core point of view

core point of view

The United States also hopes to incorporate the encryption market into the original financial regulatory system, block tax evasion, money laundering and other openings, and hopes to increase tax sources for the next round of economic stimulus plans in the United States.

The bull market is still there, but it has only briefly fallen into a technical bear market; from multiple dimensions such as technical aspects and experience, the macro environment, on-chain data, and the development of blockchain technology, the fundamentals of the bull market are still strong.

The development of blockchain technology is the main driving force for the continuation of the bull market in the second half.

secondary title

How do you view the current regulation?

Since April, the market trend of the encryption market has been mainly affected by regulation. The market trend in April is generally affected by US regulation, and the market trend in May is mainly affected by domestic regulatory policies. Influenced by the regulatory policies of China and the United States, the market is specifically manifested in two sharp falls, one on April 18 and one on May 19. Although they are the same regulation, the regulatory goals and starting points of China and the United States are obviously different, and the impact on the encryption market is also different.

U.S. regulation of the crypto market

The United States also hopes to incorporate the encryption market into the original financial regulatory system, block tax evasion, money laundering and other openings, and hopes to increase tax sources for the next round of economic stimulus plans in the United States.

"I think we really need to look at ways to reduce the use of cryptocurrencies and make sure that money isn't being laundered through those channels," U.S. Treasury Secretary Janet Yellen said at her nomination hearing in January.April 16, White HouseAgree with U.S. Treasury Secretary Yellen on regulating cryptocurrencies. Subsequently, the Office of the Comptroller of the Currency (OCC), the Financial Crimes Enforcement Agency (FinCEN), and the Internal Revenue Service (IRS) under the U.S. Department of the Treasury began to step up supervision of the encryption market from different dimensions. On April 18, the crypto market fell sharply. On April 20, a source came out and revealed that the Biden administration is developing a legislative framework for the fast-growing encrypted assets, which will legally determine the rules for the encrypted market.

Some large institutions may know or anticipate the adverse impact of regulations in advance, so they sold in advance. So what is it that makes big institutions panic sell?

Taxation of the rich is a very important item in the legislative process of encrypted assets. U.S. President Joe Biden's plan to nearly double capital gains taxes for the wealthy is a major headwind for U.S. investors investing in crypto assets, which have risen sharply since December, if held for more than a year Selling cryptocurrencies afterward is already at risk of capital gains tax. Observing the premium rate of GBTC, the main channel for institutions to enter the market, we can find that GBTC continued to maintain a high negative premium during that period, generally exceeding -15%.

A series of subsequent regulatory requirements and initiatives of the US Treasury can also prove this point of view.The U.S. Treasury expects, the entire taxpayer group of the rich hides more than half of their income other than salary.The U.S. Department of the Treasury further requires, Cryptocurrency transfers involving an amount of $10,000 or more must be reported to the IRS; as cash transfers, companies that accept encrypted assets as payment should also report to the IRS if the fair market value of the encrypted assets in the transfer transaction exceeds $10,000.

In addition to the IRS under the Treasury Department, the Office of the Comptroller of the Currency (OCC) is also taking the initiative. The OCC earlier proposed to join forces with the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) to establish an "interdepartmental sprint team" for cryptocurrency regulation. On May 27, Federal Reserve Governor Quarles stated that the OCC, Federal Reserve and FDIC review of cryptocurrency regulation includes banks charging customers for cryptocurrency capital. Review.

At the same time, the US SEC is also beginning to regulate the encryption market. On May 21, Gary Gensler, chairman of the US SEC, said that encryption exchanges need more regulation, and the public will benefit from more protection provided by the SEC to investors on encryption exchanges. at the same time,Gary Gensler also said, federal financial regulators should be “prepared to prosecute” bad actors in crypto and other emerging technologies. Subsequently, the chairman of the US SEC continued to speak intensively. So far, multi-department and comprehensive supervision in the United States has basically been rolled out.

