This article attempts to answer a question that people care about: how much can the price of Bitcoin increase in the future?

Since 2020, an epidemic that has not happened in decades is rapidly hitting the world. The new crown epidemic has shaken the firm belief of the traditional world. Major economic powers were forced to shut down their economies to stop the spread of the pandemic.

Central banks around the world have stepped in to support economies battered by the biggest recession since World War II. Over $12 trillion in money is being printed and pumped into the monetary and financial system.

Save the current system at all costs

Richard Nixon ended the gold standard in 1971, setting up the current global monetary system, an event that is iconic.

Whatever measures are taken, the consequences will be borne by the majority of ordinary people. Meanwhile, the wealth of the ultra-wealthy will continue to grow throughout 2020. Today, the world's richest man, Jeff Bezos, is worth more than $200 billion. In modern times, it is unprecedented for a single person to have such great wealth.

In the face of this, we face an alarming situation of an overheated monetary and financial system. Over the past four years, global debt has gone parabolic, reaching $277 trillion by the end of 2020. Over the past twelve months, more than 25% of the currency in circulation has been printed.

Bitcoin may be the best weapon against inflation

Inflation is making a comeback, and the stock market will eventually see the current bubble burst sooner or later. Again, this is no different than what some would like to believe. Bitcoin has become the best store of value for the future in the face of monetary inflation triggered by the monetary policies of central banks and the stimulus plans enacted by the governments of the world's major economic powers. In a world where everything will be digitized, Bitcoin will play a key role in the future. Its asset attributes will make a difference and more and more people will buy it. The fact that Bitcoin's planned monetary policy does not depend on any decisions of a few people and has a hard supply of 21 million units is clearly attractive. Bitcoin is the antithesis of the current system.

What price can Bitcoin reach in the future?

The fact that more and more people are waking up to the incredible power of Bitcoin has seen its price skyrocket since October 2020 to nearly $65,000 in mid-April 2021. Its price has since fallen back slightly to about $58,000. Bitcoin seems set to remain in a necessary consolidation phase for some time, with most investors wondering how far Bitcoin’s price gains can go in the future. After all, when Bitcoin was first listed in U.S. dollars in August 2010, the price of Bitcoin was only a few cents. It's odd to see a huge price increase of +80,000,000% in just ten years. For those of you who are still hesitant to buy Bitcoin to control the fruits of your labor, I will introduce 4 future price possibilities for Bitcoin.

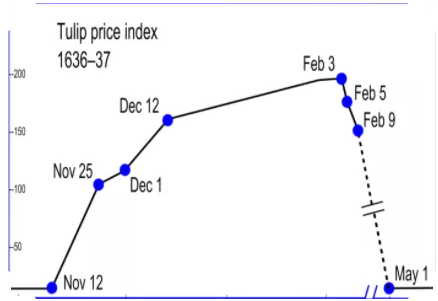

image description

Tulip Price Index 1936–37

These Bitcoin naysayers think that the Bitcoin story will end like the Wikipedia story of tulips. These opponents seem to forget that the tulip mania lasted only 18 months. As a reminder, the price of Bitcoin has been rising steadily for the past twelve years. For me, case 1 is clearly not true. We will never see Bitcoin go this route again. If a bubble can form in the Bitcoin world, it can only go up once, as we saw at the end of 2017. Speculative bubbles will eventually burst, but Bitcoin always rises like a phoenix after each plunge. This will continue in the future.

Scenario 2: Bitcoin becomes the wealth of the Internet, but only for technology enthusiasts If Bitcoin is a monetary revolution, it is also a technological revolution. Bitcoin was the first successful implementation of a P2P currency. Satoshi Nakamoto's invention accomplished a feat that many thought was impossible. In a digital world where everything is ready, Bitcoin has the potential to be the wealth of the Internet. In the second scenario, Bitcoin will remain in the $100,000-$300,000 price range, but will be mostly used by a tech-savvy audience. Due to its complexity, this digital currency will never be accessible to the general public. The work to democratize Bitcoin by improving the user experience will prove critical here in the years to come. Of course, such a scenario is possible, but I think if Bitcoin continues to rise to $100,000 by the end of this year, I have a hard time seeing how this NgU technique will keep the public on hold. It is the best marketing tool for Bitcoin to attract public attention. Additionally, the imminent rise of central bank digital currencies (CBDCs) will allow governments themselves to educate citizens about digital currencies. These CBDCs will be a kind of Trojan horse, which will then promote Bitcoin. Once educated to use digital currencies, citizens may sooner or later switch to alternatives that best serve their interests. Of course, this is Bitcoin. Therefore, Bitcoin will eventually surpass technology.

Scenario 3: Bitcoin replaces gold as the reference store of value for the general public. After breaking a record $2,000 an ounce in the summer of 2020, the follow-through has been less favorable since then, with prices stabilizing between $1,700 and $1,800. At the same time, the price of Bitcoin has indeed skyrocketed. Faced with huge monetary inflation, more and more institutional investors and large corporations have turned to Bitcoin. Bitcoin is the 2.0 version of gold and it has nothing but advantages in a world where everything is digital. In February 2021, Bitcoin's market cap surpassed $1 trillion for the first time. This has made many Bitcoin naysayers realize that Bitcoin is likely to reach the market cap of gold in the future, which is equivalent to 10 times the current market cap of Bitcoin, because at the time of writing, the market cap of gold is 10 trillion US dollars. As Bitcoin is gradually recognized by the public as the best store of value available to the public, it is more and more likely that the market value of Bitcoin will approach that of gold in the future. For many, it was the emergence of bitcoin that interrupted the rise in gold prices since the pandemic. In my opinion, by replacing gold as the preferred store of value for the general public, Bitcoin will be able to trade between $300,000 and $1 million. For me, this is very possible. This is certainly my certainty, but everything leads me to believe that this will happen in the next few years.

final thoughts

final thoughts

Of the four possible bitcoin price scenarios outlined above, the first scenario has been ruled out. Bitcoin is not a bubble. People who keep telling you Bitcoin is a bubble are lying. Scenario two has already happened, Bitcoin is priced at $58K, and it is already considered by many technology enthusiasts as the ideal Internet currency. Still, Bitcoin's role as the best hedge against the inflation we're experiencing has people thinking far beyond the world of technophiles. More and more people are realizing that Bitcoin has the potential to be the store of value of the future. There is no doubt that Bitcoin will eventually exceed the market capitalization of gold within the next decade. There aren't any guarantees like ever, but it's my feeling that the third scenario can be validated. For scenario four, it's hard to say. The possibility remains, but it depends on world geopolitics. So I won't risk commenting.

Inflation is making a comeback, and the stock market will eventually see the current bubble burst sooner or later. Again, this is no different than what some would like to believe. Bitcoin has become the best store of value for the future in the face of monetary inflation triggered by the monetary policies of central banks and the stimulus plans enacted by the governments of the world's major economic powers. In a world where everything will be digitized, Bitcoin will play a key role in the future. Its asset attributes will make a difference and more and more people will buy it. The fact that Bitcoin's planned monetary policy does not depend on any decisions of a few people and has a hard supply of 21 million units is clearly attractive. Bitcoin is the antithesis of the current system.