Author | David Hoffman

Dear Bankless Community. When Ethereum was launched, it had nothing to do with ETH.

But then DeFi was born. Launched in 2018, MakerDAO allows ETH holders to take out loans using their ETH as collateral. The more ETH you own, the more power you have.

Then came Compound, which has lower collateralization ratios and liquidation penalties. Same thing, more ETH means more power, more capital efficiency.

Then Uniswap came along, and all of its liquidity was built with ETH pairs. Now you can provide liquidity with ETH and earn transaction fees. Greater capital efficiency.

Today, there are thousands of ways to spend ETH in DeFi applications, and more are being launched every day.

So, what's going on throughout? DeFi is a global race to make ETH the most useful asset in the world.

David said so.

- RSA

first level title

ETH: The Most Capital Efficient Asset in the World

march towards capital efficiency

If you haven't heard, ETH is ultra-sound money.

Ethereum 2.0 is not only a scalability upgrade of the Ethereum network, but also an economic upgrade of Ethereum - powering and securing the Ethereum economy。

Proof of Stake is a consensus mechanism that minimizes the need to issue ETH, and EIP1559 is a mechanism that burns ETH as a function of the economic scale of Ethereum. The combination of the two turns ETH into A currency unit can only be said to have 'science fiction' economic basics behind the currency unit.Ethereum 2.0 is to make ETH a"super sound money"protocol upgrade。

on the contrary,。

on the contrary,This article is about how DeFi is the catalyst for the capital efficiency race, and how ETH is the asset that benefits the most from this race。

DeFi's relentless march toward capital efficiency

Every new protocol succeeds because it is more capital efficient than its competitors. Every protocol upgrade any DeFi application goes through is aimed at improving capital efficiency. In DeFi, capital efficiency is the deciding factor for success or failure.

As the native asset of Ethereum, and therefore of DeFi, ETH is the asset that accepts all derivatives of this competition.When DeFi becomes more capital efficient, ETH becomes a more efficient asset。

first level title

Genesis

At the beginning, Ethereum was invisible and empty, only ETH.

In the genesis block, ETH was allocated to 8893 different addresses, called"The Big Bang of Ethereum", ETH ushered in a "big bang" on July 30, 2015.

How to do? What is Ethereum? What is ETH?

Like the Internet, a small group of nerds can see that Ethereum is going to be big. But exactly how Ethereum will affect the world is still speculation.

What would it mean to have a singular world computer available to everyone? What does it mean to have a native asset that powers it - ETH?

Early Ethereum was filled with early concepts of future events. There were no successful application models to serve as examples at the time, so early Ethereum builders imitated what was working in the Web2 world.

Peepeth is a version of Twitter, only built on Ethereum. The idea is that with censorship-resistant computers, we can build censorship-resistant Twitter, where no one can be deleted tweeted or muted.

This seems like the first logical step for Ethereum. Put existing Web 2 applications on Ethereum! This is the first step of Ethereum. Of course! It's very simple!

Presumably, Twitter users migrate to Peepeth for the benefits of decentralization and censorship resistance! People will buy ETH from Binance. People will buy ETH from Coinbase or Gemini so they can write tweets on the Ethereum blockchain, and the decentralization of Ethereum will shield users from platformization!

"Yes of course...this is how Ethereum is going to change the world....and this is why we need ETH!"。

These early ideas about optimizing Ethereum were wrong。

These ideas of rebuilding Web2 applications on the main chain Ethereum were common in the early days of Ethereum. Now it seems that its significance is almost zero. The Gas fee back then was less than 1gwei, and ETH was less than $10... You can basically write a tweet in Ethereum for free.

How to use your ETH?

Imagine you participated in the Ethereum presale and you are the owner of 1000 ETH. How can an app like Peepeth (a decentralized Twitter) benefit you? At a cost of 0.00001 ETH per tweet, you can tweet 100,000 tweets and still have 999.999 ETH left over.

