Bloomberg columnist Noah Smith has written a lot about Bitcoin. Some of these are genuine and firm ideas about the Bitcoin protocol itself, which is rare in real mainstream media. He also revealed that he owns bitcoin, which is impressive for economists and members of the institution. So overall he's respectable. I don't want this article to be used as a full blown counter to the mainstream media's stance on Bitcoin. But some of what Noah said in his recent Bloomberg op-ed, “Bitcoin Miners Are on the Road to Self-Destruction,” deserves a response.

secondary title

Media misreading 1: Bitcoin is unique in that price increases require more energy consumption

Traditional media view: Since miners are rewarded through mining block rewards, higher unit prices mean that more real-world resources are put into mining. This is indeed part of the truth. But the following part of the reading is unfair: But the high price of Bitcoin may now cause new problems for cryptocurrencies, because unlike other financial assets, Bitcoin will use more resources when the price rises. Therefore, the more Bitcoin's price rises, the more resources it consumes.

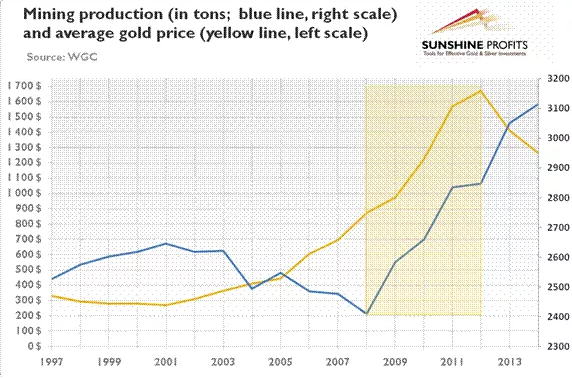

The most obvious real-world analog of Bitcoin is of course gold. Gold has the exact same properties, so it doesn't make sense to single Bitcoin here. When the unit price of gold rises, more gold is mined (sometimes with a lag), and thus its energy consumption. This is usually because gold mines have different profitability thresholds. This phenomenon can be clearly seen on this chart, thanks to Sunshine Profits' Arkadiusz Sieron:

The increase in production was driven (with a lag) by the rise in the price of gold. This phenomenon is similar to the dynamic growth relationship between the price of Bitcoin and the computing power (hash rate) of the entire network. The lag relationship between the total network computing power (hash rate) and Bitcoin price can be seen in the following figure:

secondary title

Media Misreading 2: Bitcoin Excessively Occupies Local Power Resources

Traditional media opinion: Bitcoin definitely wastes local power resources, driving other customers crazy. Bitcoin miners try to do this by harnessing the excess solar and wind energy generated during peak hours, but it remains to be seen how much of this excess energy is simply scattered around.

Well, let's see shall we? It's best not to let the media get confused about the truth.

It turns out that there is a huge amount of waste energy lying around all over the world. (If you just want numbers, skip to the end of this section.) This includes on-grid energy sources that the grid can't accommodate for various reasons, such as mismatches between production and demand, as well as off-grid potential sources that have absolutely no chance of coming online . We can call this type of energy non-rivalrous, since its use does not deprive anyone of energy and does not increase its cost - in fact, monetizing surplus energy can actually reduce grid costs (since it sponsors construction of otherwise unprofitable energy infrastructure). Now, exactly how much non-competitive energy would be used to mine Bitcoin today is an interesting and challenging question that we obviously don't have an answer to yet.

The earth is illuminated by the sun's rays, and the sun itself is a constant source of idle or unutilized energy, as well as wind eddies emanating from hot air balloons. But wind and solar power in their current form are not particularly suitable for Bitcoin mining because they generally have low capacity factors. If a miner buys a high-powered ASIC and uses it for wind and solar mining, it can only run about half the time of the day because the sun doesn't always shine and the wind doesn't always blow.

