"2021 is a difficult year for retail investors." Yu Bo, a currency and stock player, said with emotion that it is really not easy to survive in this bloody and tragic market.

On March 26, Archegos Capital, a fund managed by Korean-born hedge fund manager Bill Hwang, liquidated its highly leveraged stocks. The total amount of executed sales reached 19 billion US dollars, setting a record for the "largest single-day loss" for a single investor.

On April 18 and May 19, under the extreme price of Bitcoin plummeting more than 10,000 US dollars, the encryption market collectively plunged. According to the data of Contract Emperor, in the past two days, the contract liquidation amount of the entire network reached 6.9 billion US dollars and 5.2 billion US dollars respectively, and the encrypted assets of hundreds of thousands of investors were instantly wiped out.

As the saying goes, "success is nothing, failure is nothing", high leverage is not only the "ladder" for rapid wealth growth, but also the fatal bane of the collapse of wealth buildings. Fortune and disaster are often in a single thought.

Correspondingly, the madness in the crypto market has reached its peak. On May 20, Google Trends data showed that the number of global queries for “cryptocurrency” surpassed the peak in 2017/2018, had surged to an all-time high, and was heading towards another all-time high.

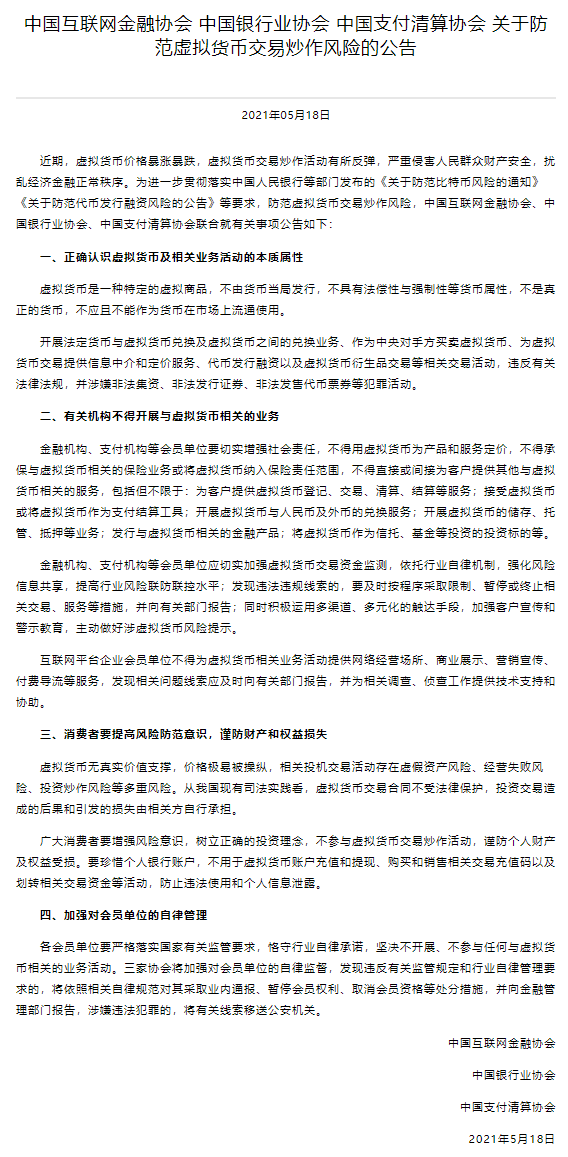

For this reason, market concerns and regulators' attention have been aroused, and domestic strict regulatory signals have been frequently released. On May 18, the China Internet Finance Association, the China Banking Association, and the China Payment and Clearing Association jointly issued the "Announcement on Preventing Hype Risks in Virtual Currency Transactions", prohibiting financial institutions affiliated to the three associations from conducting virtual currency-related businesses; On the 21st, the 51st meeting held by the Financial Stability and Development Committee of the State Council pointed out that it is necessary to strengthen the supervision of financial activities of platform companies, crack down on Bitcoin mining and trading, and resolutely prevent individual risks from being transmitted to the social field.

first level title

Encrypted market welcomes a new wave of regulation

On the surface, Bitcoin has fallen from around US$59,500 to a minimum of US$29,000. The important triggers are: first, Tesla CEO Elon Musk’s “reverse water” based on the fact that Bitcoin is not environmentally friendly and Bitcoin options Second, the skyrocketing rise of altcoins, especially the crazy rise of animal coins, and the high sentiment of new investors are important signals of market changes.