Domestic regulation of the crypto market

The domestic supervision of the encryption market is mainly to prevent the transfer of individual risks to the social field, prevent systemic financial risks, and maintain social stability. In addition, in the context of "carbon neutrality", Bitcoin mining is also the main reason for rectification due to energy consumption.

Since the beginning of this year, Dogecoin has skyrocketed, followed by the debut of a series of "animal coins" such as SHIB, which has aroused widespread concern in the traditional market, and signs of capital speculation are serious; in addition, the rise of emerging mining tokens such as Chia once caused the graphics card market to overheat , affecting normal social production and development. In addition, the energy consumption of Bitcoin mining is increasingly criticized, which is contrary to the general trend of "carbon neutrality" and is also the main reason for the suppression.

Based on the above background, on April 23, China’s inter-ministerial joint meeting on illegal fund-raising also stated: Pay close attention to new risks under the banner of virtual currency. On May 18, the China Internet Finance Association, the China Banking Association, and the China Payment and Clearing Association jointly issued an announcement that financial institutions and payment institutions are not allowed to carry out businesses related to virtual currencies. On May 21, Vice Premier Liu He presided over a meeting of the State Council's Financial Stability and Development Committee. The meeting called for strengthening the supervision of financial activities of platform companies, cracking down on Bitcoin mining and trading, and resolutely preventing individual risks from being transmitted to the social field. Subsequently, Inner Mongolia and Sichuan, the main areas of Bitcoin mining, have introduced policies and seminars to rectify Bitcoin mining. Bitcoin mining companies began to de-China.

Lebit Mining Pool Jiang ZhuoerComparing the current market chaos with the market before September 4, 2017, he said on Weibo that the highest and most fundamental purpose of regulation is to maintain social stability. Before 1994, the market was full of chaos, and various ICO coins were flying all over the sky. If they were not stopped and allowed to develop, at the end of the bull market, the final result would definitely be that a large number of retail investors went bankrupt and the society was unstable, so supervision took action.

The Impact of Regulation on the Crypto Market

At present, China is deepening the de-Sinicization of Bitcoin mining, while American mining companies are stepping up their leadership in "green encryption", and the US's dominant position in the Bitcoin market will continue to grow. With the improvement of the supervision of the encryption market in the United States, Bitcoin is increasingly recognized and accepted by traditional institutions. As a financial country, the United States is more and more likely to pass Bitcoin ETF.

Mike Novogratz, CEO of Galaxy Digital, recently stated in a podcast that it makes no sense to approve Grayscale Trust but not ETFs, which are much better than other products offered by institutions. He also hinted that Gary Gensler, chairman of the US Securities and Exchange Commission (SEC), is "smart" and will approve the plan soon. A Bitcoin ETF could go live within a year.

secondary title

Are you still in a bull market?

Following the supervision of the encryption market by China and the United States, on May 27, Lee Ju-yeol, governor of the Bank of Korea, also stated that South Korea’s individual leveraged cryptocurrency transactions threatened South Korea’s financial system. This regulation of the encryption market has obviously become somewhat global. Under such strong supervision, is the bull market still there? This article believes that BTC has fallen into a technical bear market in the short term, but the fundamentals supporting the bull market still exist. Below we introduce the basis for supporting the bull market.

BTC falls below the dividing line between bulls and bears

Many people in the encryption market regard MA200 as a very important dividing line between bulls and bears, and some people regard MA240 (currently $36,396) as a very important dividing line between bulls and bears. From the current market chart, Bitcoin has fallen into a technical bear market . Although this article believes that the fundamentals of the Bitcoin bull market exist, BTC should be careful to buy bottoms before it reaches the MA240.

