Uniswap V3 capital utilization rate increased by 4000 times? Not yet implemented.

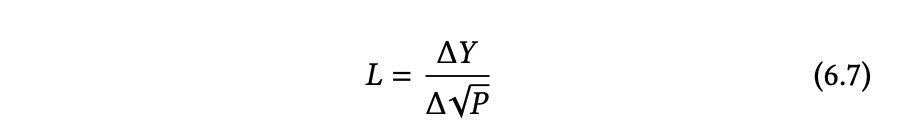

Uniswap V3 launched on Ethereum on May 5 is the most exciting DeFi update, and it can be said that there is no one.According to the latest news, if the community votes, V3 will be deployed to the Ethereum expansion network Arbitrum, bringing faster transaction speeds and lower transaction costs. So what specific innovations does V3 have?First, open the technical white paper of Uniswap V3, and its first chapter summarizes its core technical features - "Concentrated Liquidity". That is to say, on the basis of V2, V3 focuses on solving the problem of low utilization rate of AMM funds.The following formula is its core formula, that is, the relative value (the relative value of capital Y and price P) is used to calculate liquidity L, and liquidity is the amount of funds per unit "price change". In the case of a certain trading volume, if the liquidity is good, the price change will be small, and if the liquidity is not enough, the price fluctuation will be large.

I believe that many people will frown when they see such a complicated formula, but it doesn't matter, let's start with its curve.

Traders who are familiar with Uniswap products should know that the core of its "automated market making" is a mathematical model with a fixed product: x*y=k, k is a constant. That is to say, the total liquidity of any exchange pool needs to satisfy the formula on this curve, and the x and y assets put in by liquidity providers will be evenly distributed at each price point for market making. "It's like eBay. If you want to sell something, just list it (transaction)." Boris Wertz, one of the early investors in the project, likened the simplicity of Uniswap.But in fact, most of the time the token price will only be traded in a certain small area, and the funds at other prices are idle, which leads to the pain point of low capital utilization, and this is almost a DeFi AMM project Everyone wants to break through the upper limit.The daily trading volume increased rapidly after V3 went online. This picture shows the comparison of the daily trading volume in the past 7 days with that of V2

In order to concentrate on solving this pain point, after Uniswap updated V3, the official stated that the utilization rate of funds is expected to increase by 4000 times. We can verify it through the data. After counting the daily trading volume and lock-up volume in the last 7 days, we can calculate that its capital efficiency has not reached the high multiple officially declared. Among them, capital efficiency = trading volume / locked position.According to the above table, we can conclude that when the total lock-up amount is lower than that of V2, the capital utilization rate of V3 is indeed significantly improved compared with that of V2, which is about 4 times that of V2.So what methods does V3 use to improve capital utilization?LPs allow market making within a specific price range

One can imagine such a mechanism that divides the overall liquidity supply curve into small "containers", which are officially called "ticks". The price range of each "container" is very small, and each is a small automated market maker.You might be thinking, how is this a bit like creating an order book? Yes, for example, if the USDC/ETH trading pair provides liquidity between USD 1700-1800, these funds will be traded in multiple ranges.Comparison of the liquidity of V2 in the white paper and the liquidity in the V3 range

Of course, some analysts pointed out the disadvantages of doing this market. Binding assets to a certain price range in this way is not friendly to ordinary liquidity providers with small trading volumes. First, the gas fee for trading across multiple ranges will increase. Secondly, when the price range is set unreasonably, the profit of market making will be affected, unlike professional DeFi professionals and professional market makers who will benefit more due to their superior strategies. In Uniswap V2, each LP distributes the income of the liquidity pool in proportion.

Uniswap also expressed its hope for the future in an article to the community: It is hoped that the role of "Uniswap strategy integrator" will appear in the market in the future. They can aggregate the funds of small traders and distribute the benefits to them to achieve cost balance. .This also leads to the second innovative idea of the V3 version - NFT.In the V3 version, if each Uniswap LP position is unique, what would you think of? Yes, non-fungible token NFT.Some users sold NFTs representing Uniswap V3 positions on the trading platform OpenSea

Turning financial strategies into NFT is creating a "money" that is smarter than digital currency, because it is a fully automated transaction model, or a financial tool, eliminating the need for human-to-human transaction docking The cumbersome intermediate consumption of , negotiation, and signing makes the transaction easier to conclude, and it also makes it easier for ordinary people to participate, and the cooperation efficiency is higher.But there is also a small negative impact. Because of its uniqueness, these NFT tokens cannot be interchanged. Of course, there are still external contract agreements that can convert them into homogeneous tokens.In addition to the above two key innovations, V3 has two other major updates for handling fees and price inquiries:3. Use the fee level system (0.05%, 0.3% and 1%) to replace the single 0.3% handling fee of V2. The purpose of this setting is to enable liquidity providers to choose an acceptable risk level in advance and make it more reasonable Compensation - undoubtedly makes the transaction more humane.

4. Adopt an optimized price input mechanism to make price inquiries faster and lower cost by saving past price inquiry records.

The above is the core competitiveness of the V3 version. Is it easy to use? Only by getting started with trading will you know.It is believed that in the future, V3 will also create more opportunities for peripheral infrastructure and derivatives, attract more funds and talents to enter the market, and produce a positive spiral effect.As written in the Uniswap V3 white paper:Uniswap V2's core contracts should become peripherals (applications) that are not needed.The release of Uniswap V3 will bring investment opportunities in various tracks surrounding its peripheral functions. In the short-term future, as market makers gradually realize the improvement of V3 capital efficiency, the market-making capital of V3 will become larger and larger. We can foresee that the active market-making strategy track based on Uniswap V3 will be contested by a hundred schools of thought, which will lead to more investment opportunities.