Perpetual Protocol V2 - "Curie" officially released

After the main network of the perpetual protocol has been running smoothly for more than half a year, the perpetual protocol officially announced the new version "Curie". Features such as enhanced scalability, liquidity aggregation, and free market creation provide users with a new generation of DeFi derivatives experience comparable to centralized exchanges.

Naming description: The many creations of the Curies in the field of science are the basis of modern science and physics. We hope to name the perpetual protocol V2 after "Curie", hoping that the perpetual protocol can become one of the basic protocols of the future DeFi world.

Previous article: Onslaught V1

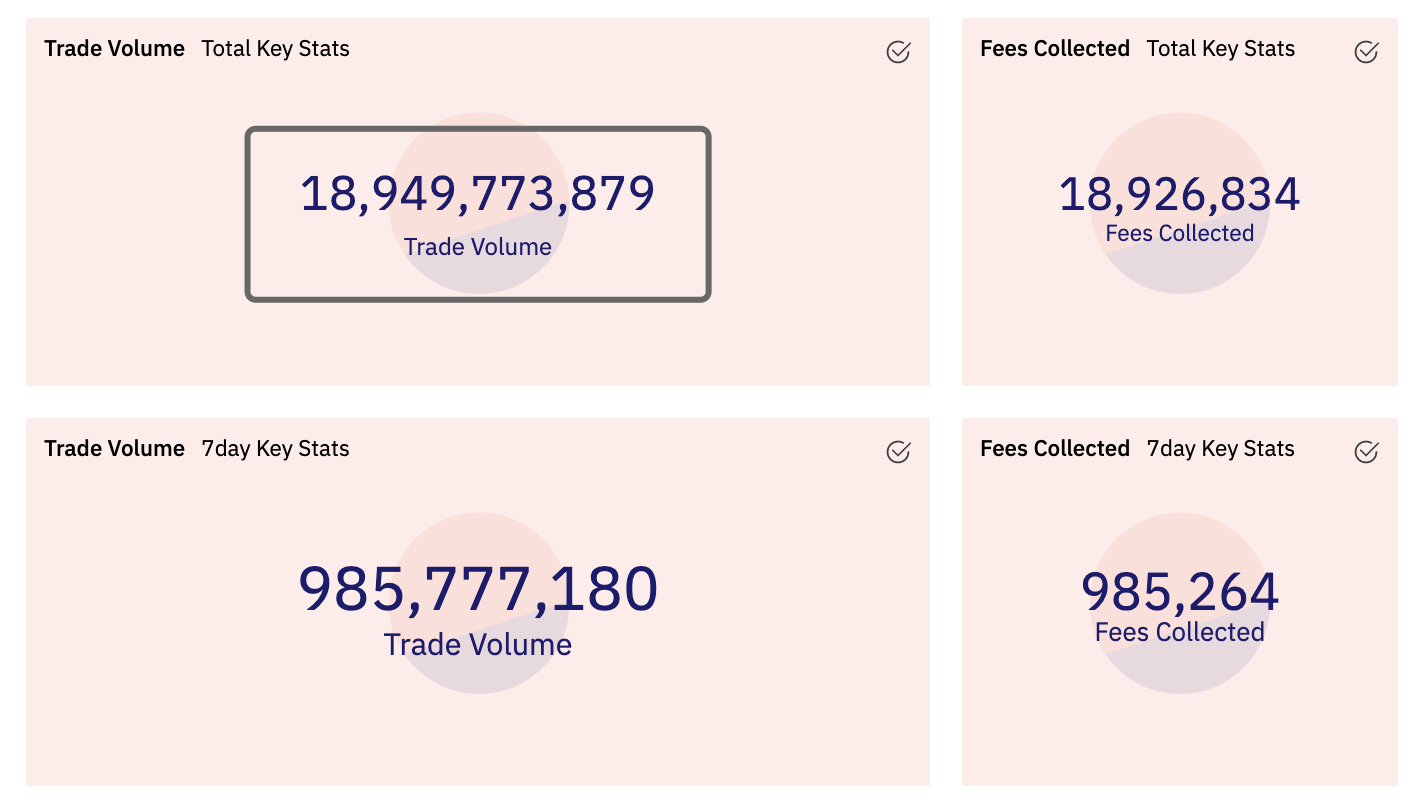

Since the launch of the Perpetual Protocol V1 mainnet on December 15, 2020, the transaction volume has gradually increased, achieving a total transaction volume of US$19 billion in 197 days.

