Note: AXIE is currently the most successful NFT game project. This article explains how asset pricing on the chain and user behavior balance each other. The authors of this article are Joel John and JX, who contributed more.

Hey,

Today's article was written in collaboration with JX. He previously handled venture capital at Distributed Markets and Binance. Follow him on Twitter for incredible alpha investment opportunities.

Axie Infinity has been a hot topic lately. I wrote about them in December 2020. If you want a quick overview of them, I highly recommend reading this article by Packy. The game has actually changed the perception of blockchain-based businesses for a number of reasons. First, they are one of the few games with mass-market appeal in emerging economies. While NBA TOP SHOT and Sorare focused on sports, Sky Mavis, the parent company behind AxieInfinity, created a whole new theme in the gaming market. Some people call it PLAY TO EARN. A few others called in via GameFi - showing the idea that gaming and finance can converge. In today’s article, we’ll take a look at how Axie Infinity’s token economy is structured, what new players can expect to earn, and how it compares to the earnings of the world’s largest economies today.

Before I start, I want to explain some terms used in this article for readers who may not know Axie Infinity

1. Axie Infinity - the game we're talking about

2. Axie NFTs - Characters used in the games mentioned above

3. SLP and AXS - two tokens used in Axie Infinity to incentivize and charge users.

With that out of the way, let's dig into how the game's economy is structured.

secondary title

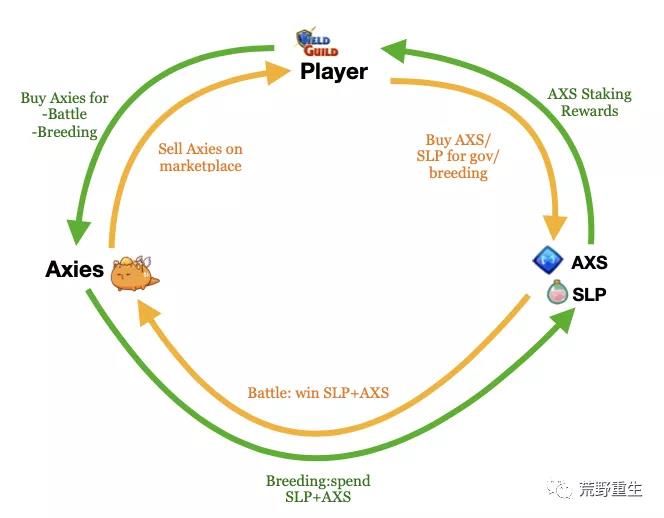

Inner loop on Axie Infinity

secondary title

money making opportunity

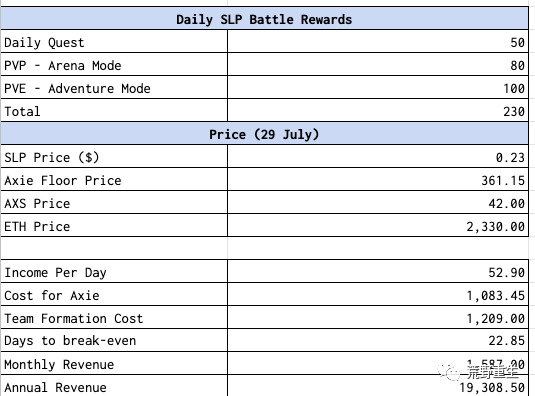

To estimate how much a user could earn from Axie Infinity, we explored what the rewards for each feature look like. The game has a daily event open to anyone with 3 native NFTs called "Daily Missions". These give users 50 SLP tokens. These are fixed rewards given out daily to keep users engaged and coming back. Once this is done, the user is ready to play in the game environment. This rewards users with 1 to 20 SLP, capped at 100 SLP tokens per day. In our model, it is assumed that players can generate these 100 SLP tokens simply by playing the game. The endgame mode of the game allows users to play against each other and generate between 1 and 12 SLP tokens per game. Players who rank higher in Axie will be able to generate more SLP tokens per game. At the protocol level, we take an average of 8 SLPs and assume that a player can play 10 games against other players in a given day. This will amount to 80 SLP tokens. A breakdown of the benefits and costs involved is shown below.