However, to make money mining Bitcoin, a miner can only use a given ASIC chip for a limited amount of time, and since chips are typically constantly being rolled out, miners must depreciate the ASIC over time. The price of chips typically declines over longer periods of time because they are not efficient enough to keep up with the growing hash rate. As such, they have a finite "useful lifetime" during which miners run them as long as possible. Mining bitcoins solely by solar or wind power will not be competitive.

What Bitcoin can do, however, is absorb structural excess energy. The best data we have comes from the Cambridge Center for Emerging Finance, which pulls data from Bitcoin mining pools to geolocate Bitcoin mining and create the Energy Consumption Index (CBECI). According to CBECI, from 4Q19 to 2Q20, about 71% of Bitcoin mining activity took place in China (they did not provide the latest figures). Within China, there are four prominent provinces, the vast majority of which are: Xinjiang, Sichuan, Inner Mongolia and Yunnan. Together, they generated 63% of the global Bitcoin hashrate during the aforementioned period, according to CBECI.

The provinces can be broadly grouped into two categories: rich in coal (with a notable contribution from renewables like wind and solar) or rich in hydro (renewables). Coal-fired power generation is significant in Xinjiang and Inner Mongolia, but their wind/solar shares are 35% and 30%, respectively, according to Bloomberg. By comparison, the U.S. grid will have just 20 percent renewable energy, including hydropower, in 2020, measured by generation, according to the Energy Information Administration. So if Bitcoin is only mined in Xinjiang and Inner Mongolia, then Bitcoin is still more green renewable in its origin than if it were mined in the interesting average energy mix of the US.

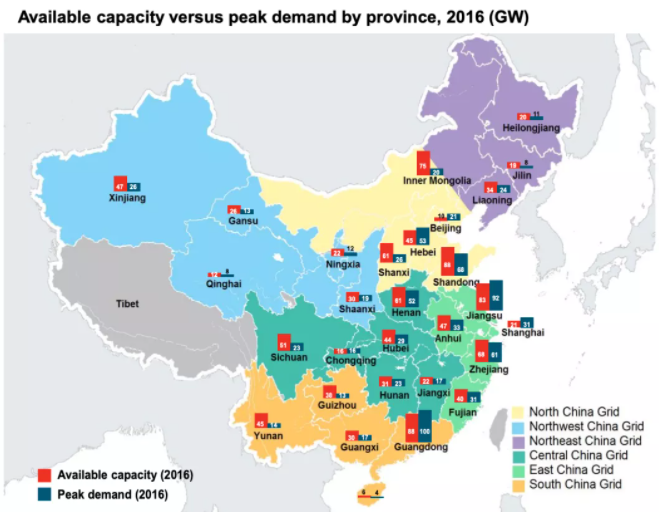

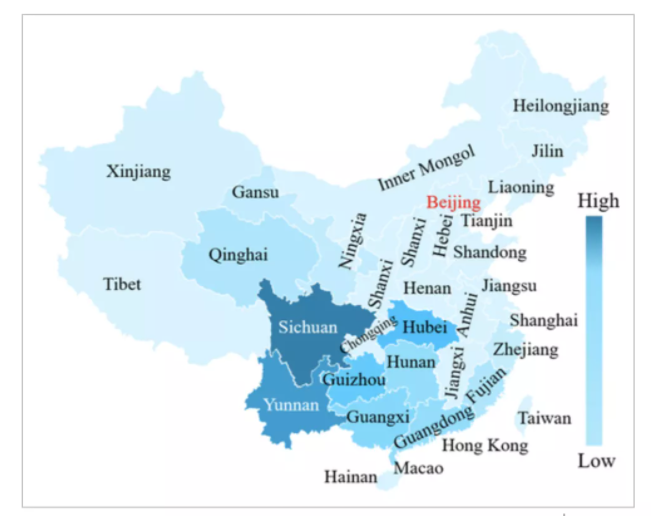

What all these regions have in common is relatively low population densities (taken together, they account for only 12.7% of China's population), but they are rich in energy resources. It is no coincidence that Bitcoin mining in China mainly takes place in these four provinces. They have a large surplus of energy and generally cannot direct it efficiently to population centers. Take a look at the map below, courtesy of Bloomberg, and see if you can find the answer:

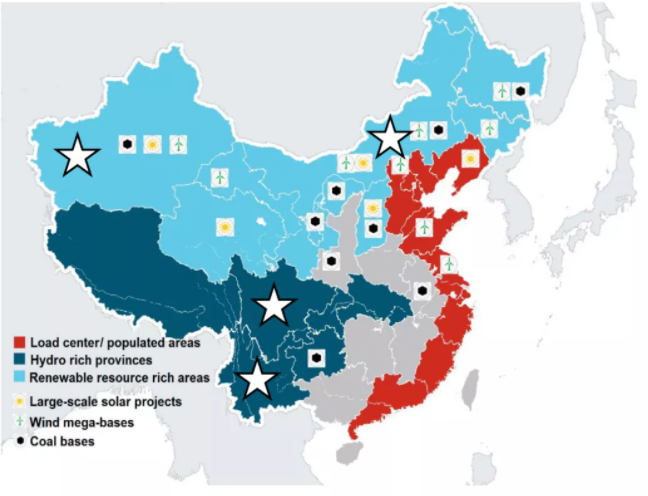

In case that wasn't clear enough, here's another graph showing the abundance of renewable energy or hydro resources in Chinese provinces compared to actual population centers. I have starred the four provinces in question. They are not far from the actual large load power station.

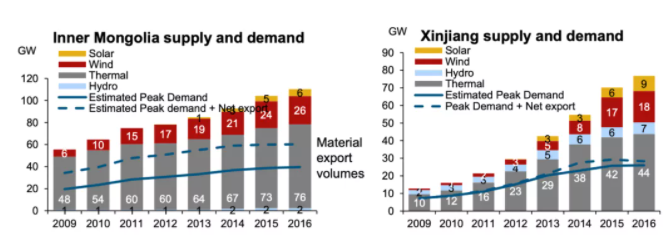

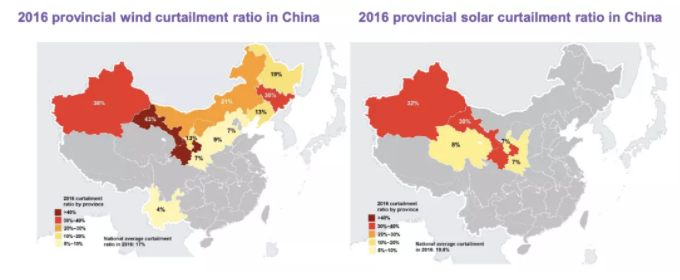

Obviously, Bitcoin miners choose these places for a reason. Xinjiang and Inner Mongolia have a lot of available capacity (both wind and solar) and little grid demand. This graph illustrates very clearly how energy-rich these two provinces are:

Sichuan and Yunnan have water resources and are far from population centers.

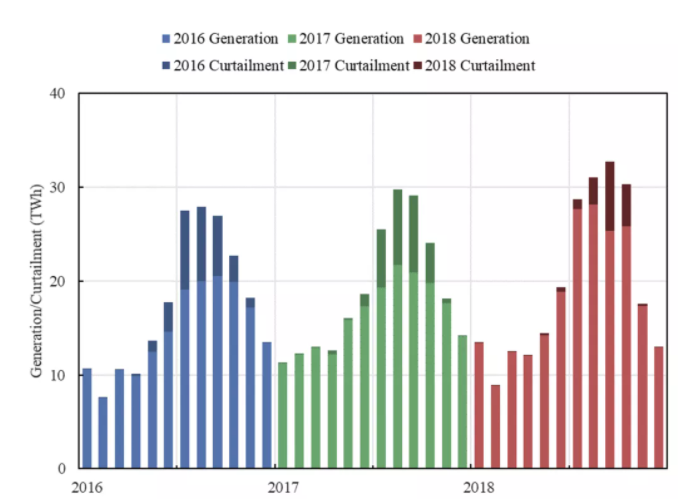

During the rainy season, there simply isn't so much water flowing through these areas into the dam that the grid can't consume it and it has to be drained. You can clearly see the seasonal shrinkage of Yunnan's water resources map in the chart below.