Peepeth doesn't solve the problem of how to use your ETH balance efficiently。

Ethereum needs applications that can utilize the amount of ETH held by ETH holders. In the beginning, Ethereum was boring and was always looking for something to do. As it turns out, applications that replicate the Web2 platform are completely homogeneous and antithetical to the attributes optimized for a public, permissionless crypto economy: money and value.

Instead, what those successful applications have in common is the use of ETH as currency. Apps that use ETH as currency allow users to use the entire balance of ETH they own and make it more useful to have more ETH.

A rare photo of a slideshow from Vitalik's 2014 talk on Ethereum modularity."The Lego of Cryptocurrency Finance". Yes......The Lego bricks of DeFi currencies were imagined back then。

Applications that make ETH more useful are more used by ETH holders and create a virtuous cycle. Users who own ETH can benefit from Ethereum applications that let users leverage their ETH balances. Because there is a group of ETH holders who need a reason to use their ETH, applications that use ETH as a capital asset have received excess adoption from a specific group of people who are interested in the survival of Ethereum and the value of ETH. This group is ETH holders. There are.

Therefore, Ethereum rejects ETH as a simple"Let you use the assets of DApps",first level title。

DeFi is not decentralized without ETH

Because it is the native asset of Ethereum, ETH holds a special place in the Ethereum economy.

It is the only asset on Ethereum that is not issued by a smart contract, so there is no smart contract risk.

It is a native asset of the Ethereum protocol, so it has no counterparty risk.

It has a guarantee of its scarcity, because any monetary policy failure is a risk to the Ethereum network, not just the DeFi applications on it (that is, we'll have bigger things to worry about).

ETH is the most trustless asset on Ethereum because every asset other than ETH has some compromise on its trustlessness。

Even highly decentralized assets such as UNI, AAVE, and MKR have governance and contractual risks associated with them. Governance can become corrupt...or just bad...and destroy the asset's value proposition.

But more importantly, DeFi tokens capture value largely by leveraging the permissionless and trustless properties of ETH. Where would DeFi apps gain value without ETH?

The end of all DeFi leads to ETH

DeFi tokens like UNI, AAVE, and MKR derive value from the surrounding Ethereum ecosystem. Each protocol captures fees using a different mechanism, but they all generally capture value by charging fees for economic activity through their platform.

There are three main types of tokens, and applications are codenamed by their method of value capture.

1. Other DeFi tokens (for example, Compound obtains UNI’s borrowing fee

2. Stablecoins (USDC, USDT, DAI)

3. ETH

But really, it comes down to capturing value in a stablecoin or ETH。

If a protocol captures value by earning fees on other DeFi tokens, this is just another intermediate step to capture value in stablecoins or ETH, as other DeFi protocols are also capturing ETH or stablecoins...or other DeFi applications value.

Capturing value by earning fees denominated in DeFi application tokens (such as UNI or COMP) will eventually fall back to capturing fees in ETH or stablecoins.

Additionally, any fees to capture in DAI are just a mix of value captured in other stablecoins and ETH, since DAI is a requirement on MakerDAOs balance sheet, which consists mostly of stablecoins and ETH.

Without ETH, DeFi apps will be forced to capture value under the pressure of centralized dependency risk。

DeFi tokens, as capital assets with the potential to issue cash flow to token owners, require a trustless, decentralized asset to issue captured value. If Uniswap can only capture the sense of agreement in USDC or USDT, then this is not true"DeFi "already, isn't it?

Without ETH, the transfer of value from Uniswap to UNI holders will depend on whether Circle or Tether allow it.

DeFi protocols require a trustless asset, which is a fundamental part of the protocol, otherwise it reintroduces the risk of centralization that we have been trying to avoid.

ETH is not subject to centralization risk and thus is a favorable asset in which to capture value。

Every asset has its own risk parameters (volatility, liquidity, centralization risk, bugs and vulnerabilities, etc.), and every DeFi application (disruptor; they all run on collateral) that runs on collateral The protocol considers it safe to set different parameters for each asset.