In the calculations above, we considered the cost of participating in Axie Infinity as a game. Currently, at least 3 Axie NFTs are required to start the game. Each one requires at least $361 to start playing, so players need to spend $1083 to start playing. Forming a team requires 3 Axie tokens, so we add that to that sum to get 1209. This is the least that players can expect to spend when they start playing the game. But how will that translate into revenue?

Given that there is a free market for SLP tokens, we can consider that users can sell their tokens to generate income. Let's say the 230 SLP that a user can sell per day is worth $52.9 today. Therefore, users who spend time on Axieinfinity can earn about $1600 per month from the game. However, if everyone keeps selling their generated SLP tokens, it could collapse over a long period of time. At this time, the breeding scene plays a balancing role in the game.

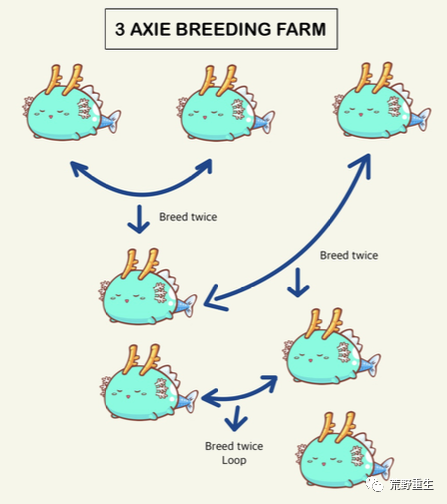

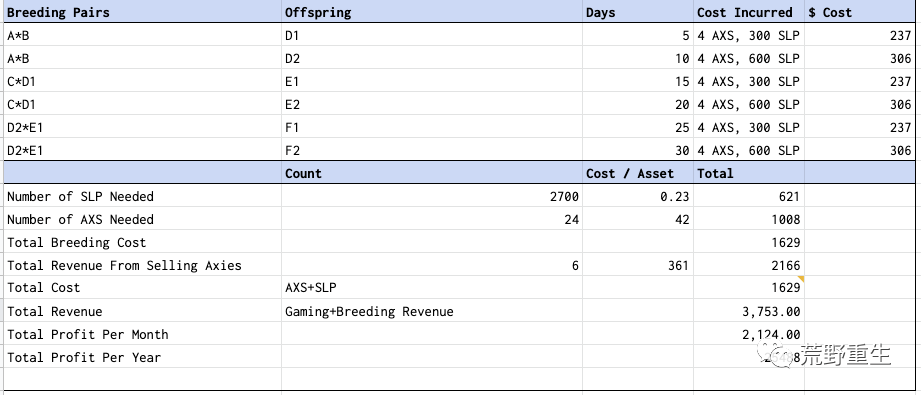

Breeding... as the word explains it - involves using two existing NFTs to create a third. A single Axie can breed 7 times, but each breeding cycle will increase the cost of breeding. The game's design prohibits users from breeding siblings, and parent NFTs cannot breed with their offspring. AXIE takes five days to mature. In general, users have no reason to sell an Axie on the free market until the cost of its reproduction exceeds the income it can generate. For context, the first round of breeding a pair might cost about $25, but the seventh round might cost $500 in SLP tokens. Interestingly, JX found a strategy to continue breeding Axie NFTs without incurring high costs. He named it the breeding tree. In each case, you use a third AXIE for breeding to avoid cost escalation. Once an Axie has bred twice, it can be sold to accumulate capital.