Note that the excess energy ratio decreased in 2017 and 2018 as Bitcoin mining activity in Yunnan started to increase following the rally. So you can start to see its impact on excess energy.

While exact figures are difficult to come by, it is fair to assume that in these key provinces, the energy used for Bitcoin mining is largely non-competitive. This is not to deprive anyone of their energy, as electricity is extremely plentiful. And when governments get disgusted with bitcoin, like Inner Mongolia shutting down mines, it's a net benefit to the bitcoin network because it means less bitcoin is mined with coal. In terms of energy structure, Inner Mongolia is slightly worse than Xinjiang.

But more and more people are writing stories about bitcoin mining outside of China. As Bixin Mining’s Mustafa Yilham pointed out in a recent podcast, none of the miner buyers in the last year were Chinese. In the U.S., where there is a huge market for bitcoin mining machines, Galaxy Digital and Digital Currency Group have built large mining divisions, along with an active group of publicly traded miners that have raised significant capital in recent months. Mustafa's comment is worth reading carefully:

Based on our conversations with various mining manufacturers, an average of about 60% of the mining rigs sold in the past two quarters or so were outside of China, while in fact the majority were in North America. And I don't think there's anything that will affect North America from being strong in mining in the future. In fact, prices in North America are now cheaper than the average price in China. In the past, we used to think that the United States has high labor costs and a small mining ecosystem, but we can clearly feel that the situation is changing rapidly in the past 1-2 years. And I think in the next cycle, you're going to see a lot more participation in mining in the U.S. and other countries. And I think the most important factor for U.S. miners is that they can get cheap capital costs, which means, they can afford to borrow money elsewhere at a much lower rate than Chinese miners.

Chinese miners will use grid power, but others will continue to pursue renewable energy strategies. In the future we will see many announcements about using clean, renewable energy for Bitcoin mining such as Square’s Bitcoin Clean Energy Investment Initiative or Aker’s Seetee initiative.

The concept of "youtube mining" is also becoming more and more common. This process entails off-grid mining of bitcoins using methane, a natural by-product of oil extraction. Depending on the regulatory framework, natural gas is vented or flared at the rig location. Because these wells are often remote, off-grid, without pipeline infrastructure, and the economics of secondary recovery are not feasible (due to low natural gas prices), oil rig operators often burn off-gases on-site.

Methane is a worse greenhouse gas than CO2 (the output of burned methane), so flaring is a net positive. When this gas is put into a generator and used to mine bitcoins, the operator can ensure complete combustion (eliminating vented methane from inefficient combustion) and can additionally reduce the resulting emissions. Given the baseline conditions for venting/flaring, clean, supervised generator flaring is positive from a carbon perspective. Many companies are taking advantage of this opportunity, some partnering with publicly traded energy companies. It goes without saying that completely off-grid natural gas is completely unrivaled in terms of home or business energy consumption. It is never monetized, captured, consumed or delivered to households. Its fate is only to be burned or vented.

The scale of natural gas energy is huge. In the United States, 538 billion cubic feet of natural gas were vented and flared in 2019, according to the Energy Information Administration. That's 1.2 percent of the total natural gas the U.S. pulled from Earth in 2019. According to Brannin McBee, an energy analyst I consulted for this article, that figure may be a vast underestimate. In McBee's words:

This is the official number reported by the Energy Information Administration. This value is collected by self-reports and state requirements across the United States. However, it is well known in the industry that true gas emission/burn values are much higher. Pipeline leaks, initial production grace periods, legacy wells with poor infrastructure all contributed to the estimate, which is nearly 10 times higher than reported to the EIA.