No asset is perfectly optimized for all risk parameters:All assets are at risk. However, as a native asset of Ethereum,Ethereum occupies a special place in DeFi as the only asset that eliminates all counterparty and contract risk. It is the single asset with the strongest settlement guarantees on Ethereum, so settlement risk is minimal.

first level title。

march towards capital efficiency

Every DeFi application succeeds using ETH as capital. Each successive application will only see success if it can utilize capital stored in ETH more efficiently than its competitors.

Starting in December 2017, ETH has a collateralization rate of 150%, a variable interest rate, and a liquidation fee of 13% (via Maker). Now, it has grown to a 110% collateralization ratio, 0% interest charges, and competitive collateral liquidation auctions.

And DeFi has only been established for 3 years.

March 2018-2019

MakerDAO: The Birth of DeFi

MakerDAO launched in December 2017, during the time of the ICO mania. MakerDAO is the first application on Ethereum that allows users to leverage their entire balance in ETH.

The more ETH you own, the more you can do with MakerDAO. More ETH means you can mint more DAI, or have larger collateral to cushion your DAI loans. More ETH is more power. MakerDAO allows ETH to be used as capital.

This is how DeFi was born. DeFi is defined as an application that accepts deposits of trustless capital assets (ETH) and allows you to use them.

Compound: ETH as collateral

Compound V1 was launched on September 26, 2018. Similar to Maker, Compound allows ETH to be deposited into its app for borrowing against the value of the deposit.

What makes sense with Maker is that Compound allows many assets to be deposited and also allows many assets to be borrowed. Also unlike Maker, Compound allows a lower collateralization rate of 133% and a liquidation fee of 8% instead of an over-collateralization rate of 150% and a liquidation penalty of 13%.

Seven months after MakerDAO launched,ETH gets its first major upgrade in terms of capital efficiency. Compound is an attractive place to store ETH because it allows capital to be used more efficiently, making Maker very competitive.

Uniswap: ETH as a trading pair

In November 2018, Uniswap V1 was launched.

Uniswap has ETH as a trading pair for every token on its exchange.Each token gains liquidity by pairing with ETH. The main innovation of Uniswap is to allow ERC20 tokens on Ethereum to utilize the liquidity of ETH as an asset in order to give the liquidity of ETH to the token.

At the same time, Uniswap also provides ETH with a variety of options to capture value, because each Uniswap market allows ETH to capture 50% of the fees of any specific trading pair (other tokens in the trading pair account for the other 50%).

Like MakerDAO, Uniswap allows ETH holders to leverage the entire ETH balance they hold. The more ETH you own, the more power Uniswap gives you. The more ETH you own, the more fees you can earn. It gives ETH holders a further option to leverage their capital as long as it is in ETH.

