This article comes fromThis article comes from, by Tom Robinson, Co-Founder and Chief Scientist, Elliptic

Odaily Translator | Nian Yin Si Tang

Odaily Translator | Nian Yin Si Tang

Contrary to popular belief that the crypto asset industry is unregulated, U.S. regulators are increasingly imposing significant financial penalties on crypto businesses — in the name of fraud, violations of anti-money laundering regulations, offering unregistered securities and violations of sanctions Regulation.

Crypto asset businesses are subject to many of the same laws and regulations as any financial services business based in the United States or serving US citizens. These are some of the strictest rules governing the provision of financial services in the world, and crypto businesses devote enormous resources to complying with anti-money laundering and sanctions obligations, among other things.

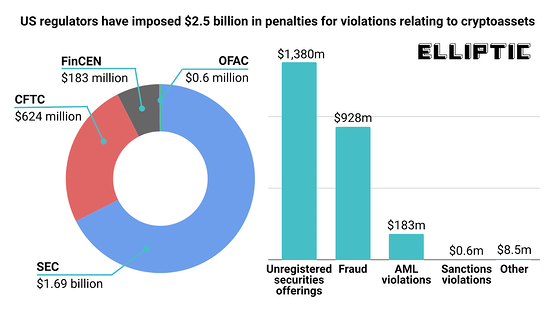

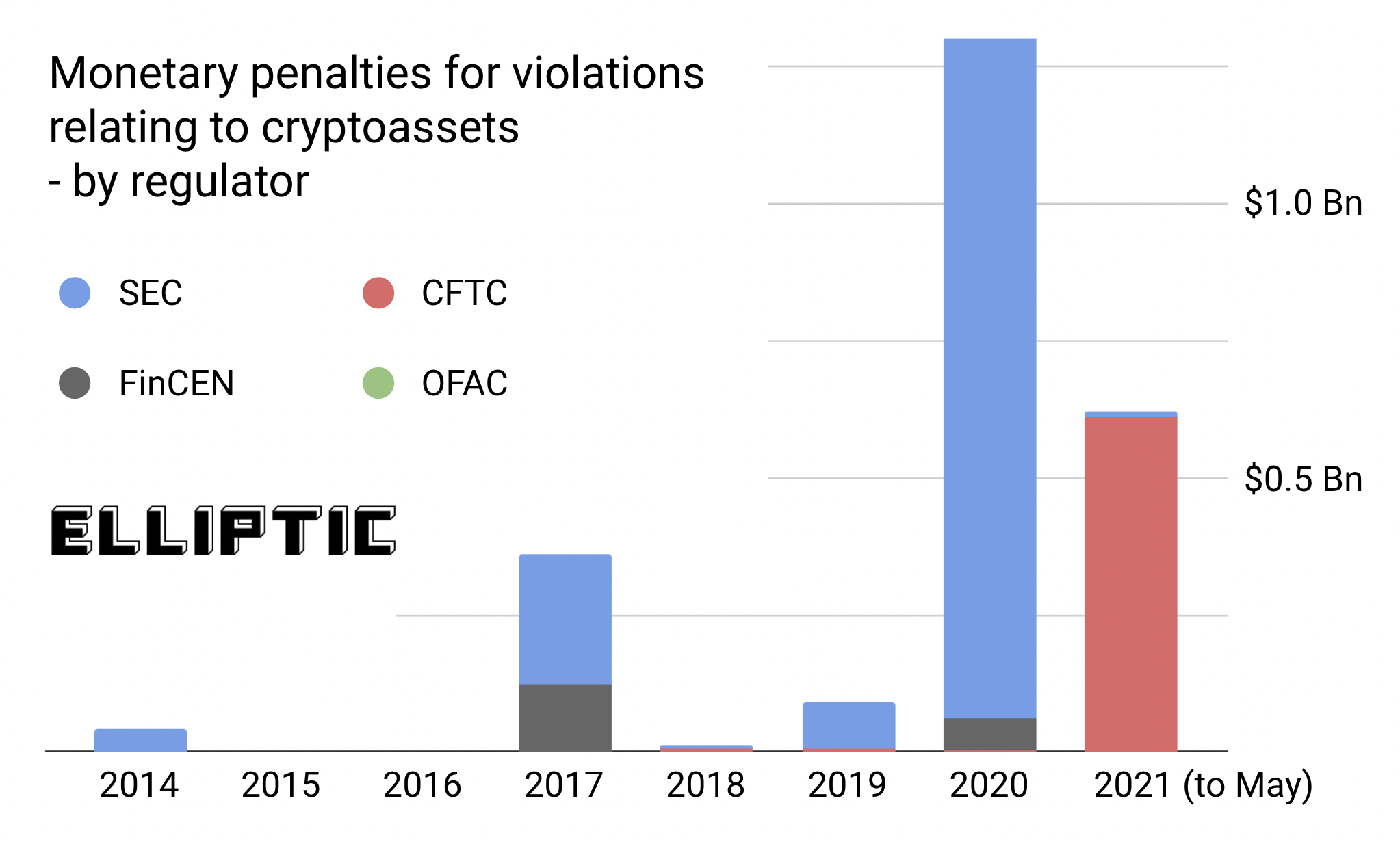

Just as traditional businesses and financial institutions have been penalized by regulators for violating these rules, so too have crypto businesses. An analysis by blockchain analytics firm Elliptic of U.S. regulatory enforcement actions since Bitcoin’s creation in 2009 shows that fines have reached $2.5 billion against companies and individuals trading in crypto.

