In an article published by Cointelegraph on June 22, the title of "alarmist" was used: "Automated Market Makers are Dead" (Automated Market Makers are Dead).

This article expounds three core points of view:

1. The biggest beneficiaries of the AMM model are not LPs but arbitrageurs. 2. Because LPs shifted to new side chains and AMMs running on layer 2, liquidity became more decentralized. 3. In order to save Gas fees and improve transaction efficiency, traders and developers will flock to the second layer to build DeFi applications, and the liquidity war between AMMs on the underlying chain will be waged on a new battlefield.

Rather than saying "AMM is dead", it is better to say that a new battle for liquidity has begun at Layer 2 (hereinafter referred to as L2).

secondary title

Why is L2 so important to all DeFi projects?

exist"

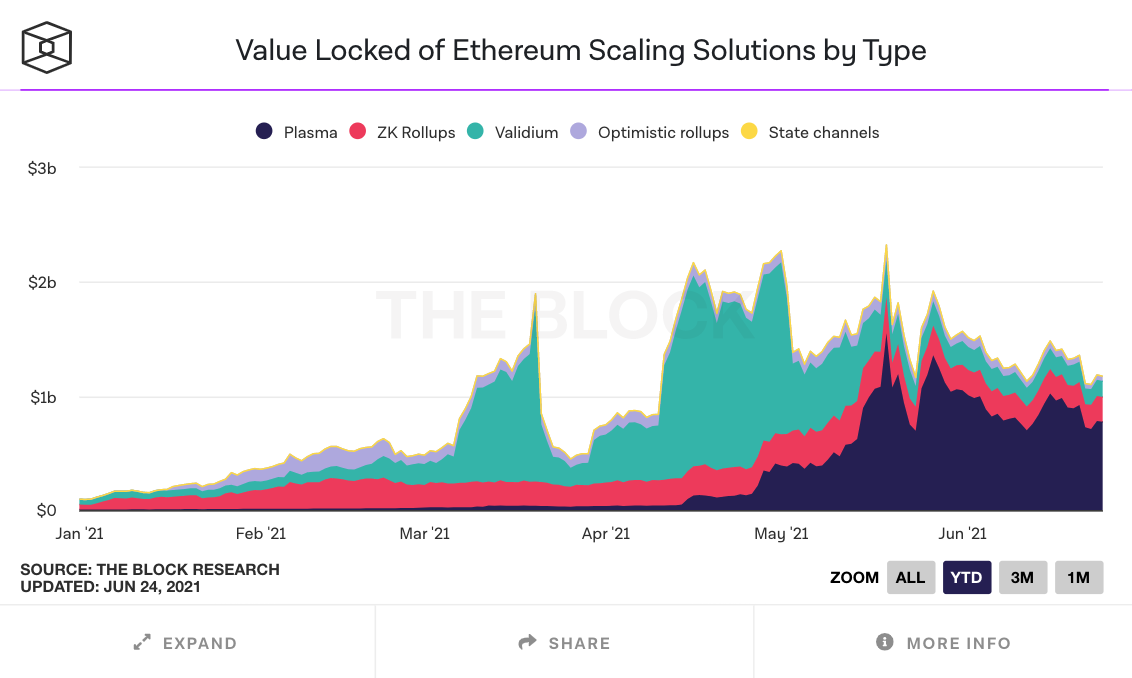

exist"Layer 2 Series 1: Who is the King of Problem Solving in Ethereum Expansion Solutions?In ", we introduced five mainstream L2 solutions, including sidechains, tubular channels, Plasma, Validum, and Rollups. From the data in the figure below, we can intuitively see the TVL data of each expansion solution (excluding sidechains). To analyze the extent of its adoption.

The first quarter of 2021 is led by ZK Rollups, followed by Validium. In the second quarter, Validium broke out first, and then Plasma rose to dominate.

