX, which has become a major trend;

The Perpetual Protocol V2 version has made several optimizations: aggregate liquidity mechanism, allow permissionless market creation, improve user usability, and provide a more complete margin mechanism;

dYdX is committed to building a CEX-like user experience, supports multiple advanced order types, and cooperates with Starkware to integrate into its perpetual contract products to achieve speed improvements. In terms of market diversification, a new contract market will be added every week;

The next stage of Injective will launch delivery contracts on the main network. Delivery contracts are not common in the current DEX field. We hope to introduce and promote more usage scenarios of delivery contracts;

Vega will launch the main network in the next three months. On the one hand, it is currently conducting comprehensive tests according to the progress of the protocol itself, and on the other hand, it is effectively making the PoS network operate safely;

In the Layer-2 expansion plan, Perpetual Protocol V1 uses xDai (side chain), and V2 will establish a perpetual contract on Arbitrum; dYdX cooperates with StarkWare to improve security and privacy through zero-knowledge proof; Injective and Vega are relatively close, All use the Cosmos SDK to build their own customized side chains based on the Tendermint consensus mechanism;

In terms of user growth, community operation is the key. It is necessary to synchronize progress with the community in a timely manner, and iterate products based on user feedback, establish in-depth communication with users and solve various questions; at the same time, create incentives for participants to help increase participation degree and long-term user retention;

secondary title

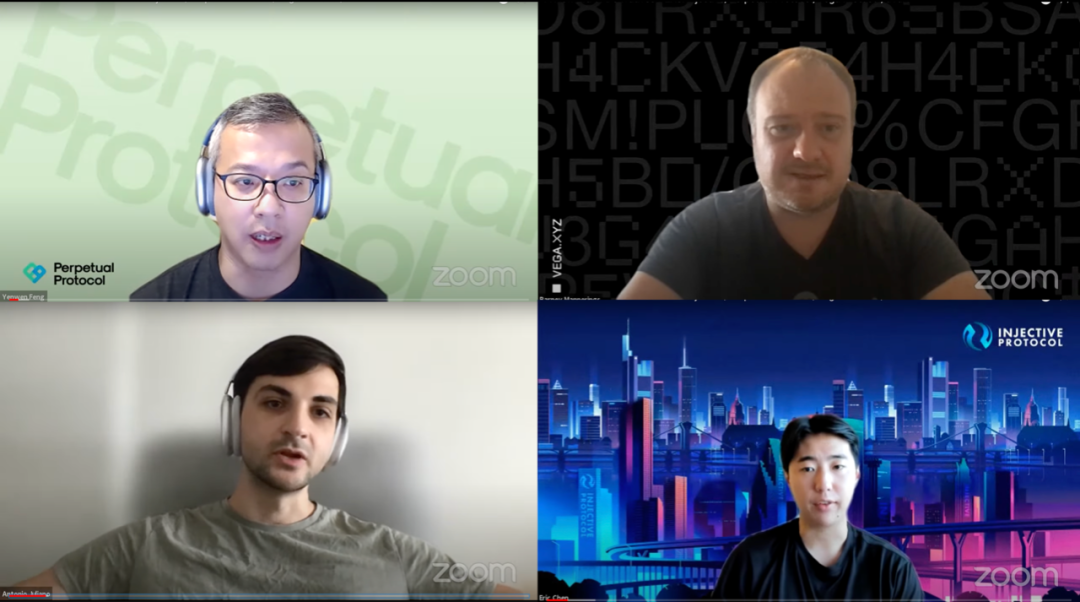

Star-studded guest panel

Yenwen,Co-founder of Perpetual Protocol

Barney,Co-founder of Vega Protocol

Antonio,Founder of dYdX

Eric,Co-founder of Injective Protocol

Yenwen (Perpetual): Hello everyone, I am Yenwen, the co-founder of Perpetual Protocol, a decentralized perpetual contract platform using vAMM. It has been in operation for more than 7 months now and has performed well in terms of transactions. Interested partners are welcome to experience (Perp.fi), thank you.