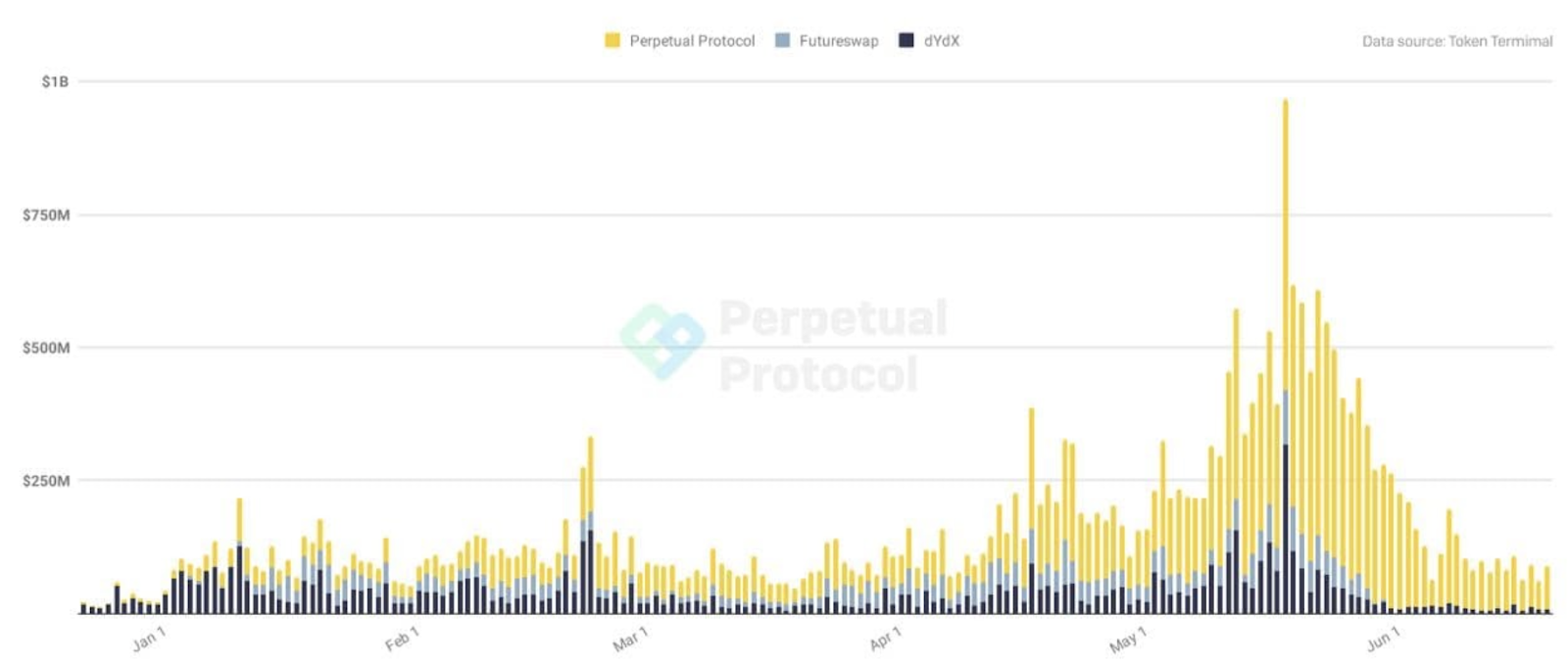

Among the perpetual contract derivatives on the chain, it accounts for more than 80% of the transaction volume (data from Token Terminal)

In the past few months, the perpetual protocol has iterated several important updates to ensure the robust growth of the protocol.

partial settlement mechanism

Weekly deals new on the market

Staking system launched

.......

New chapter: "Curie" - the final puzzle of DeFi derivatives

With the increase in the frequency of people's activities on the chain, higher requirements are put forward for the composability, scalability, and ease of use of derivatives on the chain. The Perpetual Protocol V2 will meet these needs. At the same time, as the original protocol of vAMM, the perpetual protocol V2 retains the feature of being able to trade any asset including digital currency/stock/commodities.

"Curie" overview

DeFi user experience from the future

"Curie" will be fully deployed on Layer2 Arbitrum, which will provide a faster, cheaper and more reliable transaction experience than the Layer 1 network.

In addition, "Curie" will use the joint margin model, and will add a variety of margin assets in subsequent updates.

More Aggregated Liquidity Solutions

"Curie" will be a lighter protocol, and we will couple transaction execution to Uniswap V3 to provide more centralized liquidity. The updated vAMM will mint vTokens for pending orders (makers) and traders (traders), which are used to place range liquidity and execute buy and sell transactions, respectively.

