secondary title

NFTs in the first half of 2021

image description

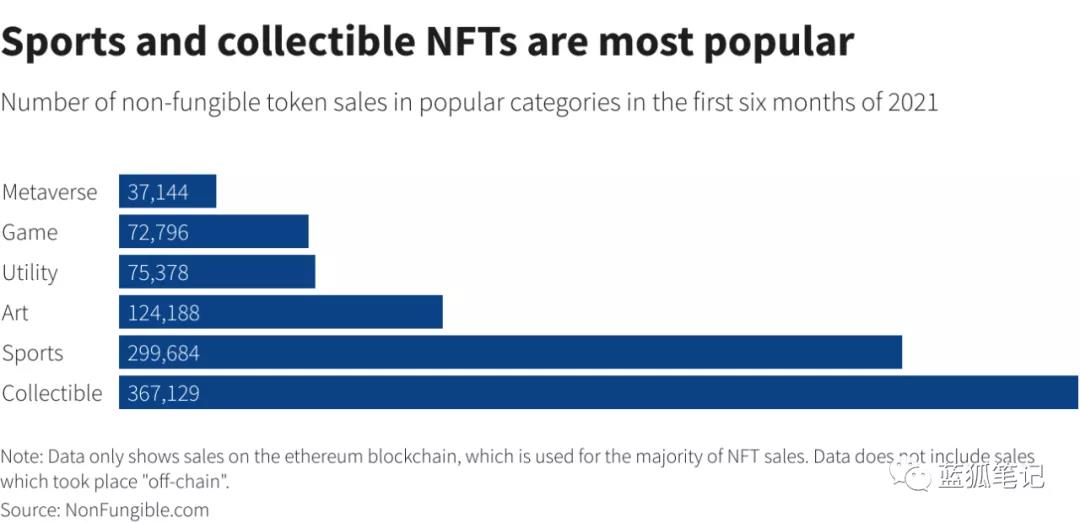

(Popularity comparison of different types of NFT, NonFungible data)

image description

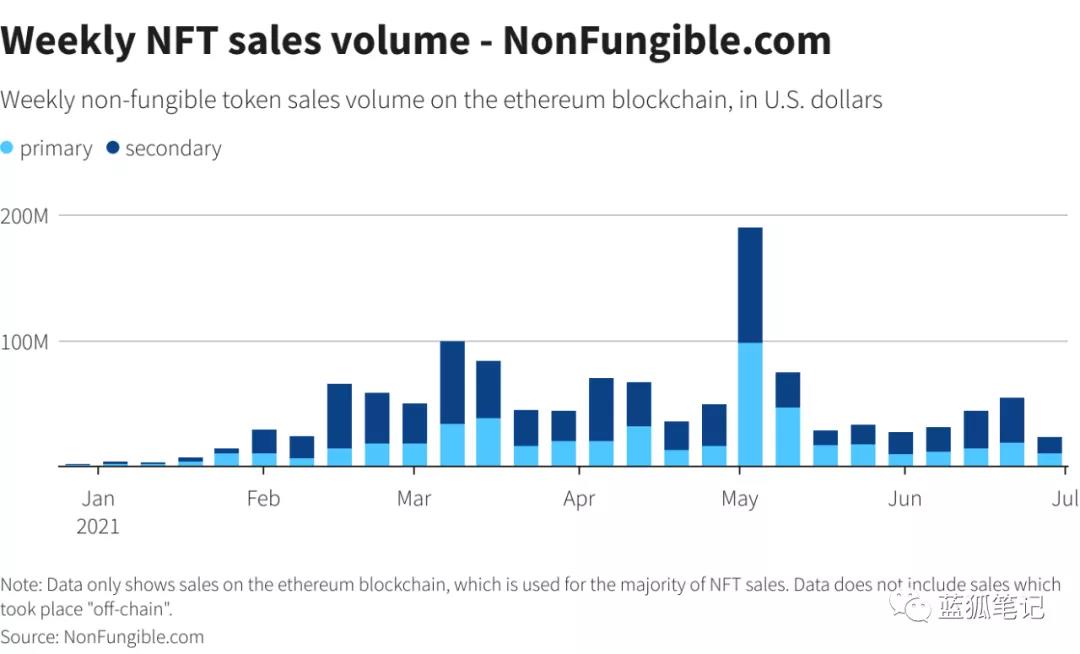

(NFT weekly trading volume change, NonFungible data)