Barney (Vega): Hi everyone, I'm Barney, co-founder of Vega Protocol. Vega is a derivatives protocol that mixes Layer-1 and Layer-2, and it runs on its own blockchain network for high-performance derivatives and other transactions. It was designed with real-world use cases in mind. Since the beginning of 2020, we have released the testnet and will launch the mainnet in the next 3 months. If you're interested in getting involved (vega.xyz), follow us on our discord and Twitter.

Antonio (dYdX): Hi, I'm Antonio, the founder of dYdX. It has been about four years since the project was born, and it is currently focusing on perpetual contract transactions, providing up to 25 times leverage. We use an order book instead of an AMM, which is different from the design choices of Perpetual and some other DEXs, but we do this to improve performance and include more advanced trading functions. We are currently working with StarkWare to integrate Layer-2 extension technology, built on On top of ZK-rollup.

Eric (Injective): Hello everyone, I am Eric, the CEO and co-founder of Injective Labs. Before founding Injective, I was doing strategy trading and cryptography research at a hedge fund. Injective Labs began to conduct research around Verifiable Delay Functions (VDF) as early as 2018, and focused on using Verifiable Delay Functions to solve the problem of frontrunning transactions, which later evolved into exploring consensus mechanism design and scaling solutions for transaction-related things solutions, and provide services in perpetual contracts, futures and trading platform infrastructure.

Classic opening question, DEX VS CEX

Hannah (Injective): The centralized trading platform in the industry has been occupied by several giants. On the other hand, there are also many new decentralized platforms emerging. So what do you think will be the pattern and final form of the future trading platform of the encrypted asset industry?

Antonio (dYdX): I think CEX and DEX have coexisted, and in terms of transaction volume, obviously CEX is still much larger than DEX in most cases. But over time, more and more trading volume will be transferred from CEX to DEX. Many people in the industry are very keen to discuss what the end state of things will be, but personally, I think that within a certain time frame, most transactions will choose to be on DEX instead of CEX. I'm sure those of you here today probably agree with that. DEX can provide more advanced encrypted financial products; it is safer and more transparent, and users can master their own private keys; they do not need to trust third-party intermediaries, because the smart contract codes are open source and can be viewed at any time. It is built in the direction of complete decentralization.

I think in a five to ten year time frame, most of the trading volume will move to DEX. But before that, there are many hurdles to overcome. From a technical point of view, DEXs, especially derivative DEXs, are fundamentally quite complex. But I think all the teams out there and others have improved a lot, especially over the last year or so. Building a two-sided marketplace from scratch is always a bit difficult. But I think there are a lot of good people working on this right now, and I expect that to change a lot in the next few years.

Barney (Vega): Yes, I agree with Antonio. I think the future of decentralized exchange protocols, infrastructure, will be open: open source, driven by the community, free for people to use, a way for more interaction and innovation. So I think over time we will gradually overcome the barriers. We're going to see more and more trading volume moving to DEXs in the 5-year, 10-year horizon. But I think there will always be room for CEXs in certain niche markets. It may be a very important group of institutional players in an industry, or it may be a regulatory reason in some jurisdictions, so CEX will still exist and be relatively easy to create.

Yenwen (Perpetual): Yes, I agree with Barney, I don’t think CEX will disappear, Binance and FTX have been doing very well, but they may try to change their operating model, and they may also cooperate with decentralized protocols to integrate.

secondary title

Sharing of the latest progress of various DEXs

Hannah (Injective): Thank you all! There will be separate questions for each guest below. Yenwen, congratulations on the recent release of the Perpetual Protocol V2 Curie, can you explain how the vAMM transaction model works and what are the main differences between V1 and V2?