Everyone has the right to create a market

Therefore, the new market will use Uniswap as the transaction layer and Chainlink as the oracle machine. PERP pledgers will be able to have more choices in this function and obtain higher rights and interests.

"Curie" Roadmap

v2.0 Testnet

v2.1 mainnet launch & default market-making strategy

v2.2 Limit Order & Liquidity Mining

v2.3 Multi-Margin Assets

v2.4 No need to create new markets

more aggregated mobility

The liquidity dilemma is a problem for all DeFi protocols. The consequence of insufficient liquidity is that users have to accept higher slippage in transactions. Since the liquidity of the perpetual contract v1 is evenly dispersed on the definite product curve, it is also facing Similar question.

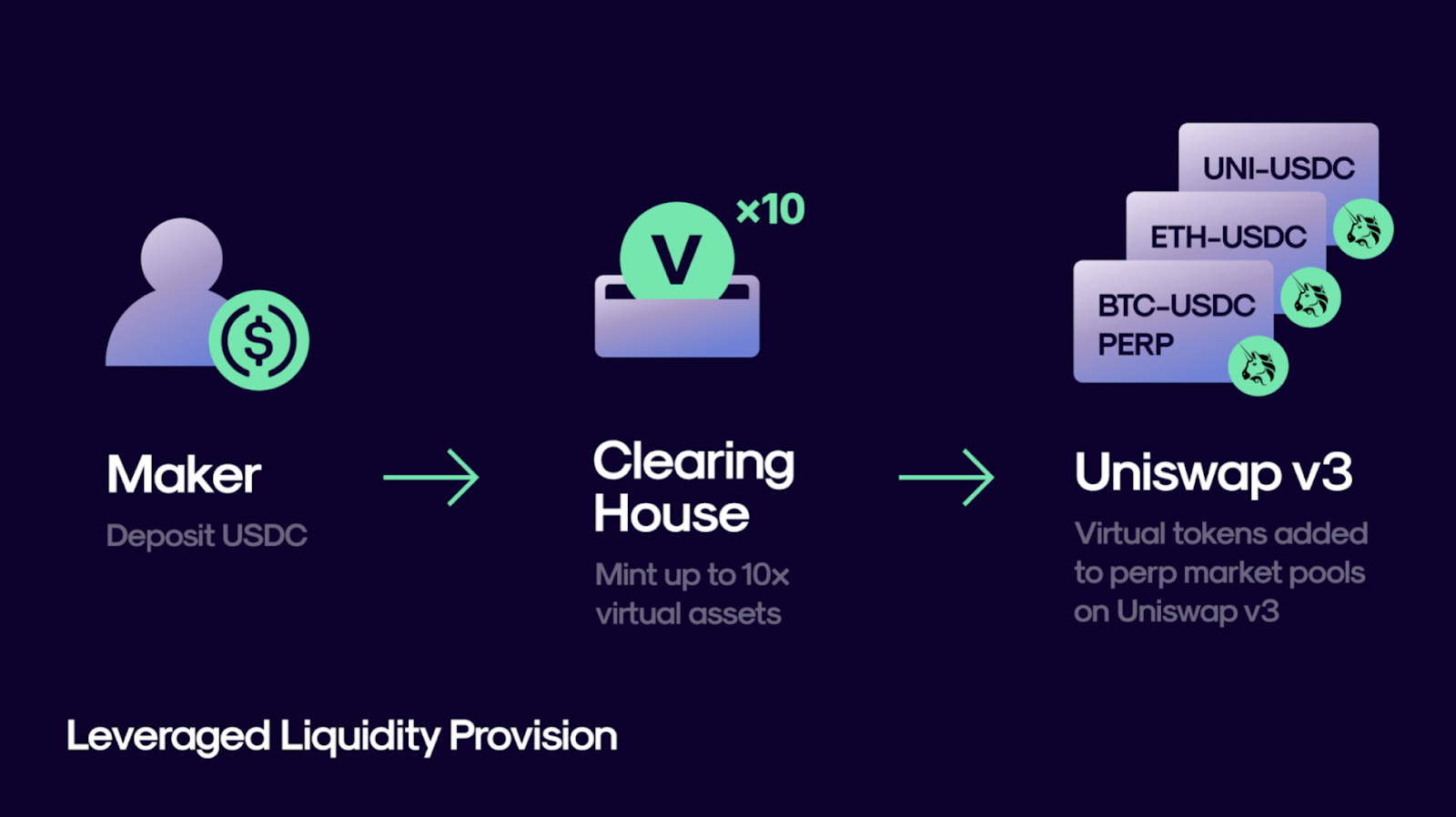

The subversive innovation of "Curie" is the key to getting rid of liquidity dependence, and can greatly improve the efficiency of capital use: the vAMM model of the perpetual agreement is coupled with Uniswap V3, and the economic model and mechanism logic are placed on the perpetual agreement. Execution layer for transactions via Uniswap V3. With the help of Uniswap V3's efficient use of funds, this innovation will enable the maker of the perpetual agreement (ie maker, hereinafter referred to as maker) to place liquidity in a more concentrated range, thereby obtaining higher service fee points. Run. At the same time, because of the improved composability brought about by Uniswap V3, the perpetual agreement will also have the opportunity to combine with more strategic market-making agreements.

In addition, in "Curie", "Leveraged LPs" (leveraged LP) is another major innovation. Makers can place leveraged liquidity in stages according to their preferences. For those users who have higher requirements for liquidity strategies It is undoubtedly an excellent tool.

Similar to Perpetual Protocol V1, the most important protocol component in "Curie" is still Clearing House, users will be able to leverage collateral assets to mint vToken virtual assets to provide liquidity or conduct transactions according to risk preferences. Taking the deposit of 100USDC as an example, 1000vUSDC can be minted with 10 times leverage. If the user wants to provide liquidity as a maker, he can divide v1000USDC into 500vUSDC and 0.25vETH (assuming that ETH is now worth 2000USDC) and place it in the desired vUSDC-vETH The interval on the corresponding definite volume curve in the liquidity pool.

Similarly, if the user wants to trade as a trader, he can use any amount in 1000vUSDC to buy long or sell short.

This means that the user role of "Curie" is no longer a single one that can only operate based on the current market price to earn directional profits, but also can become a maker according to one's own strategy and risk preference, and earn transaction procedures in market making Fees and some directional profits.

Joint margin model and multi-margin assets (Cross-margin&multi-assets collateral)