Macro positives still exist

Macro positives still exist

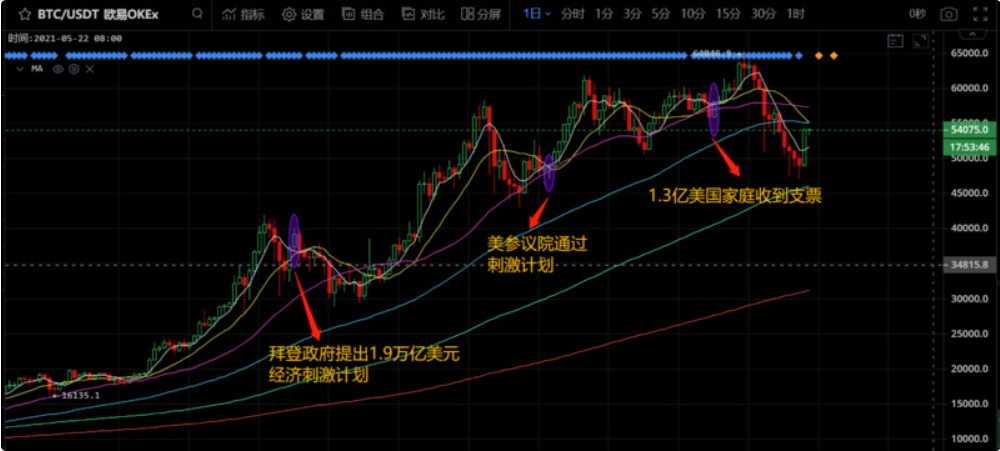

After the Biden administration of the United States came to power, it implemented the first round of economic stimulus and relief bills. We marked the key time nodes in the Bitcoin market chart. From the figure, we can see the impact of the US flood on the Bitcoin market.

In March and April of this year, the Biden administration of the United States proposed the "American Jobs Plan" of up to 2.3 trillion and the "American Family Plan" worth 1.8 trillion. In the early hours of May 29, Beijing time, the White House officially released the first budget proposal under President Biden. Biden called for an increase in government spending to US$6 trillion (about 38 trillion yuan) in fiscal year 2022. This will undoubtedly exacerbate inflation and push up the prices of major global assets such as US stocks like last year. (Note: The US$6 trillion proposed by the Biden administration is the budget for the 2021 fiscal year, of which the first round of fiscal economic stimulus plan is US$1.9 trillion. $1.8 trillion for the "American Family Plan")

Singapore's DBS Bank (DBS) recently reportedIt is pointed out that the volatility correlation between Bitcoin and US index futures is increasing, and Bitcoin is no longer a fringe asset class. Then, under the macro influence of the U.S. flood, coupled with the deflationary nature of Bitcoin itself, it still has a strong upward potential.

Against the background of the global debt crisis and severe inflation, Bridgewater Fund Dalio's attitude towards Bitcoin has also undergone a significant change, from suspicion to trying to buy Bitcoin. He believes that the U.S. dollar will return to 1971. In the future, the United States will continue to print money and increase taxes. This will cause stocks to rise and all assets such as Bitcoin, gold, and real estate to rise. The environment is a cycle of dollar depreciation. He also stated that in the case of inflation, personally, I would rather hold Bitcoin than bonds, and said that he already owns some Bitcoin.

On-chain data growth is still strong

Morgan Creek founder Anthony Pompliano said on May 24 that after analyzing Glassnode data, he found that since the market crash last Wednesday, Bitcoin whales holding 10,000 to 100,000 BTC have purchased a total of 122,588 BTC.

Moskovski Capital’s CIO Lex Moskovski shared Glassnode Bitcoin stablecoin supply data,The data showThe Bitcoin Stablecoin Supply Ratio (SSR) has dropped, hitting an all-time low. According to Lex Moskovski, SSR is the ratio between the circulating bitcoin supply and the stablecoin supply expressed in bitcoin. When the SSR is low, the current stablecoin supply has more purchasing power to buy BTC. He added that there is a lot of idle money starting to flood into the bitcoin market.

Institutions continue to enter the market, and the acceptance of traditional markets is still expanding

Institutions continue to enter the market, and the acceptance of traditional markets is still expanding

Institutions continued to enter the market to sweep goods after the sharp drop in Bitcoin. From the data point of view, the GBTC premium rate has rebounded significantly after the "519" plunge, and Grayscale Bitcoin Trust is the preferred entry point for large US institutions.