image description

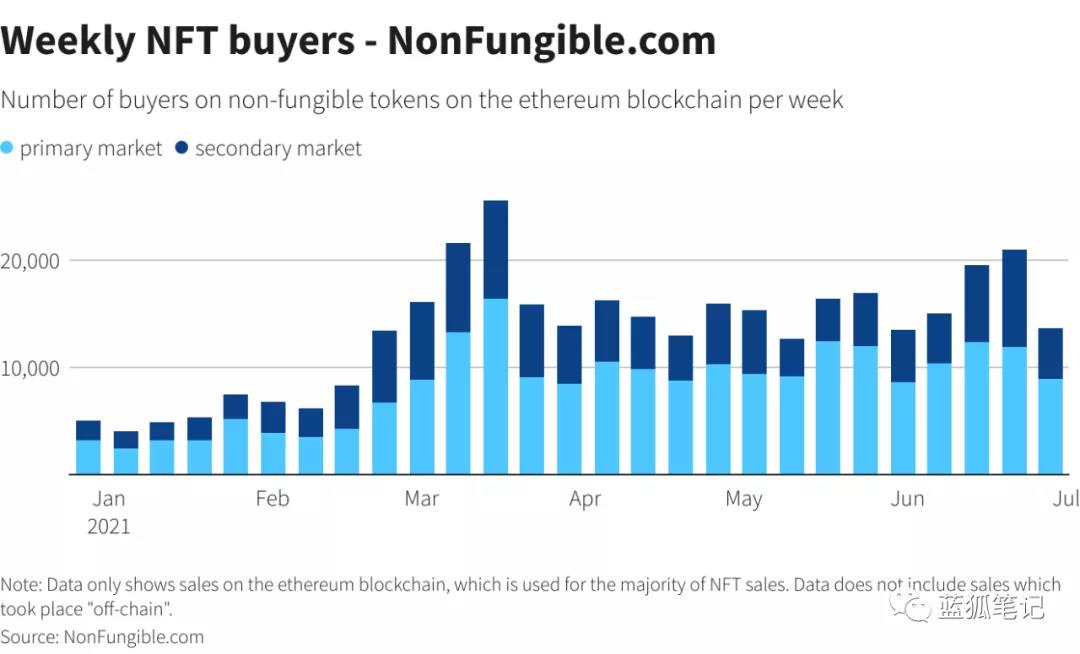

(NFT weekly buyer volume change, NonFungible data)

