Cryptocurrency mining refers to the process by which miners confirm transactions on the blockchain. This is also known as proof of work. When miners confirm transactions, it prevents double spending (double spending) on the network. When sending or receiving bitcoins, it may be necessary to wait for 3 to 6 network confirmations before the bitcoins can be credited. Behind all the confirmation of network transactions, it is the computing power in the hands of miners to ensure that transactions are safe and effective.

The daily mining income of miners will change rapidly with market fluctuations. We can often see that the income rises like a rocket within a day, or within a few days, part of the mining income may not even cover their electricity bills.

Why do mining revenues change?

The following are 3 factors by which mining revenue is affected by network fluctuations:

Cryptocurrency prices inherently fluctuate

Network difficulty fluctuates

Cryptocurrency transaction fees fluctuate

Cryptocurrency Price Fluctuations

Assuming that the price of Bitcoin and Ethereum (or other mineable currencies) rises, the mining income of miners will also increase simultaneously; and if the market price falls, the income will also decrease. Of course, this is based on network difficulty and The conclusions drawn under the condition that the blockchain reward remains unchanged.

Network Difficulty Fluctuations

Contrary to the above reasons, when the difficulty of the network increases and the market price remains unchanged, mining revenue will decrease, and vice versa.

The difficulty coefficient is used to adjust the number of blocks that can be found within a certain time range. Taking the Bitcoin network as an example, one block can be found in 10 minutes. If it is adjusted to find a block chain every 8 minutes, the difficulty will increase until every 10 minutes until a block can be found.

If the difficulty of the network doubles, the miners' mining revenue (revenue calculated in terms of cryptocurrency output rather than legal currency) will be reduced by half, but if the market is in a bull market and the currency price remains high, the miner's legal currency income will not actually decrease. There is also the possibility of rising.

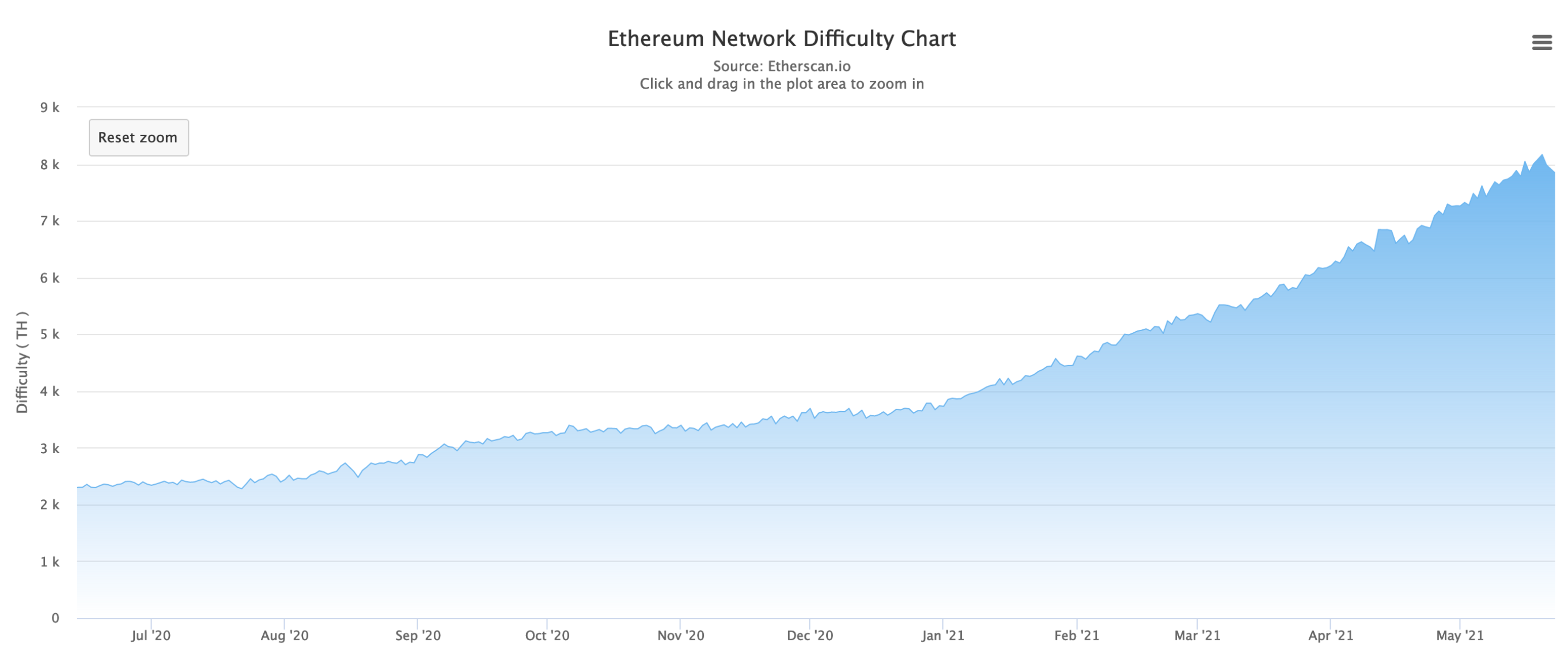

As shown in the figure below, as more and more miners join the Ethereum blockchain network, the difficulty of the network is gradually increasing. Fortunately, the short-term price increase of Bitcoin and Ethereum in the first quarter of 2021 outpaced the increase in network difficulty speed.

