Original title: "Dappradar Report: In the second quarter of the roller coaster, Polygon surpassed Ethereum"

Written by: Rachel

The second quarter was definitely a rollercoaster ride, but overall, the positive trends for blockchain continue. Although the encryption market has plummeted, users' enthusiasm for participating in the industry remains undiminished, especially DeFi and NFT. New trends such as the multi-chain paradigm seem to have a positive impact on the entire network.

In the blockchain industry, competition continues to heat up. In Q1, we saw Binance Smart Chain (BSC) establish itself with Dapps like Pancakeswap, and now Binance is looking to replicate the DeFi success story in the NFT space.

During the second quarter, Polygon made even greater strides in adoption. Aave, Sushi, Curve, and several other Ethereum DeFi Dapps have now expanded to Polygon, so it’s no surprise that sidechains are up 13,000% year-over-year.

Ethereum itself remains as important as ever. Despite the sharp drop in ETH prices, the TVL of the Ethereum network exceeded $53.3 billion, a 1% increase from the previous quarter. For example, Aave, Uniswap, and Curve are up 70.1% month-on-month.

On the NFT front, while popular collectibles such as the NBA Top Shot and Rarible (down -16.67% and -7.52% from unique active wallets in the previous quarter, respectively) have seen the market cool down, new NFTs on Ethereum, such as the Bored Ape Yacht Club (BAYC) and VeeFriends, still received a positive reception. Launched at the end of April, the BAYC collection attracted more than 100 UAWs in June alone, averaging nearly $44 million in total sales per day.

key points

key points

Polygon surpassed Ethereum with 73,000 daily unique active wallets, an increase of 13,000% over the previous year; at the same time, the TVL in the second quarter of 2021 exceeded 4 billion US dollars.

While preparing for the London upgrade, Ethereum remains at the top of TVL, worth over $53 billion.

PancakeSwap propelled BSC's success in the DeFi space with 2.13 million unique active wallets in June; TVL rose 32.8% month-on-month.

The NFT space seems to be cooling down, but in-depth data tells the opposite; unique active wallet sales and average daily active wallets increased by 111.46% and 151.89% respectively from the previous quarter.

Axie Infinity attracts over 4,700 unique active wallets per day, with usage up 360.61% month-on-month; earning money by playing games may be the key to mass adoption.

Playing to explore the benefits of DeFi, Mobox had more than 22,600 unique active wallets in June alone, while total transaction volume exceeded $57 million.

Summary of blockchain leaderboard changes

Source: DappRadar

Source: DappRadar

BSC continues to go strong. Over the past six months, BSC has grown nearly 2,000% to over 394,000 unique active wallets per day. WAX also maintained its positive trend, attracting 384,000 unique active wallets per day, a 556% increase from the previous quarter, thanks to the support of NFT and game items.

Ethereum, on the other hand, has regressed slightly in terms of usage. There were an average of over 71,000 unique active wallets per day during the quarter, down 17.4% from the previous quarter. Something to watch, as more and more dapps seem keen to follow the trend of how dapp migration continues to shape the industry.

Polygon drives the multi-chain paradigm

Problems such as high transaction fees and low scalability have plagued the industry for a long time. To solve these problems, major DeFi and gaming Dapps like Aave, Sushi, and Aavegotchi decided to extend their functionality to Polygon, which is the perfect solution for this situation.

Since expanding to Polygon, Aave's TVL has reached $2.11 billion on sidechains alone. Considering Ethereum, this amount represents 22.56% of the total TVL. A similar situation happened with Sushiswap, whose TVL in Polygon accounted for 20.4% of Sushiswap's total TVL.

While it’s too early to draw any conclusions, Polygon offers DeFi users an alternative to interact with dapps like Aave and Sushi in a more efficient manner. More affordable and faster transactions could lead to significant changes across the blockchain.

image description

image description

Source: DappRadar and DeFiLlama

The list goes on, other significant Ethereum DeFi players such as 0x, Kyber, and Curve have integrated or announced integrations into the Polygon ecosystem. The 0x API allows users to provide liquidity across integrated sources such as Aave and Sushi. On the other hand, Kyber Network is about to launch the Rainmaker liquidity plan, which will distribute $30 million in KNC and MATIC tokens, which can be further compounded by staking on the corresponding Polygon pool.

Although from a technical point of view, the migration of Ethereum Dapps to Polygon seems to be smoother, it is still very attractive to see BSC native Dapps moving to multi-chain. Apeswap and Beefy are the latest projects to integrate with Polygon, showing early positive results. For example, Apeswap has processed more than 157,000 transactions from 11,880 unique active wallets, generating nearly $85 million in volume in the past 7 days.