image description

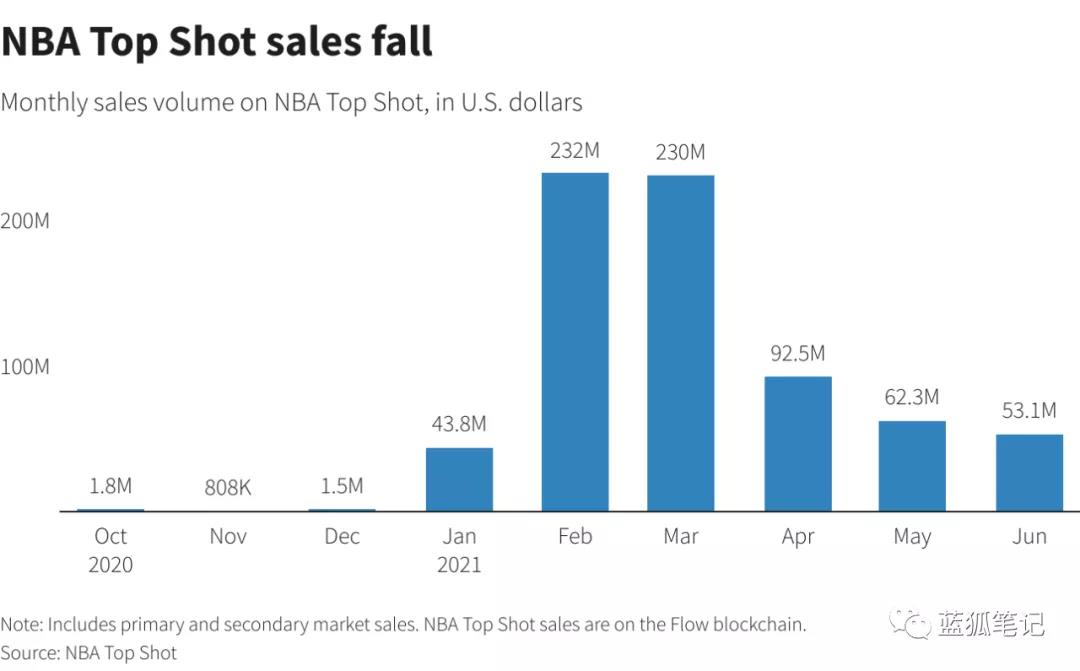

(NBA Top Shot sales change, NBA Top Shot data)

image description

(NFT weekly trading volume changes, from NonFungible)

image description

(Overall market capitalization of NFTs, Coingecko data)

So far, according to Coingecko's statistics, as of the writing of Blue Fox Notes, the overall market value of NFT has exceeded 13 billion US dollars, accounting for 1% of the entire encryption market value.

If the summer of 2020 is an important launch season for DeFi, then the summer of 2021 may become an important season for crypto games and NFT launches. And one of the most important driving forces is the demonstration force from Axie. Just like last summer, the demonstration power of Compound and YFI.

Axie is a catalyst for the development of NFTs

Axie is an encrypted game. Two years ago, Blue Fox Notes also introduced the content of Axie "Blockchain gaming: where is it headed?image description