Judging from the news, some large U.S. institutions are indeed buying Bitcoin after the pullback.Ark Investment Management's most recent filing with the U.S. Securities and Exchange Commission (SEC)It shows that it purchased $19,872,939 in Bitcoin. Kyle Davies, co-founder of Three Arrows Capital, said: "Every time we see a large amount of liquidation is an opportunity to buy, I would not be surprised if Bitcoin and Ethereum can retrace the entire decline within a week."

The intrinsic value of the blockchain is still not released

Bitcoin is regarded as a financial scam in the eyes of many traditional people, and they do not understand the continuous rise in the price of Bitcoin. At present, as more and more institutions begin to accept bitcoin payment, the currency attribute of bitcoin is continuously accepted and recognized by more people. However, it is worth noting that many cryptocurrencies that mimic Bitcoin have not fared so well.

Ethereum is regarded as blockchain 2.0, and there are many blockchain projects imitating Ethereum, and few projects are as successful as Ethereum. So why?

secondary title

Technology-Driven Bull Market

Judging from the current development of blockchain technology, there is really no need to be too pessimistic. Blockchain technology has moved from the laboratory to the application, and is expected to drive the blockchain industry to real prosperity in the second half of the year.Vitalik Buterin (V God) recently said in an interview with CNNtext

The implementation of two major blockchain infrastructures

In 2021, the two infrastructures highly anticipated by the blockchain industry should be DFINITY and Polkadot. Below we briefly introduce this important blockchain infrastructure.

Dominic Williams, founder and chief scientist of the DFINITY Foundation, once described the innovation brought by DFINITY: "This is the first real, general-purpose blockchain computer, which allows us to reimagine the way we build everything, a A seamless, unlimited performance blockchain.” Dominic’s passage briefly described the three major characteristics of DFINITY: the ability to build various applications, seamless connections, and unlimited performance. On DFINITY, developers can build programs and applications directly on the Internet ontology without cloud services, databases or payment interfaces. Since developers don't need to consider a lot of middleware, they can build applications seamlessly, which is equivalent to reducing the burden of development and allowing creative products to trial and error at low cost. DFINITY has changed the way and content of building application services, which is a paradigm shift. This will not only bring great gains to entrepreneurs and investors, but also is expected to inspire new application forms and lead the blockchain industry out of the circle.

text

Ethereum to PoS, Layer 2 and Sidechains

Ethereum 2.0 has made great progress this year. Some Ethereum core developers predict that the PoS mechanism will be implemented by the end of the year. Once Ethereum is converted to a PoS mechanism, it will greatly improve scalability, security, and accessibility. However, the market still has doubts about whether Ethereum can realize this expectation by the end of the year, but Layer 2 and others are indeed on the eve of the outbreak.

Layer 2 has attracted a lot of attention since the beginning of the year, but the wallets, applications, and supporting tools of the early Layer 2 network are not very perfect. After a period of development, Layer 2 is ready to come out.

Optimism’s mainnet is expected to be launched in July. Another hot project of Optimistic Rollup, Arbitrum, will be launched on May 28 and will be open to developers.

zkSync, which uses ZK Rollup technology, announced the 2.0 roadmap on March 27; on May 25, zkSync announced the launch of the zkSync 1.x test network; the main network is expected to be launched in August. On April 9, zkSync tweeted that zkSync 2.0 will be Turing complete, which means it will be compatible with EVM. In addition, they also launched zkPorter, a lower-cost expansion solution, which the official said will help zkSync 2.0, which will be launched in August this year.

Loopring, a decentralized trading protocol based on ZK Rollup, announced on April 21 that it will release version 3.7 of Loopring in May, which will launch Ethport, a bridge product across L1, L2 and centralized exchanges. It is understood that using Ethport can enable Loopring users to interact directly with Layer 1 DApps from Layer 2 at low cost through batch processing and zero-knowledge proof functions, and support cross-Layer 2 transfers.