So, with these case studies in mind, let's consider some excess energy numbers. First, Digiconomist puts Bitcoin's current annualized energy consumption at 89 TWh/year, while Cambridge estimates 138 TWh/year, so we assume the answer is somewhere in between. The numbers for the difference are absolutely huge, easily drawing figures that exceed the consumption of the Bitcoin network. This is because the world produces far more energy than it consumes, and it has the ability to produce more energy from unused wasteful resources such as burning methane.

Here are some numbers to give you an idea of the scale of the energy glut. I don't have access to comprehensive data on global energy excesses or idling of energy resources, but the following numbers should give you ample assurance that Bitcoin can run on non-contested energy sources only.

In 2016, China alone had a surplus of 40.7 TWh of wind and 11.5 TWh of solar.

In 2016, Yunnan province alone had a surplus of 31.4 TWh of hydropower

In 2016 and 2017, China had an average combined value surplus of 100 TWh for hydro, solar and wind

558B CF fired/vented natural gas in the US (very conservative estimate) would produce 76.9 TWh by 2019 if used in 7 thermal efficiency (7m BTU/MWh) combined cycle power plants

secondary title

Media Misreading 3: Bitcoin occupies resources in chip foundries and interferes with the global chip manufacturing industry

Traditional media take: Bitcoin's demand for computer chips has dragged down production lines at TSMC and Samsung Electronics Co., leading to a global chip shortage that is costing automakers tens of billions of dollars and threatening profitable industries.

In fact, this is the easiest claim to dispute because it relies on sources that don’t talk about Bitcoin at all. If you follow the sources Noah relies on, he linked to the FastCompany article, which reads:

The straw that finally broke the camel's back was the sharp rise in Bitcoin's price in early 2021. This has increased demand for GPU graphics processing units traditionally used for digital currency mining, further exacerbating the semiconductor supply problem.

"Graphics Processing Unit" is a false and red flag - everyone knows that Bitcoin is not mined with GPU graphics cards. If you trace the article back to its source, you'll see the SCMP article, which discusses a shortage of GPU graphics cards exacerbated by high cryptocurrency prices. Those who are familiar with Bitcoin should know that since 2013, miners have not been able to use GPUs to mine Bitcoin. Bitcoin mining relies on specialized hardware using ASICs. The price increase of Ethereum is the main reason for the shortage of GPU graphics cards. Since Ethereum miners mostly use high-end NVIDIA graphics cards, the increase in Ethereum usage (and fees and ETH price) will definitely increase the demand for GPUs and keep gamers away. Gamers, and I think some opinion columnists too, sometimes make the mistake of deriding Bitcoin for expensive gaming gear. But Ethereum should be the target of their wrath.

Interestingly, NVIDIA is aware of this problem and has built a GPU specifically for crypto mining while building lightning protection into its mainstream GPUs. General-purpose GPUs will limit usage if crypto mining activity is detected. This is a very clever way to segment their product line into different customer segments and solves the problem of miners pricing gamers and other GPU consumers.

I'm not entirely blaming the media here, as it was Fastcompany who wrongly attributed the shortage of GPU graphics cards to the rising price of Bitcoin.

So let's address the more general statement: demand for bitcoin chips (not GPUs) is disrupting key points in the supply chain for smartphones and cars.

That statement is also broad - but in a much more playful and revealing way. I personally don't know much about the semiconductor market, but I do know many analysts who hedge against big hedge funds. So I called a friend of mine who is a semiconductor expert and he agreed to talk to me on background technology. I refer to him as "Big Al", his pseudonym.