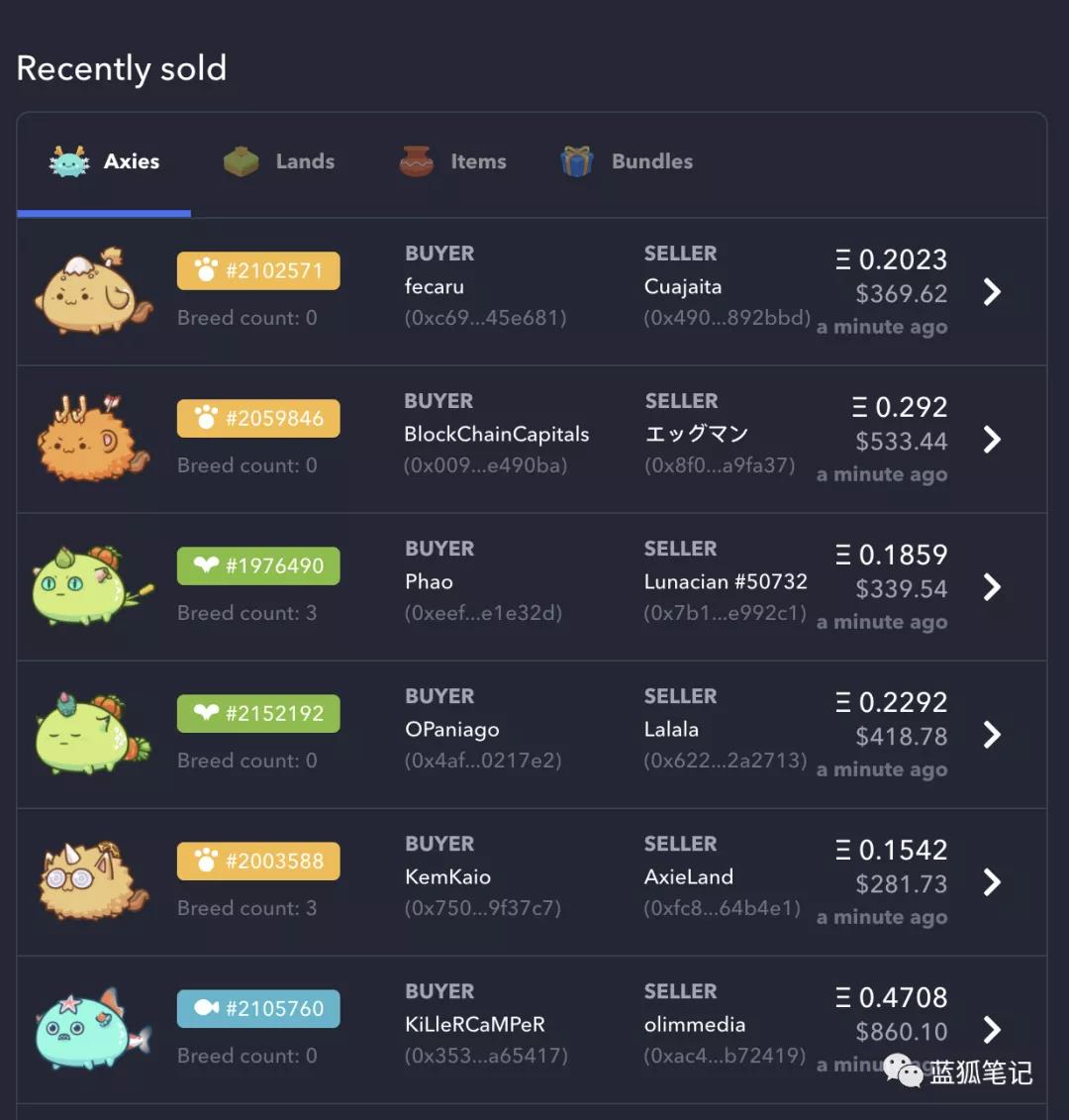

(The price of Axie is hundreds of dollars each, derived from Axie)

*User number

image description

(The number of users of Axie, from dAppRadar)

This number of daily active users is not small even in traditional games. Of course, we have also seen that a large part of Axie users come in to play because the Play2Earn model can earn income.

*Trading volume

image description

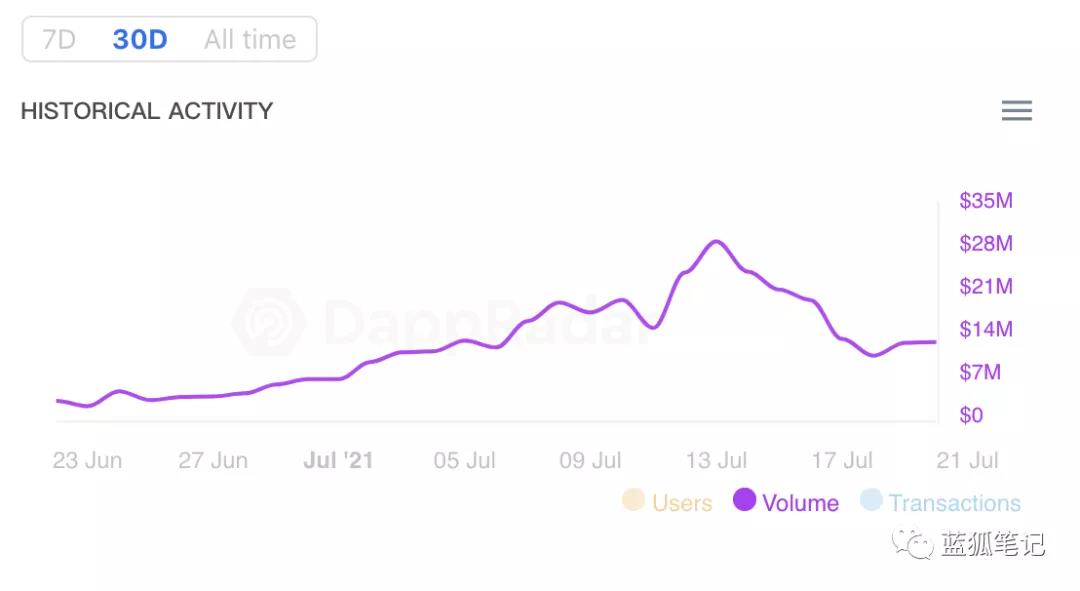

(Axie's daily transaction volume, sourced from dAppRadar)

image description

(Axie’s protocol fee trend, from TokenTerminal)