Source: DeFiLlama

Source: DeFiLlama

DeFi locked-up value is still concentrated in Ethereum

image description

Source: DappRadar, DeFiLlama and DeFistation.io

As of the end of June, TVL has exceeded $53 billion, and Ethereum still controls more than 60% of this key metric of DeFi. Notably, five DeFi Dapps (Uniswap, Aave, Curve, MakerDAO, and Compound) account for 62% of Ethereum’s TVL.

Source: DappRadar

Source: DappRadar

While it’s too early to draw real conclusions, Polygon has certainly attracted a slice of Ethereum’s DeFi users; it’s clear that DeFi Dapps are still active in the latter’s ecosystem. As more DeFi Dapps are expected to expand to Polygon or other chains, it is worth paying attention to how DeFi will develop in the future.

The next step for Ethereum

Ethereum is preparing for a major overhaul of its transaction fee structure. EIP-1559 included in the upcoming London upgrade, Ethereum will adopt two types of fees: a "fixed" fee that will be burned after each transaction, and another optional fee that can be sent as a "tip" to miners to speed up trade.

In this way, gas fees will be calculated based on real-time market rates, rather than assigning variable rates due to auctions. Additionally, since the fees incurred during this process will be burned, the supply of ETH will decrease, making it a deflationary asset.

Source: Etherscan

Source: Etherscan

Once the three main testnets (Roepsten, Goerli, and Rinkeby) have successfully launched, the London upgrade on the mainnet is expected to take place in Q3. As ETH becomes deflationary, the asset becomes scarce, potentially pushing up the price of the asset. Only time will tell if Ethereum is capable of regaining the dominance it lost over the past few months.

BSC Thrives Despite Liquidations and Bugs

BSC has performed very well since the beginning of 2021. BSC's TVL rose 39.5% quarter-on-quarter to $26.2 billion despite massive liquidation resulting in $100 million in bad debts at Venus.

Source: DappRadar

Source: DappRadar

Although Pancake is already the head project of the BSC ecosystem, countless interesting projects have also caught up. Venus is the second largest BSC Dapp in terms of TVL, worth $2.54 billion. Autofarm, Pancake Bunny, BakerySwap, and ApeSwap are the most used Dapps in BSC. In June, they were both able to drive over 50,000 unique active wallets.

Functionality within these Dapps can be combined across projects and even other verticals, giving BSC a very complete and integrated ecosystem. In addition, important DeFi Dapps such as Curve, 1inch, Sushi, and Cream completed the expansion of BSC.

For example, Bakery is an automated market maker that enables NFT transactions on its platform, and using BAKE, users can earn liquidity rewards as well as create unique NFTs that are highly appreciated in the market.

All in all, BSC’s DeFi prospects look promising. Current trends may indicate that the value proposition of the chain is not directly driven by TVL at this stage. Except for PancakeSwap, the total value locked by BSC's projects is not surprising. However, the widespread use of BSC-native Dapps deserves attention. It is important that the Dapps involved need to avoid mistakes such as the Venus liquidation or the Garuda breach in order to maintain a healthy and trustworthy ecosystem.

Binance eager to replicate DeFi success in NFT space

image description

Source: BakerySwap NFT Marketplace

Binance Marketplace is designed to incentivize creators and traders with low fees and high velocity. Digitized artworks of legends Salvador Dali and Andy Warhol are the first announced collections, with more projects coming soon. Professional esports team OG Esports has announced its NFT collection. Binance Marketplace is definitely something to watch in the coming months, especially as they launch art, games, music, and other items. But in terms of volume and traders, Binance still has a distance from NFT leaders such as Ethereum, WAX and FLOW.