The joint margin mode means that users can use the wallet address balance to open multiple positions in multiple markets at the same time on "Curie". The multi-margin asset function will be added in v2.3. For example, users can use ETH as margin to open short or long positions in the BTC (or any asset)-USDC market. Here is a simple example*:

Alice uses ETH as collateral to buy and open long positions in the BTC-USDC market. When BTC rises, Alice who closes the position at this time will receive more USDC. When BTC falls, Alice who closes the position at this time will not get More ETH than when the position was opened.

*For a detailed description of the mechanism and principle, please pay attention to the follow-up document update of the perpetual protocol.

Create new trading markets without permission

When "Curie" is updated to version v2.4, under the premise of meeting a certain amount of PERP Staking, anyone will be allowed to participate in the creation of the market. In addition to the maker and trader, the platform has added a no-access market. this new role. This means that as long as any target can be price-fed by Uniswap V3's TWAP or Chainlink, it will be recognized as a target that can open a new market in the "Curie" system.

Of course, as mentioned at the beginning, as the creation agreement of the vAMM mechanism, the virtual AMM means that the system is not restricted by the liquidity of real assets. In the future, "Curie" will support contract transactions including but not limited to stocks/commodities/precious metals.

In addition, the creator of the market can even decide the settlement currency unit of each market, which will provide users with better convenience when non-stable currency is used as the settlement currency.

Token Economic Model Update

Due to the iteration and update of the mechanism, in the perpetual protocol V1, the increase in protocol income is too variable, which leads to a delay in the progress of fee sharing. However, in "Curie", the method and proportion of fee sharing will be determined by governance , The implication is that under the new mechanism, we are very confident that once "Curie" goes online, we can start the fee sharing as soon as possible.

In addition to being able to obtain the handling fees of the open market, the market deployed by Perpetual DAO will share the handling fees with PERP Staker, which is generally composed of three parts

Open Market Transaction Fees

New markets created by users

Proceeds from funds held in the Clearing House Vault and Insurance Fund lent through mainstream lending protocols

With the increasing liquidity and trading volume of Uniswap V3, third-party single-currency market-making strategies around it are also emerging. For "Curie", we will also actively carry out strategic cooperation with relevant leading protocols, Provide optimal strategies for makers who want to make markets in "Curie" to ensure income.