image description

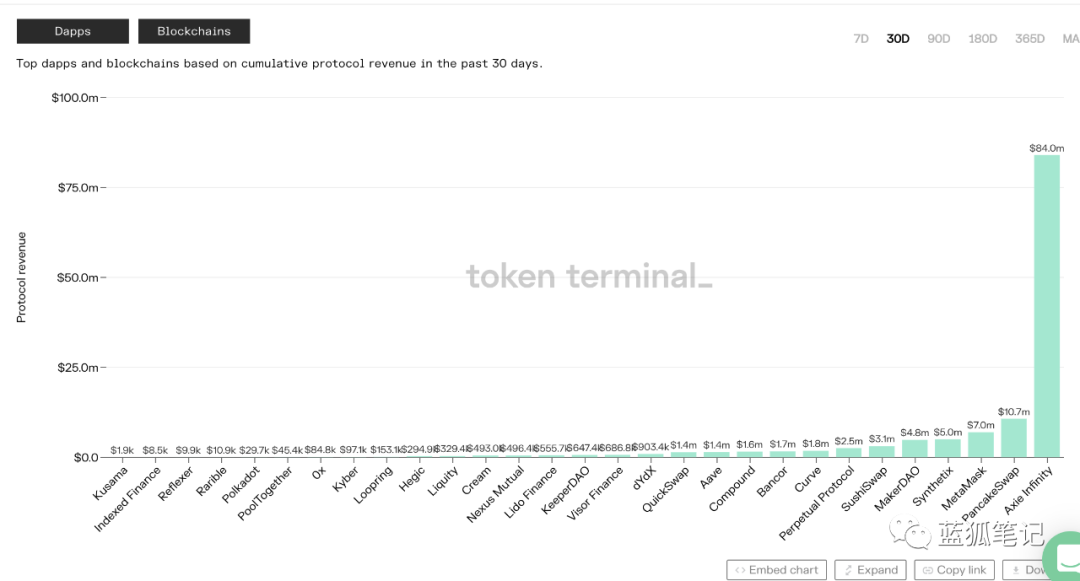

(Agreement fee comparison, from TokenTerminal)

Axie's protocol fees stand out compared to other protocols. Not to mention how long the life cycle of an encrypted game is, the magnitude of the protocol fee alone will attract great attention from the encryption community and game developers.

The highest daily income of Axie once exceeded 8 million US dollars. If it maintains this level, it will be the level of the top game in the world. It has declined recently and can still reach about 2-4 million US dollars.

image description

(Axie's P/E rate, from TokenTerminal)