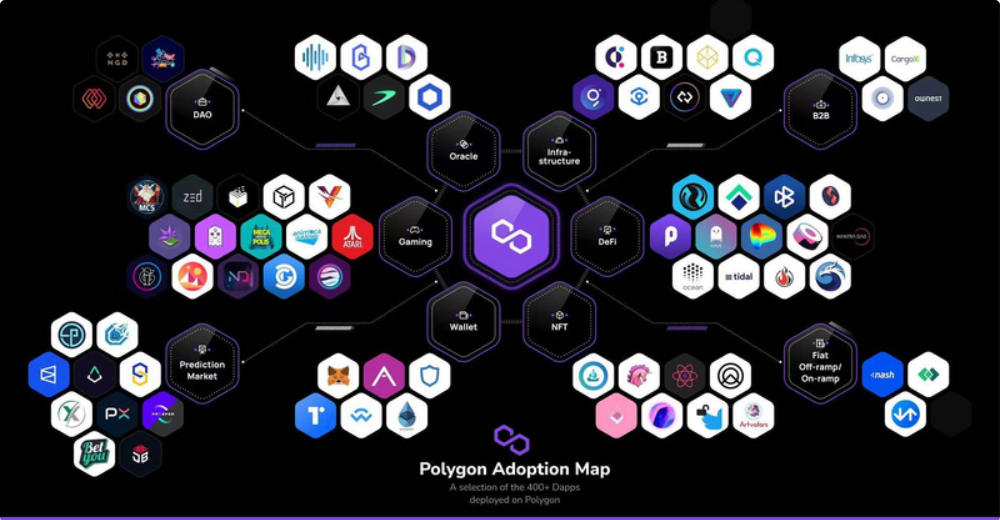

Ethereum-based side chains and state channel projects have also made great progress. Recently, such as Polygon (Matic Network), Celer Network, etc. Among them, the development of Polygon is the most eye-catching, and it also allows the blockchain industry to see the huge potential of Layer 2.

Messari researcher Mira Christanto once pointed out that the transaction volume of the Polygon network has reached three times that of the Ethereum layer 1, but the total gas fee of the entire network is only 0.01% of the former. Polygon ecological development and TVL also performed well. (More information can be found at:"Polygon exploded, and the Layer2 war ended before it started? ")

In addition, NEAR, an "alternative" Layer 2 solution, has also made good progress recently. On May 12, NEAR released the EVM solution Aurora, which means that developers can seamlessly deploy Solidity and Vyper smart contracts, and based on Rainbow Bridge technology, it can provide permissionless token transfers between Ethereum and Aurora and data transfer services. Aurora uses ETH as its internal base currency, which is used to pay transaction fees.

Comprehensive expansion of blockchain application scenarios

As the largest application scenario of blockchain technology, DeFi is essentially a financial innovation driven by technology and products. With the arrival of Layer 2, DeFi will bring new innovations to the encryption market. On May 27, Uniswap founder Hayden Adams tweeted that the community vote has received overwhelming support for the deployment of Uniswap v3 on Arbitrum. Assuming the snapshot passes, we will deploy the v3 smart contract to Arbitrum. Uniswap V3 + Layer 2 will undoubtedly bring new opportunities and differences to the encryption market.

In the process of development, DeFi has gradually gained the recognition of the traditional financial market. Judging from data such as transaction volume and lock-up volume, DeFi has also begun to challenge the traditional financial market. On December 17, 2020, CFTC released a primer on the cryptocurrency industry, in which it stated that DeFi and cryptocurrency governance have become one of the topics that CFTC focuses on in the field of digital assets.

DeFi began to empower NFT, and NFT began to link the real world. In the DeFi field, Uniswap performed the best. With the launch of the Uniswap V3 version, DeFi has begun to empower the NFT field. Uniswap V3 has many innovations, such as centralized liquidity, multiple rates, range pending orders, improved oracles, and the deployment of the Layer 2 version of Optimism. All these operations can use NFT, which is a huge breakthrough and innovation for the expansion of NFT application boundaries. NFT is currently gradually entering the real world, and many things have begun to become NFT. After DeFi and NFT are connected, it will undoubtedly open a door between the real world and the blockchain.