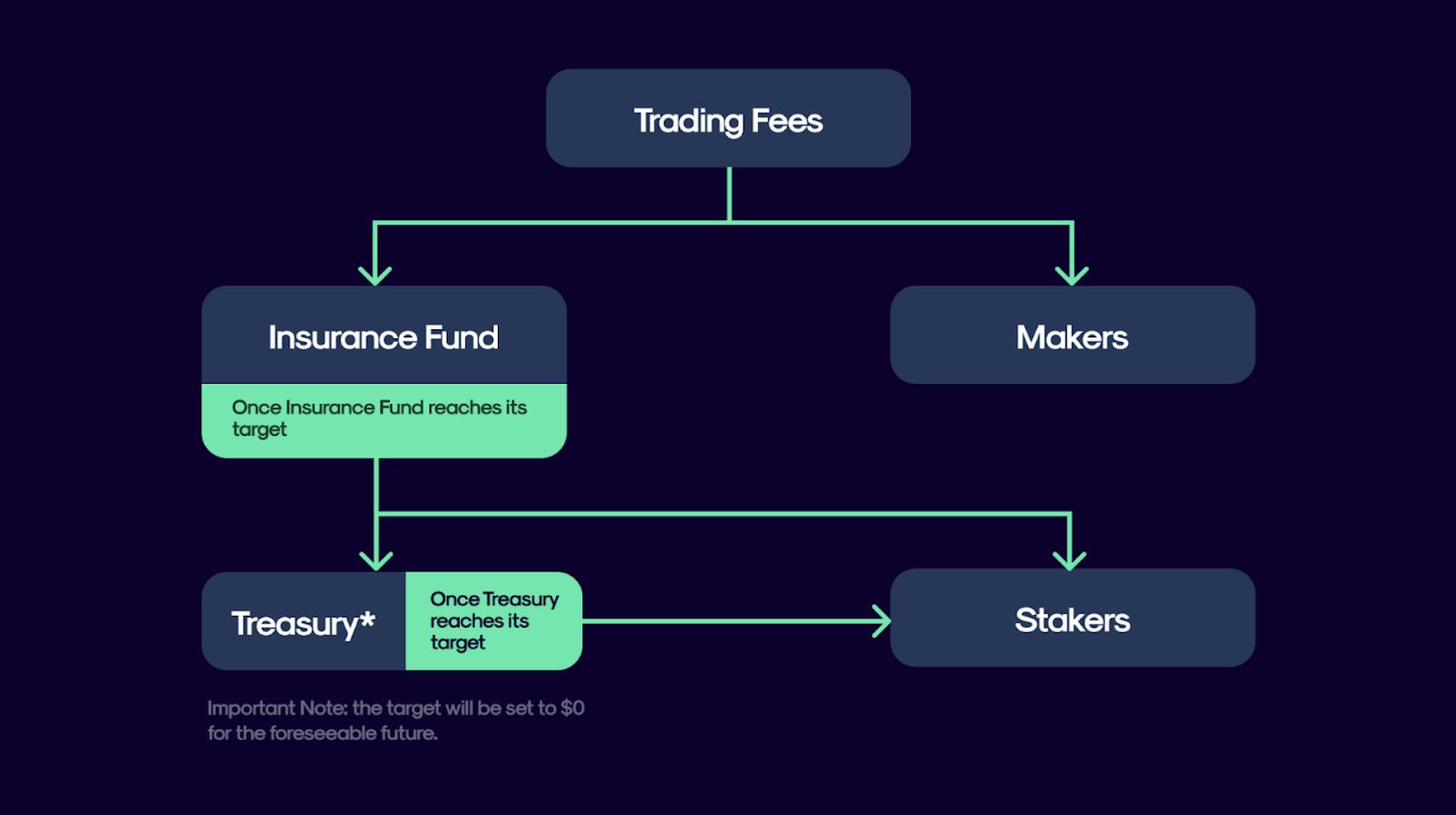

The following flow chart describes how we will share the commission in "Curie",

Makers play a key role in the system, so we will consider tilting towards Makers to a certain extent when distributing platform fees. The official ratio and number will be determined and synchronized to the community before and after the official launch of "Curie".

In addition, in view of the characteristics of "Curie", the robustness of the perpetual protocol itself will no longer depend too much on the robustness of the Insurance Fund, unless the amount of funds in the Insurance Fund will decrease in the event of an extreme black swan event, otherwise theoretically will continue to grow. Therefore, when "Curie" starts, the pink target ratio of Insurance Fund (the ratio of the current opening amount to Insurance Fund) will be set at 0%, so that once the protocol starts V2, users will clearly know when they can start Get dividends.

The above is the main content of V2 of the Perpetual Protocol, and the detailed operating principle/mechanism/functional characteristics/economic model/token model will be gradually updated in the official documents of the Perpetual Protocol.