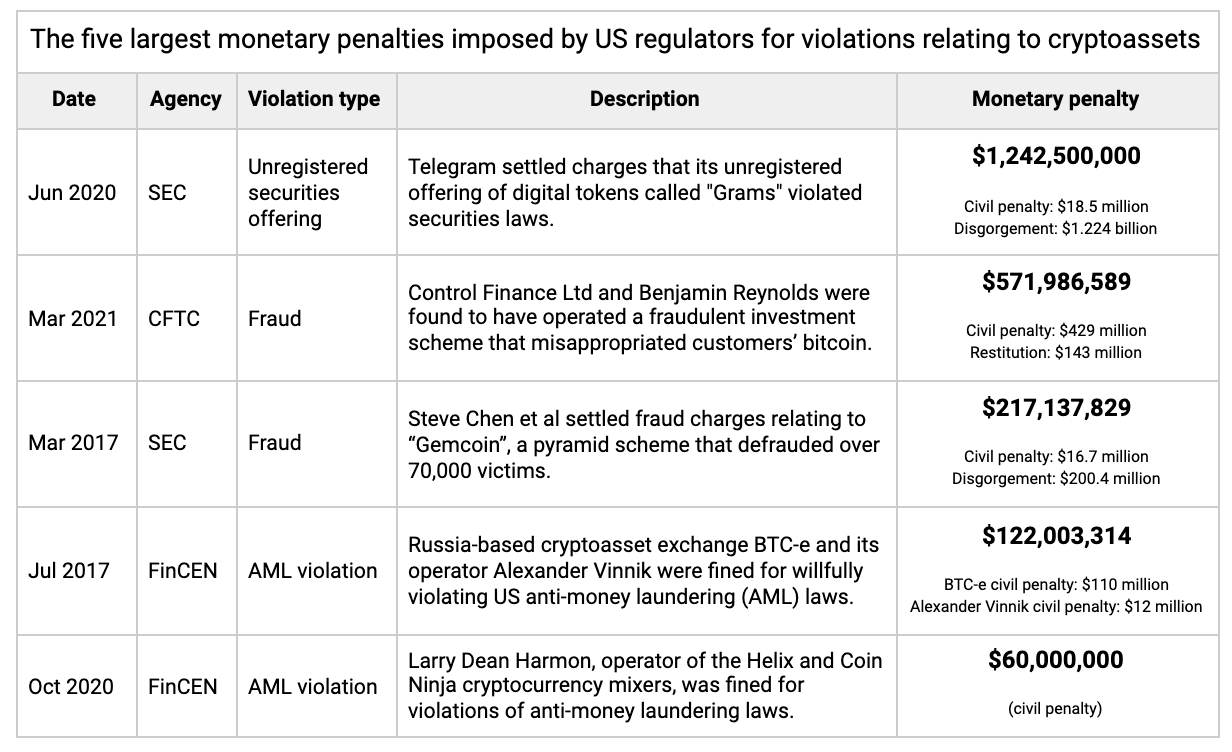

These include a $1.69 billion fine from the U.S. Securities and Exchange Commission (SEC), a $624 million fine from the Commodity Futures Trading Commission (CFTC), a $183 million fine from the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN), a $183 million fine from the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC). OFCA) fined $606,000. Most of these penalties relate to unregistered securities offerings ($1.38 billion), fraud ($928 million) and anti-money laundering violations ($183 million). Penalties can be broken down into civil penalties ($722 million), seizure ($1.62 billion), and restitution ($161 million).The first major enforcement action came in 2014 when the US SEC ordered Trendon T. Shavers and Bitcoin Savings and Trust to operate a Ponzi schemePay more than $40 million in fines

, the scam defrauded investors of more than 700,000 bitcoins. Whether it’s dollars, bitcoins, or magic beans, the SEC has proven that regardless of the asset or technology used, a Ponzi scheme is a form of fraud that can be traced under the same old laws.In 2013, FinCENClearly defined, exchangers of "virtual currency" must comply with the Bank Secrecy Act (Bank Secrecy Act), just like any other money services business. This requires them to detect and prevent money laundering through records, customer identification and other measures. This is not the case with Russia-based crypto asset exchange BTC-e, which is heavily used by criminals to launder the proceeds of crime in cryptocurrencies. Although BTC-e is not headquartered in the United States, it does serve U.S. customers, so FinCEN issued a 2017 review of the company and its operator, Alexander Vinnik。

, the scam defrauded investors of more than 700,000 bitcoins. Whether it’s dollars, bitcoins, or magic beans, the SEC has proven that regardless of the asset or technology used, a Ponzi scheme is a form of fraud that can be traced under the same old laws.In 2013, FinCENClearly defined, exchangers of "virtual currency" must comply with the Bank Secrecy Act (Bank Secrecy Act), just like any other money services