Yenwen (Perpetual): Perpetual Protocol is a decentralized perpetual contract protocol based on virtual AMM (vAMM). We are the first to introduce the concept of vAMM, that is, virtual assets are minted through smart contracts and placed in the Uniswap pool to provide liquidity. It has been working fine for the past few months. Now we have a new version V2, here we will focus on three features. One is liquidity aggregation. Our V1 version uses the AMM model of X*Y=K of Uniswap V2, and the capital efficiency is not particularly high. But in the V2 version, we use Uniswap V3 as the transaction engine, which can effectively improve capital efficiency. The second feature we want to introduce is permissionless marketplace creation. The old version needs to vote in the "governance" section to create a new market, such as the new UNI market or CRV market, but in the new version we consider releasing this restriction so that everyone can freely create the market, which will is a very cool feature. The third feature is its trading performance. Due to the performance of Layer-1 of Ethereum, the old version is not good enough in terms of user usability, so the new version will be built based on Layer-2 of Arbitrum, which will greatly improve transaction performance. Another improvement is that we will provide a more complete margin mechanism, such as accepting multiple currencies (such as wBTC or other ERC-20 tokens) as collateral, and using cross margin.

Hannah (Injective): Thanks for the introduction. So Antonio, I am very happy to see that the total trading volume of the dYdX Layer-2 version of the perpetual contract has exceeded 3 billion US dollars. What do you think are the primary needs and expectations of users? Which needs will you prioritize at this stage?

Antonio (dYdX): As crypto traders grow, we are also targeting more types of professional consumers. The growth strategy we have been trying to execute is to move more traders from centralized derivatives trading platforms like Binance, FTX to DEX. The team has been working hard to build a better user experience over the past year. Our goal is to match the centralized trading experience and support more advanced order types such as limit orders, stop orders, trailing stop orders, etc. . StarkWare is able to achieve zero-latency transactions, so it feels as fast as transactions in a centralized environment. As far as the types of products that users are currently trading in the derivatives field, most users still prefer perpetual contracts. The trading volume of perpetual contracts is about a hundred times the sum of all other types of encrypted derivatives. Therefore, it is necessary for the platform to focus on supporting perpetual contracts. Another thing we've been looking at is launching diverse marketplaces, we've launched about 25 marketplaces and adding a new one every week. Another subtle but very important thing is to support cross-margin, thereby improving capital efficiency, which is also valued by market makers. Next we will continue to iterate.

Hannah (Injective): Eric, Injective has been working on the development of the mainnet before, and with the launch of the initial spot market, the community participation is also increasing, which is really exciting. Can you introduce the next step of the roadmap, as well as the plan for perpetual contracts and delivery contracts?

Eric (Injective): The next step for Injective is to unlock derivatives such as perpetual contracts and delivery contracts, and conduct extensive testing, and will also integrate with multiple oracles. Delivery contracts are not common in the current DEX field. We hope to introduce and promote more usage scenarios of delivery contracts, for example, tokenizing them and turning them into exportable positions that can be traded elsewhere. It's also something we're very much looking forward to the community exploring and utilizing. After that, we will soon see the release of the third phase of the main network canonical chain, there will be no transaction restrictions at that time, and it can be used in a large number of new markets with mature governance capabilities.

Hannah (Injective): Barney, Vega has been working on the development of the mainnet and recently launched an incentivized testnet, can you share more information and future plans with us?

Barney (Vega): Of course, we're doing two things at the same time. The first thing is to conduct a comprehensive test according to the progress of the protocol itself, from an economic perspective, a risk perspective, a transaction perspective, capital efficiency and other aspects, and this is the work of the incentive testnet. The second thing is to effectively make the PoS network operate normally and safely. At the same time we collaborate with influential people in the field, build things with the community, develop in incentive testing. Functions such as liquidity agreements, market creation, leverage functions, and margin control functions are all completely decentralized. At the same time, in the test network, users can attack at will without worrying about financial risks.

secondary title

Comparison of expansion plans

Hannah (Injective): Each company has its own expansion plan for Layer-2, so what are your plans?