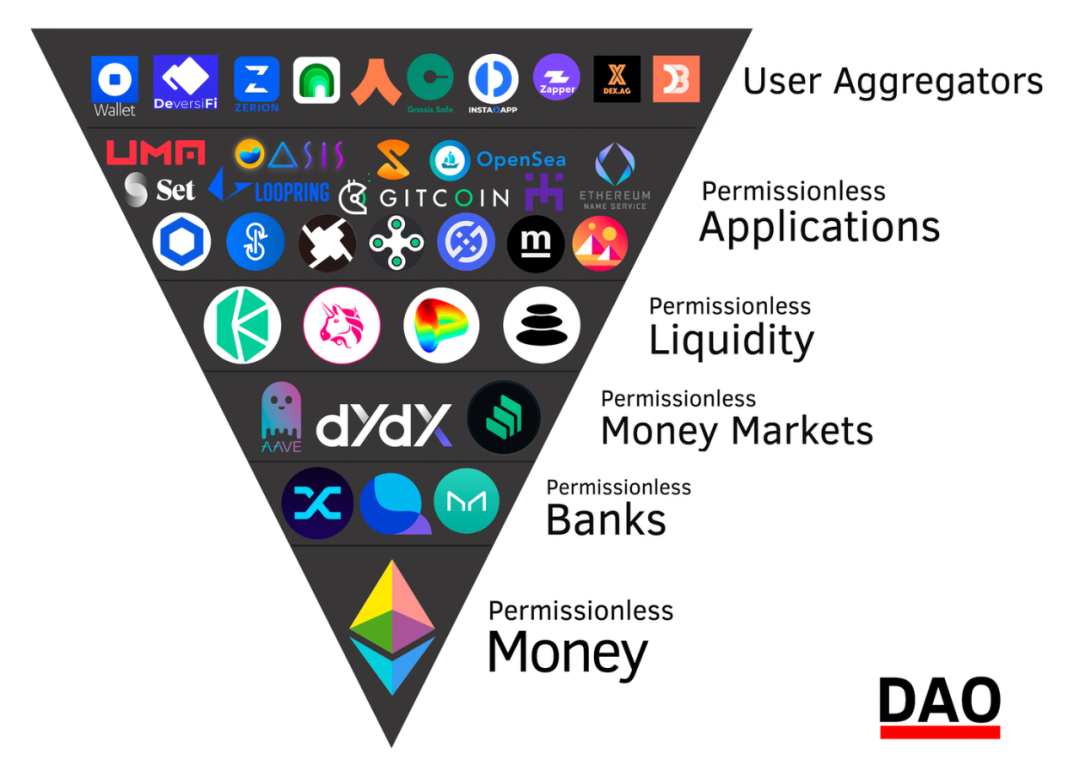

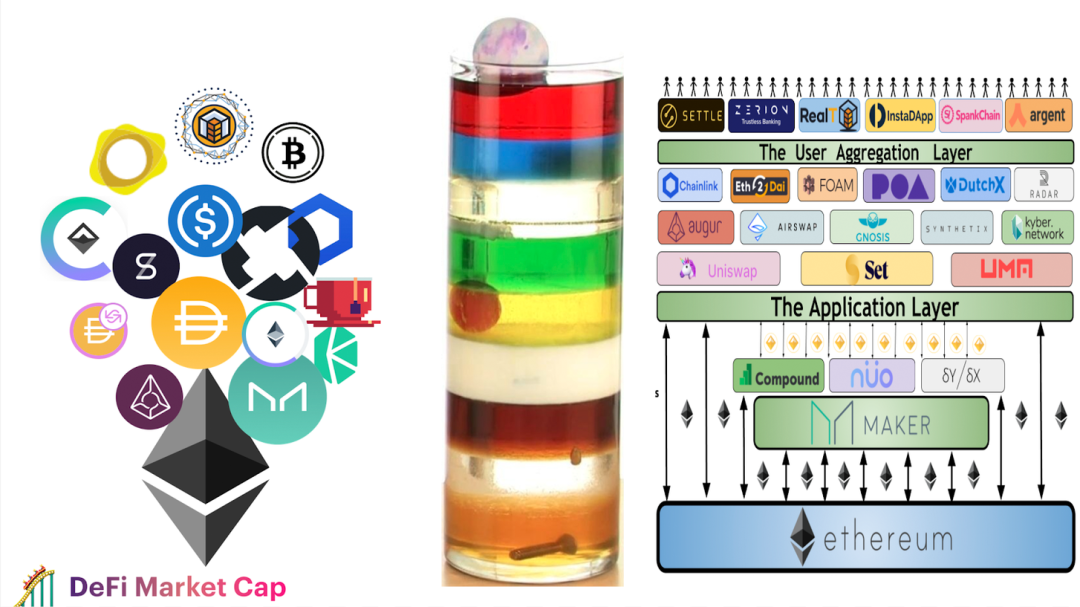

The Ethereum Application Layer Is a Crucible for Capital Efficiency Competition。

In November 2019, I wrote "Ethereum: The Currency Game Landscape", subtitled:Ethereum is a place to build value competition. The gist of this post is this: Ethereum’s application layer is a diverse set of financial applications that are all trying to convince you to deposit assets into it.