Transaction fees fluctuate

The mining reward consists of a fixed blockchain reward and transaction fee reward, which means that the miner who finds the block will receive a fixed block reward (6.25BTC for the Bitcoin network and 2ETH for the Ethereum network) and block All transaction fees paid by blockchain users (all ETH and ERC20 transactions).

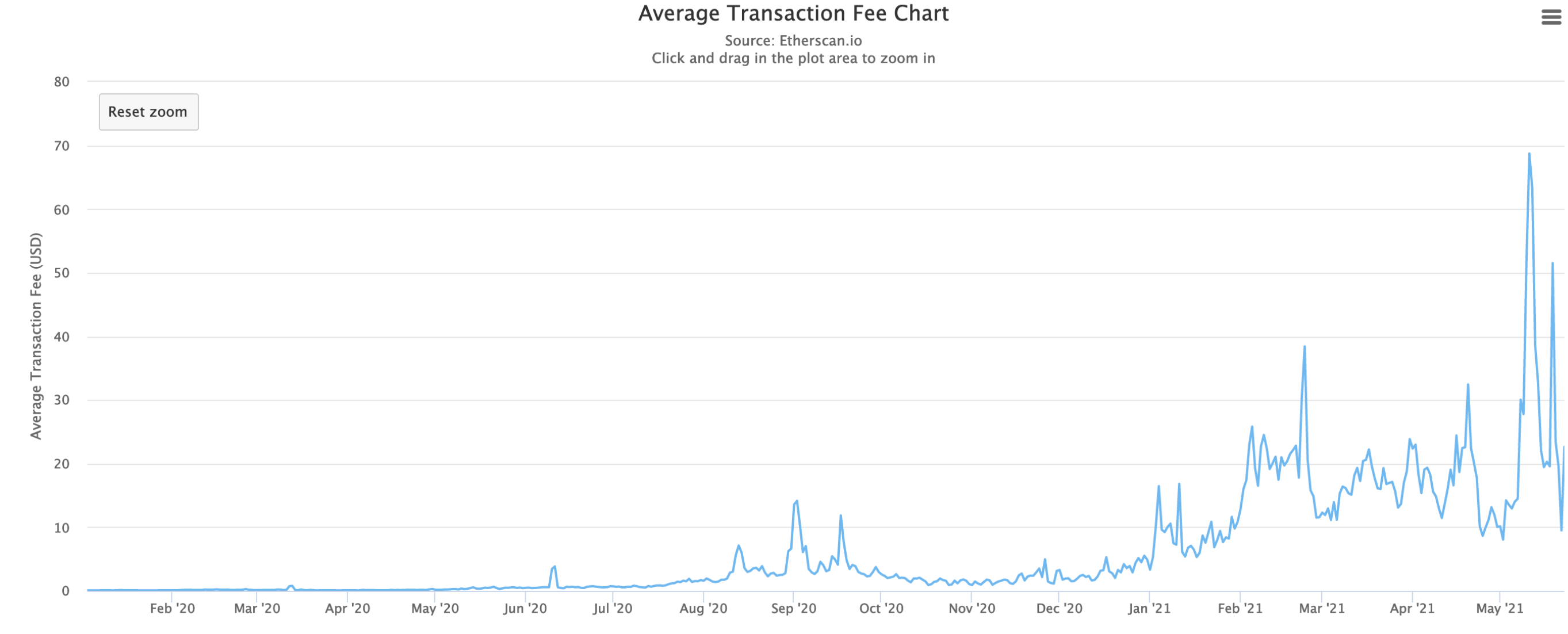

During May 12th to 13th, 2021, one of the main factors for the mining revenue of the ETHASH algorithm (that is, Ethereum) jumped to the peak was that Defi users sent a large number of transactions on the Ethereum blockchain network at that time, while Ethereum Square transactions need to pay certain fees, and these fees will be included in the block rewards as mining rewards.

For example, the fixed reward of Ethereum block #12421088 is 2ETH, while the transaction fee is as high as 8ETH.

As the chart shows, in May 2021, network transaction fees skyrocketed.

To sum up, miners' mining income is not determined by pure block output, nor is it static. When you start mining this business, you need to consider many factors to maximize your mining income with minimal risk. In any case, the economic incentive of mining is an important factor for miners to stay in the crypto market in the long run.

Risk warning: The above opinions are only the opinions of the author, not as investment advice

Risk warning: The above opinions are only the opinions of the author, not as investment advice