Yenwen (Perpetual): We are currently using the most common solution. For example, the current version uses xDai, a sidechain solution. The new version will be based on Arbitrum, so we hope that more projects will choose Arbitrum , so that they can be deeply integrated with each other. We did not build a customized Layer-2 solution like Injective and Vega, so this is also a kind of"tradeoff"Bar.

Eric (Injective): For Injective, we build on top of Cosmos and create many different interesting modules on top of our infrastructure to allow for maximum compatibility while also focusing on efficiency and transaction speed. One of the things that really surprised us while running the Solstice testnet was the number of participating users and the amount of bandwidth required to run the entire protocol. So, during the testnet phase, we saw almost 10,000 new users transacting every month. So we had to transform the EVM module so that we moved from the derivative layer of EVM (smart contract based architecture) to Cosmos based architecture. So for now, the main components of Injective include the transaction and derivatives module, which is used to execute the settlement of the transaction and the matching of the entire agreement. We also use the Frequent Batch Auctions (FBA) model as a matching mechanism to eliminate transaction collisions and front-running issues; the Soft Cancel function is especially friendly to market makers. What's more, we also reserve a module for any kind of generalized scaling solution for any Ethereum dApps and DeFi protocols for compatible composability with derivatives and DEX layers. Having said that, what really stands out about the product is that it is a dedicated application for derivatives and order book trading. Injective is specially tailored for trading platforms and derivatives market transactions, and future scalability and upgrades will revolve around the settlement of this infrastructure and derivatives. From the perspective of mass users, a very cool thing is that there is no gas fee for transactions on Injective. Another cool thing is that we can use Cosmos IBC, which means secure data and asset transfer between Cosmos-based products, and we are now integrating with Band Protocol through the IBC layer.

Antonio (dYdX): dYdX is based on Ethereum's Layer-2, and in cooperation with StarkWare, StarkWare has launched a new scaling technology called ZK (zero-knowledge) Rollups. The way ZK Rollups work is that there are some calculations you want to do, for example, all the transactions you may want to execute on dYdX, this involves zero-knowledge proofs, which can prove that all transactions in the batch of transactions you want to execute are Valid; e.g. maybe all accounts have collateral after this batch of transactions, maybe all transactions have valid signatures, etc. Because zero-knowledge proofs are all done off-chain, it means you can only put this very small proof object on the chain you build. This is where scalability comes in. The scalability built on StarkWare is super strong, better than Optimistic Rollups, and it can provide fast transactions, which is very important from the perspective of user experience. At the same time, the maximum degree of decentralization is maintained, because the zero-knowledge launch effectively inherits all the decentralization and security guarantees of Ethereum itself, kind of like this new cryptography built on top. That's why we partnered with StarkWare, we've been running on StarkWare for about four or five months and continue to build new features on top of that.

Barney (Vega): Yeah, very interesting because I think there are a lot of similar designs that everyone has in terms of scaling. Like Injective, we came to the same conclusion that in order to scale and optimize derivatives trading, it is indeed necessary to build a targeted derivatives trading optimization system. I used to work in traditional finance, building trading platforms. There are many cases where you don't use off-the-shelf, say, web frameworks or application environments, you really build highly optimized infrastructure for those. This is what we've been doing since day one. We also use Cosmos to build, based on the Tendermint consensus mechanism. When we started building Vega, the Cosmos SDK was still small and had fewer components. So we built something like a cross-chain bridge from scratch ourselves, which gave us some first-mover advantage, but obviously took more time.

secondary title

About Product Types and Marketplace Creation

Hannah (Injective): Antonio, can you tell us a little about the marketplace creation process? Do you plan to focus on perpetual contracts or expand to other types?