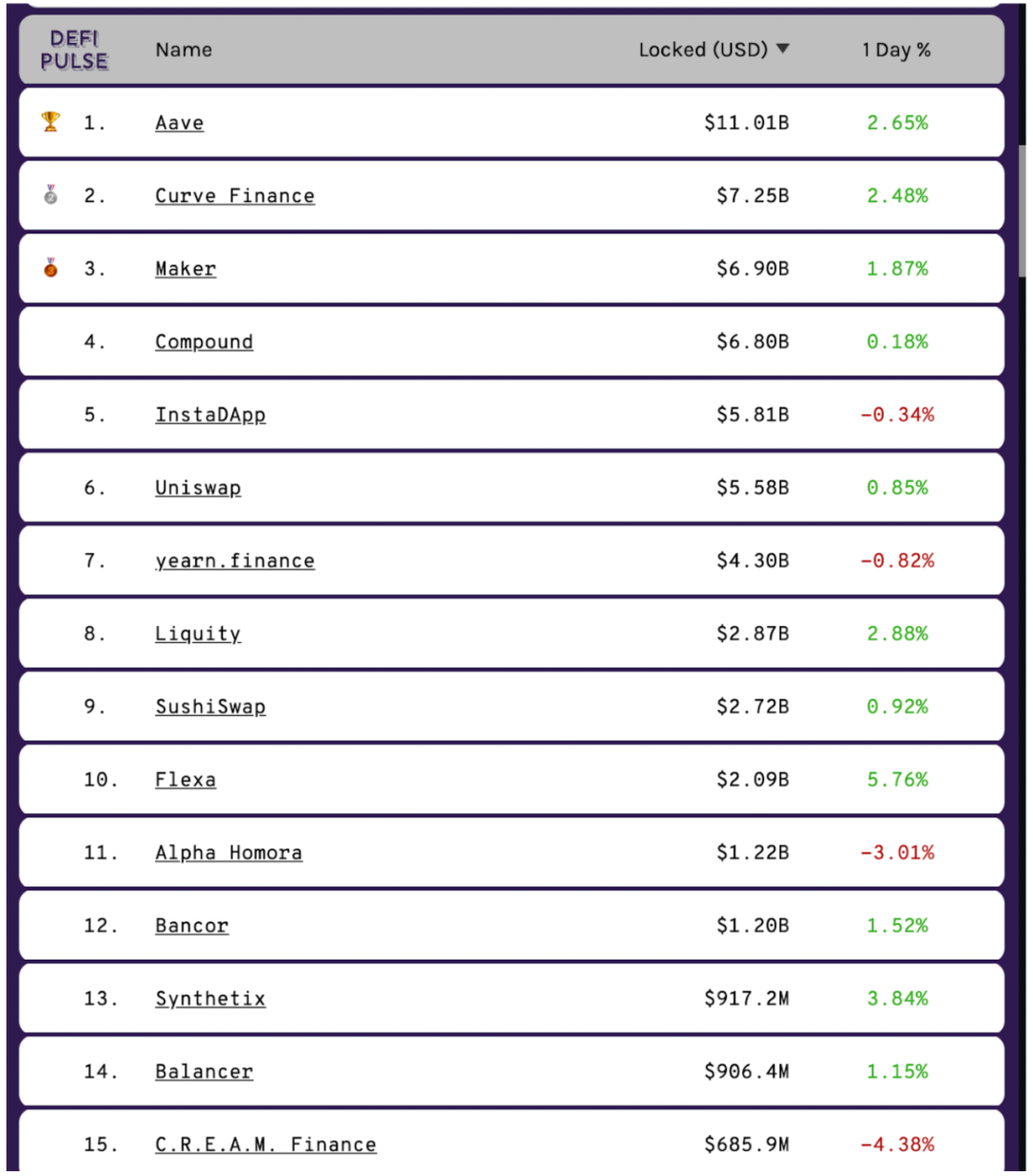

The reason we all go to DeFiPulse.com is because it is the leaderboard for deposits. We can go there to see the data of several unicorns!