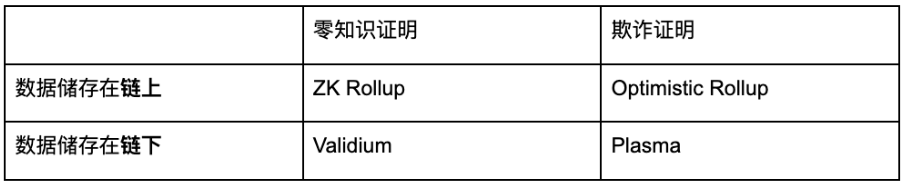

The difference between Validium and ZK Rollup is that the former is more suitable for high-frequency applications that do not require so much trust, such as game DApps, which can process 10k transactions per second, and the data is stored off-chain. ZK Rollup is more suitable for payment and transaction scenarios that require high security, and the data is stored on the chain:

After introducing all the mainstream solutions, let us narrow our attention to DEX, which can be said to be the core of the second-layer ecosystem. Different trading platforms have adopted different solutions, representative projects include:

Using Optimistic Rollup technology: Uniswap V3, SushiSwap, MCDEX, DODO

Adopt ZK Rollup technology: Loopring, dYdX, ZKSwap

Using Plasma Technology: OMG Network

Powered by Validium Technology: DeversiFi

At present, decentralized exchanges including Uniswap V3, SushiSwap, DODO, Bancor, etc. have been deployed on Arbirum. Arbitrum Rollup is also a network based on Optimistic Rollup technology. Because it is easy to integrate with DApps and fully compatible with Ethereum EVM, it has become the first choice of many well-known projects and developers.

The L2 network effect is rapidly heating up. How is the performance of the well-known top DEX projects Uniswap V3, DODO, and dYdX?

secondary title

DEX VS. CEX

1. Liquidity: 24-hour trading volume (divided into spot and futures), user visits, and supported trading methods

(Data sources: Coingecko, DeBank, FTX, official websites of various trading platforms, statistical time: 2021/6/29)

According to the above data, we can see that Uniswap V3 (L1), which ranks first in the 24-hour spot trading volume of each DEX, only accounts for about 5.8% of Binance. At the same time, the 24-hour transaction volume of some top DEXs on different side chains of L2 is:

● PancakeSwap (BSC):$ 342,091,865

● QuickSwap(Polygon): $ 208,976,311

● SushiSwap (Polygon): $ 55,816,630

There is no L2 "dark horse" DEX that can exceed the trading volume of DEX on L1, and it is still in the stage of gathering more users and liquidity. So how does the trading experience of the two compare? Let's continue the analysis.

2. Trading experience: handling fee, supported currencies, supported trading pairs, slippage, interface

image description

image description

*Slippage calculation method: take the ETH/USDT trading pair as an example to calculate the spread of 1ETH

Excluding the gas fee that needs to be paid on the chain, DEX’s transaction fee per transaction is basically the same as that of CEX. The transaction currencies and trading pairs supported by top DEX can already catch up with top CEX, including more long-term tail assets.

image description

dYdX trading page

As can be seen from the figure above, the trading interface of dYdX has already tended to the order book model of a centralized exchange. Through the combination of non-custodial, off-chain order book and management engine, traders can better manage risks and formulate trading strategies. The trading slippage in the above table is also approaching CEX.

It is particularly worth mentioning that on June 15, dYdX completed a US$65 million Series C financing led by Paradigm. Top investors also include Kronos Research, a quantitative investment research institution that incubated Wootrade, and well-known investment institutions such as QCP Capital and HashKey. StarkWare provides technical support for L2 expansion, and more trading pairs will also promote the trading volume of the platform after it goes online.

3. Security

3. Security

DEX users have 100% regulatory ownership of their assets. It can be said that the privacy and security have surpassed CEX, but if the user loses his private key string in DEX, then the property in the wallet may be will be permanently lost.

In summary, whether it is a side chain or other expansion solutions, the development of DEX on L2 is still very long. In the future, well-known projects such as Uniswap and dYdX will continue to drive transaction volume, and the competition between the AMM model and the order thin model will also Intensified.

The battle for liquidity is taking place, but whether it is CEX or L2 DEX, different users have different needs and choices. What is your choice? Welcome to pay attention to the Wootrade public account, and continue to interpret industry hotspots and trends for everyone.