NFT mania is still hot

image description

Source: Google Trends

Source: DappRadar

Source: DappRadar

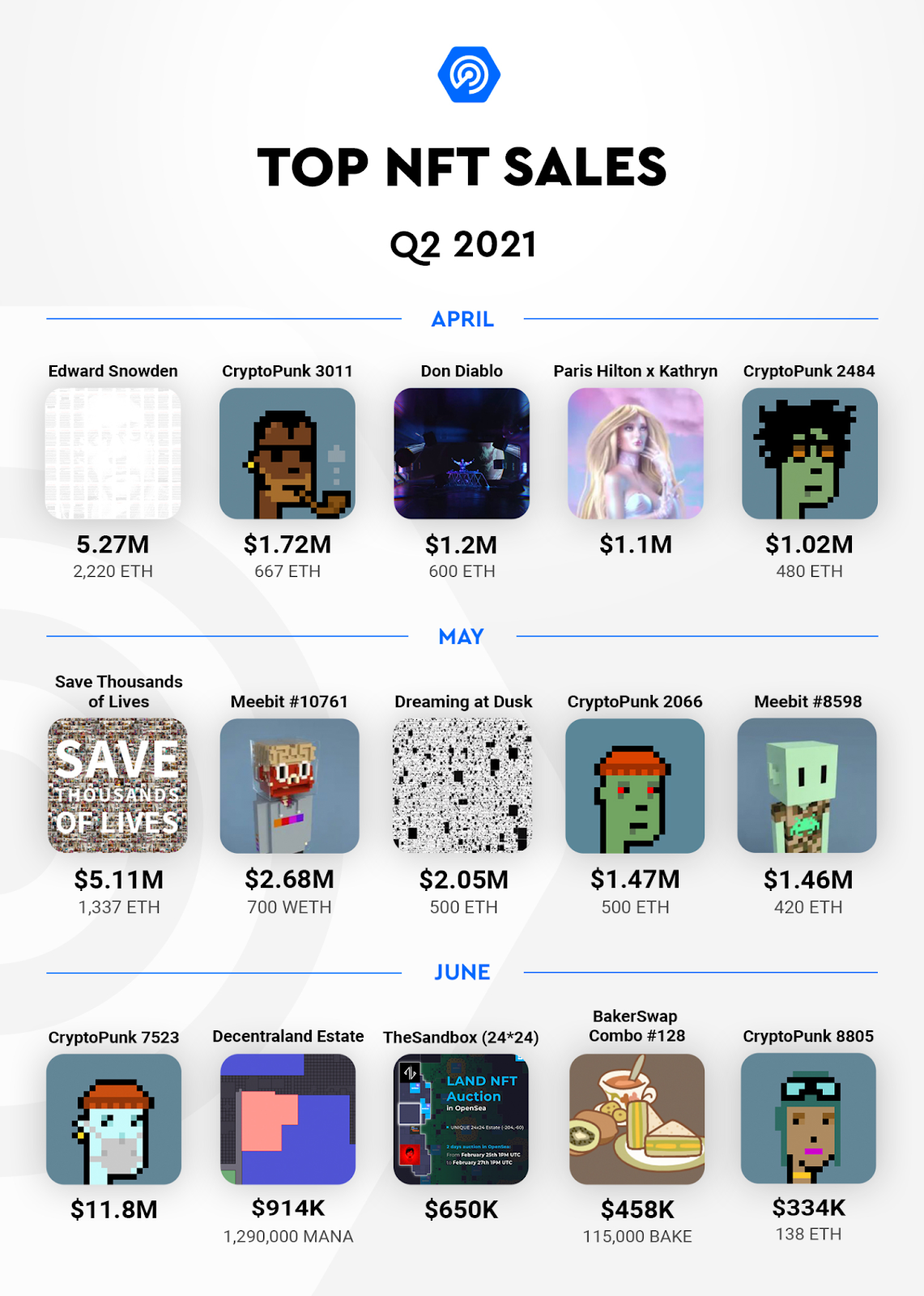

Another example is CryptoPunks, which traded more than $95 million in Ethereum collectibles by the end of last quarter, plummeting to just $16 million in June. Still, Punks sales are usually the most valuable, being put together as a compelling collectible.

Source: DappRadar

Based on the latest sales, NFTs that offer added value or utility to their owners appear to be gaining momentum. Virtual land and NFTs that unlock DeFi functionality are rapidly gaining traction. The ceiling for gamification in the Metaverse, playing games, and GameFi is higher than ever.

image description

Source: Google Trends

Sidechain Ronin Success——Axie Infinity

Axie Infinity tops the Dapp rankings in terms of transaction volume. Transaction volume of Pokemon-inspired Dapps hit $84.1 million, a 769% increase from Q1 2021. In addition, Axie has grown by 360.61% from the previous quarter, reaching more than 4,700 unique on-chain users per day.

Source: DappRadar

Source: DappRadar

In addition, the Axie marketplace also benefits from Axie's activities. In fact, it trails OpenSea in numbers, reflecting the enormous popularity the game has gained. The Axie marketplace saw $108.5 million traded in the last 30 days (+314.07% MoM).

NFT-based game upgrades

The appeal of metaverse games can be a significant catalyst in the quest for mass adoption. The previous section only detailed Axie’s current success as a money-making game, gaming Dapps from other protocols are not far behind.

In the volumetric visualization below, WAX could make a huge improvement.

Much of this is directly driven by Alien Worlds, an innovative DeFi metaverse that combines unique NFTs and tokens with gaming experiences while enhancing WAX's own marketplaces like Atomic Market.