image description

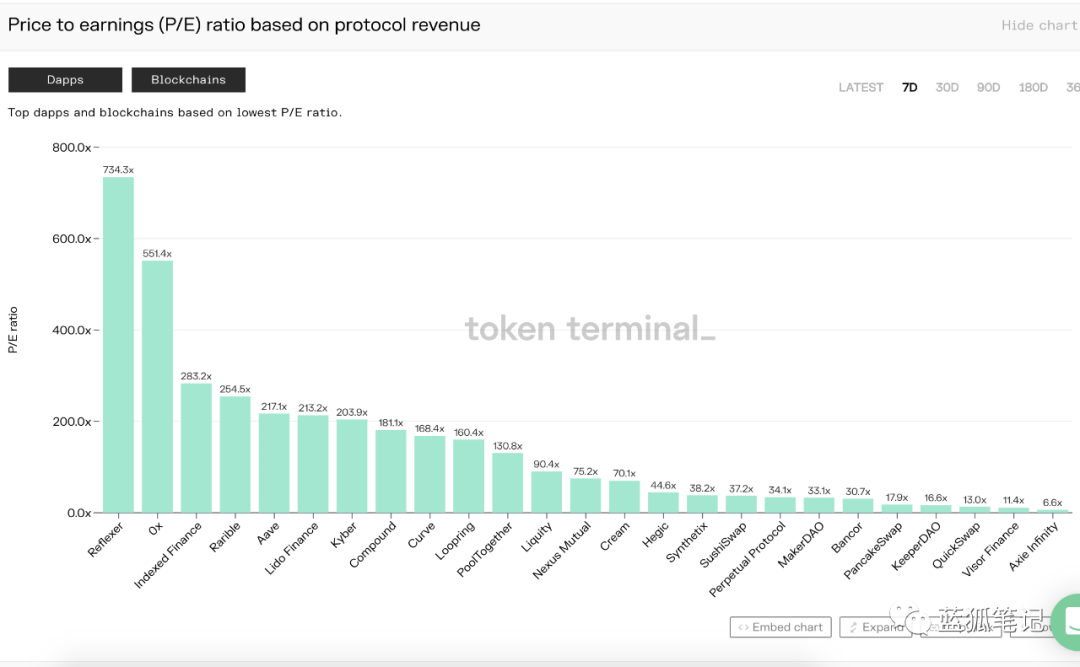

(Axie has the lowest P/E rate in the past seven days among all encryption projects, sourced from TokenTerminal)

One of the most important reasons for the rapid development of Axie's user numbers is not entirely the fun of its games (of course, Axie's quality is very good in the encryption field), but rather the support of various gold-making studios or "guilds". rise. In places like the Philippines and Venezuela, many people are willing to earn hundreds of dollars a month playing games, which is not bad for the local income level.

The important thing is that you can not only play the game, but also earn money. Just like shared car drivers and takeaway riders, they earn income through their own labor. Through the organization and training of the game guild, these hired players can get started faster. At the same time, for these hired players, these are jobs. It is said that some early players in the Philippines bought two houses locally by playing Axie.

image description

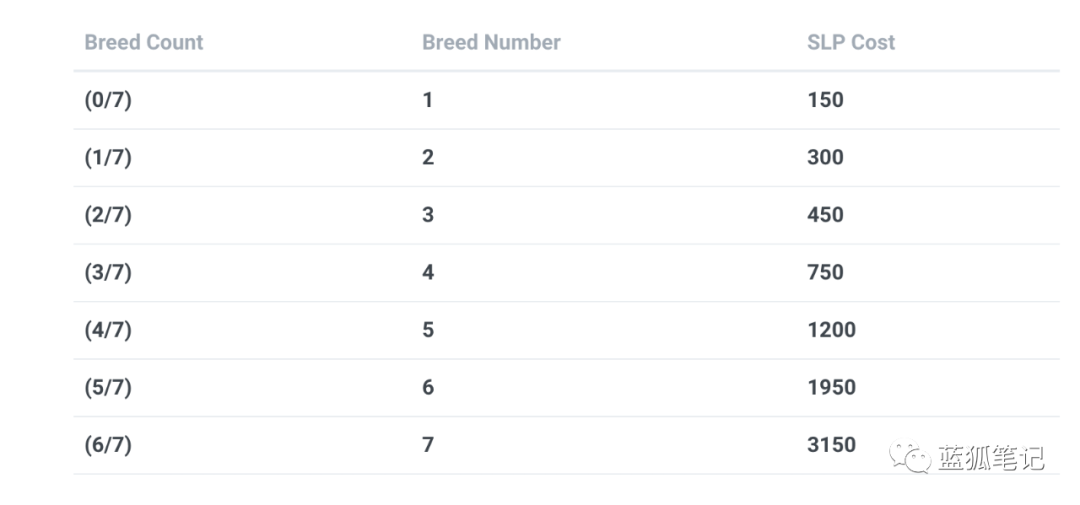

(The number of SLPs required for Axie's breeding, derived from Axie)

Breeding an Axie costs at least 4 AXS and 300 SLP (150 SLP each for the first breeding), at least $200 at the time of writing.

When the market demand for Axie increases, the price increases, and the motivation to breed Axie becomes stronger. At the same time, more AXS and SLP need to be consumed, which will lead to an increase in the price of AXS and SLP. From the current market, the price of ordinary Axie is around 200-500 US dollars, so according to the cost of its first breeding, it is still profitable. Of course, the more times of breeding, the more SLP will be consumed and the cost will be higher, which will also inhibit people from breeding more Axie. This is also a balance of the internal economy.