It turns out that the way chip foundries like TSMC (a supplier on which Bitmain relies) operate is that they tier their customers. Not only do they optimize for revenue, but they continuously optimize for demand. They'll treat Tier 1 customers better and give them a privileged allocation of foundry space. Bitmain, the largest ASIC maker, is not a Tier 1 customer. They must be obedient. According to Big Al, the main reason for the chip shortage is that the demand for consumer electronics and cloud has skyrocketed during Covid (because everyone is tied up). Additionally, Qualcomm's problems (a major smartphone chipmaker) were exacerbated by the shutdown of Samsung's Austin plant during the recent Samsung outage, where Qualcomm stopped producing radio frequency chips locally.

The way it works is that reliable first-tier customers are assigned priority, while more cyclical and predictable buyers like Bitmain have to wait. In Q3 and Q4 2020, TSMC was absolutely dogged by orders from its Tier 1 customers (Apple, Qualcomm, NVIDIA, and Broadcom, etc.). It's an active time for smartphone makers (as political pressure has hurt Huawei) thanks to Christmas and Lunar New Year shopping, the rollout and launch of 5G for phones, and the market share of Oppo, Vivo and Xiaomi. Crypto miners do not have much distribution power.

After a stalemate in 2020, crypto miners were given allocations in the first and second quarters of 2021 to manufacture their new 5nm chips. Given that Bitcoin ASICs don't have to perform as well as a smartphone can (ASICs are easier to use and are expected to depreciate faster), chip foundries are happy to supply miners with lower quality chips, and miners are happy to pay for them. In fact, in order to obtain chips from foundries, mining machine manufacturers have to pay a certain premium, which has the effect of subsidizing the construction of new infrastructure at the 5nm level. As a result, bitcoin hardware manufacturers are often second-class citizens in this highly competitive foundry allocation bidding game. And because the industry is so cyclical, it's likely to stay that way for a long time. Foundries may continue to distrust Bitcoin mining hardware manufacturers. When Q3/4 of 2021 arrives, Bitcoin ASIC manufacturers may find themselves out of luck again, as chip foundry capacity is extremely scarce. According to Big Al, there is no price at which Bitcoin miners can exceed the allocated price for Tier 1 customers — and Tier 1 customers are absolutely privileged.

secondary title

Media Misreading 4: Proof-of-Stake system POS is a viable option

Traditional media opinion: In order to avoid bitcoin mining being banned, the developers who control the bitcoin algorithm need to consider switching to cheaper technology. An alternative is a proof-of-stake system, where mining can only be done by people who already own a large amount of cryptocurrency; competition is limited by stake, which greatly reduces resource usage.

This is the cornerstone of the energy argument against Bitcoin: the notion that, with proof of stake, you get something of value for nothing. No energy consumption, yet still an efficient decentralized consensus. If this logic reminds me of perpetual motion machines, it's because that's exactly what's being suggested here: a completely free lunch with exactly the same guarantees as Bitcoin, without costing anything.

Of course, this is a dream. POS "Proof of Stake" is just a fancy way of saying "those with the greatest wealth have political control." It sounds a lot like our current system, and Bitcoin was designed specifically to solve that problem. Bitcoin expressly rejects centralization and does not grant any privileges to anyone based on the number of Bitcoins held. If holding more bitcoins gives you more control, then trying to acquire bitcoins outright through capital campaigns will be successful.

Also, as Paul Sztorc pointed out back in 2015, POS Proof-of-Stake is often just a covert (and obscure) form of Proof-of-Work. For example, if the protocol imposes a $100-worth limit on each staking node (to instigate "decentralization"), you'd see an industrial staking farm emerge with tens of thousands of nodes. This will just be a compromise.

Capital has a cost, and a PoS system in equilibrium consumes capital, just like Bitcoin. The way it would actually be instrumented would be through various arbitrage trades - borrowing USD to take advantage of the high "interest rates" offered by ETH etc. The funds allocated to the PoS system can be used to build nuclear power plants, windmills or solar power plants. Capital is just our abstraction of energy. If the PoS system consumes 1T of social capital resources, it will result in a large number of potential carbon sequestration mines not being subtracted.