However, Yu Bo didn't take it seriously. "This is determined by the game logic of the encryption market." He believes that the encryption market has experienced 8 months of rising, too much profit taking, too much leverage, and the decline is a necessary step for market cleaning and consolidation. However, due to the bad news at the regulatory level, such as the Federal Reserve’s interest rate meeting and the joint announcement of the three domestic associations, it caused a panicked plunge in the encryption market.

On the day of the crash on May 19, the “Fear and Greed Index,” a measure of the current sentiment in the Bitcoin market, had swung to a level of “extreme panic” not seen since April 2020. The index is now at 21, down from a "greedy" level of 73 last week, according to a report by Norwegian analytics firm Arcane Research. It can be seen from this.

It is worth noting that investors are generally pessimistic about the market outlook due to the domestic release of strict supervision and containment signals to prevent risks.

On May 18, the three associations jointly issued the "Announcement on Preventing the Risk of Hype in Virtual Currency Transactions", prohibiting financial institutions affiliated to the three associations from conducting virtual currency-related businesses.

Xiao Sa, a partner of Beijing Dacheng Law Firm and a director of the China Banking Law Research Association, wrote that the announcement specifically mentioned that virtual currency services should not be "indirectly" provided to customers. The second is to prevent financial institutions from cooperating with other companies to carry out virtual currency business to prevent the abuse of licenses; the third is to increase the compliance obligations of member units and screen currency-related services.

She believes that the risk prevention announcement issued by my country's three major associations has broken the infrastructure for frequent transactions of domestic residents' virtual currency, and has played a positive role in controlling mainland residents' currency speculation.

On May 21, the 51st meeting of the Financial Stability and Development Committee of the State Council requested to "crack down on Bitcoin mining and trading." The 21st Century Business Herald quoted an industry insider as saying that there are many possible reasons for cracking down on Bitcoin mining and trading, including preventing "hot money" funds from using Bitcoin to enter and exit the country illegally, cleaning up and regulating the concept and scope of digital currency, and carbon neutrality. And under the trend, Bitcoin mining consumes too much power, etc.

According to Wu Shuo’s blockchain report, in response to the news that the Financial Commission cracked down on bitcoin mining and trading, analysts pointed out that this is the first time that the State Council has publicly and clearly proposed to crack down on bitcoin mining, which may have a great impact on China’s mining industry. The impact of the follow-up implementation measures remains to be seen. In addition, the meeting clearly proposed to crack down on trading behavior, but the focus was on preventing social impact, and the focus may first be on illegal behavior targeting retail investors outside the circle.

In fact, from a global perspective, many countries such as the United States, Japan, South Korea, Switzerland, and Singapore recognize and allow Bitcoin transactions, and China is also one of the most active regions for Bitcoin transactions. At the same time, since 2013, my country has legally defined Bitcoin as a "specific virtual commodity." The "Civil Code" implemented this year also recognizes the property attribute of Bitcoin.

first level title

Bitcoin mining may be "hit" by strong regulation

Since the news of the Financial Stability and Development Committee of the State Council's "crackdown on Bitcoin mining" came out, many people in the mining circle expressed shock, and some even thought that domestic mines should be "cool".

Affected by it, the entire "mining circle" was extremely cautious about this, and many mining companies responded quickly.

On May 22, Jiang Zhuoer, the founder of Lebit Mining Pool (B.TOP), posted on his Weibo: 1. Although B.TOP has not received any regulatory requirements from relevant departments, considering the latest regulatory spirit and B.TOP .TOP's domestic business in mainland China only accounts for a small share of self-operated mining. There is no need to continue to provide mining machine purchasing services to the public in mainland China, and to bear additional regulatory risks for this. Therefore, B.TOP decided to stop providing mining services in mainland China Customers provide mining machine purchasing service; 2. If the mining machine has been purchased and paid, but the mining machine is not running, you can choose a full refund. Please contact your docking business for processing; 3. For the mining machine that has been running, although this situation falls under the contract exemption clause Force majeure "government intervention, restriction, ban", but B.TOP is responsible for safeguarding the interests of customers, and B.TOP will introduce measures to ensure that customers do not suffer losses.

BitDeer’s official announcement also shows that in order to actively cooperate with the regulatory spirit of relevant countries and regions and support the compliant development of the mining industry, BitDeer will upgrade and adjust. From 22:00 on May 26, 2021, Beijing time, BitDeer will block All IPs in mainland China to further ensure that the platform does not provide services to residents in mainland China.

At the same time, local governments have also begun to rectify bitcoin mining.

On May 25th, the Inner Mongolia Development and Reform Commission organized the drafting of the "Inner Mongolia Autonomous Region Development and Reform Commission's Eight Measures on Resolutely Combating and Punishing Virtual Currency "Mining" Behaviors (Draft for Comment)".