Big Event: Value Locked

Except that $1 in ETH locked is arguably more valuable than $1 in USD stablecoins because ETH is effectively scarce, trustless, decentralized, and printable.

good collateral

Ethereum applications have nothing to do with ETH. Ethereum applications are extremists themselves. Good Ethereum applications are always application-first. They do what is best for themselves and their users. This is what makes Ethereum so powerful: it is an open platform that enables applications to be the best versions of themselves.

It just so happens that ETH is a fantastic collateral asset, and basically every Ethereum application wants ETH for their own purposes.

Coincidentally, decentralized finance applications require maximum trustless collateral to function.

Even more coincidentally, the more trustless and decentralized an asset is, the better the risk parameters that DeFi applications can provide for the asset.

Lower fees, lower collateral ratios... better 👏 capital 👏 efficiency 👏👏👏

Good collateral...but at the protocol level

Did I mention ETH is a particularly sound currency。

The combination of EIP1559 and The Merge makes ETH the asset with the lowest circulation, and its burn rate is a function of the volume of transactions within the Ethereum economy.

While this reality doesn't necessarily affect the parameters that DeFi applications place on ETH, it does affect what people do with ETH as an asset. After all, money is a meme, and the best money is the best meme. Ultra-sound money is a pretty good meme, andIn fact, ETH is actually a very sound currency。

The monetization of ETH as an asset is one of the main drivers behind native DeFi applications and CeFi companies giving ETH increasingly favorable risk parameters. As a monetary asset, ETH has more liquidity, circulation, holders, and overall believers behind it. These are the risk reduction forces behind ETH, enabling DeFi applications to do more with less money thing.

Of course, one of the main motivations that people put so much faith behind Ethereum is because it is also a three-point asset. There are three compelling reasons to own ETH: it pays you dividends, it’s a store of value, and you need it to buy Ethereum blockspace from validators.

As the Schelling point of money, ETH has the largest surface area to convince most people of its currency.

But what’s missing from the three-point asset theory, as well as the hyper-sound money model, is that DeFi is a competitive capital-efficient crucible that’s making its way to production DeFi applications, making ETH the most capital-efficient asset ever.

secondary title

The Next Generation of DeFi Apps: 2020 and Beyond

We have recently seen a new generation of DeFi applications, all of which have intensified the fierce competition for the capital efficiency of DeFi applications.