Therefore, if PoS is just a compromise of POW, it will not provide marginal benefits. Not only that, but it's unclear whether PoS actually confers PoW-equivalent guarantees. I think it's definitely worse from a decentralization standpoint. The cost of capital is wildly unequal and gives potential oligopolies the upper hand in consensus. Problematically, large custodians can easily be exploited to take control of a proof-of-stake system.

Coin Metrics benchmarks the amount of ETH held on exchanges at 14.8 million units; Viewbase has a height of 22.8m. The latter figure is worth $37b, equivalent to 29.2% of ETH's effective supply over the past 12 months. These custodians (the largest of which holds only 8 million ether) can interfere with consensus in a PoS system, as happened with Steemit.

We see vote buying and cartel validator censorship. And, if you expect proof-of-stake tokens to truly go mainstream, the system will ultimately privilege the entities with access to the cheapest capital: large financial institutions have access to effectively unlimited liquidity from central banks. If you think Proof of Stake empowers individuals, compare the cost of capital for the average person to that of a hedge fund like Citadel.

Large, unable-to-fail institutions have access to good liquidity even when trading goes awry, as happened in 2020. Last year, the Fed also bought corporate bonds, greatly empowering large corporations. We all know that the bigger you are and the closer you are to the central bank, the cheaper your cost of funds will be. Proof-of-stake therefore crucially lacks the "hardness" that energy costs provide, and has the unfavorable characteristic of giving power to large corporations at the expense of smaller ones.

secondary title

Media misreading five: Bitcoin mining ban is bad for miners, investors and software developers

Media Opinion: "[Bitcoin mining ban] is bad for bitcoin miners as well as cryptocurrency investors and software developers."

Yes, a globally coordinated ban on Bitcoin mining would force it underground. I don't want a global ban. But certain jurisdictions already encourage bitcoin mining because they can monetize mining to consume excess energy. In other words, they can export energy, just like Iceland's historic aluminum industry. The world is a big place, and policymakers have had mixed reactions to Bitcoin. We’ve already seen Kentucky encourage bitcoin mining with new tax incentives. It is an open secret that the Georgia state government (a country in the South Caucasus region) subsidizes Bitcoin mining. A state-sponsored mining scheme is being piloted in Pakistan's Khyber Pakhtunkhwa province. Some jurisdictions will oppose bitcoin mining within their borders. Others will embrace it.

But the ban isn't bad for the average miner. First, hash rate is extremely mobile. Miners will only migrate their ASICs as they already do seasonal migrations between Sichuan/Yunnan and Inner Mongolia/Xinjiang. Bitcoin mining loves energy subsidies, and it will eventually punish governments (such as Iran and Venezuela) that subsidize energy without thinking to maintain regime legitimacy.

Second, since miners are constantly competing with other miners around the world, the suppression of specific miners at competitive prices raises the price per kWh threshold, making mining more profitable. If a miner mines using subsidized energy from coal (making the miner's market price below 2c/KWh) and the local government makes an exception for this, they can end the subsidy or fire the miner. This increases the profitability of all other miners globally.

Investors and developers don't really care where bitcoins are mined, as long as the bitcoin hash rate is sufficiently decentralized and its guarantees hold. This has been the result so far. It is important to continue developing technologies such as Stratum v2 and continue to empower individual miners at the expense of mining pools and enhance the true decentralization of block formation.

At the end of the day, Bitcoin doesn't care where it's mined. Bitcoin does not have a defined hash rate threshold at which it is considered secure. Historically, it has been safe on many levels. In my opinion, it pays too much for security. If a country expresses dissatisfaction with Bitcoin's consumption of network resources, computing power (hash rate) will go elsewhere. In the long run, I believe Bitcoin will be mined almost entirely with non-rivalrous energy in the future. We know that there is an enormous amount of idle energy waiting to be monetized. For Bitcoin, it couldn't be better.

Original: Noah objectivity on Bitcoin Mining Author: nic carter