The influence of NFT out of the circle is expanding. According to news on May 11, e-commerce giant eBay said on Tuesday that it allows the sale of digital collectible NFTs such as trading cards, pictures or video clips on its platform. According to news on May 19, encrypted artist Sean Williams tweeted that Instagram may launch an NFT platform and is currently communicating with artists to sign relevant agreements. Taobao Ali Auction Juhaowan 520 Auction Festival launched a special session of NFT digital art. It will auction artist Wan Wenguang's work "U107-No Waste Odaily Series-Van Gogh of the Cabinet Family" and other digital artworks from 10:00 on May 20. The influence of NFT is constantly expanding, and it seems that everything can be NFT.

The island effect of the public chain will be broken, and the specialized application-oriented public chain will explode. At present, the public chains are still developing independently. This fragmentation makes it difficult for the ecology to complement each other and even cause internal friction. In the future, as the public chain technology matures, more application areas will begin to migrate to the blockchain, and different fields will require differentiated and specialized public chains. Polkadot's Substrate can greatly reduce the cost and difficulty of developers developing and operating on the public chain, so that developers can focus more on applications. Polkadot will connect private chains, alliance chains, public chains, open networks and oracles, as well as future technologies that have not yet been created, which will break the "island effect" of the public chain and realize "interconnection of ten thousand chains". Accompanied by security, data and information Sharing, Polkadot will promote the explosion of professional application public chains in the blockchain industry.

secondary title

When will the bull market end?

This article believes that blockchain technology can push the bull market forward, but the bull market cannot last forever. So when will this bull market end? This may be something that many people care about and want to know. we are at"Tesla's high-profile entry, how high will Bitcoin rise in 2021? "、"Under Big Changes, Bitcoin's Trend Development and Economic Cycle"etc. have always believed that this round of bull market is formed by the mutual promotion of external and internal factors. Therefore, by analyzing the changes of internal and external factors, this article attempts to infer the development trend of this round of bull market.

External factors mainly include two aspects: 1. Under the influence of the new crown epidemic, the demand for digitalization is strong, which has prompted people to have a strong interest in digital assets such as Bitcoin, and the number of participants has gradually increased; 2. Due to the heavy impact of the new crown epidemic on the global economy , the world's major central banks have released water, and the central bank's fiscal policy has pushed up global financial assets.

At present, internal factors are mainly reflected in two aspects: 1. At the financial level, the innovation of DeFi has pushed blockchain technology towards traditional finance, and achieved breakthroughs at the application level; 2. At the technical level, with DFINITY, Polkadot, and Layer 2 When it goes online one after another in the future, breakthroughs in blockchain technology based on expansion and high performance are expected to continue to promote the development of blockchain technology. Next, we will judge the approximate time when the bull market may end from these four dimensions.

Impact of the epidemic

The impact of the epidemic on the global economy is mainly concentrated in China and the United States. If the epidemic in China and the United States can be controlled, the fundamentals of the global economy can be stabilized. China and the United States are also major vaccine producers, and they can accelerate the recovery of the global economy by exporting vaccines. At present, the epidemic situation in the United States is showing a clear improvement trend, but it is not yet stable, so the Fed still maintains the quantitative easing policy as a whole. As the epidemic is gradually brought under control and the U.S. economy is stabilizing, the Federal Reserve will inevitably raise interest rates amid increasingly serious inflation expectations, which will undoubtedly have a huge impact on Bitcoin. The chart below shows the Fed's calendar.

In terms of the epidemic, China has controlled it relatively well, and the focus of the problem is mainly in the United States. At present, about 48% of the people in the United States have received at least one dose of vaccine, and the coverage rate is about 37%. When the vaccination rate reaches 70%, herd immunity can be achieved. Biden officially entered the White House in January this year, which means that it took Biden almost 5 months to achieve this effect, which means that by October at the latest, the United States will be able to achieve herd immunity. By then, the U.S. economy will basically recover, and the Fed’s interest rate hike expectations will rise unprecedentedly. Combined with the Fed's schedule, the U.S. economic data on November 3 is crucial, and the macro trend may have certain major changes here. Even considering the weak foundation of the U.S. economic recovery, an interest rate hike may be inevitable at the end of 2021 or early in the first half of 2022.