secondary title

economic life cycle

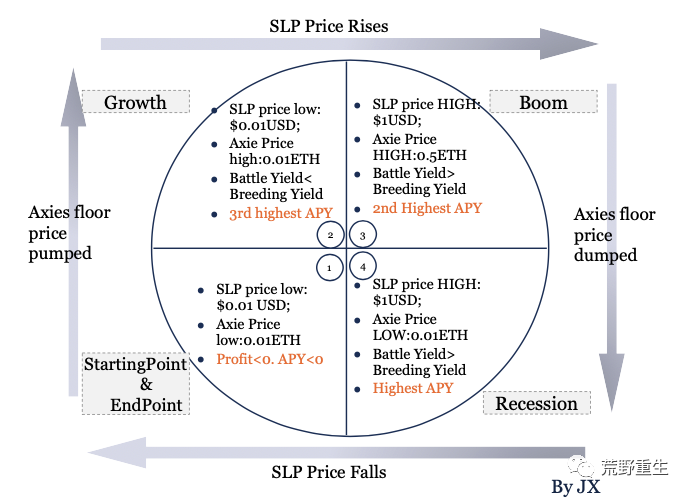

The chart above is very similar to the Merrill Lynch investment clock. The game's internal economic cycle behaves somewhat similarly across the four phases

Phase 1 -> Phase 2

The game has just been launched, and there are very few internal economic players. Asset prices remained low, but there was an initial uptick as early adopters bought AXS tokens and Axie NFTs to get in the game.

Phase 2 -> Phase 3

Early players of the game started competing with each other and started buying more AXS and NFTs to compete fiercely. This fundamentally increases the demand for the underlying asset. Rumors of the project's success were widely circulated.

Phase 3 -> Phase 4

The game has now entered mainstream media attention. Journalists describe Axie as the future of work and the underlying asset's trend toward bubble territory. The cost for new players to start playing the game is prohibitively high. A lot of money was used to start a large-scale breeding business, setting a temporary higher floor price for NFT. But the supply of NFTs increased, driving down prices.

Phase 4 -> Phase 1

Players who only play for business purposes are starting to drop out of the game entirely due to the low return on investment. This brings the price back to a level where new players who really enjoy using the product can re-enter.

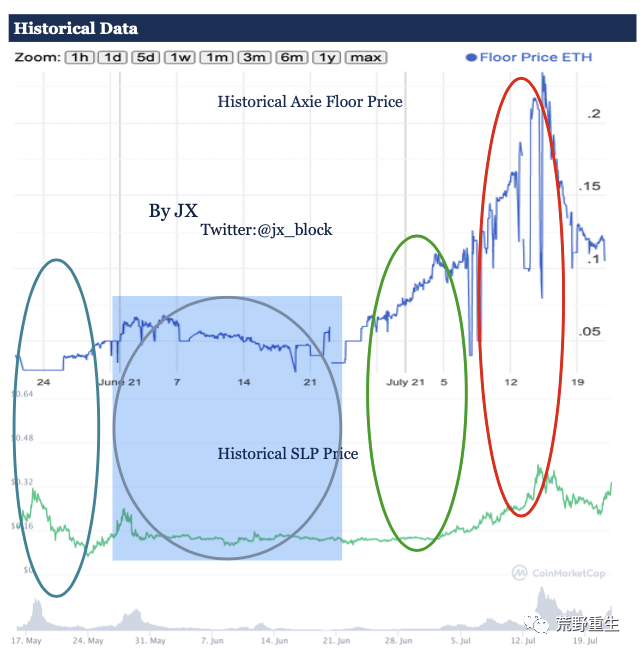

In fact, this is actually already implemented on Axie Infinity. Learn how to compare Axie NFT's reserve price to SLP's price considering the data below.

key points

key points

Axie Infinity is first and foremost a game. There have been attempts to financialize components of the game to make a quick buck, but with that came constraints imposed by market forces. If Axie Infinity were a country, the average person's salary would be $2000+. This makes the network's income per capita higher than that of Kuwait and slightly lower than that of South Korea (ranked 25th). A lot of what is driving interest in Axie Infinity today is the rise in crypto asset prices, and the economic design may put off the average user. Sky Mavis has recognized these challenges and rightly released Ronin, a sidechain scalability solution, to address common user fee-related challenges. Auto-correction of the marketplace is one way of ensuring the system is most attractive to gamers first. What we find interesting is the balance between assets on the network. For businesses launching on a “play and earn” model, understanding how each asset’s price changes affect participants will help find scale.

This article is from Rebirth of the Wild, author Joel John JX, reprinted with authorization.