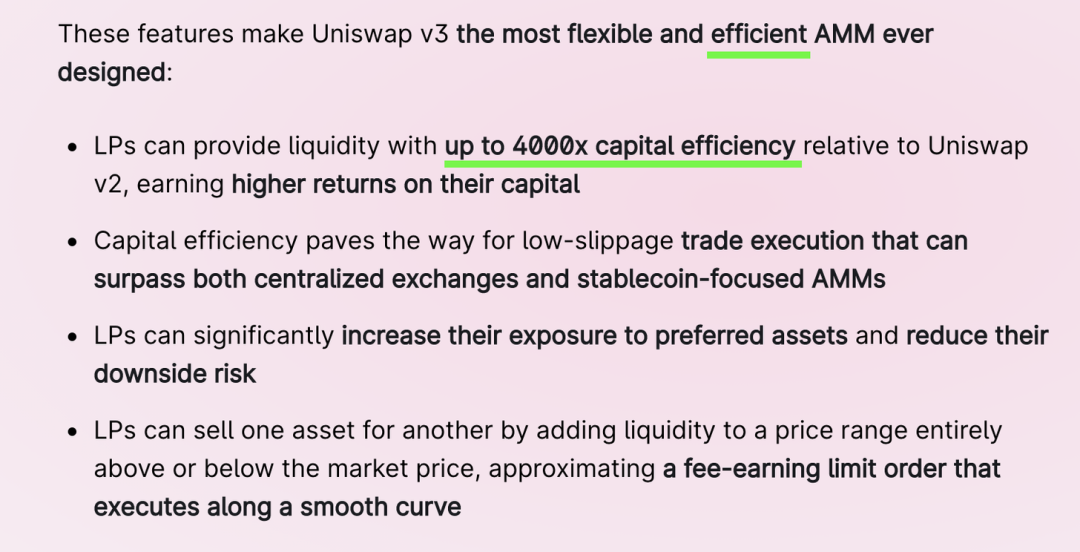

Uniswap V3

The capital efficiency of Uniswap V3 increases the capital efficiency of those who provide liquidity by 4,000 times.

Balancer V2

fluidity

fluidity

Liquity offers 0% interest and 110% collateralization on your ETH deposits. These are arguably the best rates in DeFi and also answer why Liquity already ranks 8th in TVL at such a young age.

Also, the protocol is only available for ETH.

Aave AMM token collateral

Aave allows you to borrow with Uniswap and Balancer LP tokens, allowing you to withdraw debt with one asset, spread the risk on two different assets, and charge exchange fees at the same time.

ETH: The Best Multi-App Collateral for DeFi

When two applications like Aave and Uniswap are stacked on top of each other, the risk for each increases. Aave's risk is now Uniswap's risk, and Uniswap's risk is now Aaves' risk. Additionally, other applications that affect Uniswap will therefore affect Aave, and vice versa.

The surface area of risk increases exponentially.

DeFi black swan events have different epicenters and magnitudes. Most hacks, bugs or vulnerabilities only affect one part of the DeFi whole. Fortunately, fortunately, since the DAO hack in 2016, the overall structure of DeFi has not seen any hacking. Each incident is largely contained within the local environment surrounding the hacker.

The composability of DeFi applications is why we are all here. It is a magical force that absorbs every piece of useful software into the entire DeFi structure and makes DeFi itself more and more useful over time. If it works, DeFi will integrate it.

However, it is also our Achilles' heel. DeFi composability is similar to how cancer affects the entire body. Complex bodies have complex interactions, and at some point, the level of composability and self-integration of DeFi will exceed our ability to reason.

To manage this compounding risk and exponentially growing complexity, ETH may become the asset that operates as multi-application collateral. Everyone integrating DeFi applications into new products or services needs to control the risks they introduce as they add complexity and surface area to their products. These apps can manage this risk by focusing on low-risk collateral in their apps. As mentioned above, ETH is the only asset in DeFi that eliminates all counterparty and contract risk. Any application that needs to find a way to reduce risk will naturally tend to use ETH as collateral.

ETH LP positions

Apps that already allow ETH and tokens as collateral may also allow LP positions in ETH + the same token they already use as collateral. In theory, there is little risk in allowing LP positions of ETH + approved collateral tokens as collateral for your application.

This might even be better risk management practice for lending protocols like Aave and Compound, as the LP token increases in notional value over time and provides diversification of the two assets rather than An asset without any additional risk since they already accept both tokens as collateral.