business. This requires them to detect and prevent money laundering through records, customer identification and other measures. This is not the case with Russia-based crypto asset exchange BTC-e, which is heavily used by criminals to launder the proceeds of crime in cryptocurrencies. Although BTC-e is not headquartered in the United States, it does serve U.S. customers, so FinCEN issued a 2017 review of the company and its operator, Alexander Vinnik。

$122 million fine

The largest such action to date occurred in 2020, when Telegram Group Inc. and its wholly-owned subsidiary TON Issuer Inc. filed a complaint against the U.S. SEC that Telegram violated federal securities laws by issuing an unregistered digital token called "Grams."reached a settlementreached a settlement

. Defendants agreed to return more than $1.2 billion to investors and pay an $18.5 million civil penalty.More recently, the U.S. CFTC has become a major source of enforcement action against crypto businesses for violations such as fraud, reporting failures, and false buying and selling. British national Benjamin Reynolds charged with defrauding clients in March 2021ordered to pay

Nearly $143 million in damages and a $429 million civil penalty. Previously, the CFTC charged Reynolds and Control-Finance, a so-called crypto investment scheme, with fraud and misappropriation of funds.The U.S. OFAC is the latest agency to take enforcement action against crypto businesses. OFAC is responsible for imposing economic and trade sanctions against foreign countries, organizations, and individuals deemed threats to U.S. national security. This sanction applies equally to cryptocurrencies and any other asset, which OFAC has imposed over the past yearTwo Crypto Asset Businesses

Penalties for violations of sanctions were imposed.

Our analysis of U.S. crypto-asset-related enforcement actions shows that the crypto industry is far from the “Wild West” of finance. Regulators have successfully used existing laws to deter and punish illicit activities utilizing crypto assets — from Ponzi schemes to money laundering — and hold companies accountable for compliance failures.