Antonio (dYdX): Right now, probably until at least next year, we're focusing on perpetual contracts because it's really driven by market forces and consumer demand. The trading volume of perpetual contracts is about 100 times that of other derivatives combined, but I don't think this will last forever. The obvious growth of option trading volume can be seen from the option market promoted by companies such as Deribit and FTX . I think maybe like most people in this group, I hope that dYdX is not just a trading platform for derivatives perpetual contracts, but a place where users can trade various financial products, especially derivatives, but currently Focus on perpetual contracts for now. As far as our market for perpetual contracts is concerned, it is mainly concentrated in the top 10 to 20 currencies, and prefers the DeFi category, because most users using dYdX are also DeFi enthusiasts. So far, Bitcoin's transaction volume accounts for about half, and some long-tail markets will be considered in the future.

Hannah (Injective): Injective allows users to access any market on a customized protocol for cross-chain derivatives transactions, which means users can create any market. Eric, can you explain in detail how the marketplace is created on Injective and the proposal governance process?

Eric (Injective): The governance module of Injective is very flexible. The parameters of perpetual contracts and other types of derivatives at the protocol level are all customizable. Basically, users or market traders can use any method they see fit Specify parameters. Injective Labs built a graphical interface to really turn this into a community-driven one and really democratize the process of creating derivatives markets. We have actually launched a large number of different types of derivatives during the testnet period, such as Yield-Farming derivatives, delivery contracts, stock futures, and synthetic assets. So over time, as Injective evolves towards a more professionally institutionalized direction, we hope users will really explore and take advantage of that. Another very interesting part is that in our governance module, no one has exclusive governance authority, as long as the required amount of deposits reaches the quorum, proposals can be made, and basically any type of governance vote requires the active participation of key stakeholders participate.

Hannah (Injective): Vega has designed an automated process for creating markets and margin trading, which means that potential users can start any market, can you tell us how to create a market on the Vega protocol and how it is governed?

Barney (Vega): Yes, this functionality is a core part of the Vega protocol. Our point of view is similar to Eric's: we are building infrastructure around trading and derivatives. And, one of the keys to building infrastructure is that you need to make sure that the people who use the infrastructure get something useful. For example, in the case of Ethereum, people are able to create their own tokens and build large projects out of them and have full control over them, enabling a huge ecosystem of projects that can become profitable in their own right, or, sustain economically. Our thinking is similar. For example, launching a trading market with a high market demand on Vega, and those who launch these markets and provide liquidity will actually get more returns from the agreement. So I think there really should be a growth engine built into the protocol, which would be a classic case of marketing hype.

We took the proposal and the governance approach, and if you look at Uniswap now, assuming you know the addresses, it's possible to create a market between two tokens. But even then, we’ve seen people create some sort of fraudulent token and try to scam people. Similarly, the problem that can arise with derivatives is that the average person may not be able to know whether an oracle is providing the correct price. So our conclusion is that until we find or have a way to actually generate confidence in the oracle, this is really necessary to use governance to ratify the market. Therefore, token holder governance will allow some degree of fraud checking of the market and at the same time check the parameters. The community has a role to play in ensuring that a sensible market is created and able to adjust these parameters later to make it work well.

In the first version of Vega, MVP, we had cash-settled futures contracts, and users made proposals and provided all the parameters for the futures contracts themselves. The future model may be the opposite of how it works now. Users building a transaction system on a smart contract platform is actually like building a smart contract execution platform in a transaction, so some modules will be programmable. Users can effectively design products based on cash flow, whether it is an auction or a perpetual contract, or any other aspect that can design and offer a customized product. Of course, users need to provide parameters and risk model information. Again, this is just JSON data. This is very easy to do if the user has good data, submits it to the system and eventually passes the token holder voting target.

The result of voting is basically that you submit it, get a certain percentage of yes votes, and the market for the submission will be created. This is something anyone who has dealt with order books and traditional trading platforms will see, in fact, when they open each morning, use auctions to set prices instead of going straight into real-time continuous trading mode. We use it to set the initial price when the market opens, and then the market enters the trade and proceeds as usual. That's how the whole process works. As I said, it's about empowering the community to create whatever is in demand and build some sort of success story.

Hannah (Injective): Yenwen, some of our participants today are building order book based DEXs, while Perpetual focuses on vAMM mechanism DEX, can you share more information about vAMM?

secondary title

What about user growth?