Morgan Stanley CEO Gorman James expects, the Fed will start raising interest rates as early as early next year, and will begin to taper the quantitative easing program at the end of this year. Gore Man James’ view tends to be towards the end and the beginning of this year. From the theoretical prediction of the impact of the epidemic on the economy, we believe that policy adjustments are more inclined towards the end of the year; information or become the event with the highest probability.

America's Big Water and Bitcoin ETFs

In addition to caring about the Fed's policy changes, the most noteworthy is the 2.3 trillion "American Jobs Plan" launched by the Biden administration and the 1.8 trillion "American Family Plan". At present, the Biden administration is estimated to be working hard to raise money and persuade both houses of Congress, and it is estimated that there will be substantial progress in the next few months. Once these two huge economic stimulus plans are passed, they will greatly promote the rise of Bitcoin. At this time, I am afraid that a huge bull market bubble will also be born.

As the encryption market becomes larger and larger, encrypted assets have become a part of the traditional financial market that cannot be ignored, while the United States is stepping up the formulation of bills, and Wall Street is speeding up its entry into the encryption market. The US SEC will eventually pass Bitcoin ETF. high probability event. If the U.S. releases water and the Bitcoin ETF is passed, this will trigger a large-scale entry of retail investors. Once the market is too enthusiastic, the peak may also be approaching.

DeFi and the development of blockchain technology

Summarize

Summarize

Based on the above information, we believe that due to the regulation of the encryption market, June and July tend to be in the adjustment stage, and August and September will usher in a big explosion of technology and applications, which will help promote the vigorous development of the market and form a market climax; Once the second round of economic stimulus plan in the United States is implemented, or the Bitcoin ETF is passed, the encryption market may enter a period of frenzy among retail investors, which is also a period of market risk.

Compared with the development of the Internet industry, this article believes that the blockchain industry is still in the early stage of large-scale application development, and many infrastructures need to be further improved. It will take time for blockchain applications to subvert centralized applications, at least basic user education Still lacking. When the US epidemic is basically under control, the economy has stabilized, the Federal Reserve has started to raise interest rates, and the market bubble is extremely serious, the market may face the possibility of the bubble bursting. In other words, the peak time of the bull market may appear at the end of this year or the beginning of next year.

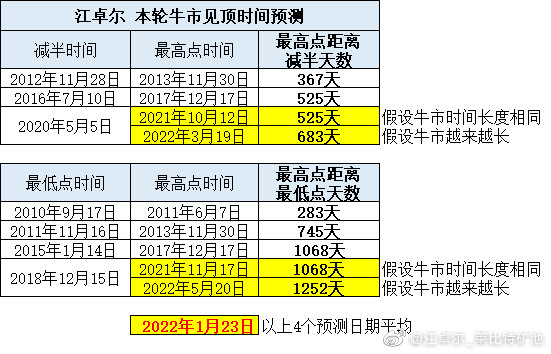

The picture below shows the peak time of Bitcoin calculated by Leibit Mining Pool Jiang Zhuoer based on the halving effect. Assuming that the bull market has the same length, Bitcoin may peak on October 12, 2021; and assuming that the bull market is getting longer and longer, the bull market May peak on March 19, 2022. From the perspective of "inventory cycle", we have scientifically explained the internal logic of Bitcoin's "four-year halving" cycle (see"Demystifying the Economic Principles Behind Bitcoin's Bull-bear Conversion"), this article believes that Jiang Zhuoer's peak time prediction is also referenced.

Finally, it needs to be emphasized that the market forecast at the end of this article is for reference only. The crypto market fluctuates greatly. Investors should operate with caution and avoid adding leverage.