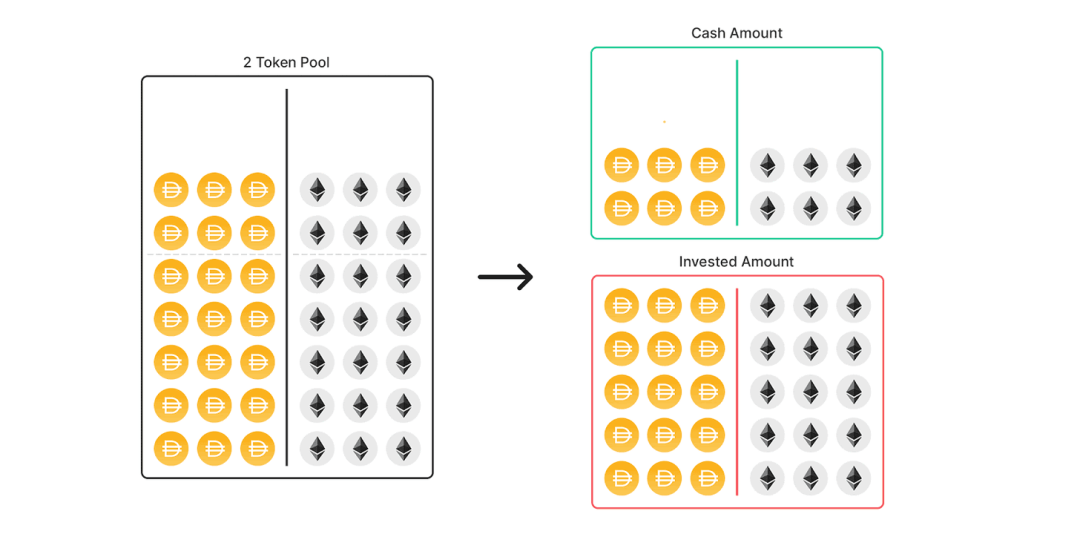

If ETH LP positions become an advantageous form of collateral for DeFi applications, this will have a huge benefit for ETH, as ETH accounts for half of each LP position.

As DeFi complexity increases, so does ETH utilization

DeFi applications with outsize composability risk will control it by focusing on the most risk-free assets on Ethereum. As such, ETH will find enormous utility from financial products that leverage a lot of composability.

I expect that the amount of total composability (however you want to measure it) will only increase as DeFi matures and as Lego blocks of monetary aggregates become available. As the magnitude of the measure of total compatibility in DeFi increases, I expect a corresponding increase in ETH utilization in DeFi.

secondary title

Where is this going?

All roads on Ethereum lead to ETH.

In addition to ETH's superpower properties found at the protocol level, DeFi is in a relentless race to make ETH the most capital-efficient asset. These apps need to win this race to stay relevant. We all know that competition is good for consumers...and the way it is good for consumers is by making the assets they hold more capital efficient.

Every asset is different, and each captures these positive externalities of DeFi competition in different amounts. Measuring how well different assets on Ethereum can catch these capital-efficient tails is probably synonymous with the Protocol Sink Thesis.

Assets that go deep into Protocol Exchange benefit more from DeFi's progress in capital efficiency. Less risky, more trusted assets are better collateral for applications. The more an asset can be used as collateral, the more it can capture the capital efficiency tailwind of DeFi.

Guess what asset fell the deepest in the protocol exchange?

secondary title

trend is clear

DeFi is advancing at an unstoppable pace with its eyes on capital efficiency, and Ethereum is the best asset for DeFi to achieve its goals.

While the Ethereum protocol is busy turning ETH into an ultra-stable currency, Ethereum's application layer is simultaneously working to make it the most capital-efficient asset in the world.

Capital efficiency attracts capital

When you can achieve the same financial results with less capital, capital flows to assets that achieve capital efficiency. If it takes $10 to achieve the same results that $1 of ETH can provide, then buying and holding assets is smart capital management that allows you to achieve your goals with minimal capital. From a capital efficiency standpoint, the options that ETH can offer you will be overwhelming.

Over time, the path to achieving specific financial goals will increasingly be through the use of ETH as capital. At this time, ETH will become the reserve currency of the Internet, and its economic bandwidth will be massive.

DeFi is turning ETH into the best store of value in its internal ecosystem. If "DeFi" just becomes "Fi", then ETH will therefore become the best store of value in the world.

If DeFi does become "Fi", then we can only assume that EIP1559 will have a high ETH burn rate, which in turn will make the incentive to stake ETH higher (for MEV fees).

All of these properties create a virtuous cycle for ETH; strengths in one feed into strengths in others.

ETH is an ultra-stable, ultra-efficient currency

- David

Original link: https://newsletter.banklesshq.com/p/eth-the-worlds-most-capital-efficient

David Hoffman Author

Iris Dong,Edited by Vivian

Edited by Vivian