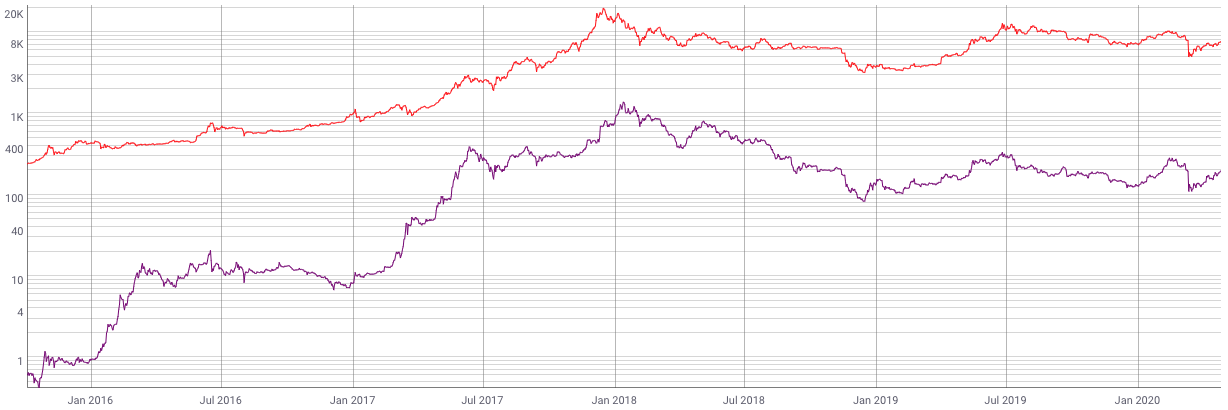

image description

first level title

Two wrong ideas:

Bitcoin and Ethereum are currencies and should be judged on their ability to earn money.

fact 1: Bitcoin and Ethereum are encrypted networks and should be judged by the value each network is able to generate. (BTC and ETH are the currencies used to reward miners for participating in the network).

BTC and ETH are zero-sum games.

fact 2: BTC and ETH can complement each other, and asset diversification can reduce risks.

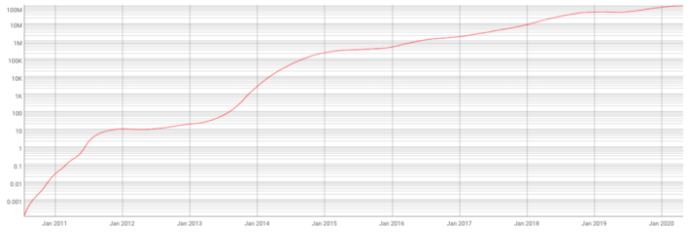

image description

secondary title

The Bitcoin network is not money, but property security

Bitcoin is the most secure decentralized network and an immutable historical calculation ledger. It has Turing-incomplete smart contracts that limit bad actors' ability to exploit it to steal network assets, and its security is backed by an incredibly large amount of hashing power, which over the past decade has led to Bitcoin's full Network computing power is growing exponentially.

Attempting to double spend on the Bitcoin network is very expensive—it is physically impossible for a single entity to buy enough mining machines and electricity to succeed at 51% without years of deployment and an investment of over tens of billions of dollars Attack the Bitcoin network.

If it's not about causing trouble, then if you're just mining bitcoin and making a legitimate profit from it, you're in a lot better financial shape than attacking the bitcoin network.

In order to achieve double spending (51% attack) on the Bitcoin network, the following things need to be done:

1- Access to a wallet containing enough bitcoins for a double spend attack to be worthwhile. As you will see shortly, you would need to buy a lot of Bitcoin (over $100 billion worth) for this attack to be feasible, and acting quickly will push the price of Bitcoin even higher. The more you buy, the more difficult it becomes to buy more BTC because more sellers have to be found who are willing to sell you for the asking price. In the process of buying enough bitcoins to enable a double spend attack, you could increase the price of bitcoins by a factor of 10 or so, making your goal increasingly out of reach.

2- Need to find enough reasons to buy that bitcoin to get something of value after the fact. If the attack is successful, it will prove that the Bitcoin network is not as secure as everyone thinks it is, and as a result, the value of your BTC for your wrongdoing will drop rapidly. You need to buy and deliver enough other assets to make the attack worthwhile. It’s hard to find someone willing to sell you a pizza for bitcoin if it’s not secure, let alone an asset worth over $100 billion.

3- Need to purchase or control enough Bitcoin mining equipment to exceed 50% of the existing network's computing power. Over the past 24 hours, the Bitcoin network has been operating at an estimated 110 million terahashes per second. A megawatt-hour is 1 trillion to 1 trillion hashes. 110 of them is so massive it's best expressed in scientific notation: 1.1x10 10 .

The most efficient miner currently on the market is the Antminer S19 Pro (110TH/sec). You'd need to buy 55 million of them at a cost of about $150 billion to attack 51% of the bitcoin network, but it's unlikely that manufacturers will produce any quantity fast enough for you to 51% attack it . In fact, they have been snapped up by miners at the time of writing.

The only real option is to attack the mining pool. There are currently 3 large Bitcoin mining pools that collectively control over 51% of Bitcoin hash power. If you manage to control all 3, you may be able to succeed, but mining pools are not only almighty hash rate controllers, they are also composed of thousands of independent miners, each miner can detect twice the income separately, Spend money and quickly switch its hash power to a backup pool.