In addition, the demand for Axie also comes from the ability of players to earn SLP in the game. Depending on the strength of the user, they can earn 150-600 SLP. According to the current price, they can earn about 40-160 US dollars per day. The player's cost is at least 3 Axies (use 3 Axies to fight), assuming that the average price of each is 300 US dollars, then the initial investment is at least 900 US dollars. Assuming that the user earns a low daily income, about 50 US dollars, then the player can recover the cost in about 18 days. Of course, this is just for illustration, and a simple calculation is made. Since the prices of Axie and SLP fluctuate all the time, the above figures will not be accurate, but a simple logical explanation.

As mentioned above, due to Play2earn, the guild mode was born. Some people invest money to buy Axie, cultivate high-quality Axie, make these Axie have strong fighting ability, and then lease these Axie to other players, and charge a certain percentage of profit. In this way, the entire economic system of Play2earn players is established. At present, some Axie game guilds have more than a few thousand members. According to the current SLP price, some game guilds can earn millions of dollars in monthly income, and the scale of income is not small.

So, this also raises a question, whether encrypted games like Axie adopt the Play To Earn model will become the main mode of encrypted games in the future, and will various game guilds become more and more prosperous in the future? Will a larger encrypted game economic ecology be formed in areas with relatively underdeveloped economies?

Of course, as everything has two sides. This kind of encrypted game promoted by Dajin studio and guild may not be able to continue or even decline when its income reaches a certain critical point, because in the end someone needs to pay the bill to support the entire economic system.

In the beginning, the increase in the price of SLP will motivate more people to play, because they can earn more income. To play this game, each player needs at least 3 Axies, so the increase in players will increase the demand for Axies and increase the price of Axies. The increase in the price of Axie will make it profitable to breed Axie (relative to the breeding cost), which will prompt more Axie to be produced. Breeding Axie costs AXS and SLP, which in turn increases the demand for AXS and SLP, which is beneficial to the price increase of both.

From the perspective of Axie’s economic mechanism, its AXS and SLP are deeply integrated with its internal game mechanism, which leads to an explosion in a short period of time once it completes its cold start.

However, as more players enter, new SLPs will continue to be released. Then, assuming that the demand for SLPs cannot keep up with its inflation rate, the price of SLPs will drop at this time. Then, the cycle we mentioned above will be reversed. As the price of SLP drops, the incentive for people to play drops, which leads to a drop in demand for Axie, and a drop in demand for Axie breeding, which leads to a drop in demand for AXS and SLP. So there will be a supply and demand balance point here, there will be inherent constraints. Nothing will go up forever unless its new demand can continuously absorb the previous supply.

Ultimately, the sustainability of encrypted games requires a combination of playability and good economic mechanism design. Only in any one aspect, it cannot be sustained, and it needs real users to continue.

Crypto games become one of the engines of the NFT market

Encrypted games have been explored for many years, and now with the rise of Axie, it will have a profound impact on the entire NFT market, just as Yearn and Compound had an impact on the DeFi market last year.

At present, the breakthrough of Axie will have the following effects:

*More and more game developers will really start to pay attention to encrypted games, and more and more well-made blockchain games will enter the encrypted market. When Axie’s daily revenue is as high as millions of dollars, even reaching the daily revenue level of “Honor of Kings” at its peak, it is impossible for game developers to remain indifferent and pay attention to its possible potential. Even if it has a lot of foam.

*Due to the market hotspot effect, at least in the short term there will be funds to promote the development of the encrypted game market, and more institutions will be willing to try to invest in the encrypted game field, which will bring more game developers.

*Axie's cold start method will be followed by more and more communities, and Axie will not be the last encryption game to achieve a breakthrough. Game guilds will play an increasingly important role in the cold start of encrypted games in the future.

*If the encrypted game market as a whole can achieve sustainability (sustainability here does not refer to short-term hype, but long-term fundamentals, including the growth of the number of users, the growth of protocol fees, etc.) then it has the opportunity to provide The warming of the encryption market brought support. Dangru, if it cannot be done, it will only accelerate the cooling of the market.

*Axie's breakthrough will expand the NFT market from an encrypted collectible market to an encrypted game-based market, and this market has a wider user base, which is conducive to promoting the adoption of NFT among a larger group of people.

* Crypto games have the opportunity to bring new income channels to people in economically underserved regions. For example, some people in the Philippines used Axie to realize a new source of income during the epidemic blockade, which solved some people's livelihood problems.