Hannah (Injective): Next question, throughout the explosive growth of DeFi protocols, we have seen many projects fail quickly. However, today each project has a sizable community that grows every day. What growth strategies have you adopted so far and how do you intend to facilitate future growth?

Yenwen (Perpetual): We were actually lucky that some community members got involved in the project before the Yield Farming craze, so we have been with us for a long time from the very beginning to now, and these early community members have been giving advice Help us grow. From the perspective of the community, I think they want to see the iteration of the product and the progress of the project, so we have a channel that will release updates related to the project and product every week, keep it open and transparent to the community, and bring everyone together Communicate and discuss together.

Barney (Vega): I agree with what Yenwen mentioned, early users who have a deep understanding of the project are very important. We are mainly three points in the maintenance and growth of the community. The first point is to establish in-depth communication. We have seen this in many communities. There will be research-based discussions and outputs. We not only research, but also cooperate with other projects or VCs to publish research reports and participate in online meeting, it's very important. And interact with VCs and KOLs on Twitter to promote and maintain communication with the encryption community and users. The second point is to be transparent to the community and increase community participation. If you share what you're doing with the community and actively engage and help community members with their questions, they'll start liking you, trusting you, and reaching out to those around them and getting them involved. The third point is that you need to provide incentives to the community, not only let them use Vega according to their interests, but also motivate them to get what they want, whether it is a bounty or the corresponding rewards they can get in the future, let them know What can be gained from the community, which helps to keep users in the long-term.

Antonio (dYdX): Our biggest concern has always been to come up with the best products. We have gone through many product iterations, from lending agreements, to margin trading, to spot trading, and now focusing on perpetual contracts. Feedback from users is very important to product development, and this is how many tech companies grow. From launching a product, to finding the market, having some early users, and then constantly iterating. I think being able to keep updating and iterating is what keeps growth going.

secondary title

other discussions

Hannah (Injective): Antonio, can you explain how zero-knowledge proofs are used in StarkWare solutions?

Antonio (dYdX): Zero-knowledge proofs are a way to transform any type of computation by just putting a very small proof on-chain, doing the work off-chain and verifying that it happened on-chain. Our partner StarkWare's approach is: there is a batch of transactions, maybe liquidation, deposits, withdrawals, etc., and we will batch these operations every eight hours and submit them to the blockchain. Basically we don't commit the entire long list of transactions to the blockchain because it would be very expensive, so what we do is we run a zero-knowledge proof that all of them are valid. And then all we get out of it is this very small constant size data object, and the data object is the only thing on the blockchain. This means it doesn't matter how many transactions there are in the batch, it could be a thousand, it could be a million, but the Proof Size is always the same. This is the core innovation of Zero-Knowledge Proofs and ZK Rollups and where all the scalability comes from, because we effectively just put the proof and ordering of all changed data on the blockchain, rather than individual transaction data, which allows The scalability is about 100 times higher than the previous Layer-1 version.

Hannah (Injective): Eric, considering the interoperability of Injective, can you tell us about the cross-chain plan? Such as crossing to BSC or Polygon. I know that Injective is built using the Cosmos SDK, so what role does this play in achieving the cross-chain goal?

Eric (Injective): Injective intends to use IBC from the very beginning, so this means that for any type of IBC-compatible public chain, it is easy to perform cross-chain operations and transfer data and assets in a seamless manner . And I think there are many creative ways to use IBC to ensure that any type of data is transferred and transferred between different types of modules to enhance composability. In terms of integrating with other popular chains such as BSC and Polygon, especially Polygon, there is a very interesting story behind it, my co-founder Albert went to India for a few months, actually to integrate with the then Matic (Polygon former name) for integration. So we have a very strong belief in integrating with Polygon and building this unique ecosystem of products on top of Polygon. Obviously, their founder, Sandeep, is a good friend of ours, so look forward to cross-chain cooperation with Polygon soon. As far as BSC is concerned, given our relationship with Binance, and BSC itself is EVM compatible, this allows us to deploy some kind of bridge contract very easily, so as to achieve seamless asset transfer. Therefore, Injective Labs tries to create a set of cross-chain tools and ecosystems, and include them in governance, so that users can decide which cross-chain bridges should be included in the ecosystem, and let the community decide the integration order of public chains and way.