On May 27th, the Sichuan Supervision Office of the National Energy Administration issued a notice on holding a research symposium on virtual currency mining. According to the notice, according to the relevant requirements of the National Energy Administration, in order to fully understand the situation of Sichuan virtual currency mining, our office decided to organize a seminar, which will be held from 9:30 to 11:30 on June 2, 2021. Participants included relevant persons in charge of power grid enterprises, trading centers and electricity sales companies. Regarding the specific content of the meeting, State Grid Sichuan Electric Power Company and Sichuan Energy Investment Group will respectively report on the status and suggestions of virtual currency mining in their respective supply areas, and analyze the impact of shutting down virtual currency mining on Sichuan’s abandoned water and electricity this year; The Sichuan Power Trading Center reported the situation and suggestions of big data companies participating in market transactions in the hydropower consumption demonstration zone; the power sales company reported the situation and suggestions related to the participation of big data companies on behalf of big data companies in market transactions.

In this regard, Jiang Zhuoer said on his Weibo that many cryptocurrency mining regions, such as the Northwest and Southwest regions, have serious local debts and electricity abandonment. All of them are of great help, and it will also help new energy facilities to gain benefits and further expand their scale. I believe that with similar rational analysis and research, people in various industries will continue to give feedback through various channels.

first level title

Suspicious clouds under the pressure of the exchange

Within a week, the encryption market was hit hard by the three major financial industry associations and the Financial Stability and Development Committee of the State Council. Under the crackdown on Bitcoin transactions, exchanges have also become key targets.

Recently, some media reported that, judging from the screenshots of chats between users and Huobi customer service, “Currently, Huobi Futures does not support account opening for Chinese users, and users who have previously authenticated Huobi accounts but have not opened a contract account cannot open a contract account now. At the same time, Huobi responded that because the market fluctuates greatly, in order to protect the interests of investors, it temporarily does not open services such as contracts, leverage, and ETP for new users in some countries and regions.

In addition, according to Bybit's official announcement, Bybit will restrict IP addresses in mainland China from accessing the API interface from 16:00 Beijing time on June 15, 2021, to perform operations such as market quotations, account asset inquiries, and order placement, including third-party trading tools.

Judging from the reaction of the exchanges, some trading services have been suspended or restricted for users in mainland China.

Analysts believe that this round of regulation is mainly a reaffirmation and emphasis on the "Notice on Preventing Bitcoin Risks" issued by the People's Bank of China and other five ministries and commissions in December 2013, and there is no new content.

Lawyer Sun Jun interpreted that, judging from the content of the announcements issued by the three major financial industry associations, first of all, we must correctly understand the essential attributes of virtual currency and related business activities. Virtual currency is a commodity and cannot be used as legal tender; secondly, relevant institutions must not To carry out businesses related to virtual currency, Internet platform enterprise member units are not allowed to provide online business premises, commercial exhibitions, marketing promotions, payment backflow and other activities for virtual currency-related business activities; third, consumers should raise awareness of risk prevention and beware of property and Loss of rights and interests; Fourth, strengthen the self-discipline management of member units, otherwise they will be punished accordingly.

Ding Feipeng said that the Financial Stability and Development Committee of the State Council requires "crackdown on Bitcoin mining and trading behavior", which will have a profound impact on the ecology of the virtual currency industry. He believes that the issuance and financing of tokens in the name of mining may be completely suspended, and clues about crimes such as illegal fundraising, illegal issuance of securities, or illegal sale of token coupons may be transferred to judicial authorities. At the same time, the contract transactions on the virtual currency trading platform may not be able to continue to operate, and the possibility of further accountability cannot be ruled out.

In short, under the current situation of high regulatory pressure, exchanges are treading on eggshells and dare not slack off.

In contrast, the United States is trying to achieve better regulatory goals by regulating encrypted asset exchanges.

Recently, Gary Gensler, chairman of the US Securities and Exchange Commission, told Democratic Congressman Mike Quigley that there are many encrypted tokens that meet the requirements of the securities law, and our agency is working hard to enforce the law. However, there are currently tens of thousands of tokens and we are currently only able to perform 75 actions.

Gary Gensler wrote in his prepared testimony that the SEC has been consistent in its communications with market participants that those who use ICOs to raise funds or engage in securities transactions must comply with federal securities laws. At the same time, he also reiterated his intention to work with Congress to regulate exchanges. According to Gary Gensler, daily trading volumes have ranged from $130 billion to $330 billion in recent weeks. However, these figures were not audited or reported to regulators as the tokens were traded on unregistered crypto asset exchanges. This is just one of many regulatory gaps in these crypto asset markets.