Alien Worlds continues to grow its numbers by combining DeFi features with in-game collectibles.

NFTs in the Metaverse include virtual land (in a different game, Odaily), which can provide the owner with fees generated by the in-game mining process. Additionally, the Dapp’s governance token, TLM, can be used to stake and vote on game change proposals, but is also required to purchase and improve game items.

Source: DappRadar

Source: DappRadar

Source: DappRadar

Source: DappRadar

Aavegotchi switched from Ethereum to Polygon last March, showing positive results. Although the number of unique active wallets is down 22.45% compared to its peak in March, the next expansion will be the launch of the Gotchiverse Realm, a digital metaverse world.

Source: DappRadar

Source: DappRadar

Gamified-DeFi

As the blockchain proliferates to enable faster and cheaper transactions, decentralized games can be upgraded with financial features to create unique ecosystems.

GameFi combines the characteristics of DeFi, games, and NFTs to create an entertaining option that generates passive income. Additionally, GameFi Dapps allow players full control over their in-game assets to use them in different ways.

BSC's Mobox is a recognized GameFi reference.

Source: DappRadar

Source: DappRadar

Mobox attracted over 22,600 unique active wallets and generated over $57 million in total transaction volume in June alone. It's too early to draw conclusions, but the future seems bright. If similar projects can replicate Mobox's success, the industry could look very different in a few months.

The latest series of Ethereum

As mentioned in previous sections, users want to optimize the value of their digital assets. Still, existing collectibles are a strong trend in demand for NFTs. In fact, in every month of the quarter, at least two Crypto Punks or Meebits were in the top 5 sales.

Although volumes on Ethereum marketplace OpenSea fell 47% month-on-month, the trend appears to be reversing.

On a monthly basis, traders and volumes increased by 46.24% and 5.32%, respectively, which is an encouraging sign.

Source: DappRadar

Source: DappRadar

It's also worth noting that CryptoPunks and BAYC owners will be rewarded soon. The RTFKT platform already offers Punk owners real-life sneakers. The platform looks forward to repeating this behavior with other projects and inspiring collectors with real-life clothing, and the program really gives more interest to current collections.

All in all, Ethereum collectibles are well on their way to establishing themselves as high-profile collectibles. But perhaps more importantly, they're looking for a way to retain their digital avatar while generating additional utility in the real world.

The blockchain industry is going to get very crowded

While the DeFi and NFT scenes are currently focused on a limited number of protocols, several other smart contract blockchains are preparing their respective ecosystems to enter the fray, some of which are worth a look.

Algorand

Algorand's pure proof-of-stake mechanism PPoS allows network transactions to exceed 1000 TPS, and it has been announced that Balancer will become Algorand's first automatic market maker, paving the way for the application of DeFi in the Algorand network. On the NFT side, Algorand aims to be a reliable source for verifying digital identities on the blockchain, an interesting use case for NFTs that has yet to hit the mainstream.

Cardano

According to PoolTool, Cardano has over $31 billion in ADA staked from 667,456 unique active wallets. One might think that when DeFi is fully operational on this blockchain, funds will flow from staking pools to DeFi tools. However, ADA holders will be able to earn staking rewards while using ADA to provide liquidity. This is just one example of how Cardano is entering the entire DeFi ecosystem. Cardano is currently in the middle of its roadmap, but this chain is definitely worth considering when all is said and done.

Polkadot

Polkadot is one of the most complex ecosystems in the industry, consisting of many autonomous networks called parachains connected to the main blockchain called the relay chain. While Polkadot's roadmap is currently underway, hundreds of projects are already building on top of the network, aiming to create a new generation of DeFi projects.

Solana

Similar to the situation with Polygon, Solana is one of the few protocols that has been able to withstand falling cryptocurrency prices. Solana is expected to handle around 50,000 TPS, and more interestingly, the network speed also applies to its smart contracts, making this network the fastest smart contract blockchain in the industry. With the multi-chain paradigm at its best and with over 250 projects built on top of Solana, the DeFi space could be headed for another major shift.

Tezos

Summarize

Summarize

DeFi and NFTs are booming, while cryptocurrencies are not seeing massive growth. Both verticals have found a healthy balance in the blockchain industry by mixing different components in a way that attracts more users.

The next few months will be big for Ethereum. Both BSC and Polygon have made great strides this year, BSC’s PancakeSwap was the most used Dapp last month, and Polygon now feels like Ethereum’s de facto sidechain solution.

With the integration of the DeFi ecosystem, it is worth watching what impact the London upgrade will have.

Source link:

Source link:www.tuoniaox.com