Hannah (Injective): Barney, Vega's mission is to create a decentralized trading infrastructure that allows professional institutions to enter the decentralized trading market, but at the same time DEX also has many challenges, such as front-running transactions. I know Vega is working on a solution to these issues, can you share more with us?

Barney (Vega): What we're addressing is the trade-off between order book and its transaction performance, and identifying good prices, avoiding things like impermanent losses. In the AMM model, they have the ability to obtain liquidity and provide liquidity for potentially smaller markets and early-stage projects. It is very interesting that our solution to this may be a combination of the two. For example, Uniswap is gradually moving from the V2 AMM model to the V3 similar to the order book. And we may start from the order book and gradually develop in a direction similar to AMM. For example, we will allow hybrid order books to provide range liquidity to order books without having to place limit orders on the order book. The protocol then allocates the order, either to the order book or to the liquidity pool, depending on which type will give the best price at that point in time. This guides the market and provides liquidity in one platform. In general, there is no active pricing without active traders. But it allows the market to become very liquid with intense competition. Therefore, we believe that this hybrid form can achieve the best of both worlds, allowing the market to automatically determine how much liquidity is in the order book and how much liquidity is in the AMM. This will be the future.

Hannah (Injective): Yenwen, please briefly introduce the process of liquidating positions on the Perpetual Protocol, and what mechanisms have you integrated to achieve liquidation?

secondary title

Finally, cooperation or competition?

Hannah (Injective): Last question, many people think that trading platforms are inherently competitive with each other. However, decentralized derivatives trading platforms occupy a market full of opportunity. Do you guys think each of you will define your own niche or work together in some way over time?

Eric (Injective): I think this industry is developing very fast, the overall market is large enough, each company can find its own position, each platform has its own position and purpose, for example, we are a foundation that can be used to build DEX facility. Therefore, I think each platform will form unique competitiveness in the future. Everyone has their own take on the trading platform model, the product model, and the derivatives model, so I think there are a lot of opportunities for us to collaborate and work on more interesting things. Another interesting thing is that we are exploring cross-margining, which also makes the cooperation between our derivatives protocols more and more important over time.

Antonio (dYdX): I think it is definitely more cooperative. One of the reasons is that this is a very new industry, and the expansion of DEX is our common goal. The openness of the DeFi field and the exploration and development of different technologies give us many opportunities for cooperation, so that new ideas can emerge continuously. I think that's one of the really exciting things about the space, is that there's so much going on, and we're really excited about the many innovations happening in the industry and ready to build on that in a collaborative way.

Barney (Vega): I agree with what everyone said, I think cooperation is more valuable, making the cake bigger and creating value for everyone is our common goal. But at the same time there will be some healthy competition, each protocol will make different trade-offs, each transaction and each market will require different things. Therefore, there will not be a situation where a certain platform can occupy all the market share. In fact, if you need better compatibility, you'll choose a protocol that makes compatibility the easiest, fastest and best. If you need performance, you will choose a product with other features. So I think we will all find a niche market in the right field, cooperate with each other, and let users get greater value. In fact, we are all competing with CEX and traditional finance. We share the same vision and hope that the entire industry will be fairer and more open.

Yenwen (Perpetual): Yes, I totally agree with you. One thing I want to add is that Eric and Albert (Note: Both are Injective's Lianchuang) are actually the first batch of people who saw our Perpetual white paper People, so we're already collaborating in some way. This industry is huge, and we are destined to fight side by side in the market!

Hannah (Injective): Thank you for your participation, I am very happy to see what you have achieved so far, and look forward to your future performance!