If you can overcome all these hurdles and pull off a double spending attack, then everybody will know, everybody will know what wallet you are using to do these things. These wallet addresses can and will soon be blacklisted on every major exchange.

Breaking into the vault is only half the battle. You also need to be able to get out of real situations. Recently, a DeFi hacker on Ethereum returned stolen funds to avoid punishment after his identity was cannibalized. If you try to launch a double-spending attack on a network as large as Bitcoin, you will run into the same problem.

There have been successful double spend attacks on smaller altcoin networks. But the difference between a double spend on a small network and a double spend on Bitcoin is like the difference between drinking a glass of water and drinking an ocean.

All of this security exists to protect property, and the Bitcoin network is particularly good at protecting transactions worth more than $10,000.

Bitcoin's immutable ledger also protects data without requiring any financial transactions. The OP_RETURN operation can permanently record a small piece of data on the Bitcoin ledger. This data can be a unique fingerprint that can identify larger blocks of data, including transaction histories of off-chain ledgers, real estate deeds, or hashes of creative works (for the purpose of protecting copyrights, trademarks, or patents). These records can be used as evidence of ownership independent of any national legal system.

Using the Bitcoin network, authors can prove according to mathematical laws that they own a document at a given point in time and provide evidence that can substantiate a claim of ownership. The certificate is a valid proof of fact in each jurisdiction and the International Court of Justice is likely to recognize this fact.

secondary title

The Ethereum Network Is Not Money - It's Programmable Value

Ethereum excels at creating tokens that can represent fractional ownership shares, vested interests, control over voting, access and permissions, the ability to share control of assets with people who may not trust them, etc.

So far, Ethereum has produced several phenomenal applications:

Crowdfunding (the ICO bubble of 2017).

Decentralized Finance (DeFi).

Non-fungible tokens (NFTs), including digital collectibles of many different varieties.

Ethereum could replace the stock system, reinvent insurance, and break reliance on things like checking accounts, savings accounts, and loans at banks. Since Bitcoin chooses security over flexibility, none of this would be possible with Bitcoin alone without a separate, more flexible network alongside the main Bitcoin network (e.g., Blockstack and friends).

But the security of Ethereum is far lower than that of Bitcoin, and it has been questioned. With all this extra flexibility, hackers can take advantage of a larger attack surface. But what if a transaction is made on Ethereum and then its state is periodically recorded immutably on the Bitcoin network for further protection?

A large number of bitcoin network transactions do not actually send bitcoins. Instead, they secure data using hashes (data anchors) using protocols such as Proof of Proof and Proof of Existence. Bitcoin is currently the most secure decentralized ledger in the world, and the best known way to protect this valuable data.

first level title

correct evaluation

Which currency will win? unimportant. The value of each currency is derived from the value of each network, and if you really want to compare assets, you have to compare networks.

Bitcoin is a bit like a bank vault. You can store and transfer ownership of anything in the vault (including messages), but you can't really do much else.

Ethereum is more of a computing center where you put any kind of computer into it to perform any kind of computation, but within certain limits. Every computer must follow some specific rules.

Ethereum is the best choice when many distrusting people need to reach consensus on the state of computation (such as financial transactions).

Some say that one day the Ethereum network may replace the Bitcoin network and BTC may continue to exist with all its wonderful financial policies on top of the Ethereum network.

This is true in theory, but since hackers can explore that data center and there are so many interesting ways to make those computers attack each other, it's not a very good idea. In my opinion, the enhanced security of the Bitcoin network will always be able to provide a security guarantee that Ethereum may never match.

Likewise, by design, Ethereum is able to do things that the Bitcoin network simply cannot.

Bitcoin trades flexibility for security, while Ethereum trades security for flexibility.

Both are valuable and worth paying for, and there are trade-offs to be made in terms of their respective payoffs.

Both are great complementary networks. You can use Bitcoin to secure assets that are tokenized and traded on Ethereum. BTC may be more useful to holders if you can use Ethereum’s DeFi protocol to mortgage BTC.

As for the asset itself, BTC vs. ETH: Currencies have different attributes that are worth considering:

Medium of exchange, store of value, unit of account

medium of exchange. Both are great mediums of exchange, but BTC has more opportunities now (more merchants accepting BTC for payments).

store of value. Both could be important long-term stores of value. Which is better remains to be seen.

unit of account. Both are currently too volatile to be a good unit of account (stablecoins have emerged).

The upper limit of BTC is 21 million. Eventually (100+ years from now), there will be no more bitcoins to mine - unless a majority of bitcoin network miners agree to a policy change. If the BTC cap is hit or reached, the Bitcoin network will transition to transaction fee incentives (which is what it has always had). With the relative security of the network, transaction fees will increase over time. As fees increase, lower-value transactions will move to other networks, while higher-value transactions will likely stay on the Bitcoin network for enhanced security.

As the security and settlement layer of the Internet of Value, this is not a problem because transactions are usually very valuable. Today, the average value of a BTC transaction is around $5,700. People who trade thousands of assets don't mind paying a small fee. Today, the Bitcoin fee market is thriving.

For those who don’t need as much security, there are already low-fee and no-fee options for morning latte purchases, including sidechains and the Lightning Network. You can even spend close to zero BTC via an Ethereum sidechain if you can find someone willing to pay.

Satoshi Nakamoto talked about channels for cheap transactions back in 2011. This has always been part of Bitcoin's plan, and has been for 10 years.

Imagine Bitcoin and Ethereum both operating as complementary protocols, the foundation of an internet worth tens of trillions of dollars.

Both can win.